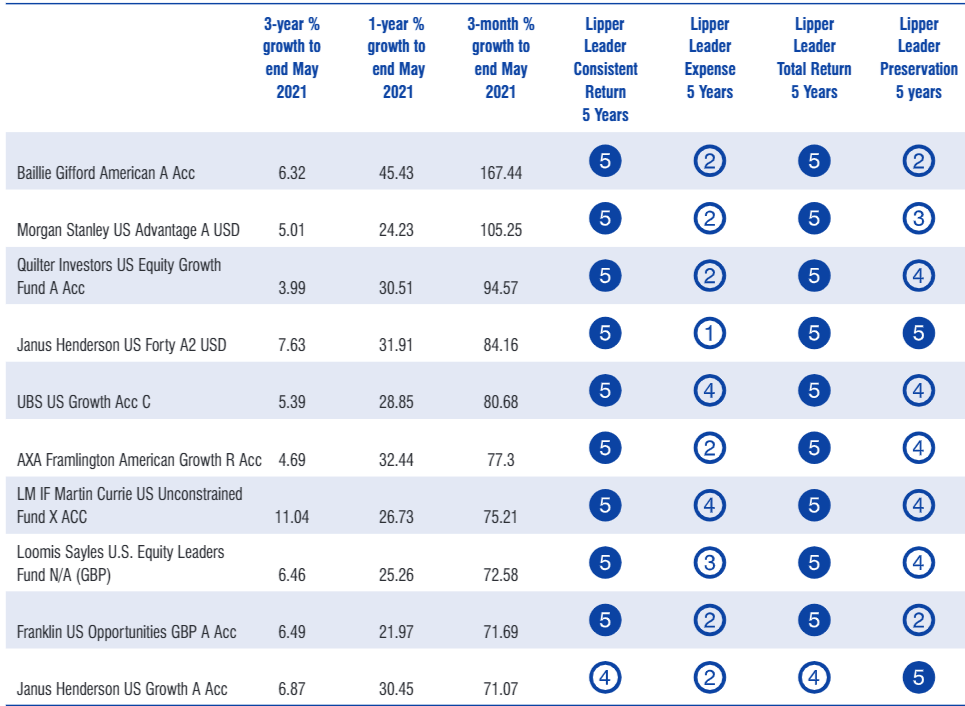

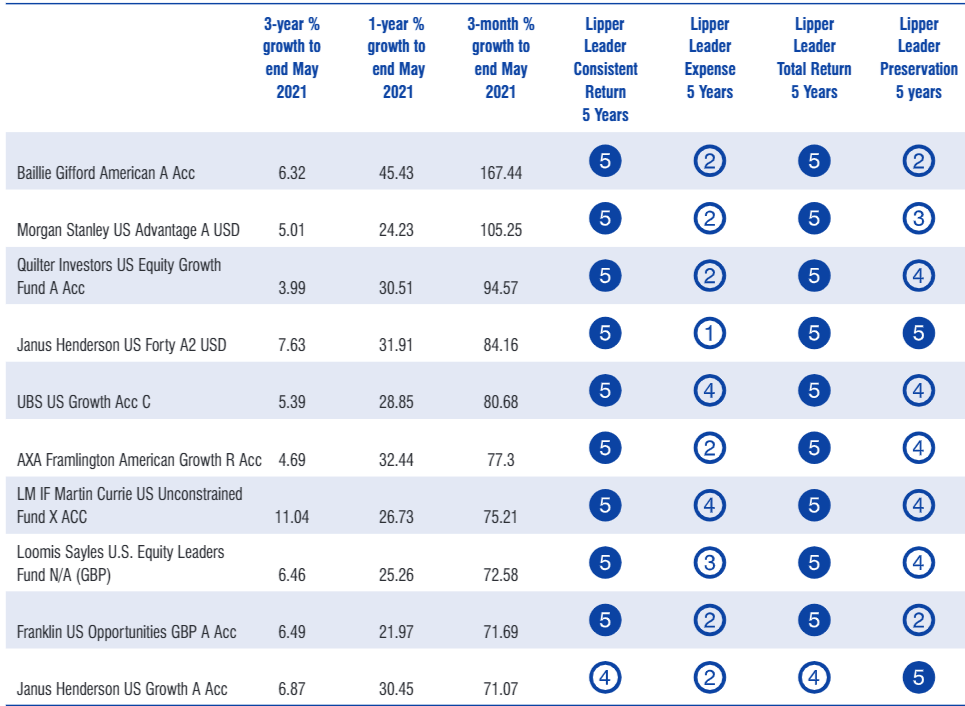

Using the Lipper Leaders scoring system to analyse the best-performing funds in the IA North America sector.

Ongoing liquidity injections from major central banks have pushed US equities ever higher. This has lately been reinforced by concerns over the contraction in Chinese liquidity, the country’s crackdown on tech companies, and the rising COVID uncertainty, which taken together have increased demand for safe-haven assets such as the US dollar.

In short, investors have piled into US equities over the past several months and beyond.

While there has been some volatility over July, driven by concerns over rising inflation, key US indices such as the S&P 500 have ground ever higher. Indeed, not a few constituents have more than ground, but leapt forward over the recent period. You have to look at the eye-watering valuations of many US stocks and ask yourself, just how far can this go? This, of course, isn’t just an issue for US stocks, but those to which investors have flocked—not least the FANGs (Facebook, Amazon, Netflix, and Google/Alphabet)—are high-profile, high-valued examples. That implies a large degree of downside risk.

While some of these valuations can seem crazy, as my favourite and heavily used quote from economist JM Keynes goes, “the market can stay irrational longer than you can stay solvent”. With the returns that US leading lights have delivered over the past few years, fear of missing out has proven a strong lure, and investors have piled in.

As ever, fund selection is all important: while three-year returns for the IA North America sector average 51.3%, the range goes from 4.5% to 167.4%.

Shooting the Lights Out

Starting at the top end, the Bailie Gifford American fund has shot the lights out, with a three-year return of 167.4% against its benchmark S&P 500, which still posted an impressive return of 55.6%. Over five years, those figures are 340.1% and 112.5%, respectively, so its investors have been well rewarded. The bulk of the three-year returns (119.6%) were garnered over 2020.

