As Spring 2025 unfolds, Europe finds itself at a potential turning point. Following prolonged stagnation and inflationary pressure, and amid a backdrop of escalating tariff tensions, a cautiously optimistic tone is beginning to emerge across macroeconomic indicators, financial markets and investor sentiment. This note brings together developments across key areas — economic data, inflation dynamics, market behaviour and geopolitical risk — to provide a coherent snapshot of Europe’s evolving outlook.

Refresh this chart in your browser | Edit the chart in Datastream

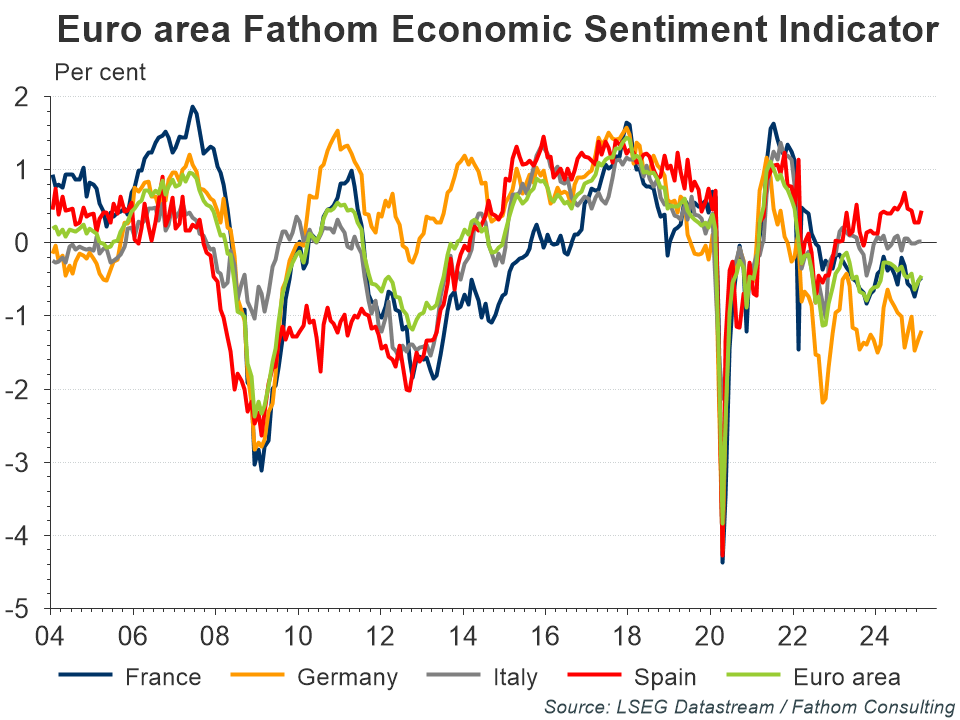

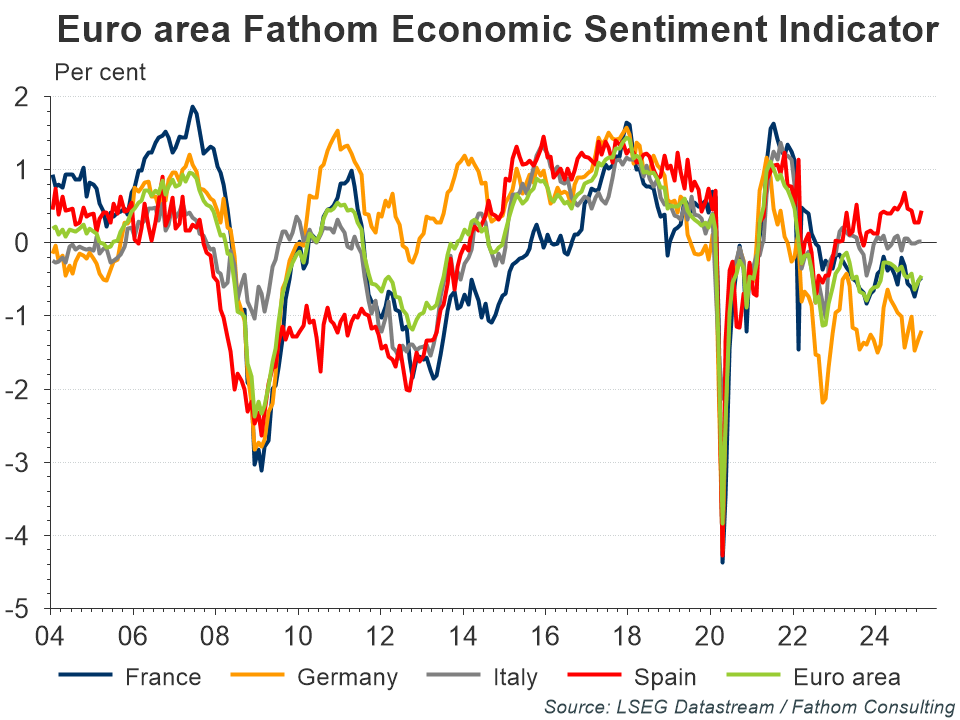

Euro area economies are gradually emerging from the stagnation that defined much of 2024. Recent improvements in industrial production and the composite PMI suggest a modest but encouraging rebound. These signs of economic resilience are helping lift sentiment, as captured by Fathom’s Economic Sentiment Indicator. Germany and France, the bloc’s largest economies, are stabilising, while inflation continues its descent toward the European Central Bank’s (ECB) 2% target (across the bloc as a whole).

