The views expressed in this article are the views of the author, not necessarily those of Refinitiv Lipper or LSEG.

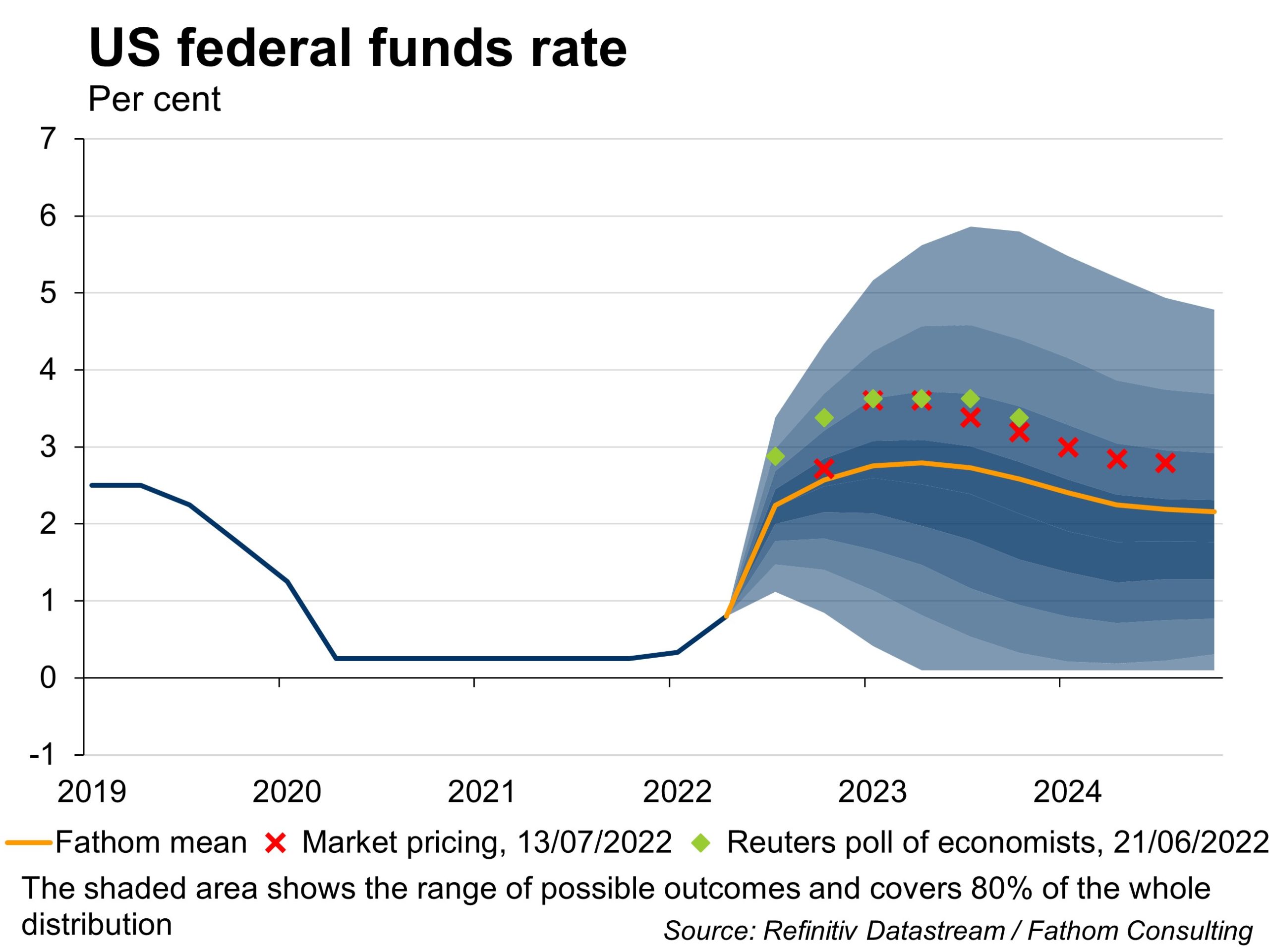

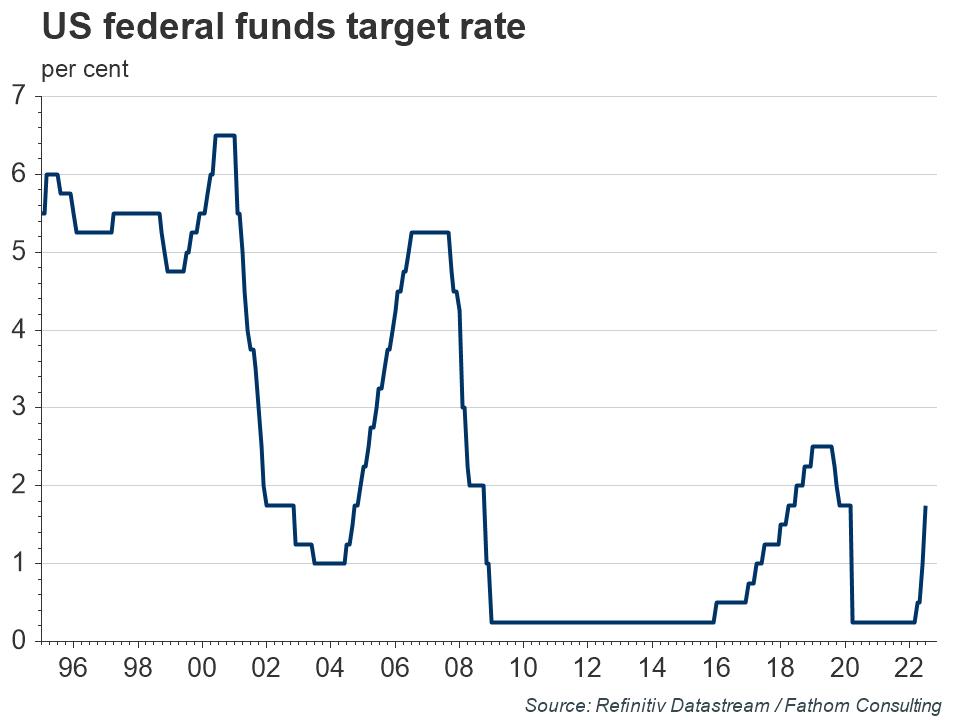

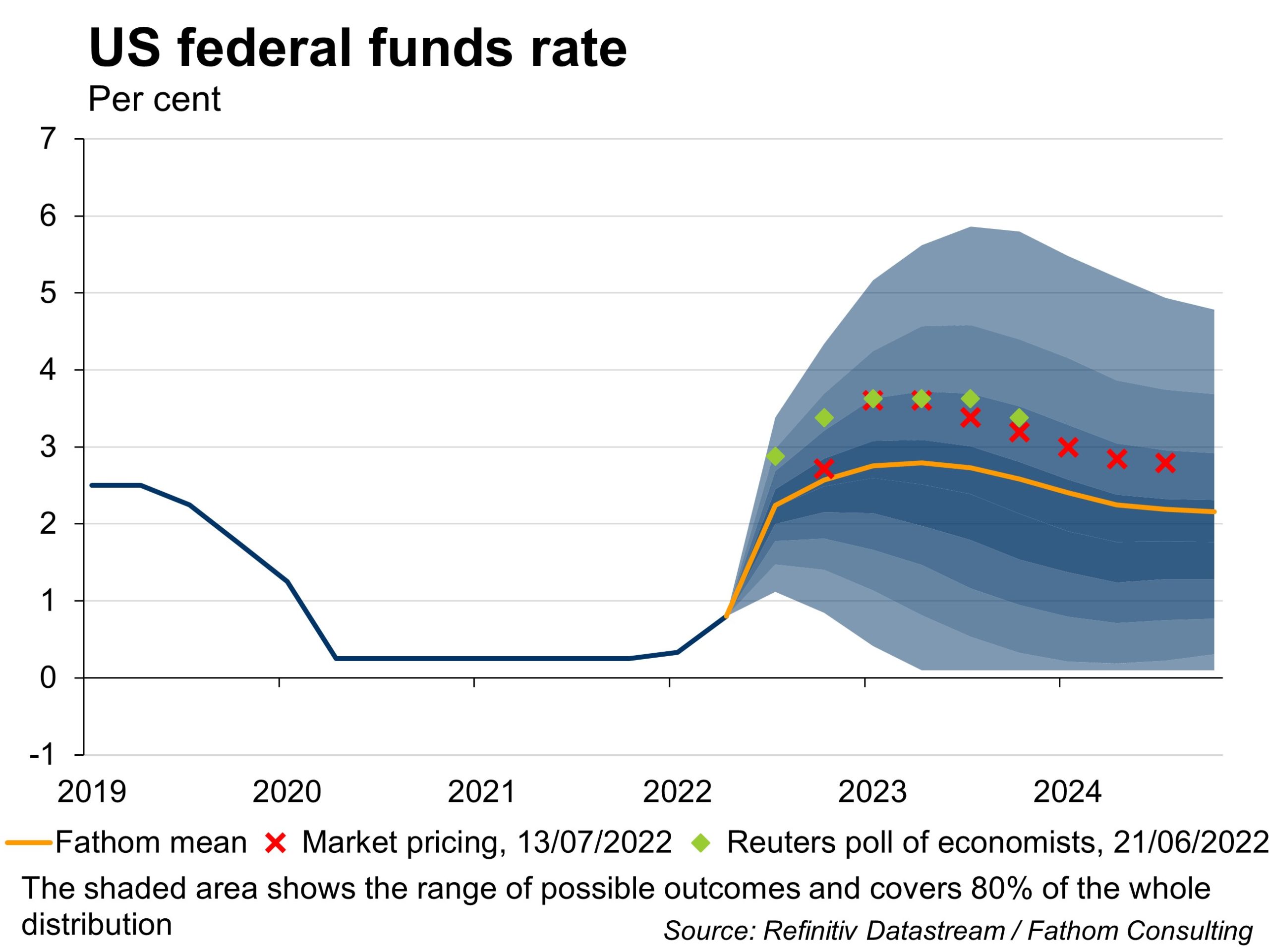

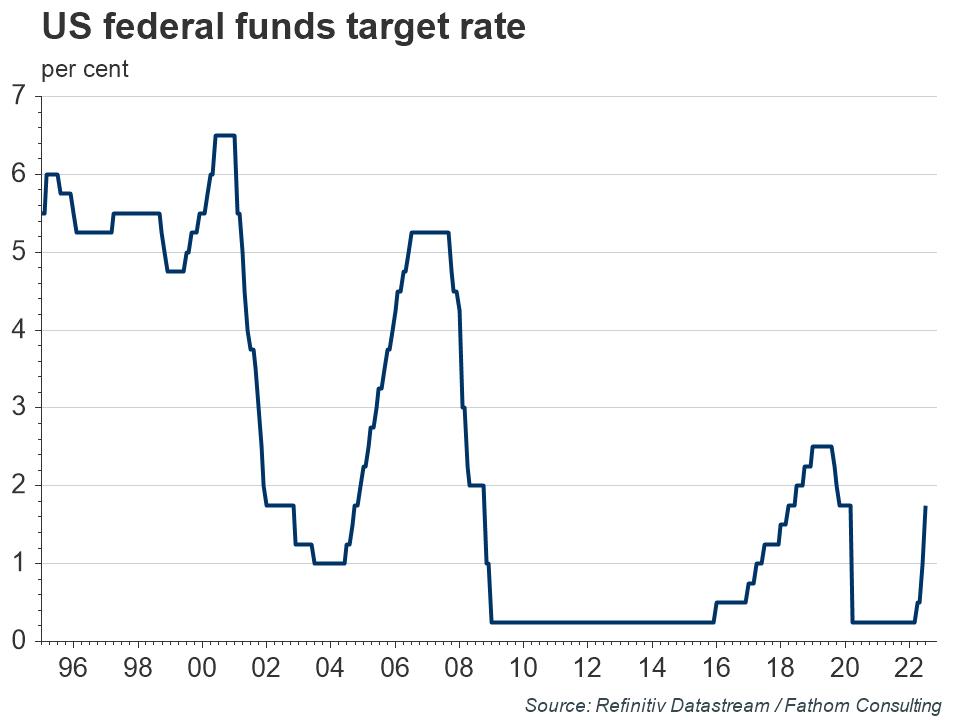

Fathom revised up its US interest rate forecasts late last month, pushing up the probability-weighted path for the federal funds rate in the near term. As always, we present our clients with a distribution of possible outcomes for the federal funds rate, and for other macroeconomic and financial market variables, based on scenarios.[1] The mean outcome across our three scenarios was for the US policy rate to peak at a little under 3% by the beginning of next year, before falling back gradually thereafter. This forecast remains some way below both market pricing and consensus expectations, which see a peak of around 3.5% towards the middle of next year.

IN HOUSE

Part of Fathom’s upward revision reflected the fact that the FOMC had hiked interest rates by 75 basis points in June rather than by the 50 basis points it had previously telegraphed, and the increasing likelihood that it will deliver another 75-basis point hike at its upcoming meeting on 27 July. A more important driver for our revised forecast was developments in the data: both the May CPI and average hourly earnings data surprised to the upside, with the 8.6% twelve-month change in the CPI being the fastest monthly increase since December 1981. In short, the combination of a more hawkish FOMC and the deterioration in the inflation outlook prompted us to push up our near-term rates forecast.

Refresh this chart in your browser | Edit the chart in Datastream

Key data releases for June have kept the pressure on the Federal Reserve to rapidly rein in its monetary accommodation. The labour market remained solid, with non-farm payrolls increasing by 372,000 after a gain of 384,000 in May, while the unemployment rate remained unchanged at just 3.6%. Average earnings growth moderated slightly, but remained strong at 5.1% on a twelve-month basis. Meanwhile, headline CPI rose further to 9.1% year-on-year – its highest rate since November 1981.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

Refresh this chart in your browser | Edit the chart in Datastream

We remain much more bearish than consensus on the economic outlook for the US, particularly when compared to the FOMC. Our best judgment is that the slowdown in economic activity will surprise the FOMC by much more to the downside than inflation will surprise to the upside, resulting in a lower path for short rates than investors and the median FOMC member currently expect. We currently place a 50% probability on a US recession over the next twelve months.

The rest of our economic forecasts are broadly unchanged from our Global Outlook, Summer 2022. We see very high probabilities of recession over the coming year in the UK (80%) and euro area (70%), as high inflation crushes spending power and consumer confidence. Against such a backdrop, both the Bank of England and the European Central Bank have signalled a much less aggressive tightening path than their US counterparts, although this increases the risks to their credibility, which could ultimately mean they are forced to tighten policy more aggressively than desired. The European Central Bank faces the additional problem of the impact its tightening will have on the financial stability of peripheral countries.

Refresh this chart in your browser | Edit the chart in Datastream

Given the significant risks of recession in the major economies, we continue to adopt an underweight position on risky assets. The backdrop for risk assets could start to become more constructive if the US Federal Reserve were to execute a major pivot later in the year, in response to signs that the labour market was beginning to cool and inflation pressures were beginning to moderate.

[1]. Our three scenarios this time were: ‘Time to dissave’ and ‘Time to save’, which were mutually exclusive; and ‘Back to the 1970s’, which was independent, and could occur whether or not the global economy was already on the verge of recession.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

_________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.