European investors were in a risk-on mode over the course of June since the COVID-19 pandemic in Europe was easing further. Because of this, it was no surprise that June 2021 was another positive month for the European fund industry since the promoters of mutual funds (+€40.8 bn) and ETFs (+€14.3 bn) enjoyed inflows. The overall flow pattern in Europe showed that investors continued to be in risk-on mode in June. In more detail, investors bought further into risky assets as long-term funds (+€70.6 bn) enjoyed inflows, while money market products (-€15.5 bn) faced estimated net outflows. In line with the general flow pattern, Equity Global (+€16.7 bn) was the best-selling classification for the month.

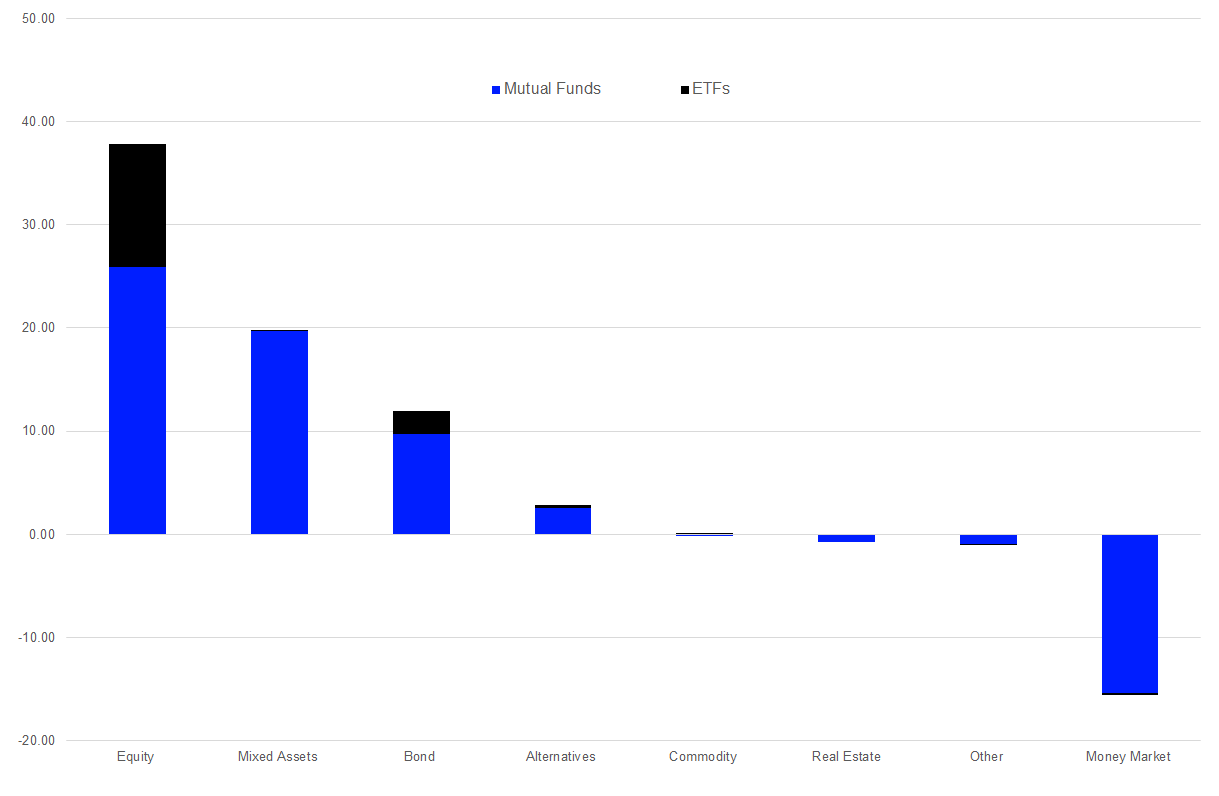

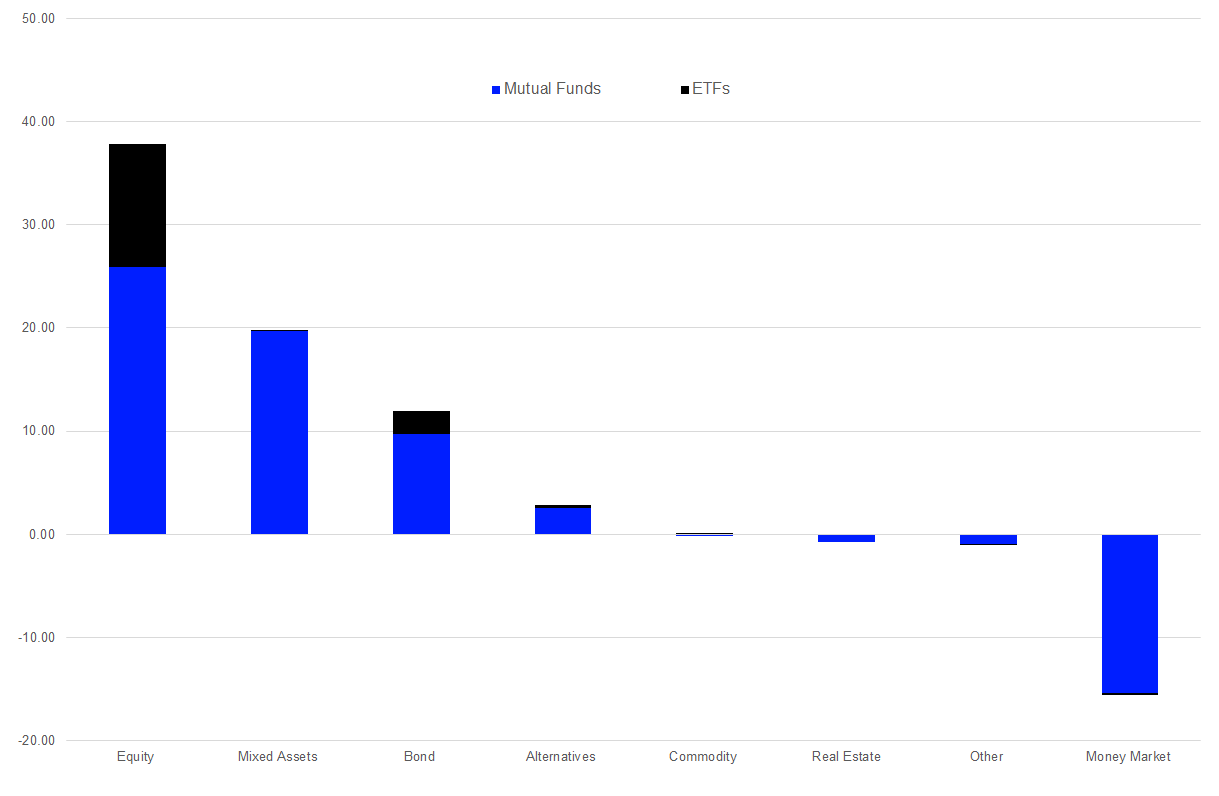

Equity funds (+€37.8 bn) were the best-selling asset type overall for the month. The category was followed by mixed-assets funds (+€19.7bn), bond funds (+€12.0 bn), and alternative UCITS funds (+€2.8 bn). On the other side of the table, commodities funds (-€0.1 bn), real estate funds (-€0.7 bn), “other” funds (-€0.9 bn), and money market funds (-€15.5 bn) were the asset types showing outflows.

Graph 1: Estimated Net Flows by Asset and Product Type – June 2021 (Euro Billions)

Source: Refinitiv Lipper

Money Market Products

With a market share of 9.91% of the overall assets under management in the European fund management industry, money market products are the fourth largest asset type. Therefore, it is worthwhile to briefly review the trends in this market segment. As the market environment normalized further, as the situation around the COVID-19 pandemic eased up, it was not surprising that European investors sold money market products. As a result, money market funds faced outflows for the month (-€24.3bn). In line with their active peers (-€15.3bn), ETFs investing in money market instruments contributed estimated net outflows of €0.2 bn to the total.

