On the evening of March 20, 2025, LSEG Lipper announced the winners of the prestigious LSEG Lipper Fund Awards Europe 2025 at its awards ceremony in London.

This in-person event gathered investment professionals from all over Europe who wanted to celebrate their success with the other winners, industry experts, and journalists.

The periods spanned by these awards delivered a host of challenges, whether Covid, war in Europe, or major policy shifts in leading economies. This has been intertwined with economic turbulence, from rising volatility to the implosion of the low-rate environment born in the wake of the global financial crisis. The winners of the LSEG Lipper Fund Awards Europe 2024 therefore have had to weather numerous storms hitting capital markets. In doing so, they achieved an outstanding risk-adjusted return, qualifying them to become a winner for their respective Lipper global classifications over three, five, or 10 years.

Different methodologies lead to different results

While the LSEG Lipper Fund Awards are entirely quantitative, this should not be understood in the sense of raw return numbers alone—award winners aren’t determined by picking the funds with the highest returns over the respective awards periods.

The LSEG Lipper Fund Awards are based on the Lipper Leader rating for Consistent Return. These ratings are calculated using a utility function based on the effective return over multiple non-overlapping periods—within the respective three-, five-, and 10-year horizons. The calculations over multiple periods ensure that all periods in which a fund underperforms the average of its peer group are identified. Then, LSEG Lipper uses a utility function based on behavioral finance theory to penalize periods of underperformance against the peer group average, with more significant weightings being given to excess losses.

This calculation methodology ensures that the winners are funds that have provided superior consistency and risk-adjusted returns compared to similar funds. We believe this is more in line with how investors view financial gain and loss, meaning that funds receiving a LSEG Lipper Fund Award may be the best fit for investors who value a fund’s year-to-year consistency relative to other funds in a particular peer group.

In contrast to the single country awards, where all funds from the eligible asset classes with a sales registration in the respective country are taken into consideration, the fund universe for the European fund awards is composed of funds with UCITS status which are registered for sale in at least three out of 31 European countries composed of the 27 EU member state countries and the four EFTA countries.

The best mutual funds in Europe

There were 5,541 mutual funds eligible for a LSEG Lipper Fund Award in Europe. Out of the respective fund universe, the fund awards honour those funds which had the highest score in the Lipper Leader rating for Consistent Return over the three-, five-, and 10-year periods.

Overall, there were 105 funds that won an award for the three-year period. Also, 101 funds were recognized with a LSEG Lipper Fund Award over the five-year period, and 84 funds won the prestigious trophy for the 10-year period. The complete lists of the winning funds can be found on our awards website.

