S&P 500 Earnings Dashboard 24Q4 | March. 14, 2025

Click here to view the full report.

Please note: if you use our earnings data, please source "LSEG I/B/E/S".

S&P 500 Aggregate ...

Find Out More

Weekly Aggregates Report | March. 14, 2025

To download the full Weekly Aggregates report click here.

Please note: if you use our earnings data, please source "LSEG I/B/E/S".

The Weekly ...

Find Out More

This Week in Earnings 24Q4 | March. 14, 2025

To download the full This Week in Earnings report click here.

Please note: if you use our earnings data, please source "LSEG ...

Find Out More

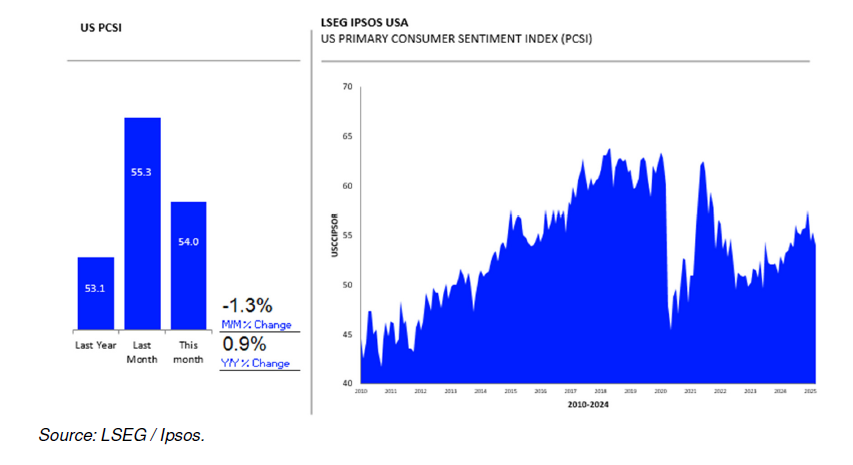

Consumer Confidence Continues Unsteady Start to 2025 as Expectations Index Falls Sharply

WASHINGTON, DC - The LSEG/Ipsos Primary Consumer Sentiment Index for March 2025 is

at 54.0. Fielded from February 21 – March 7, 2025*, the Index ...

Find Out More

Far from Monopoly: Why Investors Shouldn’t Fear Asset Management Consolidation Any Time Soon

Another asset management acquisition, and another time-honoured name looks set to disappear. The announced purchase of Putnam by Franklin Templeton at the start of June throws up the questions (again, and inevitably): how much is the asset management industry being dominated by large players, and what are the effects? LSEG Lipper analysis of the UK asset management industry shows that between 2003 and 2023, the top 10 asset managers’ market share by total net assets (TNA) have gone from 49.3% of TNA to 52.6% (see table).[1] Top-heavier So not much to get excited about, you might think. However, within those

Another asset management acquisition, and another time-honoured name looks set to disappear. The announced purchase of Putnam by Franklin Templeton at the start of June throws up the questions (again, and inevitably): how much is the asset management industry being dominated by large players, and what are the effects? LSEG Lipper analysis of the UK asset management industry shows that between 2003 and 2023, the top 10 asset managers’ market share by total net assets (TNA) have gone from 49.3% of TNA to 52.6% (see table).[1] Top-heavier So not much to get excited about, you might think. However, within thoseRead More

Fund IndustryLipperLipper for Investment ManagementLSEG LipperUK

Jun 6, 2023

Monday Morning Memo: 2022 – Full Steam Ahead or is a Crisis Looming on the Horizon?

