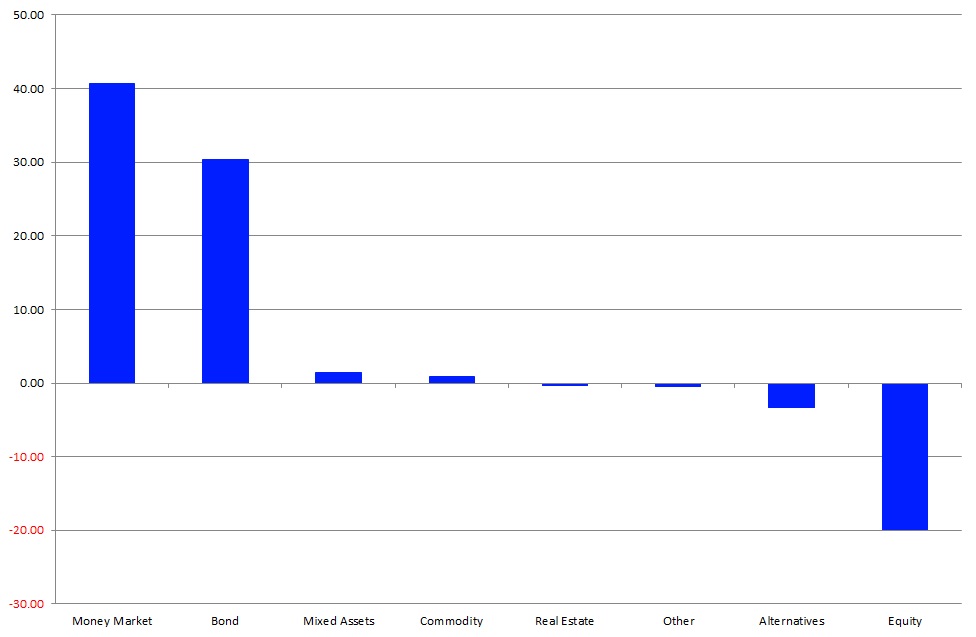

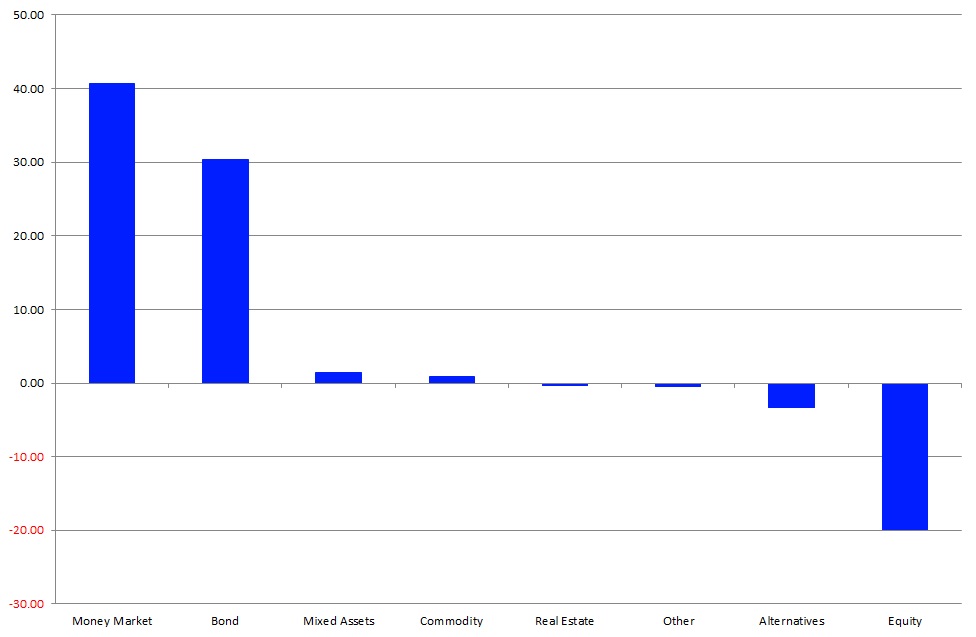

Investor concerns regarding declining earnings and the possible effects of a trade war between the U.S. and China materialized in Europe’s August fund flows. Nevertheless, August was the sixth month that long-term mutual funds posted net inflows this year. Taking the current interest rate environment into account, it was surprising that bond funds (+€30.3 bn) were once again the best-selling asset type in the segment of long-term mutual funds, followed by mixed-assets funds (+€1.5 bn) and commodity funds (+€0.9 bn). All other asset types faced outflows: equity funds (-€20.0 bn), alternative UCITS funds (-€3.3 bn), “other” funds (-€0.5 bn), and real estate funds (-€0.3 bn).

