In a prior note (click here), we looked at uranium prices and the nuclear energy industry, highlighting a demand/supply imbalance that will need to be filled by new production capacity.

Nuclear energy is a hotly contested debate among many, given the pros and cons of the fuel source, but it is also part of the conversation around decarbonization.

Arguments for nuclear include:

- A reliable source of electricity which is not prone to intermittent issues that arise from renewable sources (i.e., wind and solar rely on weather conditions).

- Nuclear is a far less carbon-intensive fuel source compared to fossil fuels such as coal.

- Nuclear reactors have a long operable lifetime (more than 40 years).

However, for all the pros, there are many hesitancies towards nuclear energy which include:

- Significant costs to assemble a nuclear reactor facility that can take many years to complete. For example, U.K.’s Hinkley Point C nuclear plant is planning to launch in 2026, after being delayed by almost 10 years. The total cost of the plant is estimated to be £22-23 billion.

- How to safely decommission an end-of-life nuclear reactor without harming the local environment.

- How to deal with the safe treatment and removal of radioactive waste from nuclear facilities.

- Fears of a nuclear accident.

Therefore, the adoption of nuclear in a country will largely depend on government policy. For example, the U.K.’s “Net Zero Strategy: Build Back Greener” report last month said that nuclear will play a key role in achieving net zero emissions by 2050.

Part of the U.K.’s strategy is to invest in Small Modular Reactors (SMR), a cutting-edge technology that will allow for quicker and cheaper construction of nuclear plants. On November 8th, Rolls Royce (RIC: RR.L) announced successful funding for the newly launched business ‘Rolls-Royce Small Modular Reactor’. According to the company, a single Rolls-Royce SMR power station will occupy the footprint of two football pitches and power approximately one million homes.

Regarding the announcement, U.K. Business and Energy Secretary Kwasi Kwarteng stated, “SMR offer exciting opportunities to cut costs and build more quickly, ensuring we can bring clean electricity to people’s homes and cut our already-dwindling use of volatile fossil fuels even further.”

Energy mix by country – who is ‘pro-nuclear’?

In this data insight, we take a closer look at how users can see the energy mix of a country using the Renewables Dashboard in Refinitiv Workspace.

The Renewables Dashboard provides a global real-time database of renewable facilities which allows users to view data at a company/country level while also accessing related news and research. Users can access the app by typing “Renewables” in the search toolbar.

Within the app, users can go to the Country/Region Dashboard page which highlights the energy mix by country. This is one method to gauge a country’s attitude towards nuclear energy and quickly see if it is “pro-nuclear.”

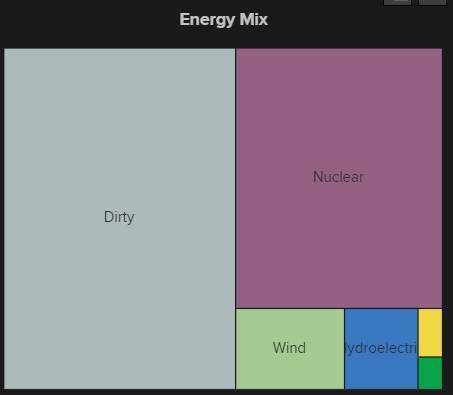

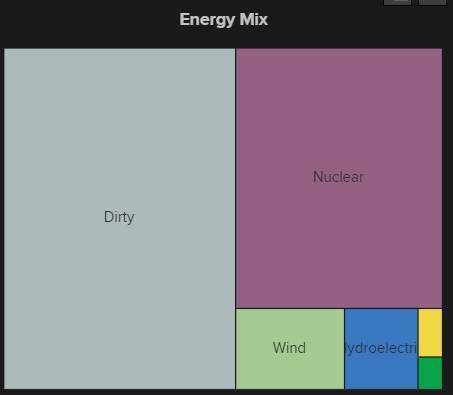

For example, Exhibit 1 provides the energy mix for France and Germany. We can see the stark difference between the two: nuclear is accountable for 35.9% of France’s total energy mix, while only 6.1% for Germany.

Exhibit 1: Renewables App – Country/Region Dashboard

France

Germany

Source: Refinitiv Workspace

Those familiar with the nuclear industry will be aware that Germany is planning to completely phase out nuclear energy by the end of 2022, while France is looking to increase its reliance on nuclear energy.

