Policymakers at the European Central Bank, led by its president Christine Lagarde, have agreed hike their three key interest rates by 50 basis points. This is the first policy rate tightening since 2011. The last time they did this it was followed by the start of the euro crisis. Ultimately, that crisis could only be solved by the then-president Mario Draghi’s commitment to do “whatever it takes” (WIT) to save the euro area. The limits of that commitment were never tested to the full, but his presidency did see a pivot towards ultra-loose monetary policy. Ms Lagarde’s commitment to WIT has been questioned in the past and is likely to be so again, as the central bank normalises policy amid political uncertainty in Italy — ironically, triggered by Mario Draghi’s resignation as prime minister of Italy.

Refresh this chart in your browser | Edit the chart in Datastream

The central bank’s decision to raise rates is in response to a rapidly increasing inflation rate, which reached 8.6% in June. The current overshoot of the central bank’s 2% target is primarily the result of temporary factors, namely shocks to supply chains brought about by the COVID-19 pandemic and a surge in commodity prices. Macro theory will tell you that a central bank can look through the first-round (i.e., direct) effects of these shocks since they are transitory in nature. If, however, it perceives a risk that these shocks could lead to higher inflation becoming embedded into the expectations of households and consumers, then the risk of a sustained inflation overshoot is high. If such second-round effects occur, macro theory will tell you that, all else equal, the central bank should act decisively and hike rates to cool the economy (textbook monetary policy rules state, following a persistent positive shock to inflation, the policy rate should be raised by more than the increase in inflation).

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

But that phrase “all else equal” is doing a lot of work. Clearly, not all else is equal — euro area consumer confidence has fallen off a cliff in recent months (it is at the lowest level since the European Commission’s survey began in 1970) and the warning signs of a recession are everywhere. Indeed, the euro area has never escaped a recession when either consumer confidence has been this low or inflation has been this high. Ms Lagarde and her colleagues are therefore grappling with an unwanted dilemma — should they focus on fighting inflation or supporting growth?

Refresh this chart in your browser | Edit the chart in Datastream

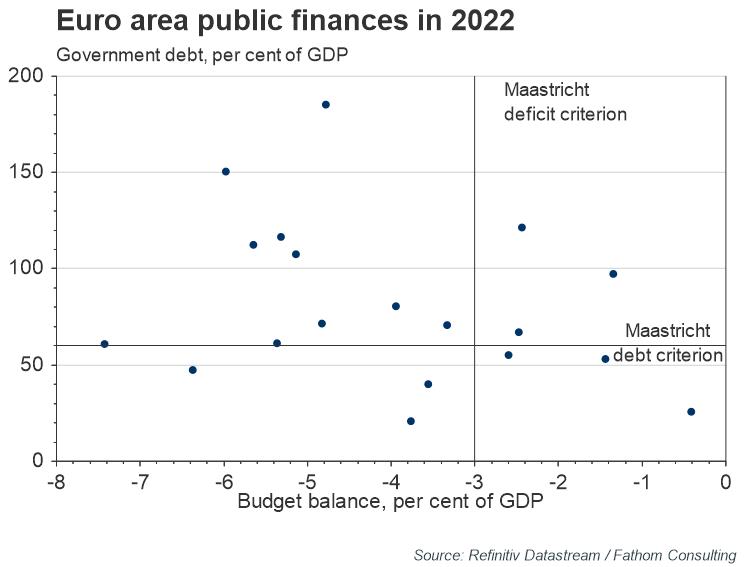

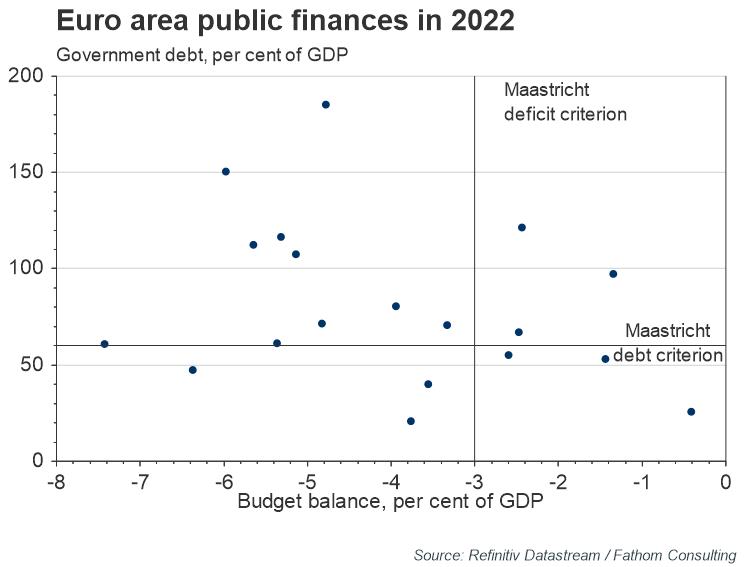

But there is a third factor that the ECB president must consider — the risk of fiscal instability. Debt ratios have been elevated across the bloc for some time but have remained affordable thanks to the loose monetary policy ushered in by Mr Draghi during his tenure as ECB chief. Bond yields have already risen in anticipation of monetary policy tightening, with investors appearing concerned about the impacts of higher rates on debt sustainability. The first time that Ms Lagarde’s commitment to her predecessor’s policy of WIT was questioned was in early 2020, the last time spreads were this high. Then, she famously declared that closing spreads was not the ECB’s job (most now consider its job to be precisely that). As the central bank now hikes rates, she must convince the public of her commitment to WIT if the ECB is to be able to pull off a successful normalisation of monetary policy (the newly launched Transmission Protection Instrument is designed to do just this).

Refresh this chart in your browser | Edit the chart in Datastream

Italy threatens to put a spanner in the works. Never far from the limelight, the nation’s politics are once again centre stage following the collapse of Mario Draghi’s coalition government. Remarkably (or unremarkably, for those who closely follow Italian politics) this is the third government to have collapsed since the last election in 2018. A new election was due next March anyway, so news of the government’s collapse is not particularly game-changing, though it does bring forward any possible risk. However, it does serve to highlight the difficulty that the country’s leading political parties have in maintaining stable coalition agreements; and it increases the likelihood that Matteo Salvini’s more confrontational Lega party will dominate the next Italian parliament (raising the possibility of conflict with the European Commission and the chances that disbursements of some recovery funds are disrupted). Fathom’s proprietary probability of exit metric, which tracks investors’ views of the likelihood of Italy quitting the single currency bloc, suggests that fears of ‘Italexit’ could be back on the news agenda.

Refresh this chart in your browser | Edit the chart in Datastream

Increasingly, the ECB president must think as much about politics as they do about economics. That is more true than for their peers at other central banks. Mr Draghi’s commitment to saving the euro may or may not have been a bluff — in the event WIT was never truly tested, with tools such as Outright Monetary Transactions ultimately left unused. Ms Lagarde now faces a similar challenge as the central bank raises rates the success of policy normalisation likely dependent upon the success of her own WIT device, the Transmission Protection Instrument.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

_________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.