These fund flows added up to overall net outflows of €8.6 bn from long-term investment funds for August. ETFs contributed outflows of €8.8 bn to these flows.

Money Market Products

The current market environment led European investors to buy money market products. As a result, money market funds were again the best-selling asset type overall, witnessing net inflows of €40.6 bn for August. ETFs investing in money market instruments contributed net outflows of €0.1 bn to the total in contrast with their actively managed peers.

This flow pattern led to overall net inflows of €49.2 bn for August, and inflows of €186.0 bn for mutual funds in Europe to date this year.

Money Market Products by Sector

Money Market EUR (+€26.4 bn) was the best-selling sector overall, followed by Money Market GBP (+€10.4 bn), Money Market USD (+€3.6 bn), Money Market CHF (+€0.3 bn), and Money Market Global (+€0.2 bn). At the other end of the spectrum, Money Market EUR Leveraged (-€0.7 bn) suffered the highest net outflows in the money market segment, bettered by Money Market Other (-€0.1 bn) and Money Market AUD (-€0.02 bn).

Comparing this flow pattern with the flow pattern for July revealed that European investors seemed to prepare their portfolios for Brexit, as they were further building up their positions in the euro and increasing their positions in the British pound sterling and the U.S. dollar. That said, these shifts might have also been caused by corporate actions such as cash dividends or cash payments since money market funds are also used by corporations as replacements for cash accounts.

Graph 1: Estimated Net Sales by Asset Type, August 2019 (Euro Billions)

Source: Lipper from Refinitiv

Fund Flows by Sectors

Within the segment of long-term mutual funds, Bond USD (+€11.9 bn) was the best-selling sector, followed by Bond USD Medium Term (+€3.0 bn). Bond EUR (+€2.6 bn) was the third best-selling long-term sector, followed by Bond EUR Short Term (+€1.8 bn) and Bond EUR Corporates (+€1.7 bn).

Graph 2: Ten Top Sectors, August 2019 (Euro Billions)

