On April 11, 2000, the first two exchange-traded funds (ETFs) based on the EURO STOXX 50 and the STOXX Europe 50 were listed in Germany. With this listing, Merrill Lynch International brought a product to Europe which had been established in the U.S. since 1993. In addition to Germany, the trading of ETFs also began in Sweden, Switzerland, and the U.K. over the course of the year 2000.

Even as the first reactions to these new products were positive, no one at that time really expected the future success that ETFs would experience. The following is a summary of major developments for European ETFs over the past two decades.

2001

The first year after launch was rather quiet as far as the trading and the listing of new products. This changed over the course of 2001, as State Street launched the first sector ETFs which enabled European investors for the first time to implement their expectations of the different sectors of the MSCI Europe by overweighting or underweighting specific sectors in their portfolios. In addition, investors could use these products as a proxy to implement exposure to a specific sector within their portfolio without the need to select single stocks. Also, the French ETF promoter Lyxor launched the first so-called synthetic ETF that used a swap to track the risk/return profile of the underlying index (EURO STOXX 50).

2003

With the launch of the first bond ETF in 2003, Indexchange (which is now a part of iShares), enabled investors to buy specific bond markets with a single security. By looking at the assets under management, I would assume that these products did not meet the expectations of the fund promoter, as investors were at that time more focused on equities since the equity markets had started to rally again after the tech bubble burst earlier in the decade.

2004

As more and more investors, especially in the institutional segment, used ETFs in their portfolios, the demand for access to new markets increased. As a result, the promoters of ETFs launched the first emerging markets equity ETFs, as well as ETFs investing with a geographical focus in real estate investment trusts (REITS) over the course of the year.

2005

The first strategy ETFs were launched by Lyxor ETF in Europe. These products enabled investors for the first time to implement a specific investment strategy with an ETF. The new strategies ranged from leveraged long strategies to covered-call strategies. In addition to this, EasyETF (BNP Paribas) launched the first commodities ETF.

Even as the trend towards the so-called “smart beta” or factor investing ETFs started years later (approximately in 2012/2013), the first ETFs that enabled investors in Europe to capture risk premia from different factors were launched in 2005 when Lyxor launched the first ETFs to capture the small cap, growth, and value premia, while iShares launched the first ETF with a dividend strategy.

2006

Commodities ETFs started to become a success when ZKB launched the first ETFs on gold, silver, and platinum which were fully backed by the specific precious metals in 2006. These products were not only fully backed, they were also exchangeable—the investors could claim for physical delivery of the metal.

2007

At this point, the only missing asset type in the ETF segment was money markets. This gap was closed in 2007 when db x-trackers launched an ETF on the EONIA money market index. In the awakening of the upcoming financial crisis, these products immediately found favor with investors in Europe. In addition to this, the range of strategy ETFs was expanded by so-called short strategies—ETFs that enable investors to take advantage of decreasing equity markets. We also witnessed the launch of new strategies in the bond and alternatives sectors, as the first ETFs using credit spreads as well as currency pairs as underlying hedges were introduced. In addition, Lyxor launched the first ETF with a multi-factor strategy (RAFI).

2007 also marked the first major corporate action since the German ETF promoter Indexchange (part of Hypovereinsbank – HVB) was bought by Barclays Global Investors (BGI) and renamed Barclays Global Investors (Deutschland) later during the year, while the respective ETFs were renamed with the iShares branding (the ETF brand of BGI).