Equity Europe

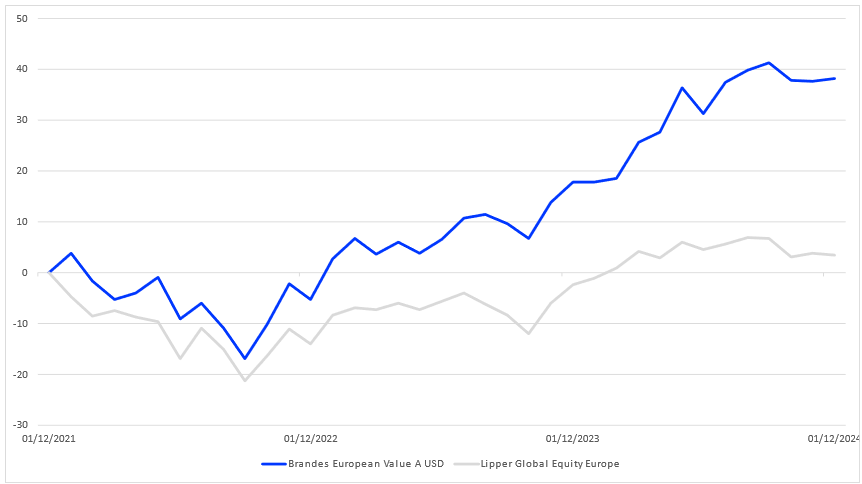

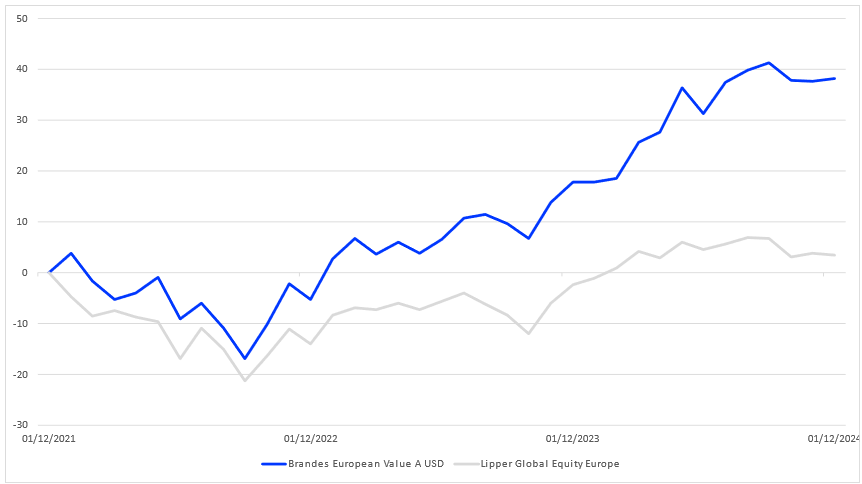

Brandes European Value Fund A USD won the LSEG Lipper Fund Award for the Equity Europe category over the three-year period, while Quoniam Funds Selection SICAV European Equities EUR A Dis won for the five- and 10-year periods.

Graph 1: Brandes European Value Fund A USD vs Lipper Global Equity Europe 01.01.2022 – 31.12.2024 (in %)

Calculation Currency: EUR

Source; LSEG Lipper

Equity Europe Income

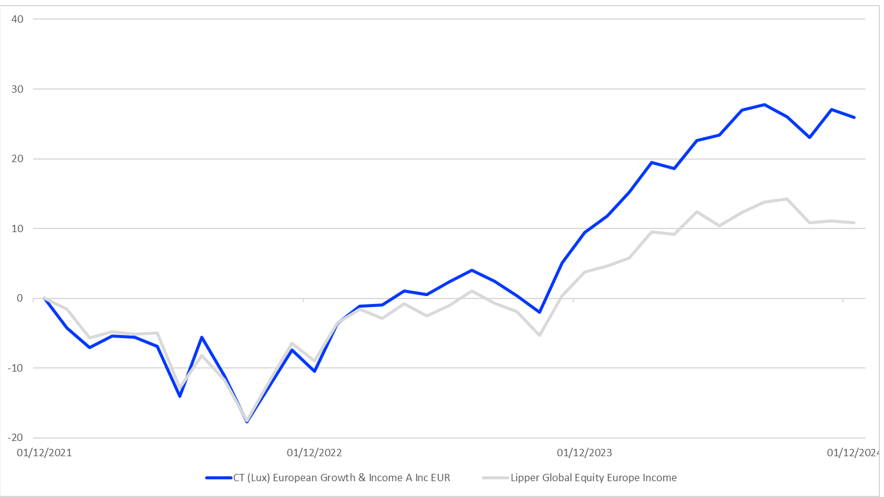

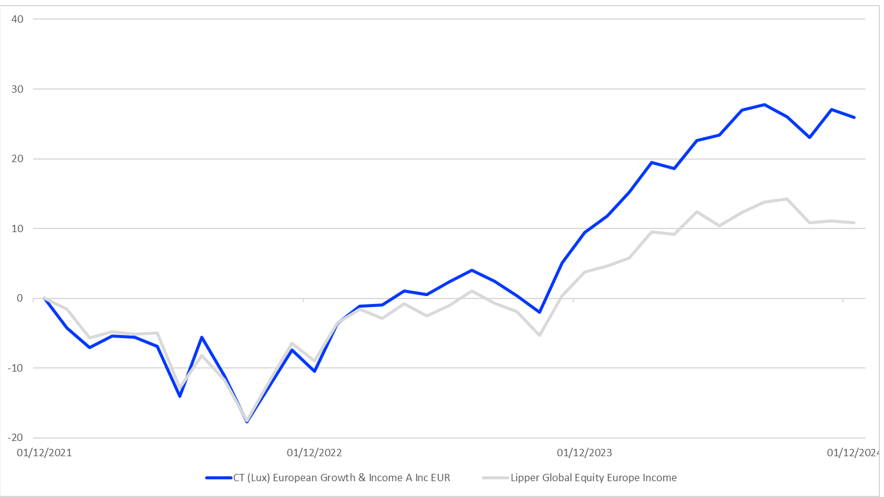

Columbia Threadneedle (Lux) III – CT (Lux) European Growth & Income A Inc EUR took the LSEG Lipper Fund Award for the Equity Europe Income category over the three- and five-year periods, while CT (Lux) European Growth & Income A Inc EUR won for the five-year period and Guinness European Equity Income Fund class C EUR Acc was named the best fund over the 10-year period.

