Despite the fact that media coverage around sustainability in general has gone further down over the course of 2024, it is important to have a look at the estimated net flows in the European ETF industry by SFDR article to determine if investors have returned to sustainable investment strategies or if they still prefer ETFs without any sustainability related screening criteria.

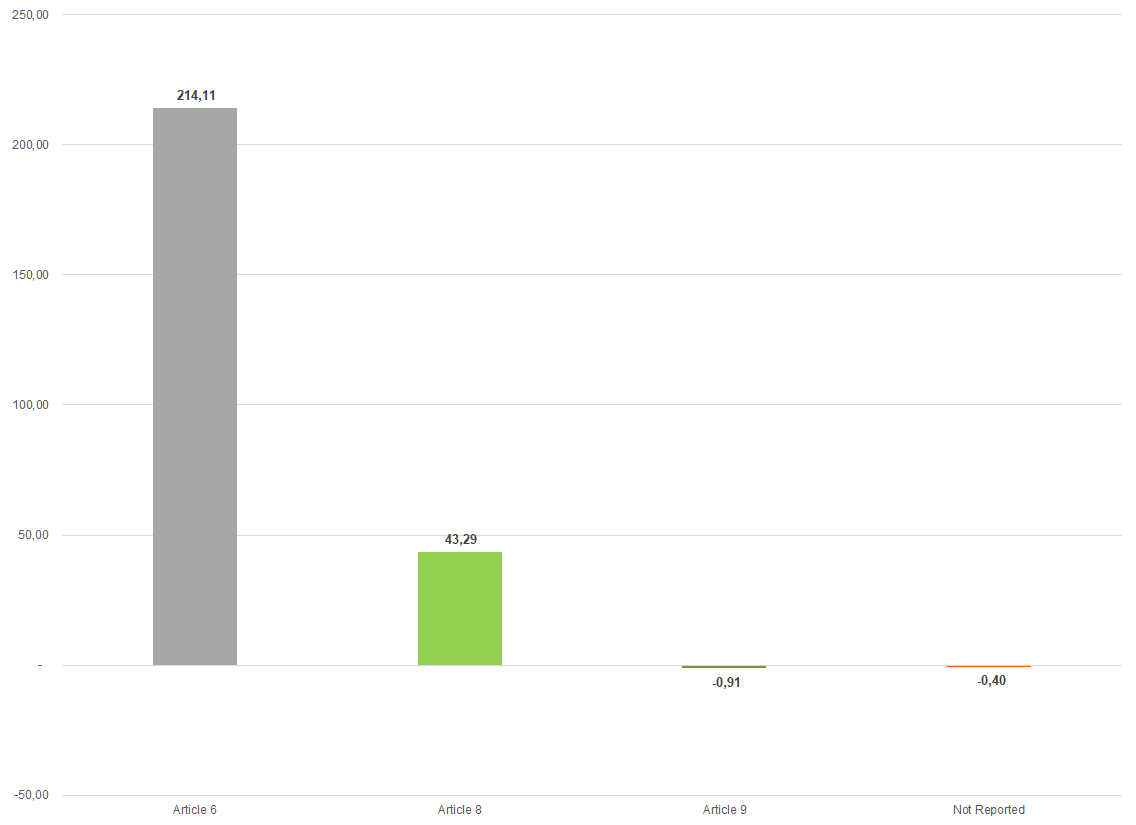

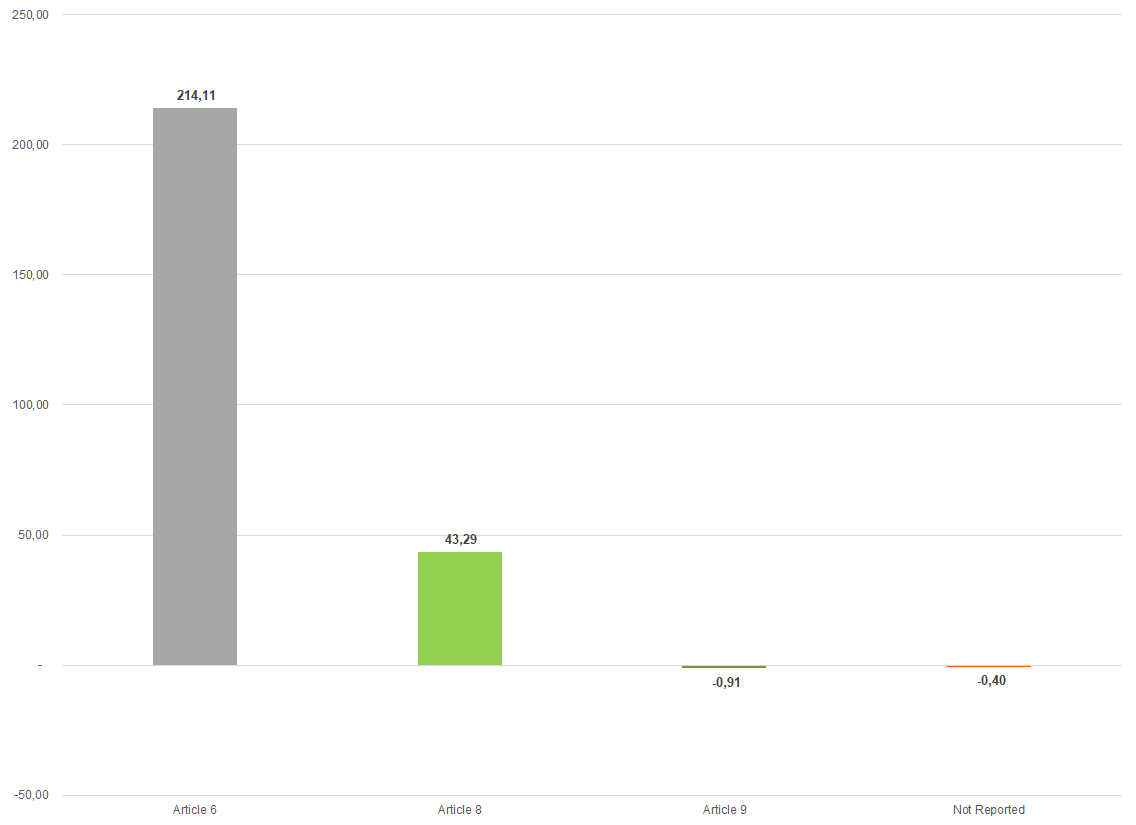

As for the year 2023, ETFs classified as article 6 products (+€214.1 bn) enjoyed the highest inflows over the course of 2024, followed by ETFs classified under article 8 of the SFDR (+€43.3 bn). Conversely, ETFs classified under article 9 (-€0.9 bn), and ETFs which were not reporting their SFDR status (-€0.4 bn) faced outflows.

The estimated fund flows by SFDR article show a clear preference of European investors for ETFs assigned to article 6 of the SFDR. This preference is not surprising as a high number of investors measure the performance of their portfolio against conventional benchmarks and may therefore prefer conventional over ESG-related ETFs. This might become a subject of change once European investors start to measure the performance of their portfolios against benchmarks which use sustainability credentials to determine their constituents.

In addition to this, investors do see sustainable investing as a natural habitat for active portfolio managers and may therefore prefer actively managed mutual funds over ETFs when it comes to sustainable investing. This might also be a subject of change, once there are active ETF offerings which are using ESG credentials for the selection of their portfolio constituents.

Graph 1: Estimated Net Sales in ETFs 2024 by SFDR Article (Euro Millions)

Source: LSEG Lipper

By looking at these numbers, one needs to bear in mind that investors as well as ETF and index promoters were somewhat in limbo when it comes to product/index design as they still miss some definitions and hard coded criteria from the regulators, even as there was some new guidance published over the course of the year.