Cameco Corp. highlighted in its 21Q3 earnings call that “French President Emmanuel Macron pledged he would invest EUR 1 billion in small modular reactors, crediting nuclear power for insulating France from the current impact of rocketing energy costs and shortages of natural gas. In fact, France’s grid operator says that the most cost-effective way for the country to meet its carbon neutral goal by 2050 is to build 14 new large-scale nuclear reactors in addition to building SMRs and extending the lives of the existing fleet.” (Source: Cameco 21Q3 Earnings Call)

State-owned Electricite de France SA (RIC: EDF.PA) also highlighted its reliance on nuclear in its latest H1 earnings call, indicating “our nuclear output estimate for the whole of 2021. The new range is from 345 terawatt hours to 365 terawatt hours… regarding nuclear new build in May, we submitted to the French government the studies that had been requested concerning the feasibility and the conditions for the success of such a program of building three pairs of EPR 2 reactors in France.” (Source: Electricite de France SA 21H1 Earnings Call)

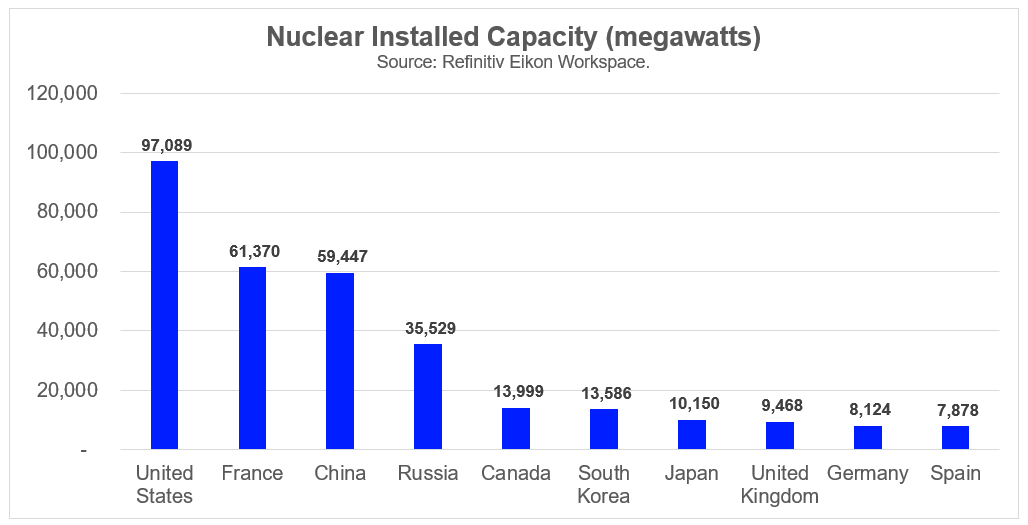

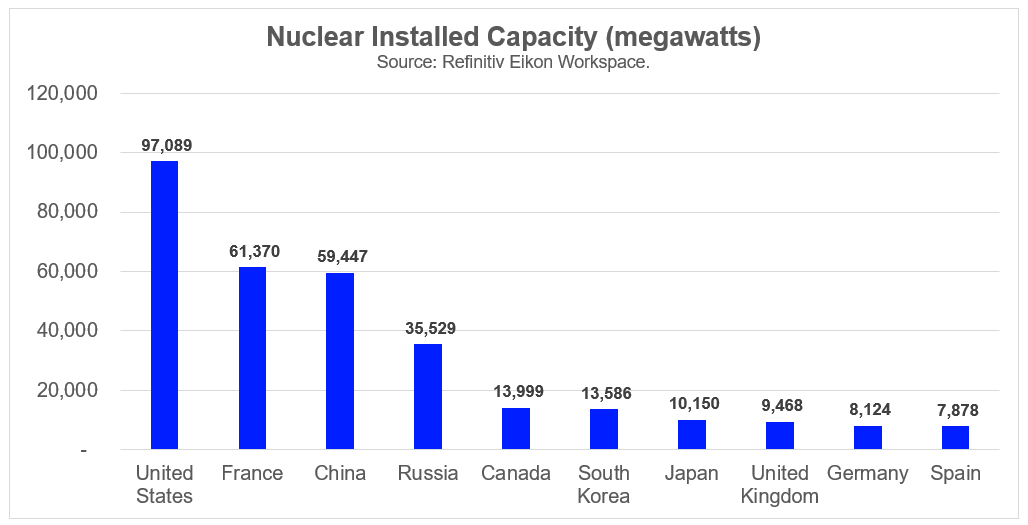

Exhibit 2 highlights the countries that have the largest nuclear installed capacity (in megawatts).

United States has the highest capacity at 97,089 MW followed by France (61,370), China (59,447), Russia (35,529), Canada (13,999), South Korea (13,586), Japan (10,150), United Kingdom (9,468), Germany (8,124) and Spain (7,878).

Exhibit 2: Nuclear Installed Capacity in Megawatts

Refinitiv Eikon is a complete solution for research and analytics. It places the most comprehensive market information, news, analytics and trading tools available into a desktop.