Source: Lipper from Refinitiv

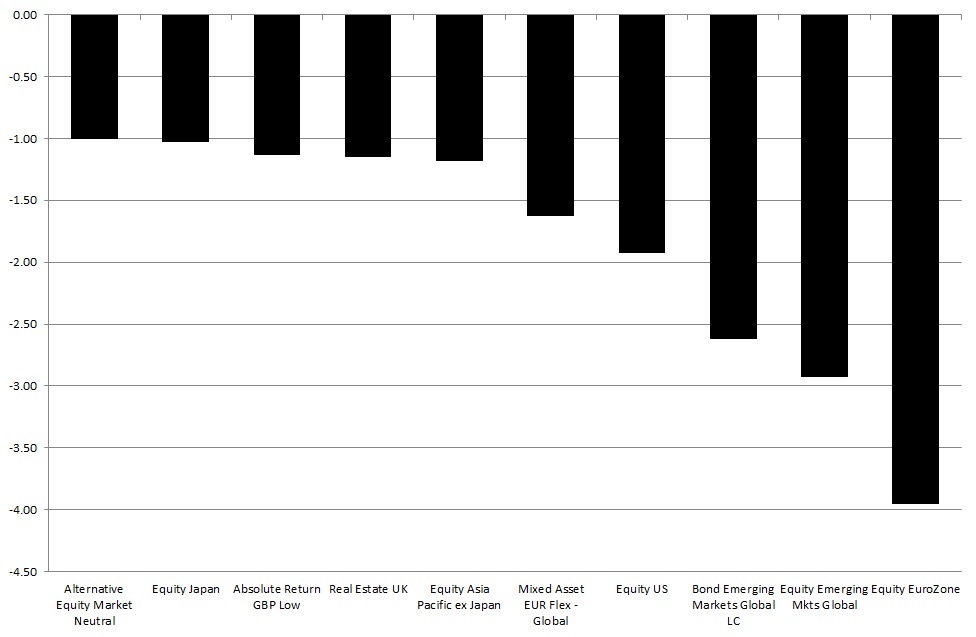

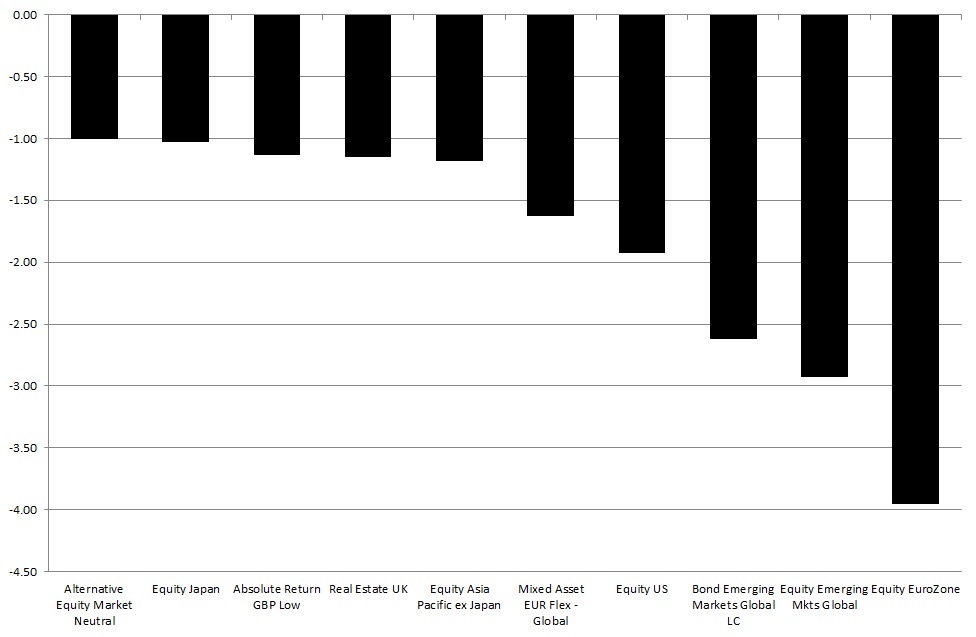

At the other end of the spectrum, Equity Eurozone (-€4.0 bn) suffered the highest net outflows overall, bettered by Equity Emerging Markets Global (-€2.9 bn), Bond Emerging Markets Global in Local Currencies (-€2.6 bn), Equity US (-€1.9 bn), and Mixed Asset EUR Flexible – Global (-€1.6 bn).

Graph 3: Ten Bottom Sectors, August 2019 (Euro Billions)