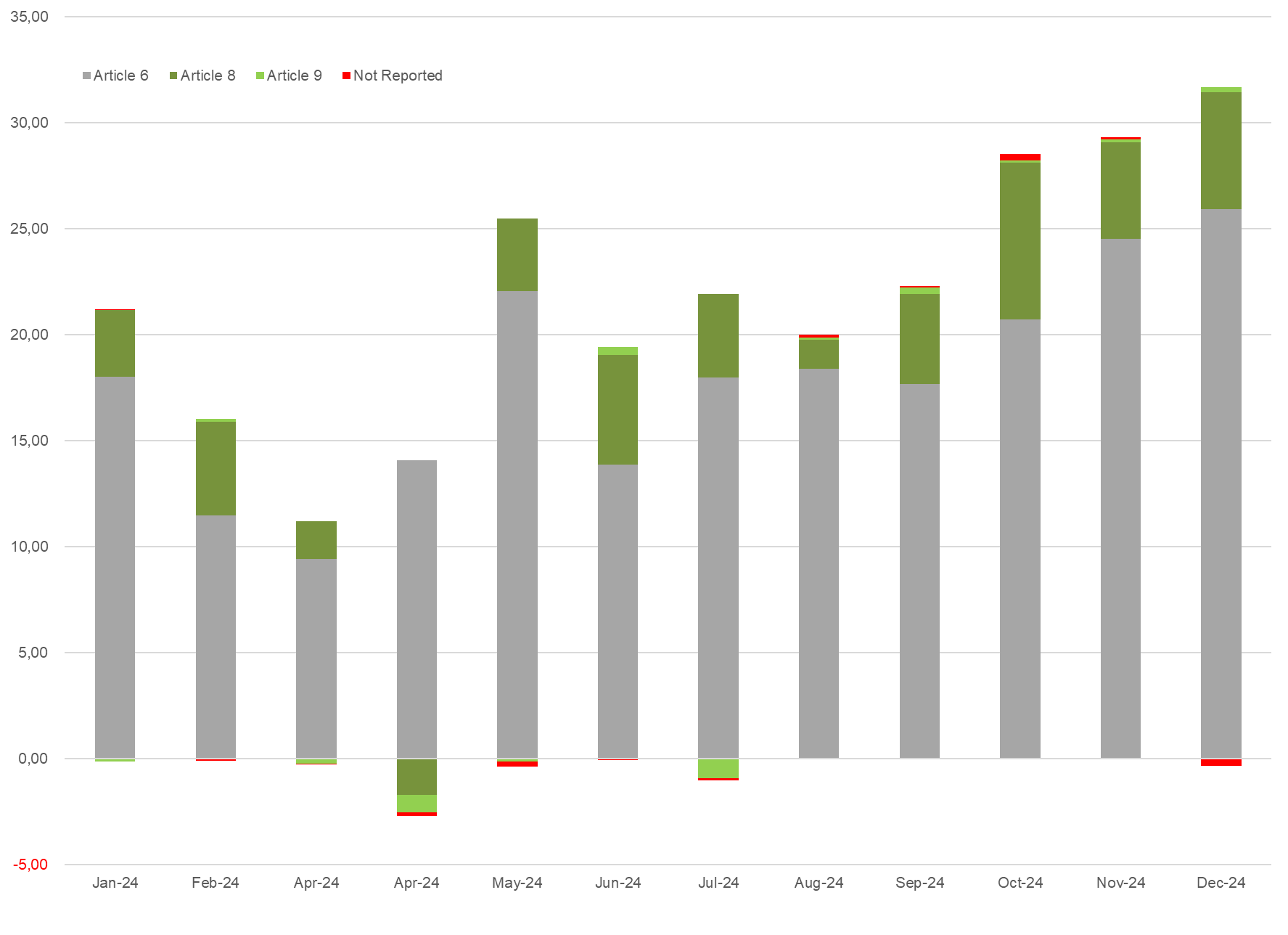

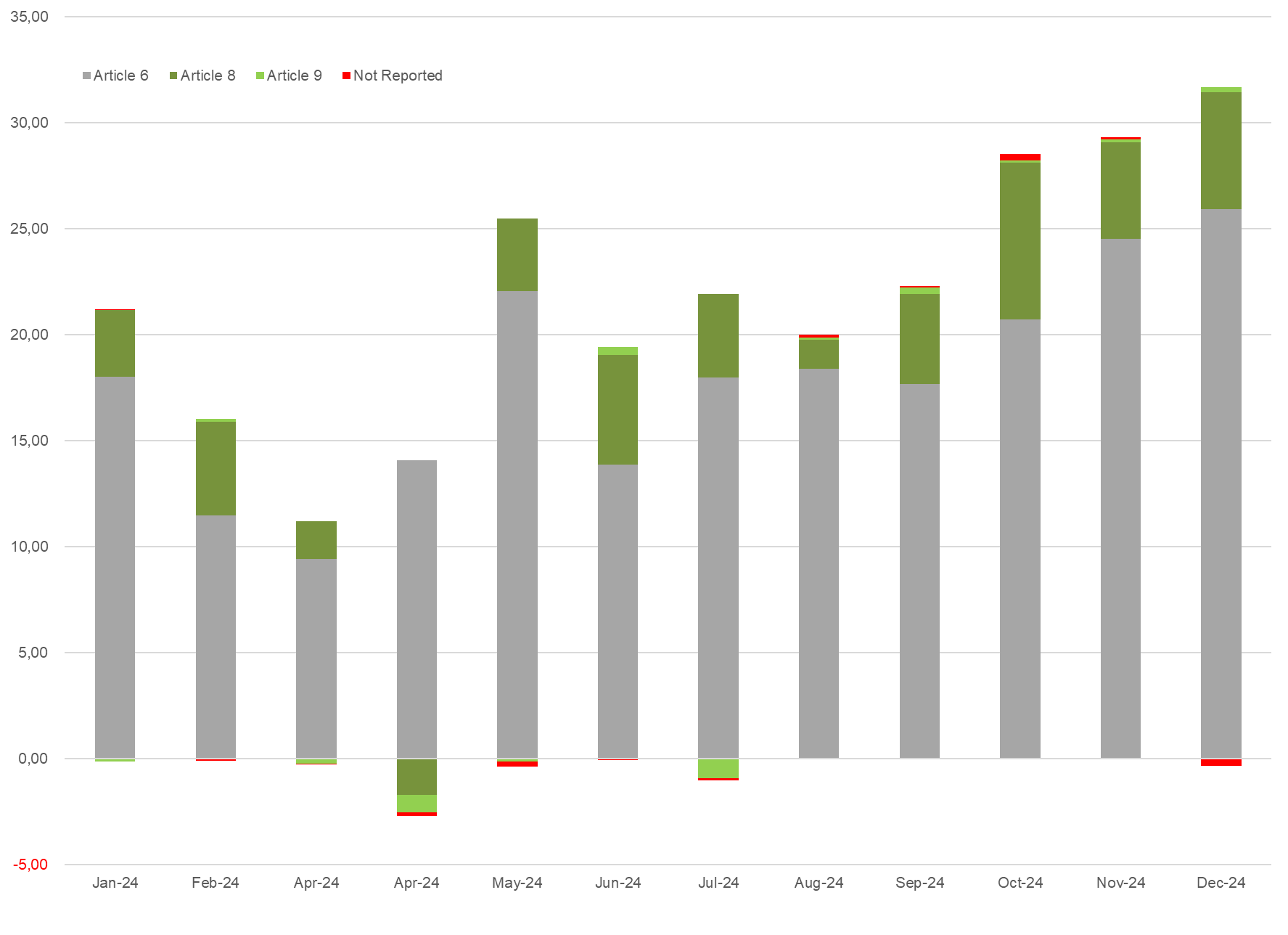

In addition to this, the sluggish performance of many stocks active in climate related businesses let in some cases to an underperformance of ESG-related indices compared to their conventional peers. This might be another reason why ETFs assigned to article 9 ETFs were the only products with an SFDR assignment which faced five months with estimated outflows over the course of 2024.

Graph 2: Monthly Estimated Net Sales in ETFs by SFDR Article (Euro Millions)

