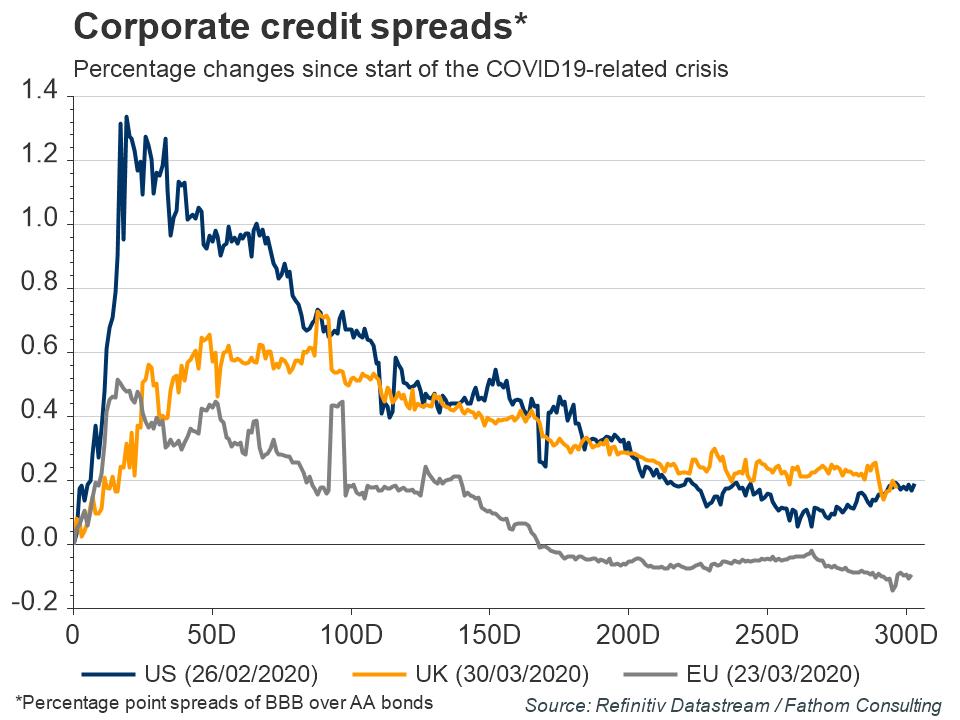

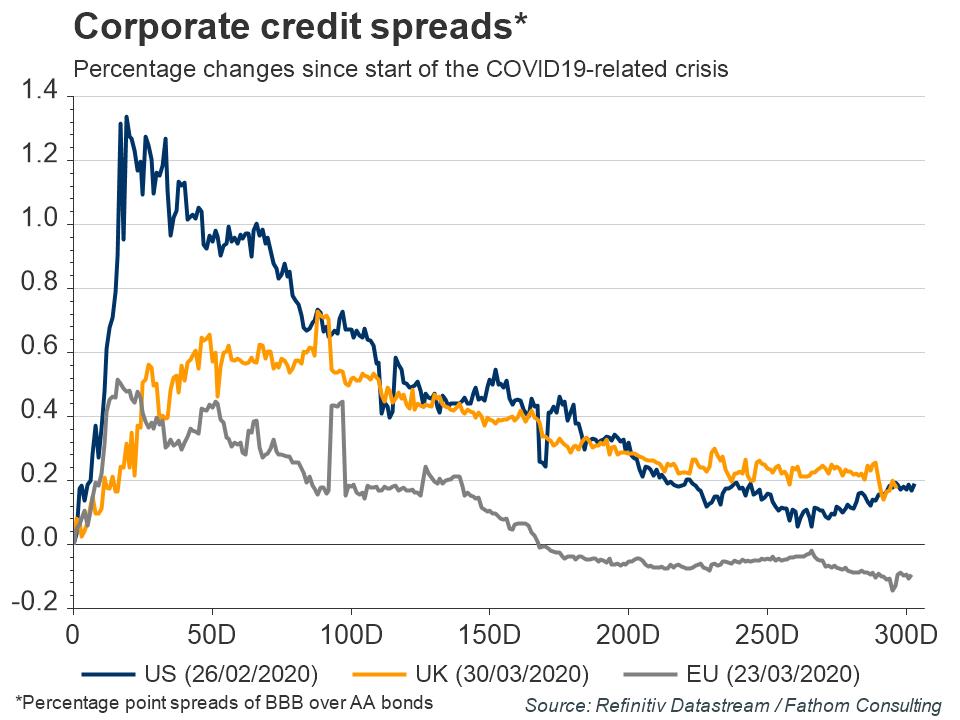

The spread between the yields of BBB-ranked and AA-ranked corporate bonds, commonly known as the default spread, tracks the equity risk premium and reflects aggregate default probability. Of course, by indicating increased default probability when it gets higher, the default spread reveals the market’s view about the “health”, i.e., earnings prospects, of the corporate world. Those earnings prospects were significantly worsened when the pandemic-related recession began in the US, UK, and EU. Each of these hubs experienced a different magnitude of negative shocks about earnings prospects, due to the distinct characteristics of their corporate space. The shock was larger in the US, where the competitive ethos and minimalist intervention setting increases entrepreneurship but also “mortality”. The shock about earnings prospects was smaller in the EU as it is traditionally more protective of its businesses than the US. The shock in the UK was somewhere in the middle, reflecting the UK’s more balanced approach when it comes to barriers and support for business. Moving forward almost a year, the unprecedented government backing for businesses and employees has largely allayed concerns about corporate “health”, as the declined default spreads for all three hubs show. Interestingly, the latest pick-up in the US default spread reflects a belief that the US has progressed to the next, post-pandemic business cycle, and is, in turn, about to the face the next challenge.

Refresh this chart in your browser | Edit the chart in Datastream

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.