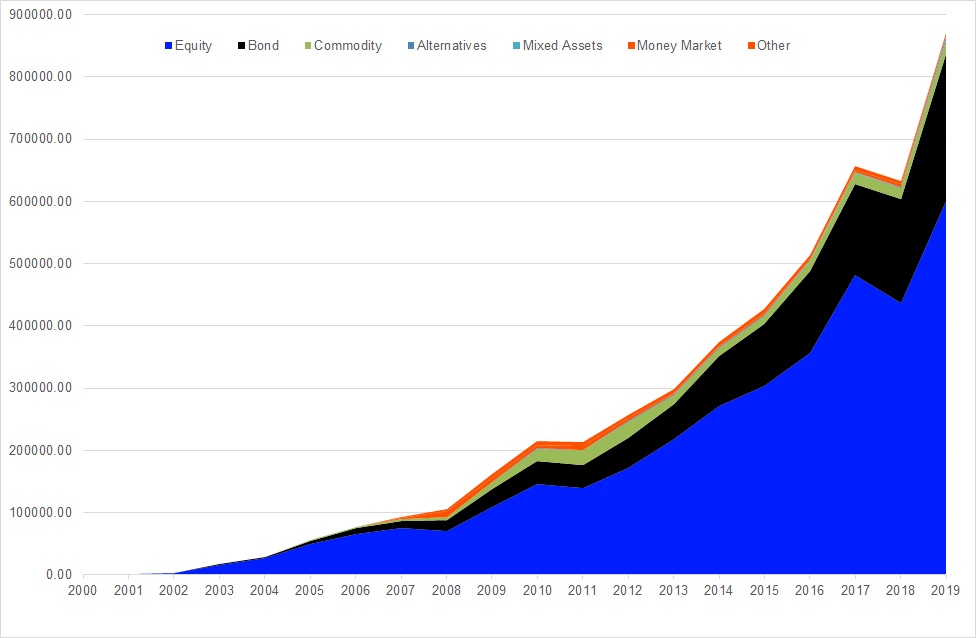

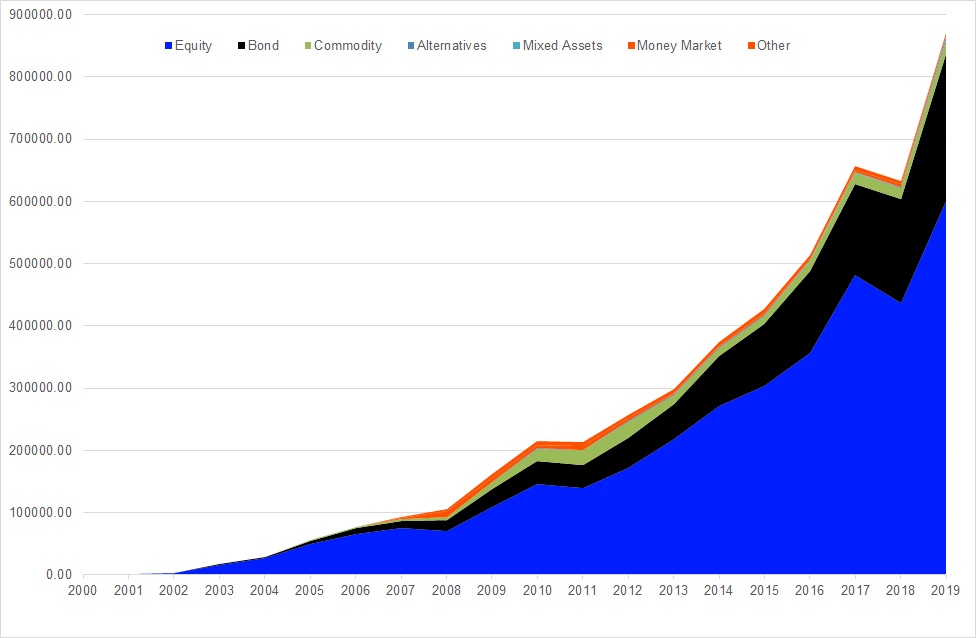

Graph 1: Assets Under Management in the European ETF Industry by Asset Type (in billion EUR)