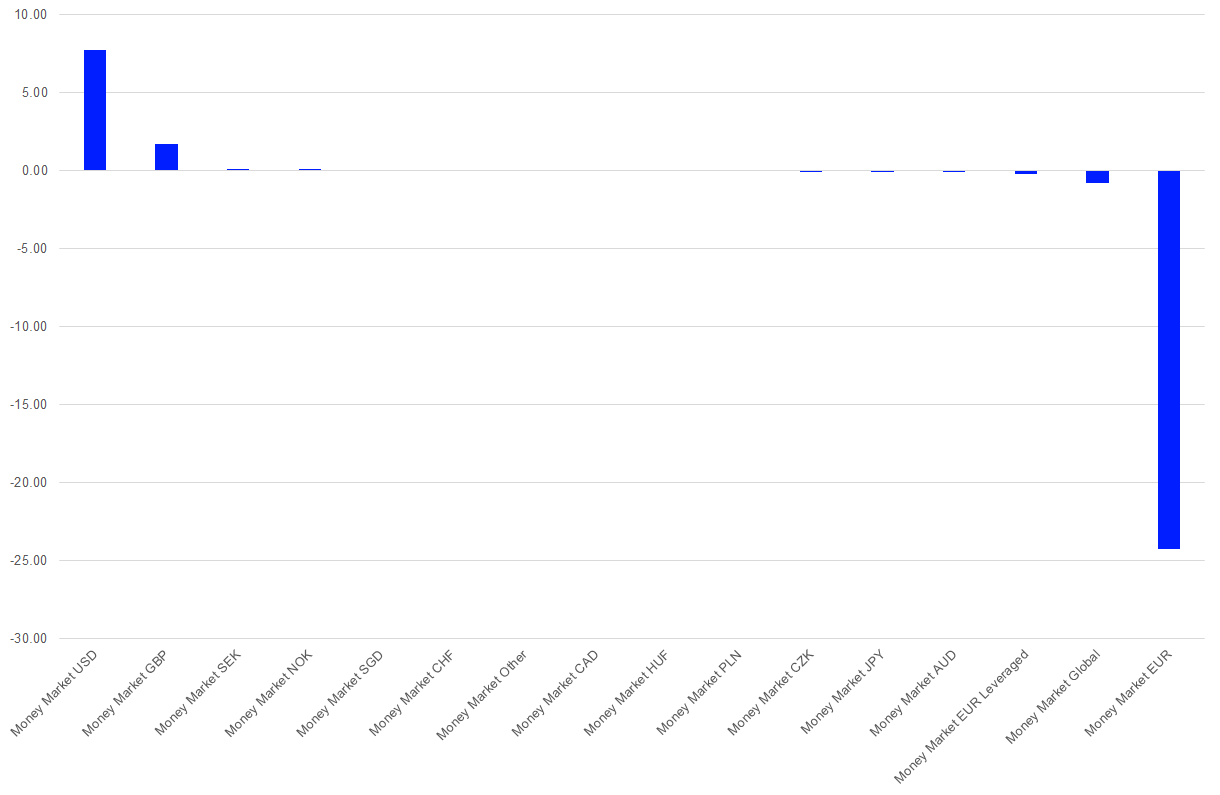

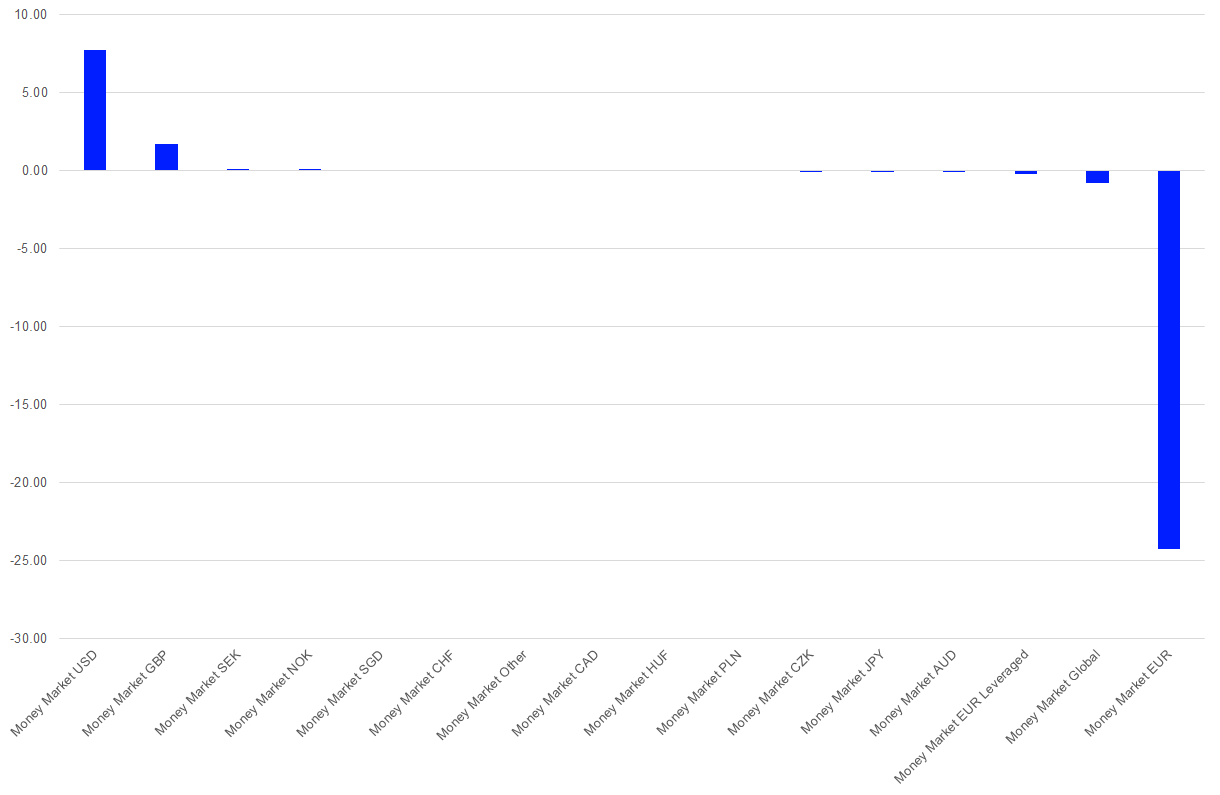

Graph 2: Estimated Net Flows in Money Market Products by LGC – June 2021 (Euro Billions)

Source: Refinitiv Lipper

Money Market Products by Lipper Global Classification (LGC)

In more detail, Money Market USD (+€7.7 bn) was the best seller within the money market segment and the best-selling Lipper classification overall, followed by Money Market GBP (+€1.7 bn) and Money Market SEK (+€0.1 bn). At the other end of the spectrum, Money Market EUR (-€24.2 bn) suffered the highest net outflows overall, bettered by Money Market Global (-€0.8 bn) and Money Market EUR Leveraged (-€0.2 bn).

This flow pattern revealed that European investors sold money market products denominated in the euro, while buying back into foreign currencies. In conjunction with the asset allocation decisions of portfolio managers, these shifts in the money market segment might have also been caused by corporate actions such as cash dividends or cash payments, since money market funds are also used by corporations as replacements for cash accounts.

Fund Flows by Lipper Global Classifications

With regard to the overall sales for June, it was not surprising that Equity Global (+€16.7 bn) dominated the table of the 10 best-selling peer groups by estimated net flows. It was followed by Money Market USD (+€7.7 bn), Mixed Asset EUR Flexible – Global (+€6.8 bn), Equity US (+€5.8 bn), and Mixed Asset EUR Balanced – Global (+€4.2 bn).

Graph 3: Ten Best- and Worst-Selling Lipper Global Classifications by Estimated Net Sales, June 2021 (Euro Billions)

Source: Refinitiv Lipper

On the other side of the table, Money Market EUR (-€24.2 bn) faced the highest estimated net outflows for June, bettered by Bond Global Short Term (-€3.1 bn) and Real Estate Switzerland (-€1.6 bn).

Fund Flows by Promoters

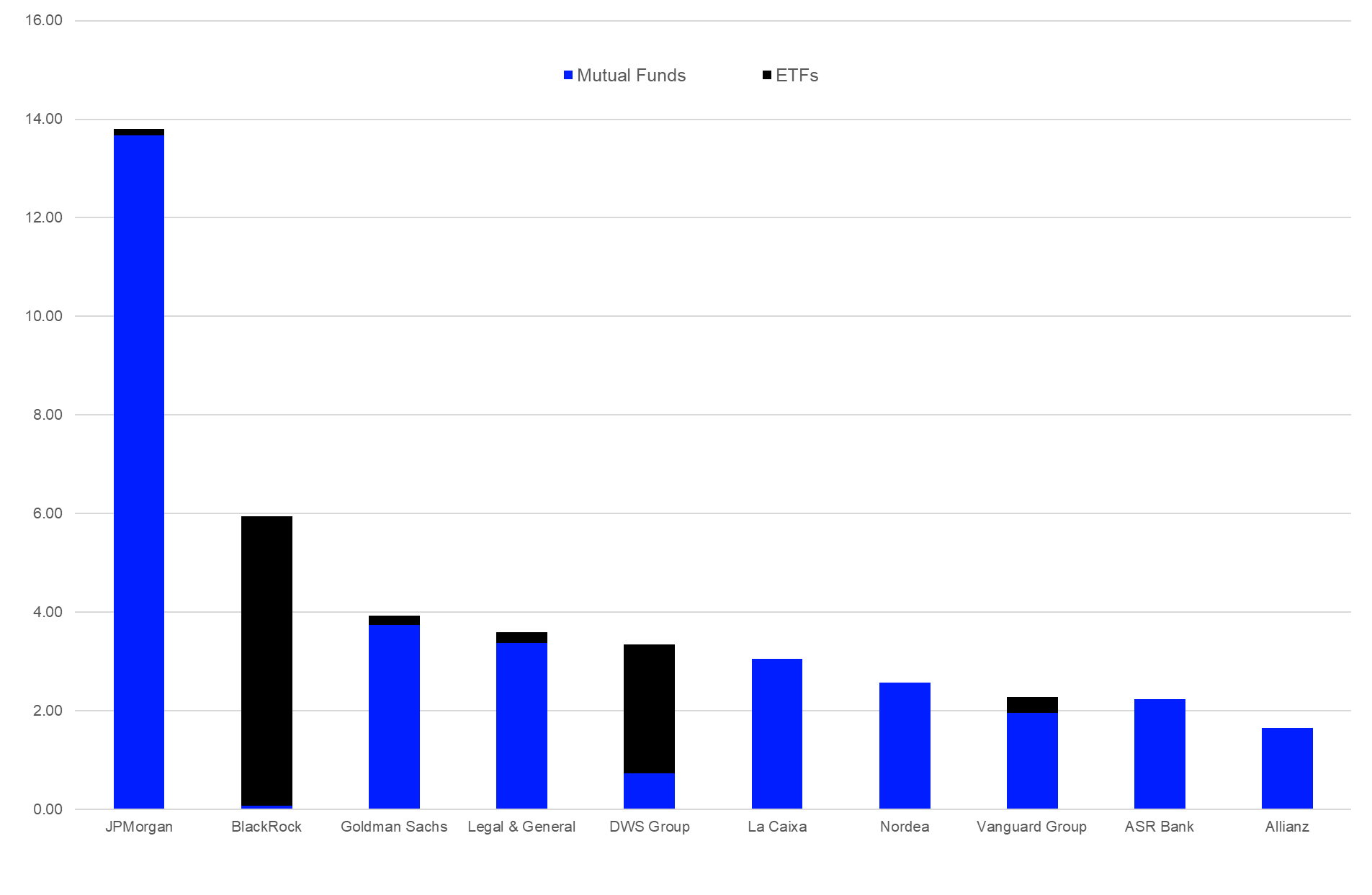

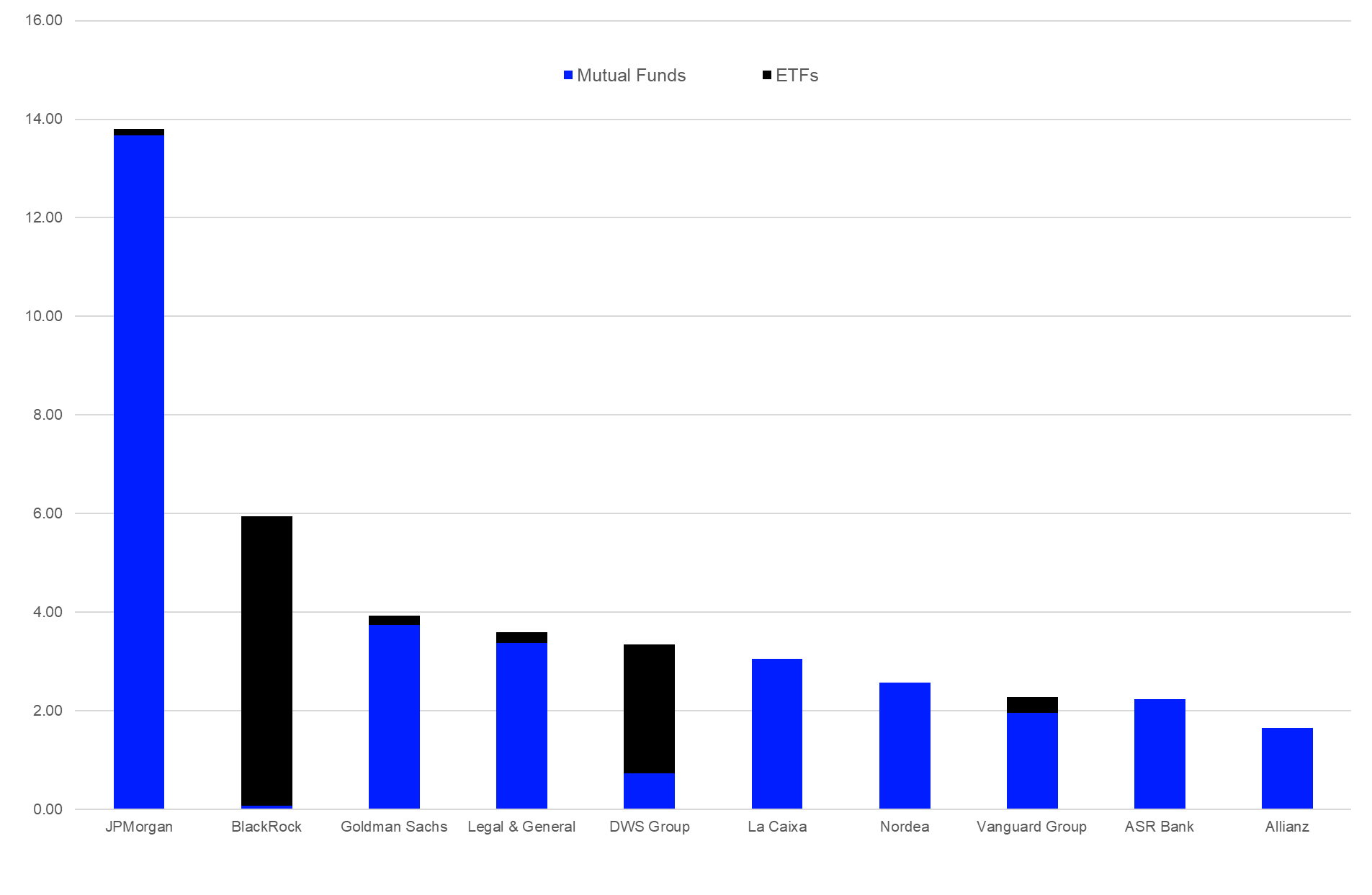

JPMorgan (+€13.8 bn) was the best-selling fund promoter in Europe for June, ahead of BlackRock (+€5.9 bn), Goldman Sachs (+€3.9 bn), Legal & General (+€3.6 bn), and DWS Group (+€3.3 bn). Given the product ranges of the top five promoters and the overall fund flow trends, it was not surprising to see that ETFs played a vital role only for BlackRock and DWS Group in the success of the five best-selling fund promoters in Europe.

Graph 4: Ten Best-Selling Fund Promoters in Europe, June 2021 (Euro Billions)

Source: Refinitiv Lipper

Considering the single-asset classes, UBS (+€1.3 bn) was the best-selling promoter of bond funds, followed by BlackRock (+€1.3 bn), M&G (+€1.2 bn), La Caixa (+€1.0 bn), and Credit Suisse Group (+€0.8 bn).

Within the equity space, BlackRock (+€7.6 bn) led the table, followed by DWS Group (+€2.3 bn), ASR Bank (+€2.2 bn), Amundi (+€2.0 bn), and JPMorgan (+€1.6 bn).

Bankia (+€3.1 bn) was the leading promoter of mixed-assets funds in Europe, followed by Allianz (+€1.3 bn), Amundi (+€1.0 bn), Scottish Widows (+€1.0 bn), and DWS Group (+€0.8 bn).

Aviva (+€0.7 bn) was the leading promoter of alternative UCITS funds for the month, followed by Insight (+€0.5 bn), Ruffer (+€0.5 bn), DWS Group (+€0.4 bn), and Aegon (+€0.3 bn).

Fund Flows by Fund Domiciles

Single-fund domicile flows (including those to money market products) showed, in general, a positive picture during June. Twenty-four of the 34 markets covered in this report showed estimated net inflows, and 10 showed net outflows. Luxembourg (+€37.9 bn) was the fund domicile with the highest net inflows, followed by Ireland (+€20.1 bn), the UK (+€7.2 bn), Spain (+€5.7 bn), and Germany (+€2.9 bn). On the other side of the table, France (-€27.5 bn) was the fund domicile with the highest outflows, bettered by Denmark (-€1.8 bn) and Switzerland (-€0.8 bn). It is noteworthy that the fund flows for France (-€22.3 bn), Luxembourg (+€7.1 bn), and Spain (+€1.1 bn) were impacted by the flows within the money market segment.

Graph 5: Estimated Net Sales by Fund Domiciles, June 2021 (Euro Billions)

Source: Refinitiv Lipper

Within the bond sector, funds domiciled in Luxembourg (+€6.7 bn) led the table, followed by Ireland (+€5.5 bn), Switzerland (+€1.7 bn), Finland (+€1.1 bn), and Belgium (+€0.6 bn). Bond funds domiciled in France (-€5.3 bn), Italy (-€0.2 bn), and Spain (-€0.1 bn) were at the other end of the table.

For equity funds, products domiciled in Luxembourg (+€14.5 bn) led the table, followed by Ireland (+€12.5 bn), the UK (+€3.3 bn), Sweden (+€1.9 bn), and the Netherlands (+€1.6 bn). Meanwhile, Switzerland (-€0.5 bn), the Isle of Man (-€0.02 bn), and Jersey (-€0.01 bn) were the domiciles with the highest estimated net outflows from equity funds.

Regarding mixed-assets products, Luxembourg (+€7.8 bn) was the domicile with the highest estimated net inflows for June, followed by Spain (+€4.4 bn), the UK (+€3.8 bn), Italy (+€1.3 bn), and Belgium (+€1.1 bn). In contrast, Denmark (-€2.4 bn), Liechtenstein (-€0.9 bn), and Jersey (-€0.3 bn) were the domiciles with the highest estimated net outflows from mixed-assets funds.

Luxembourg (+€1.8 bn) was the domicile with the highest estimated net inflows into alternative UCITS funds for June, followed by Ireland (+€1.3 bn) and the Netherlands (+€0.2 bn). Meanwhile, the UK (-€0.7 bn), Italy (-€0.3 bn), and France (-€0.2 bn) were at the other end of the table.

Refinitiv Lipper delivers data on more than 330,000 collective investments in 113 countries. Find out more.

The views expressed are the views of the author and not necessarily those of Refinitiv. This material is provided as market commentary and for educational purposes only and does not constitute investment research or advice. Refinitiv cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned. Please consult with a qualified professional for financial advice.