Source: Lipper from Refinitiv

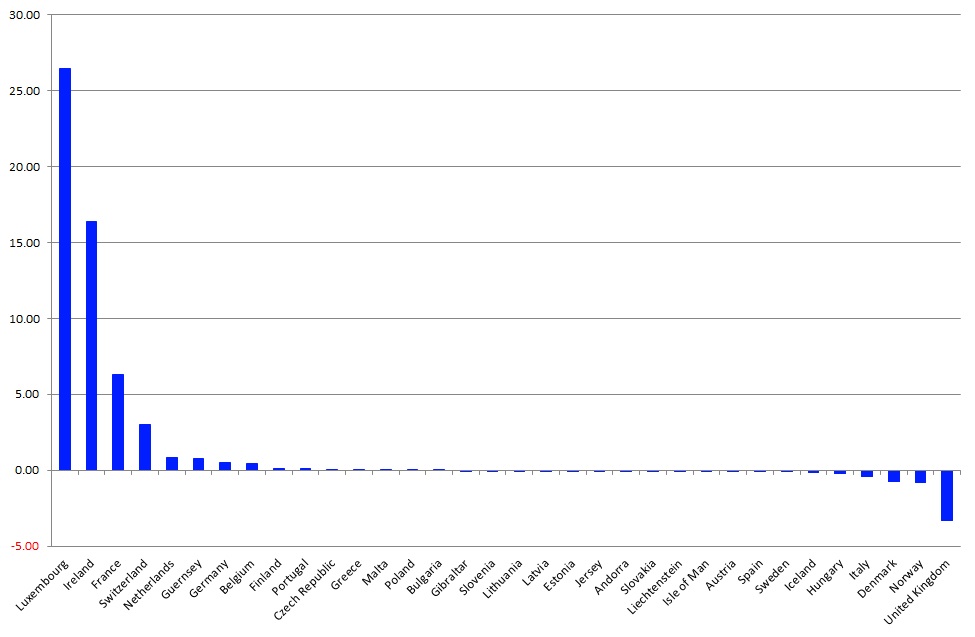

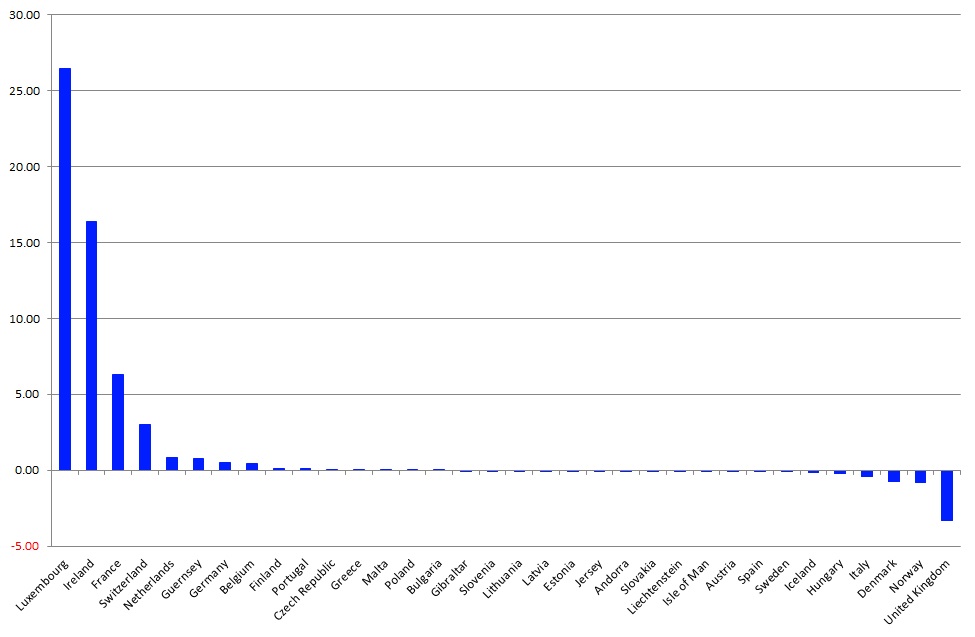

Fund Flows by Markets (Fund Domiciles)

Single-fund domicile flows (including those to money market products) showed, in general, a negative picture for August. Fifteen of the 34 markets covered in this report showed net inflows and 19 showed net outflows. Luxembourg (+€26.4 bn) was the fund domicile with the highest net inflows, followed by Ireland (+€16.4 bn), France (+€6.3 bn), Switzerland (+€3.0 bn), and the Netherlands (+€0.8 bn). It is noteworthy that the fund flows for Luxembourg (+€13.8 bn), Ireland (+€17.7 bn), and France (+€5.8 bn) were driven by flows into money market products. On the other side of the table, the U.K. (-€3.3 bn) was the fund domicile with the highest outflows, bettered by Norway (-€0.8 bn) and Denmark (-€0.4 bn).

Graph 4: Estimated Net Sales by Fund Domiciles, August 2019 (Euro Billions)

Source: Lipper from Refinitiv

Within the bond sector, funds domiciled in Luxembourg (+€22.7 bn) led the table, followed by Ireland (+€4.7 bn), France (+€1.7 bn), Guernsey (+€0.9 bn), and the U.K. (+€0.8 bn). Bond funds domiciled in Denmark (-€0.7 bn), Norway (-€0.6 bn), and Austria (-€0.3 bn) were at the other end of the table.

For equity funds, products domiciled in Switzerland (+€1.9 bn) led the table for August, followed by funds domiciled in the Netherlands (+€0.4 bn), Austria (+€0.1 bn), Portugal (+€0.03 bn), and Liechtenstein (+€0.02 bn). Meanwhile, Luxembourg (-€9.0 bn), Ireland (-€7.3 bn), and the U.K. (-€1.9 bn) were the domiciles with the highest net outflows from equity funds.