The European fund industry can look back on a quite successful year in 2021 since the industry enjoyed in general healthy inflows despite the third and fourth wave of the COVID-19 pandemic hitting the economies of Europe and all over the world. That said, one would expect cautious behavior from investors and corporations in such an environment, but in fact the opposite was the case. European investors bought into risky assets and we witnessed high mergers-and-acquisitions activity on all levels of the asset management industry. With these developments in mind, one might forecast an even better year in 2022 since

The European fund industry can look back on a quite successful year in 2021 since the industry enjoyed in general healthy inflows despite the third and fourth wave of the COVID-19 pandemic hitting the economies of Europe and all over the world. That said, one would expect cautious behavior from investors and corporations in such an environment, but in fact the opposite was the case. European investors bought into risky assets and we witnessed high mergers-and-acquisitions activity on all levels of the asset management industry. With these developments in mind, one might forecast an even better year in 2022 sinceRead More

ETFsEuropeFeaturedLipperMonday Morning MemoRefinitiv LipperRegionThought Leadership

Dec 27, 2021

Monday Morning Memo: Mergers and Acquisitions Driving the Change of the Asset Management Landscape

Over the course of the last few months—actually one could say the last few years—we witnessed a number of mergers and acquisitions in the asset management industry, which are somewhat reshaping the landscape of the global asset management industry. As these activities are happening in all parts of the asset management value chain, I view these corporate transactions rather as clear signs of a matured industry, and not a general consolidation. That said, some of the takeovers are leading to consolidation within their sectors since the number of competitors within these sectors will shrink after the transaction and/or the dominance

Over the course of the last few months—actually one could say the last few years—we witnessed a number of mergers and acquisitions in the asset management industry, which are somewhat reshaping the landscape of the global asset management industry. As these activities are happening in all parts of the asset management value chain, I view these corporate transactions rather as clear signs of a matured industry, and not a general consolidation. That said, some of the takeovers are leading to consolidation within their sectors since the number of competitors within these sectors will shrink after the transaction and/or the dominanceRead More

LipperMonday Morning MemoRefinitiv LipperThought Leadership

Oct 11, 2021

Breakingviews: Buyout firms download promising $14 bln data deal

Buyout firms EQT and Digital Colony Partners have downloaded a promising $14 billion data deal. They are buying serial acquirer Zayo on the cheap. The fiber and data center firm’s subdued growth and hefty need for capital made for an uncomfortable five-year ride as a public company. A brighter future, helped by 5G growth, awaits as a private firm. At the turn of the millennium, companies like WorldCom, Global Crossing and a slew of smaller firms went on an investment rampage laying fiber-optic cable to transmit data. The result was a tsunami of bankruptcies. Zayo was formed a few years

Buyout firms EQT and Digital Colony Partners have downloaded a promising $14 billion data deal. They are buying serial acquirer Zayo on the cheap. The fiber and data center firm’s subdued growth and hefty need for capital made for an uncomfortable five-year ride as a public company. A brighter future, helped by 5G growth, awaits as a private firm. At the turn of the millennium, companies like WorldCom, Global Crossing and a slew of smaller firms went on an investment rampage laying fiber-optic cable to transmit data. The result was a tsunami of bankruptcies. Zayo was formed a few yearsRead More

Breakingviews

May 9, 2019

Breakingviews: Goldman Sachs will spend 2019 in velvet handcuffs

David Solomon is like the owner of a Ferrari who hasn’t been given the keys. The new Goldman Sachs boss starts 2019 with one of Wall Street’s most prestigious jobs, and something to prove. This could be the first year in over a decade that the $63 billion bank starts with a smaller market capitalization than its chief rival, Morgan Stanley. Goldman set out in 2017 to create $5 billion of new revenue streams, and Solomon starts with half that figure already in the bag. But there’s a lot to play for. Morgan Stanley boss James Gorman runs a bank

David Solomon is like the owner of a Ferrari who hasn’t been given the keys. The new Goldman Sachs boss starts 2019 with one of Wall Street’s most prestigious jobs, and something to prove. This could be the first year in over a decade that the $63 billion bank starts with a smaller market capitalization than its chief rival, Morgan Stanley. Goldman set out in 2017 to create $5 billion of new revenue streams, and Solomon starts with half that figure already in the bag. But there’s a lot to play for. Morgan Stanley boss James Gorman runs a bankRead More

