S&P 500 Earnings Dashboard 24Q4 | March. 14, 2025

Click here to view the full report.

Please note: if you use our earnings data, please source "LSEG I/B/E/S".

S&P 500 Aggregate ...

Find Out More

Weekly Aggregates Report | March. 14, 2025

To download the full Weekly Aggregates report click here.

Please note: if you use our earnings data, please source "LSEG I/B/E/S".

The Weekly ...

Find Out More

This Week in Earnings 24Q4 | March. 14, 2025

To download the full This Week in Earnings report click here.

Please note: if you use our earnings data, please source "LSEG ...

Find Out More

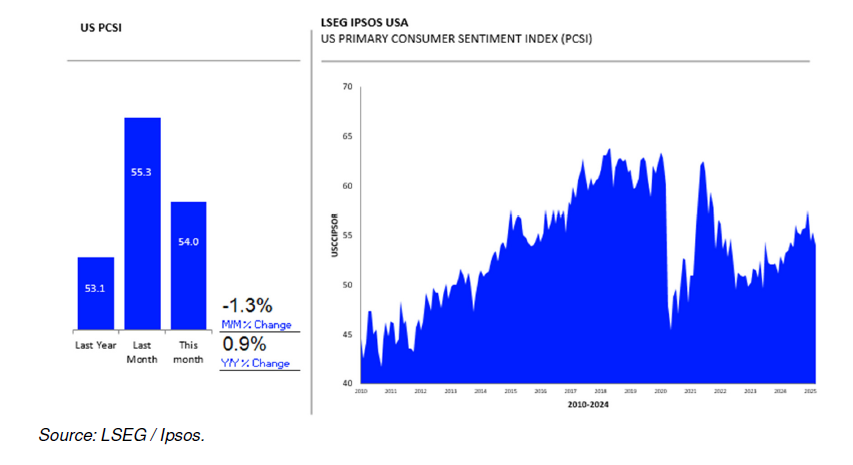

Consumer Confidence Continues Unsteady Start to 2025 as Expectations Index Falls Sharply

WASHINGTON, DC - The LSEG/Ipsos Primary Consumer Sentiment Index for March 2025 is

at 54.0. Fielded from February 21 – March 7, 2025*, the Index ...

Find Out More

The cost averaging effect is a fundamental principle in investing particularly associated with saving plans/saving schemes/individual investment plans. The cost averaging effect occurs when an investor consistently invests a fixed amount of money into mutual funds, exchange-traded funds (ETFs), or any other asset at regular intervals, regardless of the asset’s price at the time of purchase. The cost averaging effect can play a significant role in smoothing out the impact of market volatility over time. With regard to this, one needs to bear in mind that this effect gets smaller over time since the impact of the individual regular payment

The cost averaging effect is a fundamental principle in investing particularly associated with saving plans/saving schemes/individual investment plans. The cost averaging effect occurs when an investor consistently invests a fixed amount of money into mutual funds, exchange-traded funds (ETFs), or any other asset at regular intervals, regardless of the asset’s price at the time of purchase. The cost averaging effect can play a significant role in smoothing out the impact of market volatility over time. With regard to this, one needs to bear in mind that this effect gets smaller over time since the impact of the individual regular payment