The Information Technology sector ranks third out of the ten sectors as detailed in our 1Q17 Sector Ratings for ETFs and Mutual Funds report. Last quarter, the Information Technology sector ranked third. It gets our Neutral rating, which is based on an aggregation of ratings of 28 ETFs and 108 mutual funds in the Information Technology sector as of January 19, 2017. See a recap of our 4Q16 Sector Ratings here.

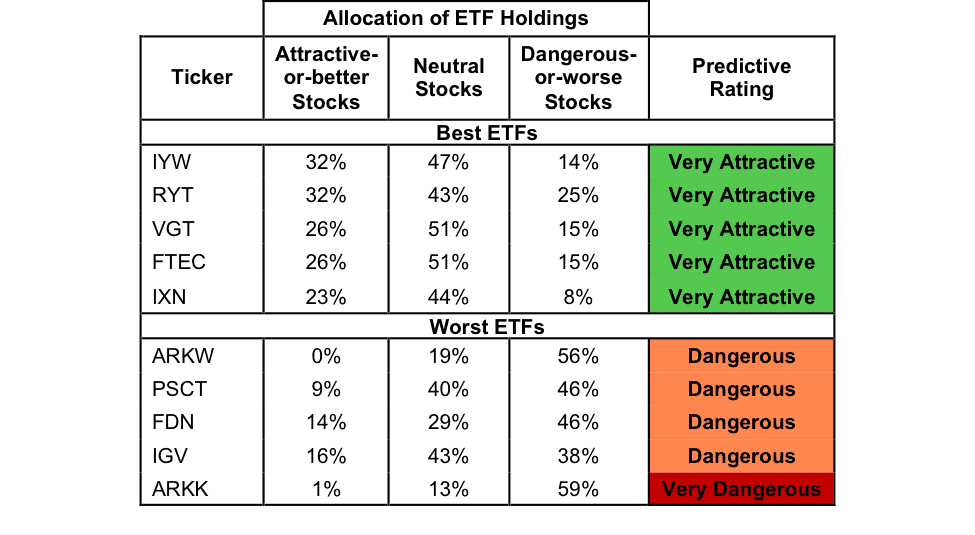

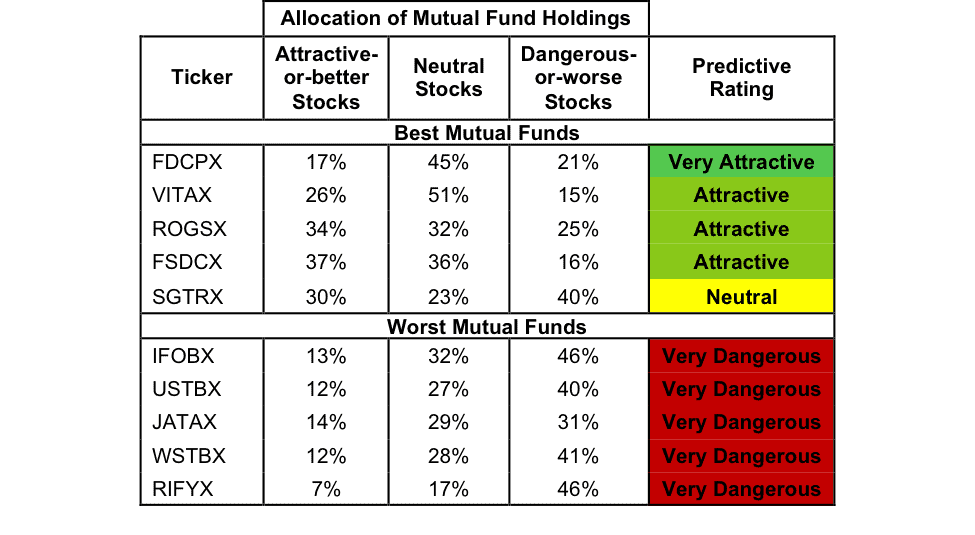

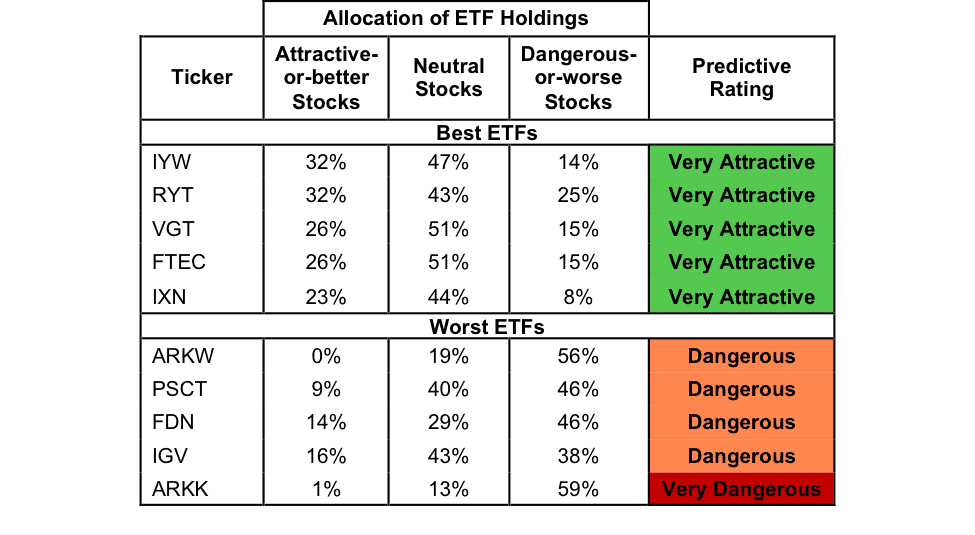

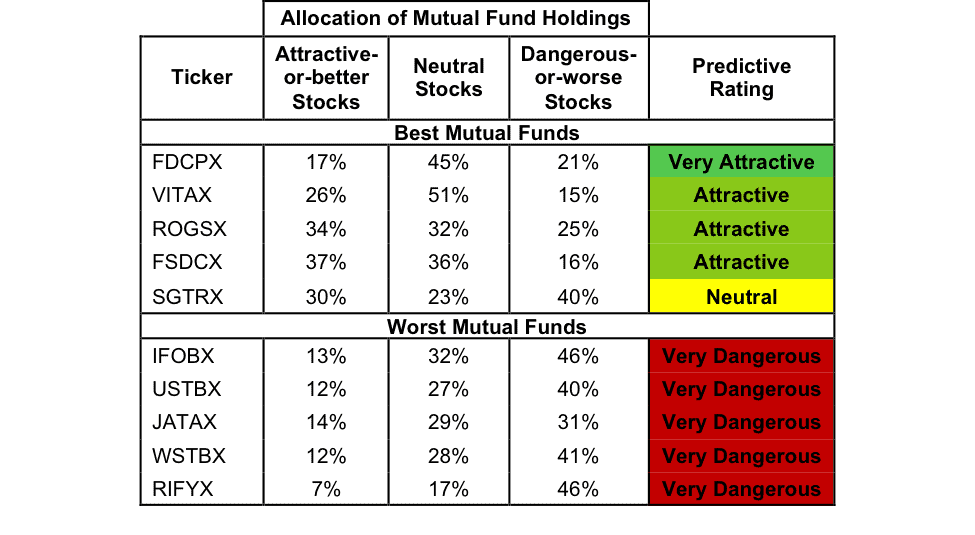

Exhibits 1 and 2 show the five best and worst rated ETFs and mutual funds in the sector. Not all Information Technology sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 374). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the Information Technology sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Here is our ETF and mutual fund rating methodology, which leverages our rigorous analysis of each fund’s holdings. We think advisors and investors focused on prudent investment decisions should include analysis of fund holdings in their research process for ETFs and mutual funds.