Breakingviews

Dec 18, 2018

Breakingviews: Cannabis starts to copy tech’s Indian rope trick

Silicon Valley startups sometimes talk about the “SoftBank effect.” It’s what happens when the Japanese tech group or its giant venture fund approaches a company looking to invest some of its nearly $100 billion war chest. Whoever takes the money has the means to grind their rivals into the dust, but with the pressure that comes from having to justify a generous valuation. The same thing looks to be happening in another fast-growing industry: cannabis. U.S. Marlboro maker Altria said on Friday that it will invest $1.8 billion – a 41.5 percent premium – for a 45 percent stake in

Silicon Valley startups sometimes talk about the “SoftBank effect.” It’s what happens when the Japanese tech group or its giant venture fund approaches a company looking to invest some of its nearly $100 billion war chest. Whoever takes the money has the means to grind their rivals into the dust, but with the pressure that comes from having to justify a generous valuation. The same thing looks to be happening in another fast-growing industry: cannabis. U.S. Marlboro maker Altria said on Friday that it will invest $1.8 billion – a 41.5 percent premium – for a 45 percent stake inRead More

Breakingviews

Dec 10, 2018

Breakingviews: Campbell lukewarm sale pitch is begging for a cook

Campbell Soup’s lukewarm sales pitch is begging for a real cook. The $12 billion canned food and snack company is trying to sell its fresh and international brands while stepping up cost cuts on its stagnant core business. It is leaving the door open for a sale, but that’s unlikely to appease activists like Third Point’s Dan Loeb. The New Jersey-based prepared foods outfit has had a difficult run. Chief Executive Denise Morrison quit abruptly in May after leading a string of questionable acquisitions, and the company launched a strategic review under an interim CEO. Meanwhile its main businesses are

Campbell Soup’s lukewarm sales pitch is begging for a real cook. The $12 billion canned food and snack company is trying to sell its fresh and international brands while stepping up cost cuts on its stagnant core business. It is leaving the door open for a sale, but that’s unlikely to appease activists like Third Point’s Dan Loeb. The New Jersey-based prepared foods outfit has had a difficult run. Chief Executive Denise Morrison quit abruptly in May after leading a string of questionable acquisitions, and the company launched a strategic review under an interim CEO. Meanwhile its main businesses areRead More

Breakingviews

Aug 31, 2018

Breakingviews: West Texas mergers test shareholder blind faith

A gush of mergers in the Permian Basin is testing shareholders’ blind faith. In a few months West Texas drillers have chalked up nearly $30 billion in deals focused on one of the world’s largest oil patches. Consolidation helps combat rising costs, but high prices leave scant margin for error. Diamondback Energy was the latest to gobble up a neighboring producer, offering $8.3 billion for Energen last week. The all-stock deal, which valued Energen at roughly $29,000 an acre, is about in line with BP’s deal to buy BHP’s shale assets last month. While that represented a steep discount to

A gush of mergers in the Permian Basin is testing shareholders’ blind faith. In a few months West Texas drillers have chalked up nearly $30 billion in deals focused on one of the world’s largest oil patches. Consolidation helps combat rising costs, but high prices leave scant margin for error. Diamondback Energy was the latest to gobble up a neighboring producer, offering $8.3 billion for Energen last week. The all-stock deal, which valued Energen at roughly $29,000 an acre, is about in line with BP’s deal to buy BHP’s shale assets last month. While that represented a steep discount toRead More

Breakingviews

Aug 22, 2018

Breakingviews: Pepsi’s fizzy water deal may have flat aftertaste

Indra Nooyi is handing her successor a fizzy leaving present. One of the final acts of the outgoing PepsiCo chief executive is to buy Israeli-based SodaStream for $3.2 billion. Diversifying into the faster-growing carbonated water market has strategic logic. But incoming boss Ramon Laguarta will need some sparkling top line growth to make the deal as financially attractive. The purchase announced on Monday is part of Pepsi’s low sugar future. The company is paying $144 a share in cash for SodaStream, which sells sparkling water makers. That represents a 32 percent premium to the Israeli group’s volume-weighted average share price over