Graph 2: Columbia Threadneedle (Lux) III – CT (Lux) European Growth & Income A Inc EUR vs Lipper Global Equity Europe Income 01.01.2022 – 31.12.2024 (in %)

Calculation Currency: EUR

Source; LSEG Lipper

Equity Europe Small- and Mid-Cap

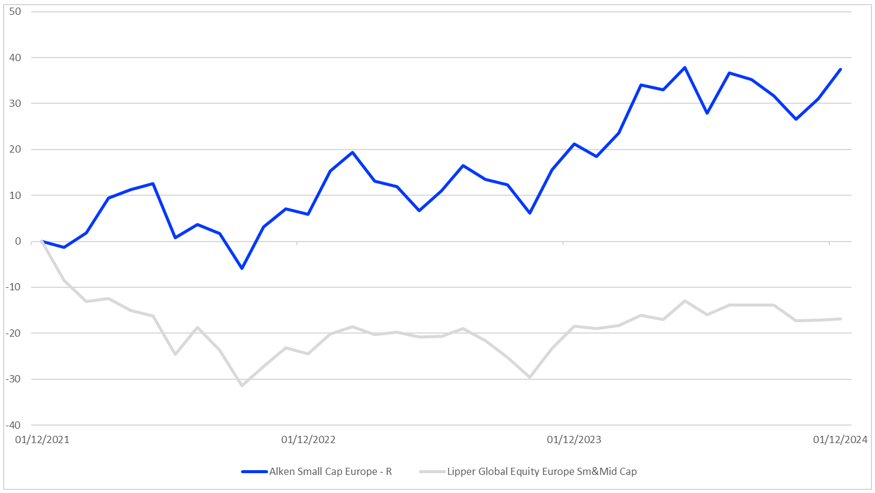

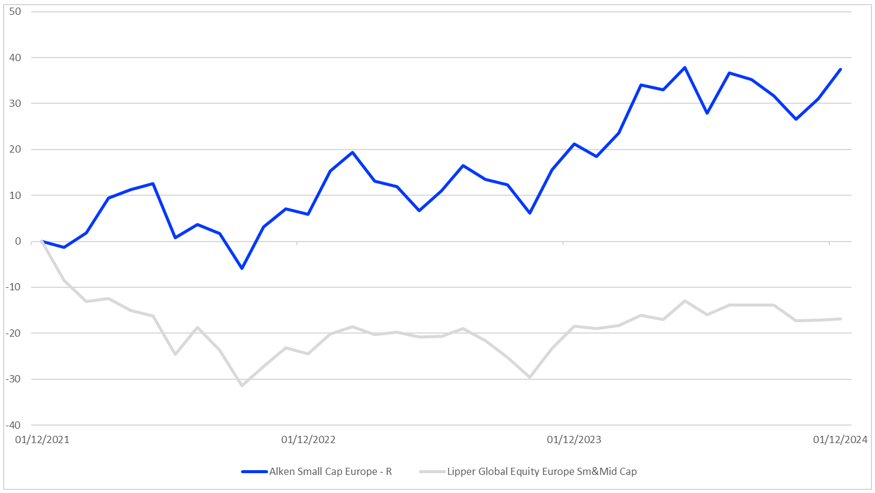

Alken Fund Small Cap Europe – R was named the LSEG Lipper Fund Award winner for Equity Europe Small- and Mid-Cap over the three-year period, while Hermes Linder Fund SICAV – Hermes Linder Fund Class AR Shares EUR won over the five-year period, and Janus Henderson Horizon Fund Pan European Smaller Companies Fund A2 EUR was top over the 10-year period.

Graph 3: Alken Fund Small Cap Europe – R vs Lipper Global Equity Europe Small- and Mid-Cap 01.01.2022 – 31.12.2024 (in %)

Calculation Currency: EUR

Source; LSEG Lipper

Bond Europe

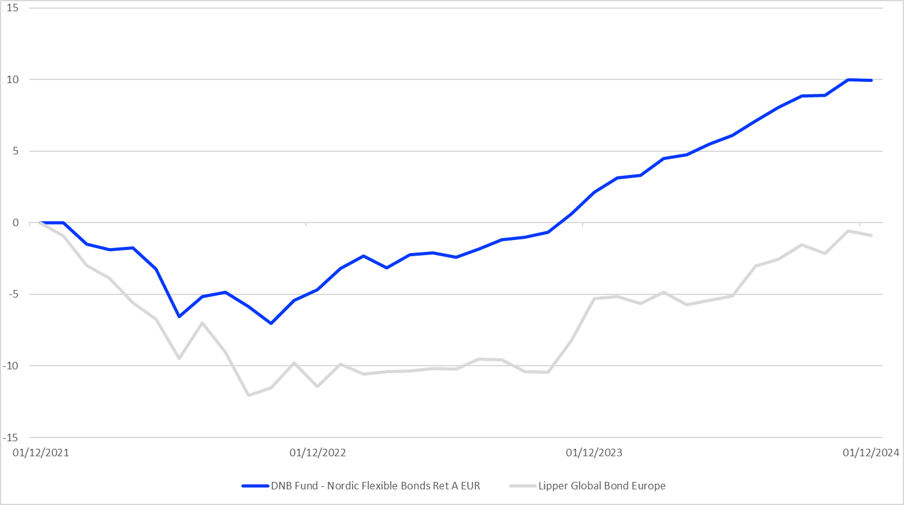

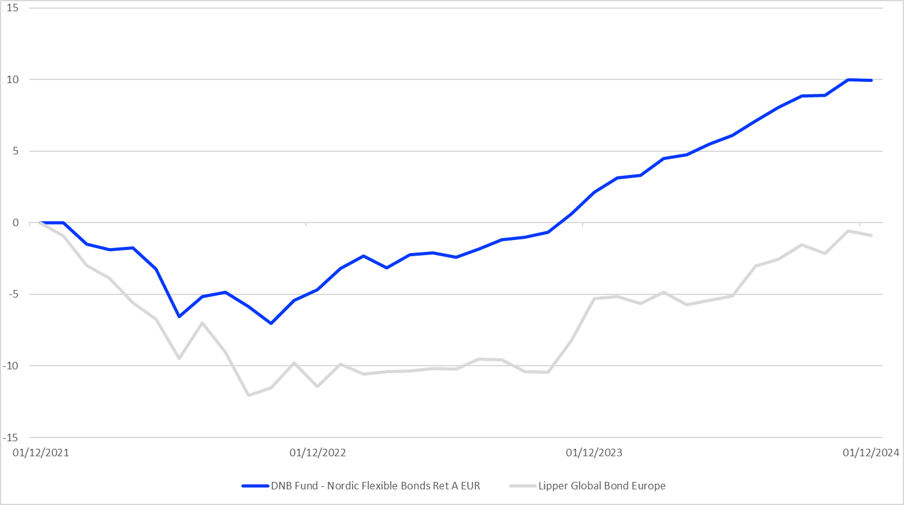

Within the bond classifications, DNB Fund – Nordic Flexible Bonds Retail A (EUR) won the LSEG Lipper Fund Award for the Bond Europe over three years, while Berenberg Credit Opportunities R A was named the best fund over the five- and 10-year periods.

Graph 4: DNB Fund – Nordic Flexible Bonds Retail A (EUR) vs Lipper Global Bond Europe 01.01.2022 – 31.12.2024 (in %)

Calculation Currency: EUR

Source; LSEG Lipper

The best asset management groups in Europe

The group awards are divided into those for large and small asset management groups based on a regional assets-under-management split. It is not enough for a fund management company to hold just one large fund. A large management group must have at least five equity, five bond, and three mixed-assets portfolios, while a small group must have at least three equity, three bond, and three mixed-assets portfolios. The complete lists of the winning asset management groups can be found on our awards website.

Within the bond segment, the best small asset manager was Corum Butler, which outperformed 58 competitors in this category. The best large bond fund manager was again DNCA Investments, which beat 67 competitors in its category.

Alken once more outperformed its 116 opponents and was named the best small asset manager in the equity segment. Northern Trust won the trophy as the best large asset manager of equity funds, beating 76 competitors in terms of consistent outperformance.

There were 57 large asset managers and 41 small asset managers competing for the LSEG Lipper Fund Awards in the mixed-assets segment. While Swiss Rock won the trophy for the best small manager, the award for the best large manager went to Danske Invest.

The winning groups for the overall awards were able to show an above-average risk-adjusted performance within their bond, equity, and mixed-assets products. In this category, there were 47 large groups and 12 small groups competing for the prestigious trophy. GAM won the award for the best small fund management group, while Rothschild was named the best large fund management group.

As one can see from the number of fund management groups in the single categories, the LSEG Lipper Fund Awards are exceedingly competitive and recognize the fund managers that are setting benchmarks within the industry. The Awards commemorate the expertise of the collective fund management industry and the individual funds’ ability to outperform its peer group.

The views expressed are the views of the author and not necessarily those of LSEG. This material is provided as market commentary and for educational purposes only and does not constitute investment research or advice. LSEG cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned. Please consult with a qualified professional for financial advice.

Disclaimer

The LSEG Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers.

The LSEG Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60, and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the LSEG Lipper Fund Award. For more information, see lipperfundawards.com. Although LSEG Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by LSEG Lipper.

About LSEG Lipper Fund Awards:

For more than 30 years and in over 17 countries worldwide, the highly respected LSEG Lipper Awards have honoured funds and fund management firms that have excelled in providing consistently strong risk-adjusted performance relative to their peers and focus the investment world on top funds. The merit of the winners is based on entirely objective, quantitative criteria. This, coupled with the unmatched depth of fund data, results in a unique level of prestige and ensures the award has lasting value. Renowned fund data and proprietary methodology is the foundation of this prestigious award qualification, recognizing excellence in fund management. Find out more at www.lipperfundawards.com.