Regarding mixed-asset products, Ireland (+€1.3 bn) was the domicile with the highest net inflows, followed by funds domiciled in the U.K. (+€0.9 bn), Switzerland (+€0.3 bn), Austria (+€0.2 bn), and Germany (+€0.2 bn). In contrast, Luxembourg (-€0.6 bn), France (-€0.6 bn), and Jersey (-€0.2 bn) were the domiciles with the highest net outflows from mixed-asset funds.

The Netherlands (+€0.3 bn) was the domicile with the highest net inflows into alternative UCITS funds for August, followed by France (+€0.1 bn) and Liechtenstein (+€0.01 bn). Meanwhile, the U.K. (-€2.1 bn), Ireland (-€0.7 bn), and Italy (-€0.4 bn) were at the other end of the table.

Fund Flows by Promoters

BlackRock was the best-selling fund promoter for August overall, with net sales of nearly €9.0 bn, ahead of UBS (+€6.3 bn) and Northern Trust (+€4.8 bn).

Table 1: Ten Best-Selling Promoters, August 2019 (Euro Billions)

Source: Lipper from Refinitiv

Considering the single-asset classes, UBS (+€14.1 bn) was the best-selling promoter of bond funds, followed by Amundi (+€2.3 bn), AB (+€2.1 bn), PIMCO (+€1.7 bn), and BlackRock (+€1.4 bn).

Within the equity space, Vanguard Group (+€1.2 bn) led the table, followed by Capital Group (+€1.2 bn), Mercer (+€0.9 bn), AXA (+€0.8 bn), and Northern Trust (+€0.7 bn).

Mercer (+€0.8 bn) was the leading promoter of mixed-asset funds in Europe, followed by Vanguard Group (+€0.6 bn), Union Investment (+€0.3 bn), JP Morgan (+€0.3 bn), and Flossbach von Storch (+€0.3 bn).

DWS Group (+€0.6 bn) was the leading promoter of alternative UCITS funds for the month, followed by Insight (+€0.4 bn), Nordea (+€0.3 bn), Transtrend (+€0.3 bn), and Credit Suisse Group (+€0.3 bn).

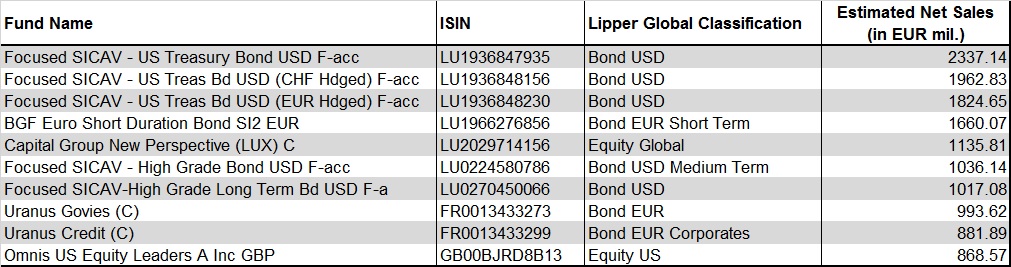

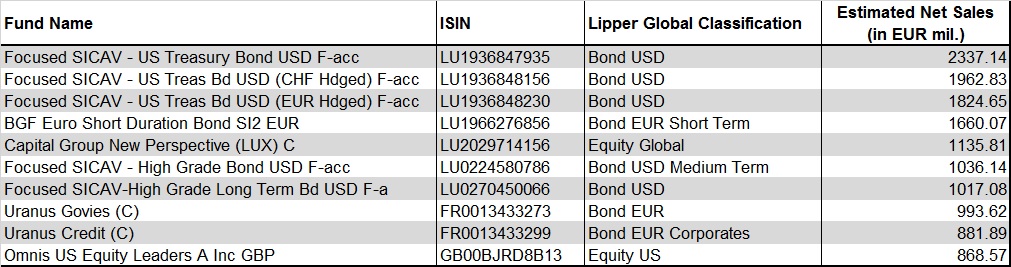

Best-Selling Funds

The 10 best-selling long-term funds, gathered at the share class level, amounted to €13.7 bn of estimated net inflows for August. In line with the general fund-flows trend, bond funds dominated the ranking of the asset types with regard to the 10 best-selling funds (+€11.7 bn), followed by equity funds (+€2.0 bn).

Table 2: Ten Best-Selling Long-Term Funds, August 2019 (Euro Millions)

Source: Lipper from Refinitiv

The views expressed are the views of the author, not necessarily those of Lipper or Refinitiv.