Exhibit 1 ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Exhibit 2. Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Six mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity minimums. See our mutual fund screener for more details.

iShares US Technology ETF (IYW) is the top-rated Information Technology ETF and Fidelity Computers Portfolio (FDCPX) is the top-rated Information Technology mutual fund. Both earn a Very Attractive rating.

ARK Innovation ETF (ARKK) is the worst rated Information Technology ETF and Victory RS Science and Technology Fund (RIFYX) is the worst rated Information Technology mutual fund. Both earn a Very Dangerous rating.

476 stocks of the 3000+ we cover are classified as Information Technology stocks.

The Danger Within

Buying a fund without analyzing its holdings is like buying a stock without analyzing its business and finances. Put another way, research on fund holdings is necessary due diligence because a fund’s performance is only as good as its holdings’ performance. Don’t just take our word for it, see what Barron’s says on this matter.

PERFORMANCE OF HOLDINGs = PERFORMANCE OF FUND

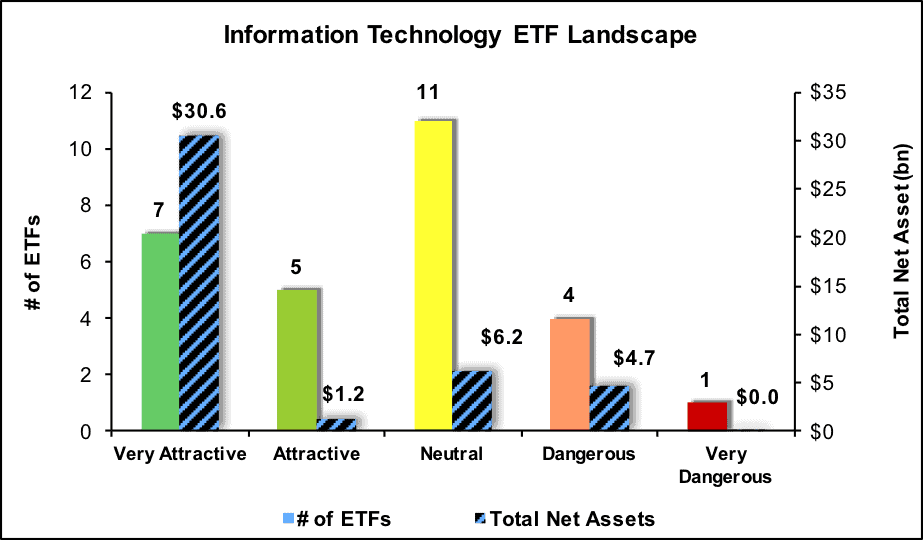

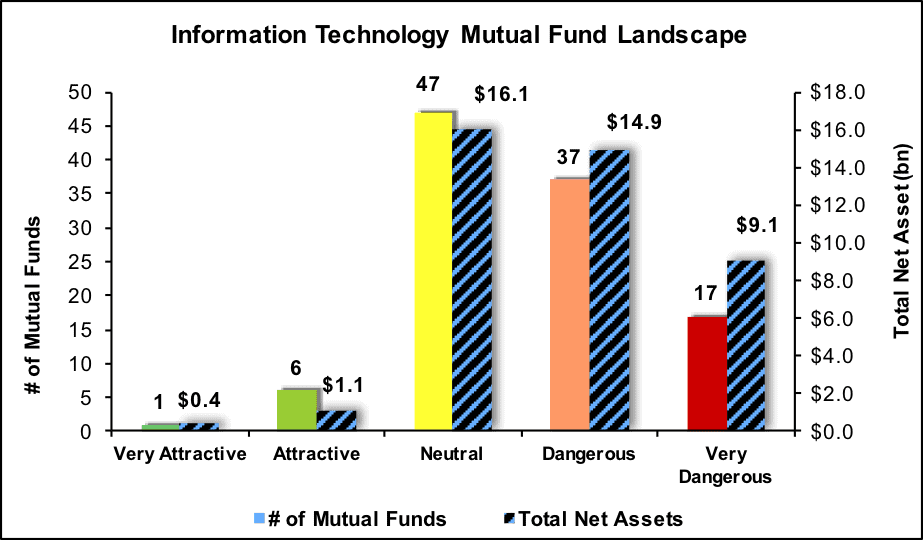

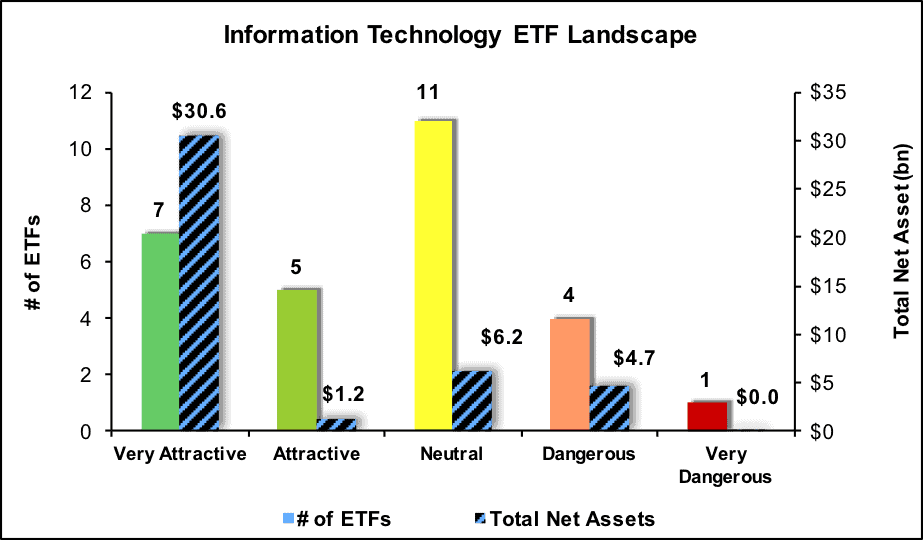

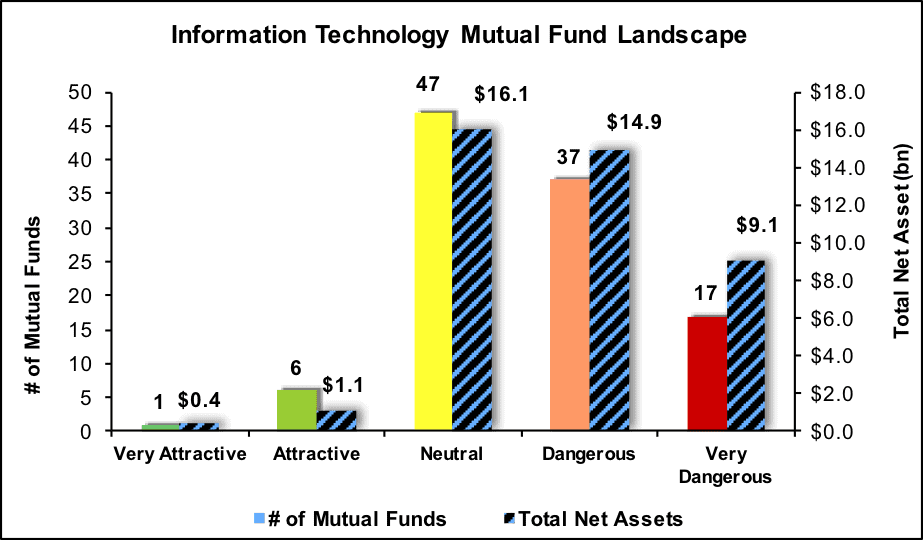

Exhibits 3 and 4 show the rating landscape of all Information Technology ETFs and mutual funds.

Exhibit 3. Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Exhibit 4. Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings