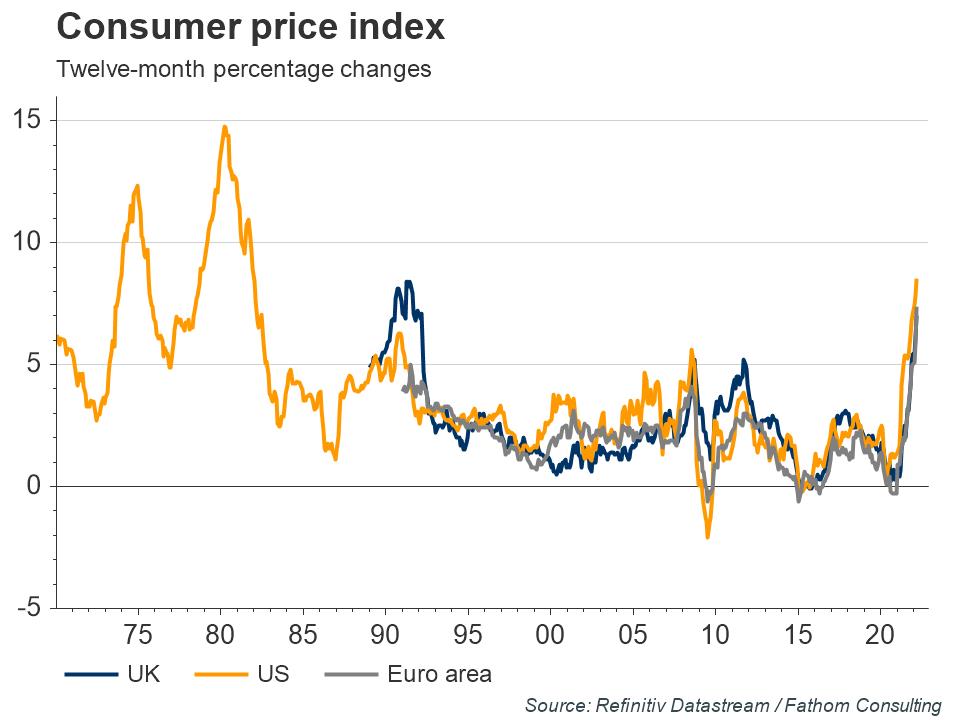

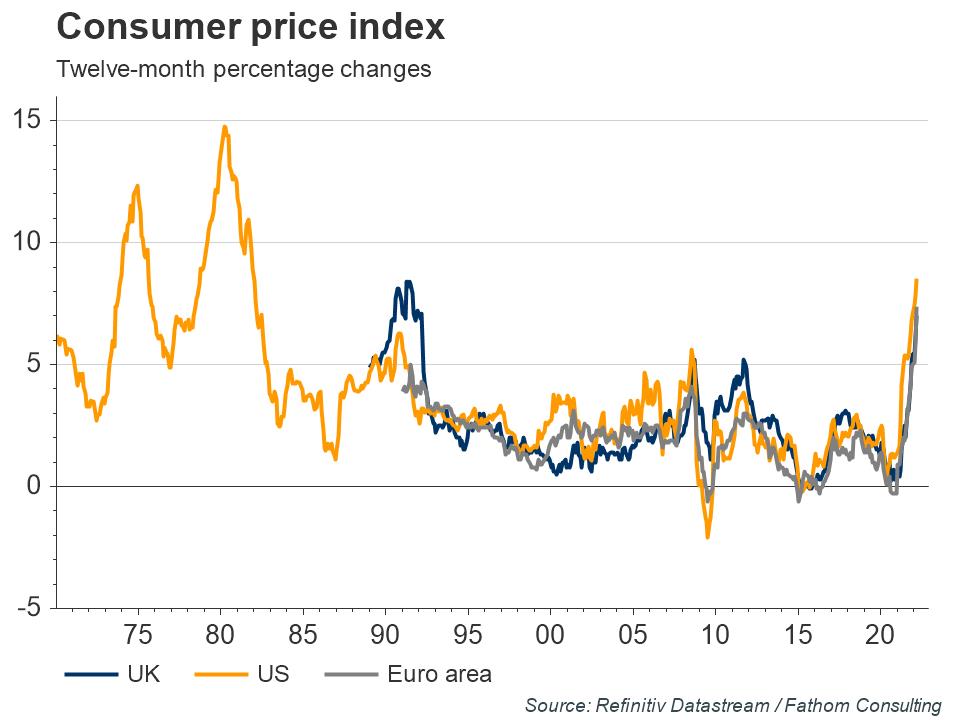

Inflation has continued to soar across much of the world and is significantly above central bank targets in most advanced economies. In the US, UK and euro area it is at its highest level in decades, raising concerns about a return to the ‘Great Inflation’ of the 1970s. In Fathom’s central scenario (70% probability), inflation returns to central bank targets next year. However, we assign a 30% probability to a ‘Back to the 70s’ scenario, where inflation expectations become unanchored, wage-price spirals re-emerge, and inflation dynamics briefly mirror those of the 1970s.

Refresh this chart in your browser | Edit the chart in Datastream

In the 1970s and early 1980s, global inflation surged due to the massive oil price shocks in 1973, triggered by the Arab oil embargo related to the Yom Kippur War, and in 1979, following a drop in production after the Iranian revolution. US inflation rose above 12% in 1974 and peaked at almost 15% in 1980 (chart below), nearly double its current rate. Inflation rose by much less in Germany than most other countries, however, remaining below 8%.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

Germany’s superior performance reflected the independent Bundesbank’s aggressive policy tightening in response to inflation shocks, which resulted in a sharp rise in real interest rates. This sent a very strong signal to wage- and price-setters that the central bank was determined to keep inflation under control. In contrast, the US Federal Reserve’s unwillingness to tighten policy aggressively, reflected in highly negative real interest rates, meant that inflation shocks became self-fulfilling with subsequent wage and price gains reinforcing each other.

Refresh this chart in your browser | Edit the chart in Datastream

On a number of metrics, the current inflation backdrop looks like the 1970s. Fiscal policy has been very easy and monetary policy remains extraordinary loose in advanced economies, with US real interest rates deeply in negative territory. Moreover, short-term inflation expectations had risen sharply even before the global economy was hit by an energy price shock amid recent events in Eastern Europe. Labour markets are also very tight in a number of countries, particularly the US, where wage gains are running at their fastest pace since 1984.

Refresh this chart in your browser | Edit the chart in Datastream

Central bank credibility and low and stable long-term inflation expectations have been anchors for inflation over the past thirty years. Both are threatened by persistently high inflation, but in Fathom’s opinion probably continue to hold fast. When the one-year ahead inflation expectations of US households last moved above 5% for a sustained period, five-year ahead expectations were also above 5%. Currently, five-year ahead inflation expectations of households are around cycle highs at 3% (chart above), but have not kept pace with shorter-term expectations.

