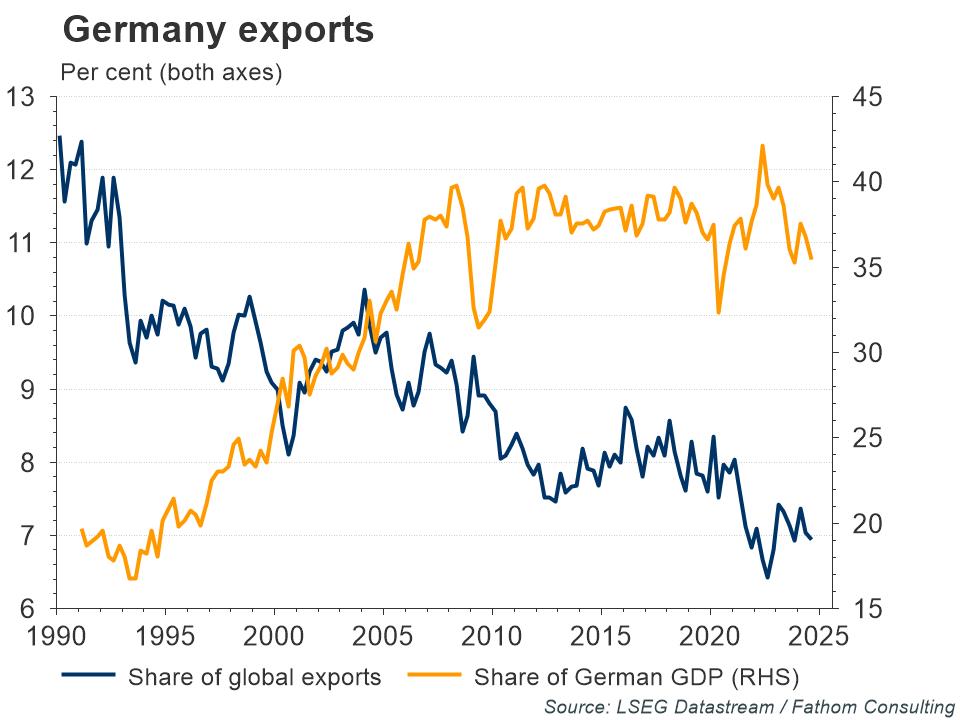

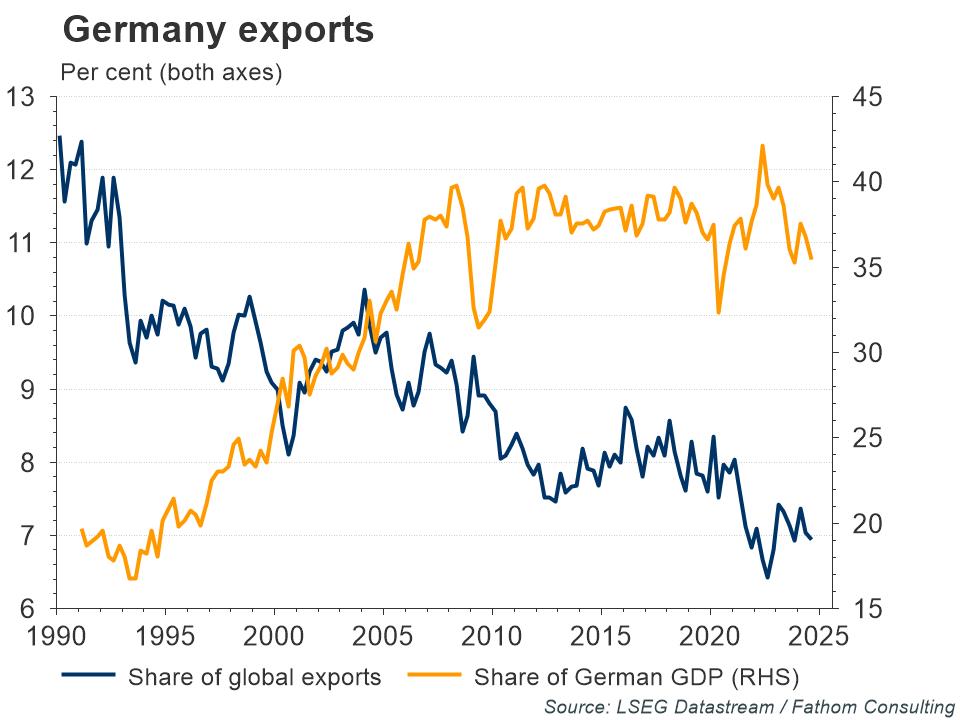

Germany’s snap election on Sunday, 23 February, has come against a backdrop of economic malaise in Europe’s largest economy. Patience with the incumbent Chancellor, Olaf Scholz, of the Social Democratic Party, had grown thin after two consecutive years of negative GDP growth. Mr Scholz said his hands had been tied by the German ‘debt brake’, a rule inserted into the German constitution by Angela Merkel in 2009 which limits the annual deficit of the federal government to 0.35% of GDP. But Mr Scholz’s political rival Friedrich Merz, the leader of Mrs Merkel’s former party the Christian Democratic Union and Christian Social Union (CDU/CSU), said that the root of Germany’s problems lay in its export-based growth model.

Refresh this chart in your browser | Edit the chart in Datastream

The German economy has been assailed by COVID-19 shocks, domestic bureaucracy, high energy prices and increased competition from China, formerly one of Germany’s premier export destinations but now a keen rival. Now the prospect of US tariffs on the European Union threaten to erode German economic activity even further.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in LSEG Workspace.

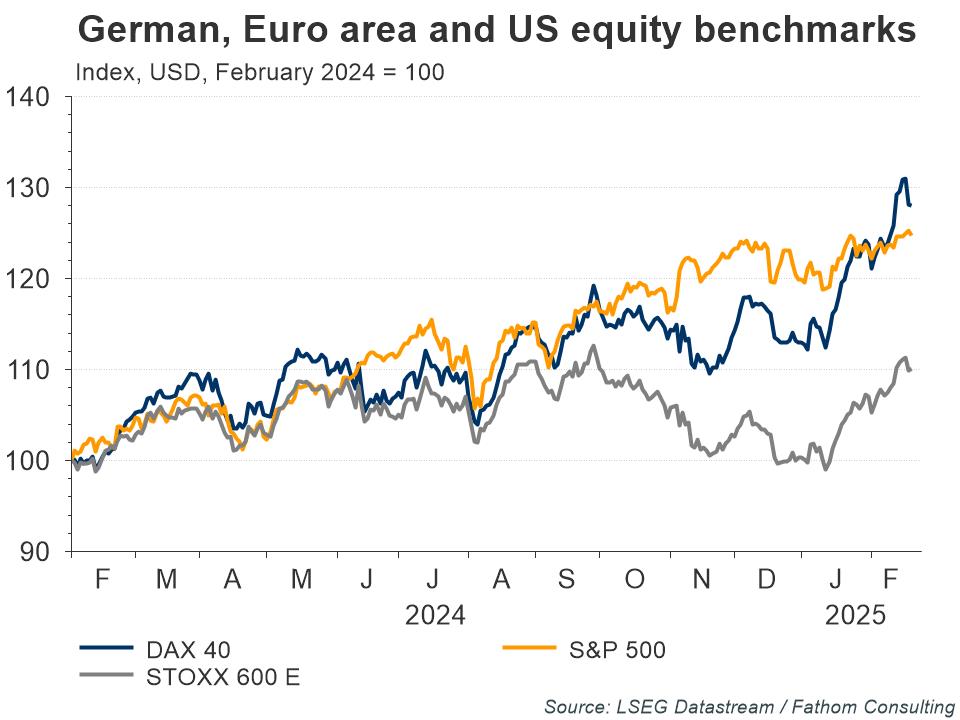

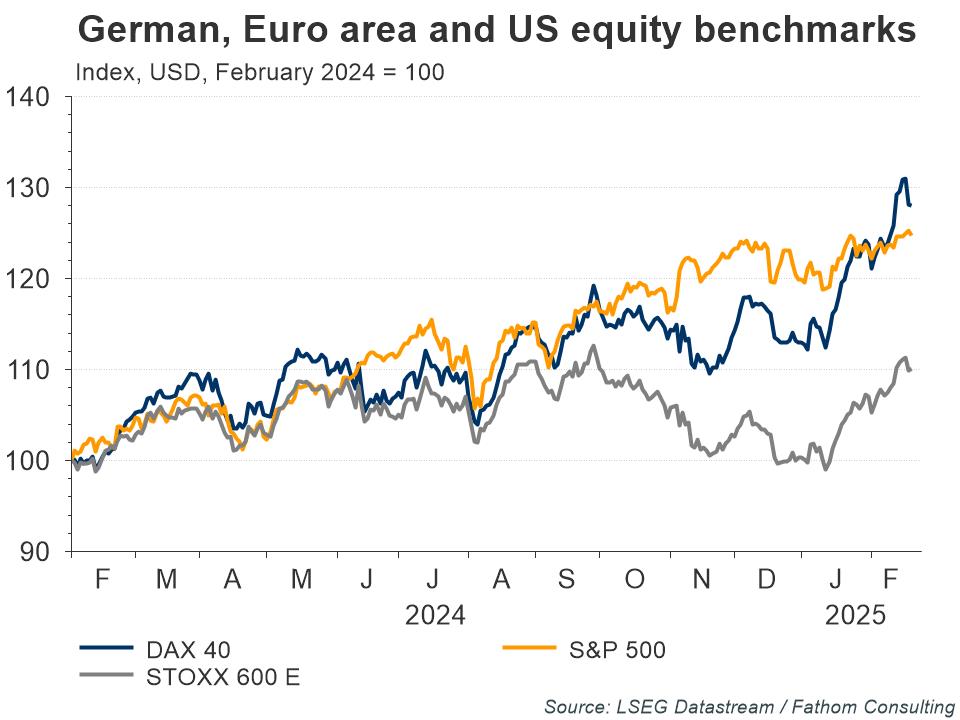

Yet despite the bleak economic outlook, the DAX 40 has outperformed the S&P 500 and other major indices over the last 12 months, and staged a rally since the beginning of 2025. Much of this success can be tied to Germany’s very own ‘Magnificent Seven’, which includes Allianz, Deutsche Telekom, Rheinmetall, Muenchener Ruck, Siemens, Siemens Energy and SAP. Unlike the US ‘Magnificent Seven’ which are predominantly tech-oriented (with the exception of Tesla), Germany’s ‘Magnificent Seven’ are spread across insurance, renewable energy, defence, telecoms and technology sectors. But like their US counterparts they play a dominant role in driving their country’s main index. Collectively, they currently represent 61.3% of the DAX 40’s total market capitalisation, up from 48.5% in January 2024. Their sectoral diversity as well as their global market reach have put the German stock market in a healthy position; their diversity also makes them comparatively resilient to AI-based corrections.

Refresh this chart in your browser | Edit the chart in Datastream

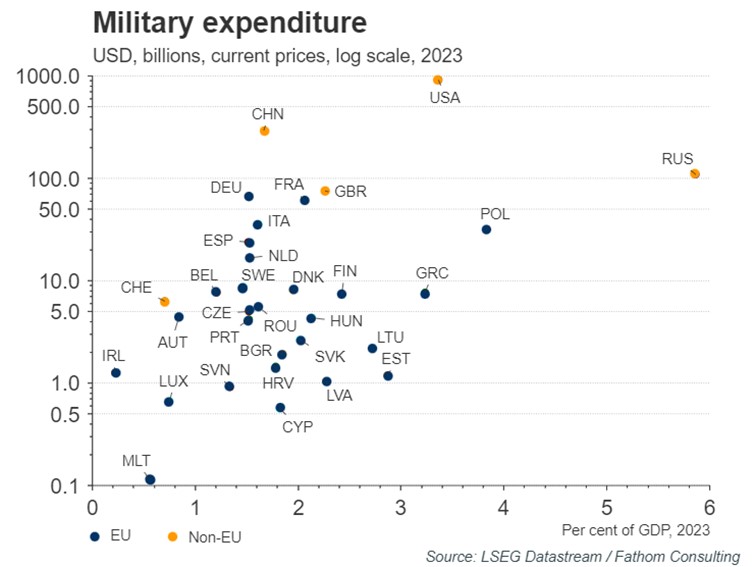

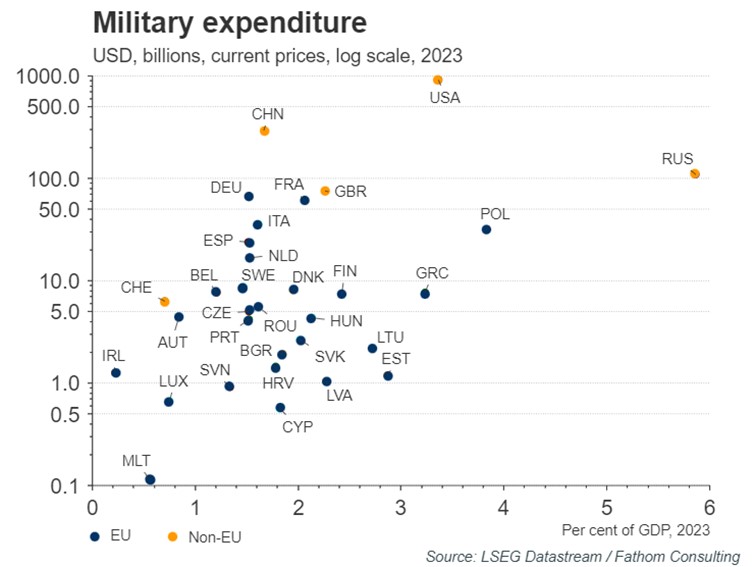

Recent geopolitical developments are set to change Germany’s budget priorities, with defence spending likely to rise. Germany and other NATO members have come under pressure from President Trump to commit at least 3% of GDP on defence spending (indeed, this spending could be as high as 5% in some European nations). It is probable that the incoming Chancellor will need to reform the constitutional debt brake if Germany is to achieve this, as the government spent only USD 66.8 billion — around 1.52% of GDP — on defence in 2023. To match 3% of 2024 German GDP, this expenditure would need to rise by around USD 50 billion, and by USD 127.8 billion to attain 5%.

