The United Kingdom faces a defining moment as it prepares for the grand finale of Brexit, a process that has lasted three and a half years. During this time, it also needs to prepare for how it will negotiate trade deals with its global counterparts. The U.S. is a key trading partner for the U.K. and will need to work on a future trading agreement.

Negotiating a deal will be intensive for both parties and according to Reuters, Presidential Candidate Joe Biden has made it clear about one of the requirements for any trade deal with the U.K. Biden has indicated that as part of Brexit, the U.K. must not interrupt the Good-Friday Agreement set in 1998, and if interrupted, it meant “no chance” for a U.S./U.K. trade deal.

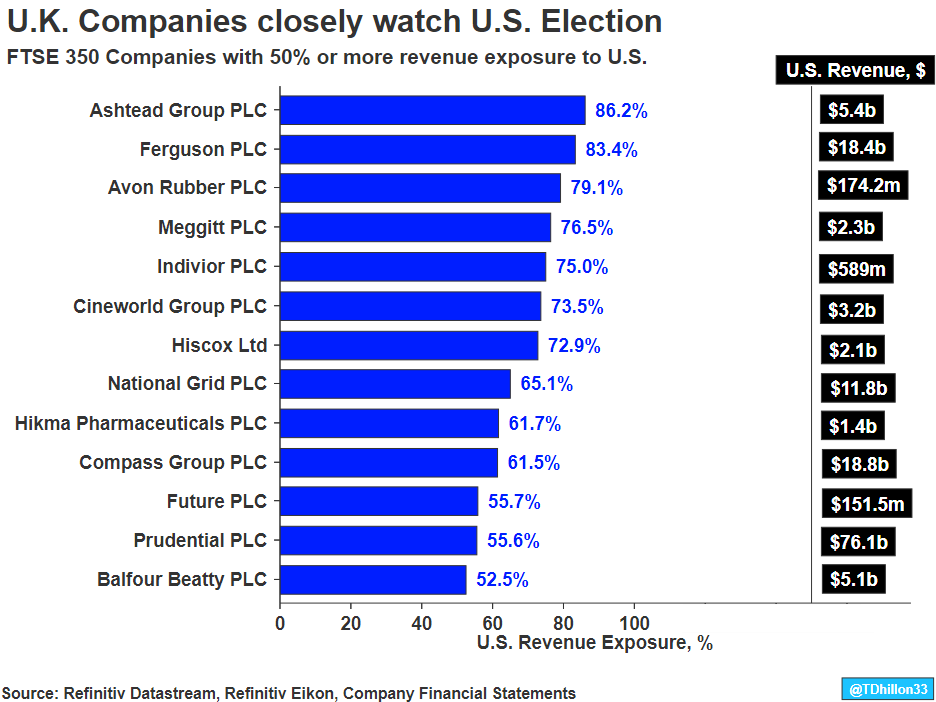

We focus our attention to British companies who generate a substantial portion of their revenue from the U.S. and will be keen to know how the U.S. election plays out. Using Refinitiv Eikon, we look at the Refinitiv Fundamentals database to assess the companies with the highest U.S. revenue exposure based on a universe of FTSE 350 constituents. We are using the latest annual financial statement provided by each company. It is important to note that providing geographical revenue data is done on a voluntary basis and thus only companies that report this data are included in the graph above.

Refinitiv offers a powerful combination of content, analytics and tools for better investment research, find out more.

Rounding out the 13 companies, five come from the Industrials sector which also make the top four including Ashtead Group (AHT.L), Ferguson (FERG.L), Avon Rubber (AVON.L), and Meggitt (MGGT.L). These four companies have over 75% of their revenue exposure to the U.S. and have done so in each of the prior four years.

Cineworld Group also appears in the top 10, having acquired Regal Cinemas who operates 546 sites in the U.S, generating $3.2 billion in revenue for the latest fiscal year.

On an absolute basis, life & health insurance Prudential (PRU.L) has the largest dollar exposure to the U.S., generating $76.1 billion in revenue for the latest fiscal year.

In addition to the U.S. election, these companies will also need to monitor the result of Brexit as it will play a key role in the Pound Sterling. A weaker sterling will help multinationals with high international revenue exposure, while also helping domestic companies who incur costs in sterling. The Pound Sterling has stayed at approximately the same level since the beginning of the year but did suffer volatile movements during the Coronavirus pandemic. GBP= dropped 12.5% in eight trading days to a trough of 1.1485 during March 2020. A Brexit no-deal will also likely have a large negative impact to the Sterling.

Refinitiv Eikon is a complete solution for research and analytics. It places the most comprehensive market information, news, analytics and trading tools available into a desktop.