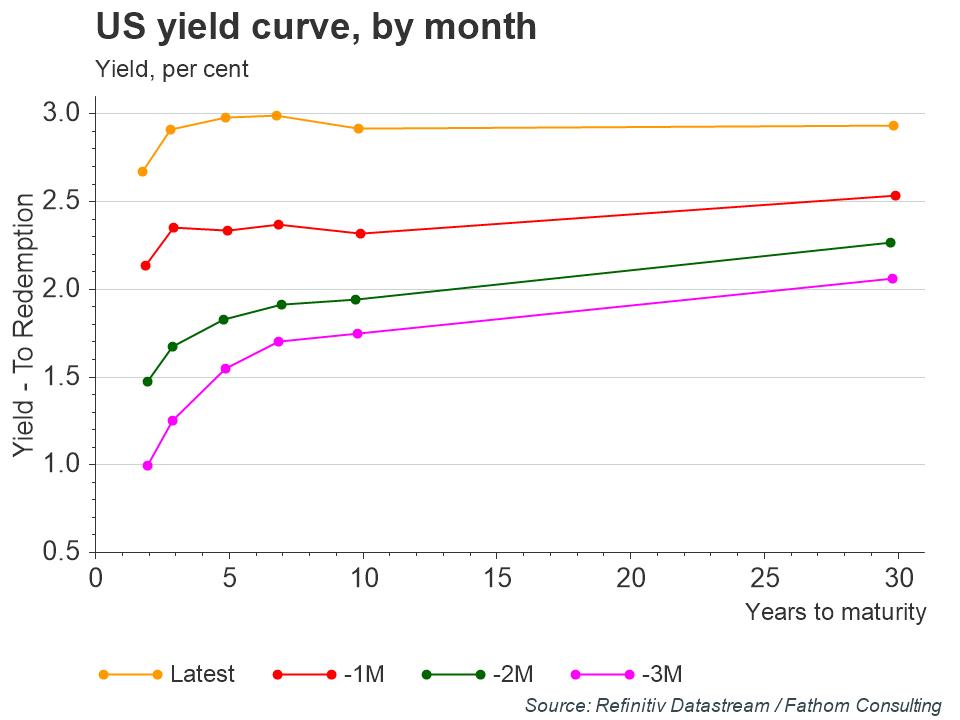

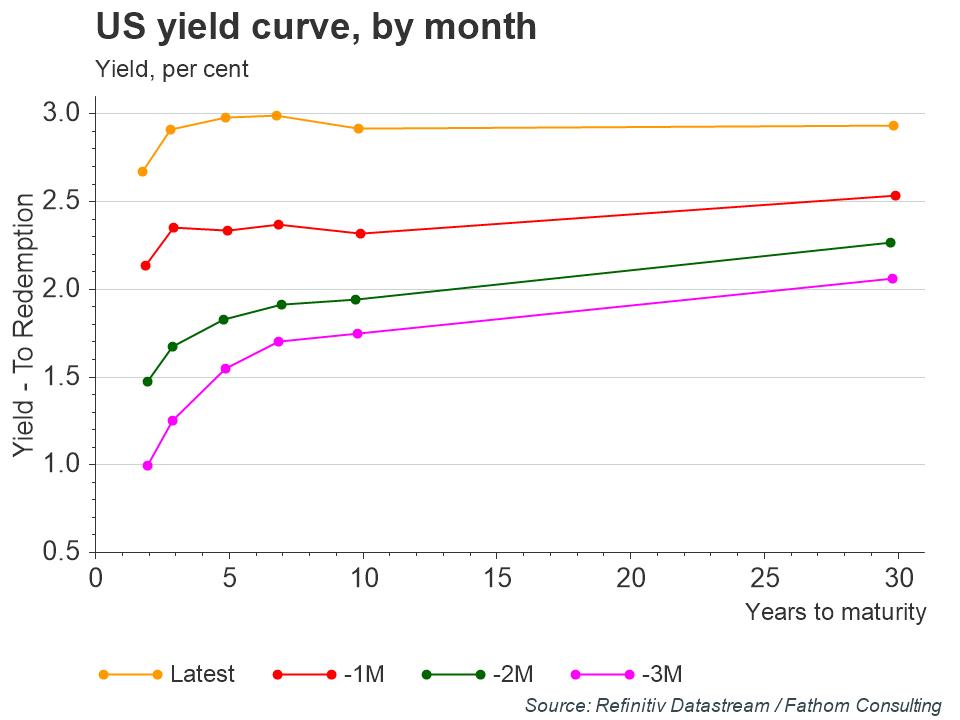

Over the past several months, US treasury yields have moved significantly higher as the Federal Reserve has shifted its policy stance. Against a backdrop of high inflation and aggressive monetary tightening, we remain cautious on risk assets and favour continued exposure to inflation-sensitive assets. If inflation expectations were to slip their anchor, as in the 1970s, this would prompt an even more aggressive policy-tightening cycle, and a major recession. Risk assets would be hit extremely hard. Indeed, US real yields have just approached positive territory, leaving significant upside in such a scenario.

Refresh this chart in your browser | Edit the chart in Datastream

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

_________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.