The fund’s philosophy is that stock market returns are asymmetric, with the majority of returns being accounted for by relatively few stocks. The team that runs the fund aims to identify these stocks and hold them over a five-year period.

The fund’s largest sector exposures are Information Technology (30.9%), Consumer Discretionary (24.2%), and Healthcare (20.2%). An example of a holding in the latter is pharma company Moderna, which has obviously been high profile over the pandemic.

Other leading holdings include ecommerce platforms Shopify Wayfair, the latter of which focuses on home goods. Both have thrived during the pandemic and helped drive returns, as shoppers have abandoned the malls. But, as Amazon has shown, this is more than a short-term reaction to adverse conditions—it’s now a deeply embedded trend, and the upsurge in e-footfall from last year could prove sticky.

Second-placed Morgan Stanley US Advantage, which is a large-cap growth fund, also has Shopify as its top holding, followed by Twitter and cloud communications and service company Twilio. Top sector weightings are Information Technology, Communications Services, and Health Care, with the former making up 43.3% of the portfolio.

While there’s reason for concern over valuations, this is a market that offers companies that are changing the world. And, short term, its reputation as a safe haven will be supportive.

Table 1: Top-Performing North America Over Three Years (with a minimum five-year history)

All data as of July 31, 2021; Calculations in GBP, Source: Refinitiv Lipper

This article was originally published in Moneyfacts, p16.

Refinitiv Lipper delivers data on more than 330,000 collective investments in 113 countries. Find out more.

The views expressed are the views of the author and not necessarily those of Refinitiv. This material is provided as market commentary and for educational purposes only and does not constitute investment research or advice. Refinitiv cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned. Please consult with a qualified professional for financial advice.