Refresh this chart in your browser | Edit the chart in Datastream

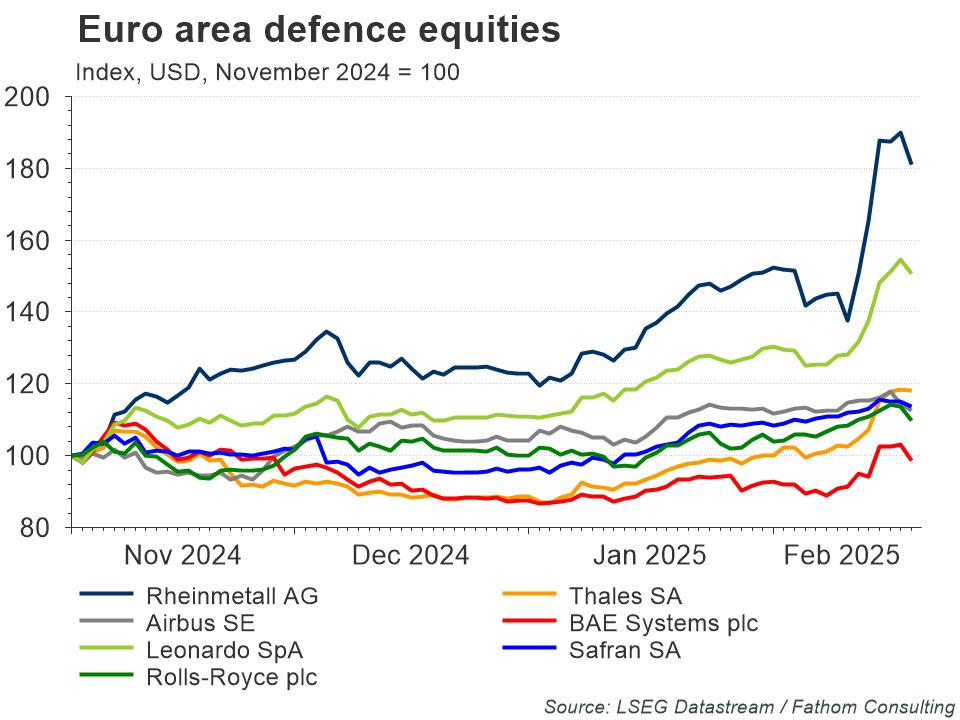

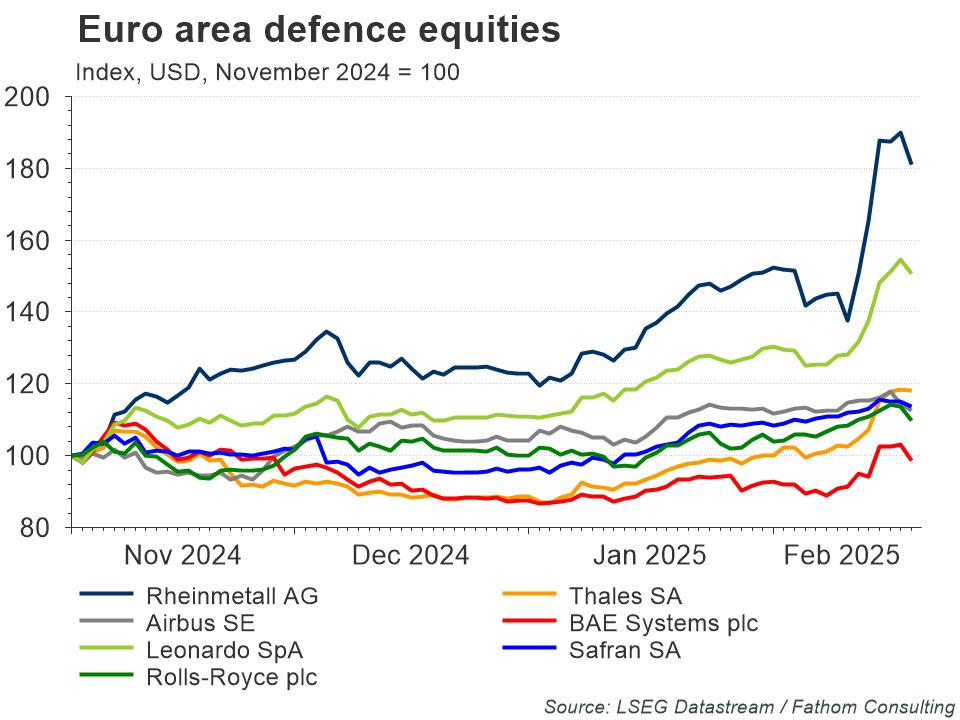

The new US president’s foreign policy interventions have offered a potential boost to German manufacturers. Germany’s Rheinmetall, part of the German ‘Magnificent Seven’, has led the way in EU and UK aerospace and defence equity performance since Mr Trump was elected, experiencing a sharp uptick after a phone call between the American President and Vladimir Putin on 12 February over ending the war in Ukraine. Domestic and EU-wide demand for defence equipment is likely to stay elevated at least for the remainder of President Trump’s term — a favourable steady state for Germany, considering the fragility of Chinese and American industrial demand in an increasingly fragmented world.

Refresh this chart in your browser | Edit the chart in Datastream

Whichever party they are from, the next Chancellor of Germany will need to address both the country’s debt brake and industrial underperformance if German GDP growth is to be steered positive. But evidence from Germany’s stock market and, more specifically, its aerospace and defence sector, suggest the economy possesses sturdy foundations. Furthermore, if the US succeeded in brokering a peace deal between Ukraine and Russia this could have significant positive GDP boosts, particularly if natural gas prices were to decline following increased Russian gas flow into Europe — putting Germany on the pathway back to positive growth.

The views expressed in this article are the views of the author, not necessarily those of LSEG.

______________________________________________________________________________________

LSEG Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop viewpoints on the market.

LSEG offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.