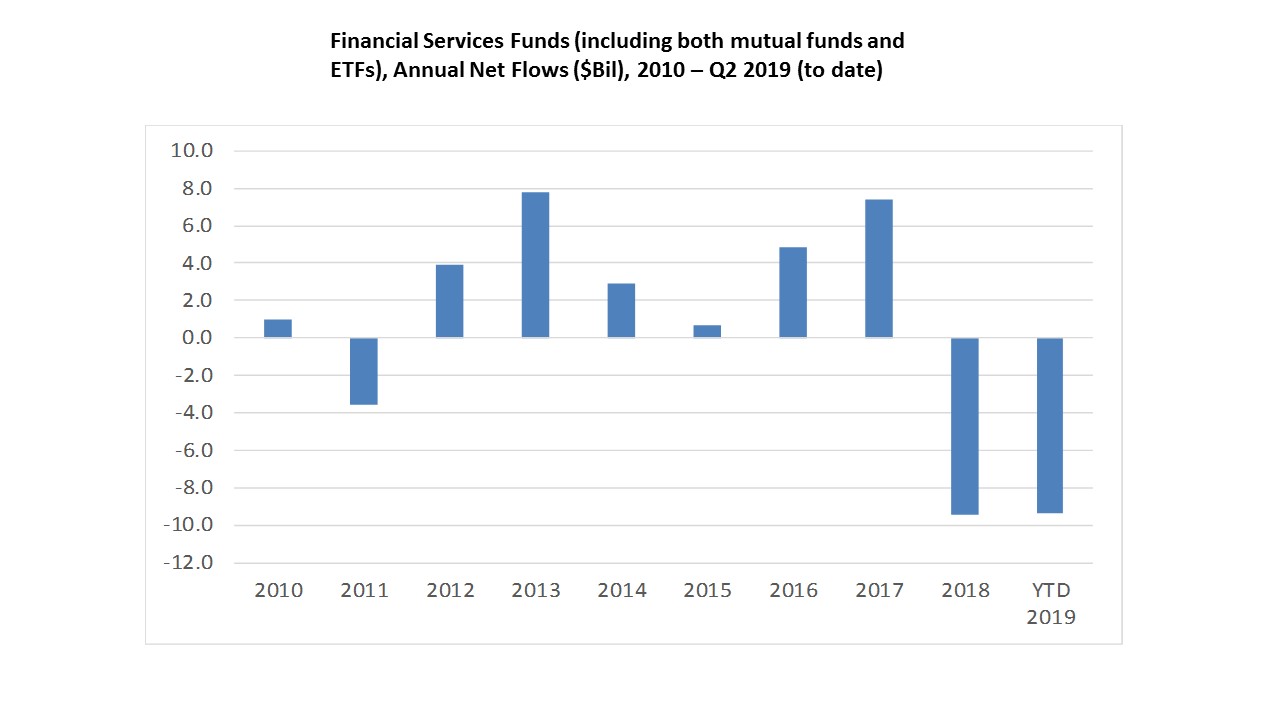

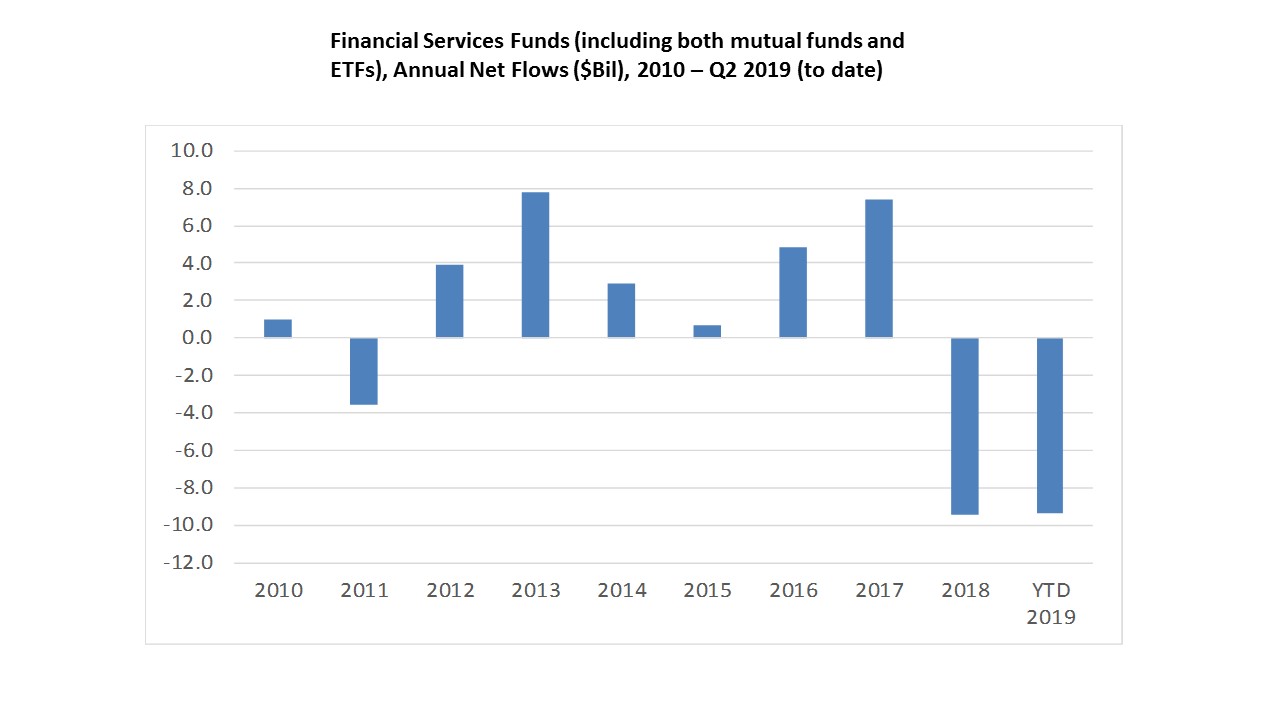

In what was already a down year for the group the Financial Services Funds (including both mutual funds and exchange-traded funds) peer group suffered their two largest weekly net outflows of 2019 during the last two fund-flows trading weeks. The group saw $1.7 billion and $1.3 billion leave its coffers for the weeks ended Wednesday, August 7 and Wednesday, August 14. These results pushed the group’s net-negative flows for the year to date to $9.4 billion, just slightly below its worst ever annual net outflow of $9.5 billion in 2018.

Financial services sector funds have been hurt by the continued talk of a global economic downturn as well as the current interest rate environment. Weak economic and inflation data coupled with the escalation of the U.S.-China trade war and the protests in Hong Kong led to a temporary inversion of the important 2-year/10-year Treasury spread on August 14. This spread is important because it has been a reliable predictor of recessions in the past, with the recessions generally starting one to two years after the inversion. The Federal Reserve’s reversal in its stance on interest rates has also hampered the group. As the primary business of banks is to loan money higher interest rates are good for business. It has been a huge negative for the sector that the Fed has done a complete 180-degree turn from forecasting two rate hikes in 2019 to reducing rates by 25 basis points at its last meeting.

The lion’s share of the net outflows for the last two weeks as well as the year to date have come from the ETF side of the financial services peer group. Financial services ETFs are responsible for $8.0 billion of the net outflows for the year to date and just shy of $3.0 billion over the last two weeks with one ETF, Financial Select Sector SPDR Fund (XLF), accounting for $2.5 billion of the recent net outflows.

Article Topics

Uncategorized