Source: Refinitiv Lipper

2008

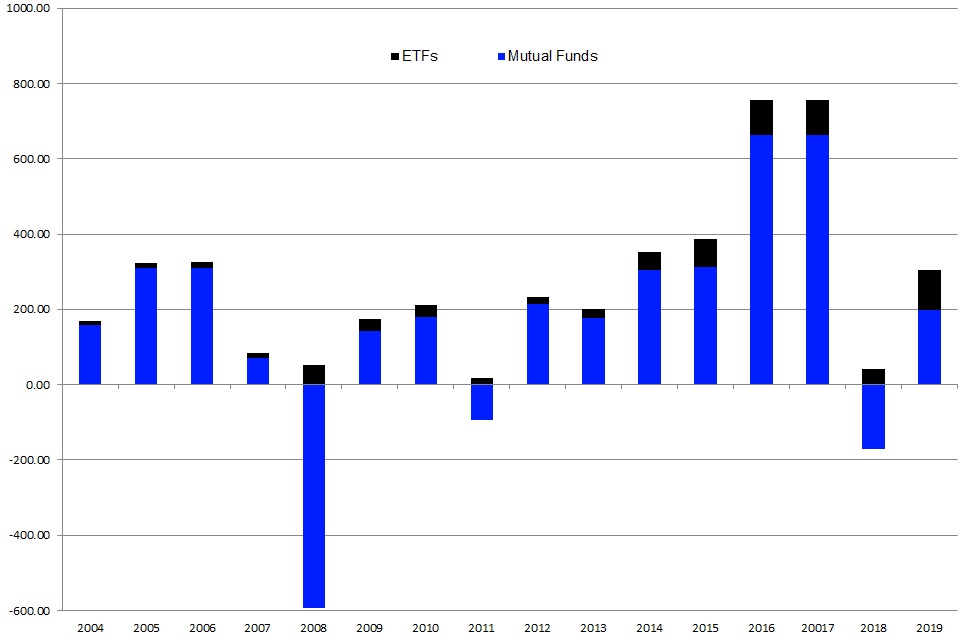

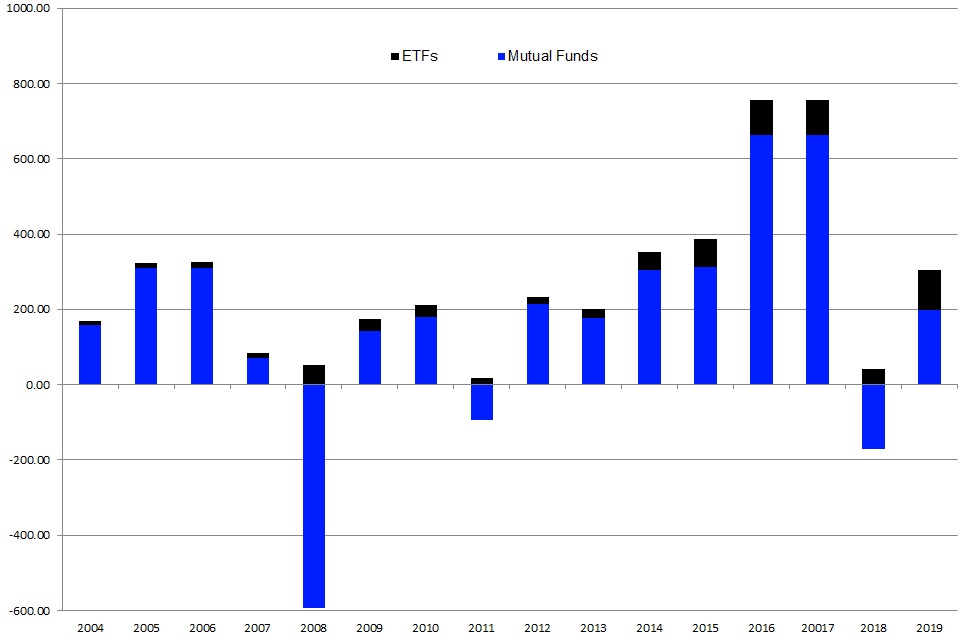

As a result of the increasing popularity of ETFs in Europe, the assets under management hit the €100.0 bn mark for the first time in April 2008. Even as the trend toward mixed-assets products was not in place in 2008, we witnessed the launch of the first mixed-assets ETF by db x-trackers during the tough market environment of the financial crisis. The increased popularity of ETFs was shown by the fact that ETFs enjoyed inflows over the course of the year, while mutual funds faced heavy outflows.