Source: LSEG Lipper

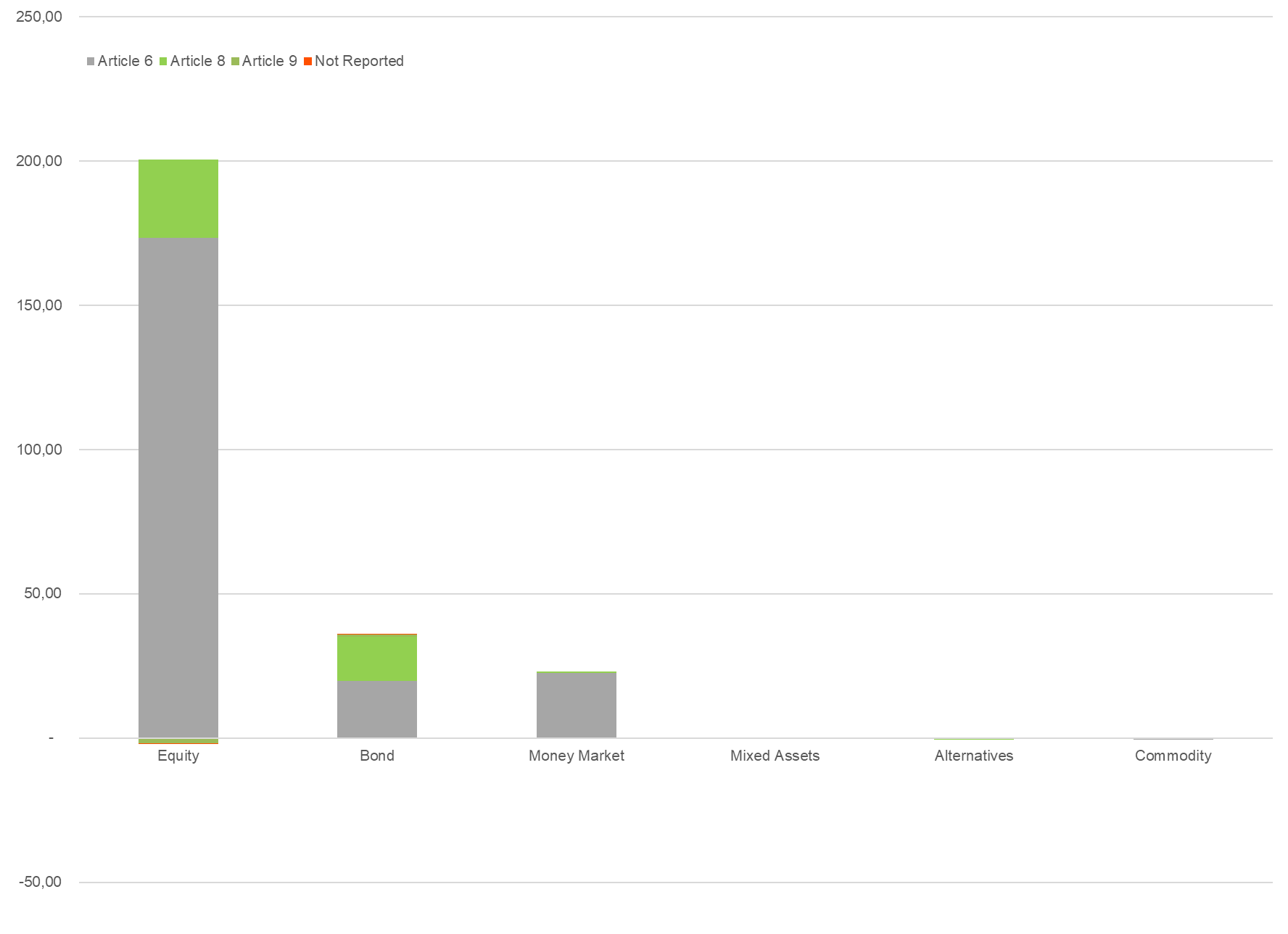

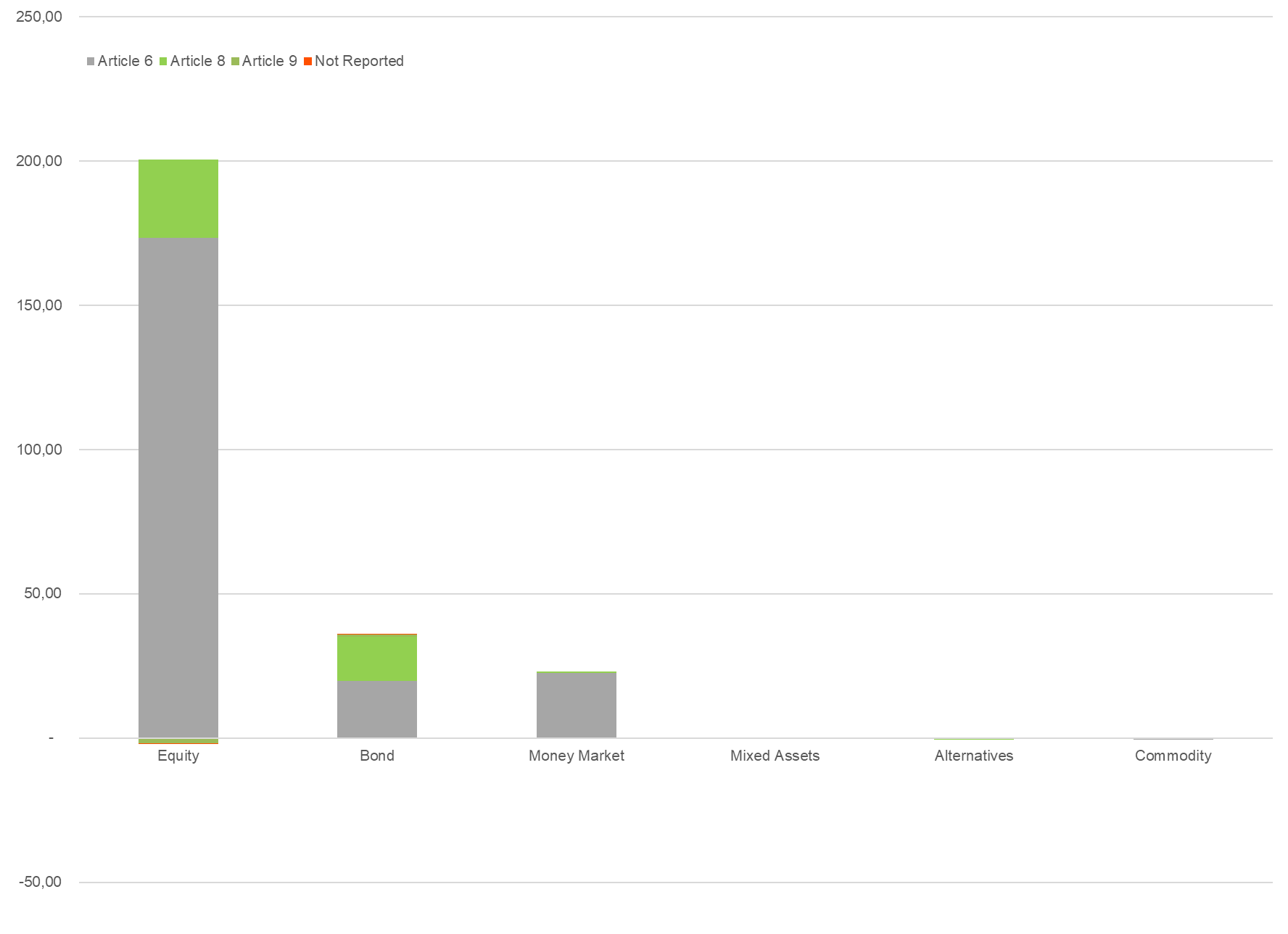

Given the overall fund flow trends in the European ETF industry over the course of 2024, it was no surprise that equity ETFs witnessed the highest inflows for article 6 products (+€173.2 bn) and article 8 products (+€27.3 bn), while equity ETFs assigned to article 9 products (-€1.8 bn) faced outflows. Conversely, bond ETFs from all SFDR articles enjoyed inflows—article 6 products (+€19.7 bn) , article 8 products (+€15.4 bn) and article 9 products (+€0.9 bn) were all up.

Graph 3: Estimated Net Sales in ETFs 2024 by Asset Type and SFDR Article (Euro Millions)

Source: LSEG Lipper

By looking at the overall estimated fund flow numbers it can be said that the trend toward sustainable investments within the European ETF industry, which we have seen over the course of 2022, was reverted over the course of 2023 and hasn’t seen a comeback over the course of 2024. I strongly believe that this will be subject of change, as more and more investors switching their portfolio benchmarks to ESG-related benchmarks. In addition to this, the emerging trend of active ETFs will give investors, who believe that active management is needed to run an ESG-related portfolio the choice to establish their views with respective ETFs over the next few years.

This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of LSEG Lipper or LSEG.