Indra Nooyi is handing her successor a fizzy leaving present. One of the final acts of the outgoing PepsiCo chief executive is to buy Israeli-based SodaStream for $3.2 billion. Diversifying into the faster-growing carbonated water market has strategic logic. But incoming boss Ramon Laguarta will need some sparkling top line growth to make the deal as financially attractive. The purchase announced on Monday is part of Pepsi’s low sugar future. The company is paying $144 a share in cash for SodaStream, which sells sparkling water makers. That represents a 32 percent premium to the Israeli group’s volume-weighted average share price overRead More

Breakingviews

Aug 21, 2018

Breakingviews: Takeda takes a turn at Shire’s risky M&A strategy

Takeda Pharmaceutical may take a turn at Shire’s risky M&A strategy. The $42 billion Japanese drugs group is mulling a bid for $45 billion takeover machine Shire. There’s not much overlap, and uncertainties hang over key businesses. But Shire is cheap, and its shareholders exasperated. While that may appeal to Takeda boss Christophe Weber, it’s also a warning. Takeda prospered for decades in its cozy domestic market. A declining population, government-reimbursement cuts and increased competition from cheap generic pills have forced Takeda and its peers to look abroad for growth. That’s a difficult prescription to fill. Takeda is large enough

Takeda Pharmaceutical may take a turn at Shire’s risky M&A strategy. The $42 billion Japanese drugs group is mulling a bid for $45 billion takeover machine Shire. There’s not much overlap, and uncertainties hang over key businesses. But Shire is cheap, and its shareholders exasperated. While that may appeal to Takeda boss Christophe Weber, it’s also a warning. Takeda prospered for decades in its cozy domestic market. A declining population, government-reimbursement cuts and increased competition from cheap generic pills have forced Takeda and its peers to look abroad for growth. That’s a difficult prescription to fill. Takeda is large enoughRead More

Breakingviews

Mar 28, 2018

Breakingviews: Mukesh Ambani’s music deal could get a remix

Mukesh Ambani is playing a new tune. India’s richest man, through his flagship conglomerate Reliance Industries, is merging two music-streaming services into one worth $1 billion. Reliance is following a well-trodden path of telecom operators dabbling in music, movies and other entertainment to attract subscribers. As his oil-to-retail giant starts to throw off cash, the tycoon could take his content ambitions to another level. Ambani’s upstart telecom operator has attracted 160 million subscribers in barely 18 months. Its super-fast network has more than half the combined data capacity of the top three players, well ahead of incumbents Bharti Airtel and Vodafone

Mukesh Ambani is playing a new tune. India’s richest man, through his flagship conglomerate Reliance Industries, is merging two music-streaming services into one worth $1 billion. Reliance is following a well-trodden path of telecom operators dabbling in music, movies and other entertainment to attract subscribers. As his oil-to-retail giant starts to throw off cash, the tycoon could take his content ambitions to another level. Ambani’s upstart telecom operator has attracted 160 million subscribers in barely 18 months. Its super-fast network has more than half the combined data capacity of the top three players, well ahead of incumbents Bharti Airtel and VodafoneRead More

Breakingviews

Mar 27, 2018

Breakingviews: Market jitters accentuate M&A regulatory risk

Market swoons are bad news for dealmakers. Stock-market plunges can erode the value of bids involving acquirers’ stock, make bankers reluctant to lend, and change the outlook violently. Recent market tumult, with the S&P 500 Index down 6 percent last week, doesn’t qualify as an extinction event – at least not yet. It does, however, make it harder to overlook regulatory dangers attached to certain possible deals, like the combinations of CVS Health and Aetna and AT&T and Time Warner. Last year was the fourth in a row with over $1 trillion of announced transactions involving U.S. companies worth over

Market swoons are bad news for dealmakers. Stock-market plunges can erode the value of bids involving acquirers’ stock, make bankers reluctant to lend, and change the outlook violently. Recent market tumult, with the S&P 500 Index down 6 percent last week, doesn’t qualify as an extinction event – at least not yet. It does, however, make it harder to overlook regulatory dangers attached to certain possible deals, like the combinations of CVS Health and Aetna and AT&T and Time Warner. Last year was the fourth in a row with over $1 trillion of announced transactions involving U.S. companies worth overRead More

Breakingviews

Mar 27, 2018

Load More