2009

In 2009, db x-trackers launched the first ETF that invested in hedge funds. Even as this segment is lacking in transparency and is highly illiquid, the respective ETF showed the same intraday liquidity as all ETFs. With regard to this, investors did not have to deal with the issues arising from the limited liquidity of a hedge fund when they used this product. Even as Marshal Wace and UBS also launched ETFs with hedge funds indices as underlying in 2010, these products have so far not gathered a lot of interest from European investors.

2009 also marked the year of the second major corporate transaction, as the US asset manager BlackRock bought BGI, the asset management arm of the British Barclays Bank. This deal included iShares and created the world’s biggest asset manager.

2011

During the market turmoil of the euro crisis in 2011, ETFs were once again the product type of choice of investors in Europe, as they again showed inflows, while their actively managed peers suffered heavy outflows. With regard to this, it seems that European investors prefer ETFs over active managed funds in times of market turmoil.

In the aftermath of the euro crisis, European ETF promoters started to launch bond funds that enabled investors to invest in specific segments of the bond markets. The opportunity to avoid or to take the risk from specific market segments or use these ETFs as proxies for single bonds—for example, avoiding the risk from a single bond by buying a basket of bonds with the same or very similar provisions—led to a very dynamic growth for bond ETFs overall.

2012

The next step to enhance the coverage of ETFs with regard to the asset classes and investment themes was taken by Lyxor in 2012, as the French promoter launched the first ETF that enabled investors to use the S&P 500 VIX Futures Index in their portfolios.

2013

The year 2013 started with a big bang since Credit Suisse announced in January that it had sold its ETF business to BlackRock.

2016

In 2016, the assets under management in the European ETF industry surpassed €500.0 bn, ending the year with overall assets under management of €514.5 bn.

2017

The takeover of Source by its rival Invesco PowerShares in April 2017 marked the next major corporate action in the European ETF segment.

Later in the year, Hector McNeil and Nik Bienkowski founded the ETF white label platform HANetf. While white label platforms have been established in the mutual funds space for a long time, HANetf is the first full service white label platform in the ETF space. This launch shows that the whole ETF ecosystem is advancing while the industry is maturing.

2017 started as it ended, since Legal & General Investment Management (LGIM) announced in November that they acquired the ETF platform “Canvas” from ETF Securities.

The success of the European ETF industry raised a lot of interest from the promoters of mutual funds who looked at ETF market entry as a way to enhance their success. As such, the market entry of Fidelity, Franklin Templeton, and JP Morgan was not surprising, since these asset managers are also involved in the U.S. ETF market. Nevertheless, the entry of active asset managers in the ETF market has the potential to become a game changer for the whole asset management industry.

2018

Since all major asset classes and markets were already covered by ETFs, it is not surprising that ETF launch activity has shifted from a focus on plain vanilla indices to sectors, market segments or trends. This activity was fueled by the demand for ESG products, as well as demand for specific market sectors in the bond and equity segments.

The preference of European investors for ETFs in rough markets was once again shown in 2019, when mutual showed outflows, while the promoters of ETFs enjoyed inflows.

Graph 2: European Fund Flow by Product Type (in billion EUR)

Source: Refinitiv Lipper

2019

With net inflows of €106.7 bn, the European ETF industry enjoyed inflows of more than €100.0 bn for the first time in history. Additionally, the assets under management reached €870.0 bn at the end of the year, which marked a new all-time high.

Graph 3: Fund Flows in the European ETF Market (in billion EUR)

Source: Refinitiv Lipper

2020

The year 2020 started with rough market conditions as the coronavirus put the world in lockdown mode, which may lead to the roughest recession since the 1930s. This being the case, 2020 has the potential to become the first year with net outflows since the inception of ETFs in Europe.

The views expressed are the views of the author, not necessarily those of Lipper or Refinitiv.