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in LSEG Workspace.

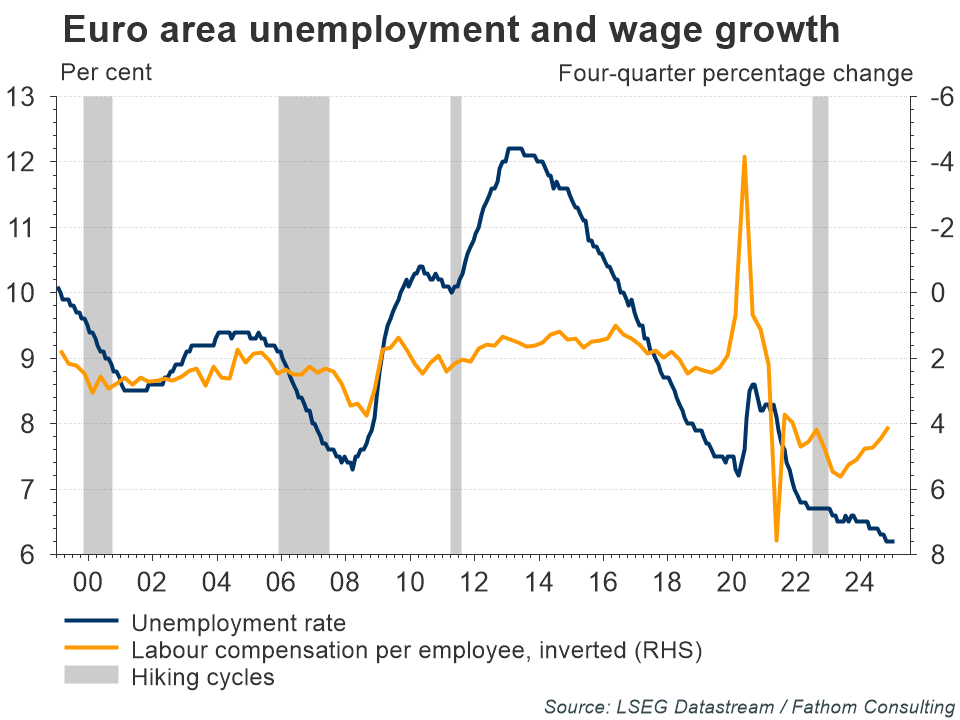

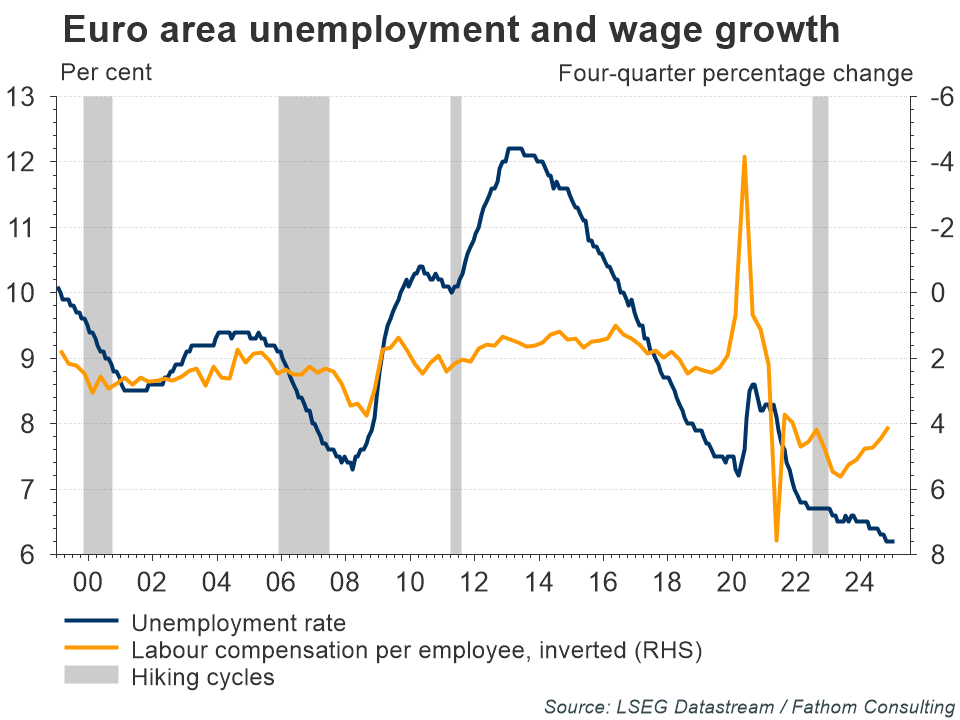

Labour markets remain historically tight by euro area standards, with unemployment rates hovering near record lows. Wage growth, although moderate, has recently outpaced inflation, supporting real income gains and helping sustain household consumption. This resilience has been a crucial buffer against external shocks, reinforcing domestic demand, even as global trade and industrial output recover more gradually. However, structural fragilities in southern Europe, along with continued geopolitical tensions and trade frictions, remain as headwinds. Meanwhile, although energy prices have stabilised since the shocks of 2022-2023, they continue to pose risks to industrial competitiveness.

Refresh this chart in your browser | Edit the chart in Datastream

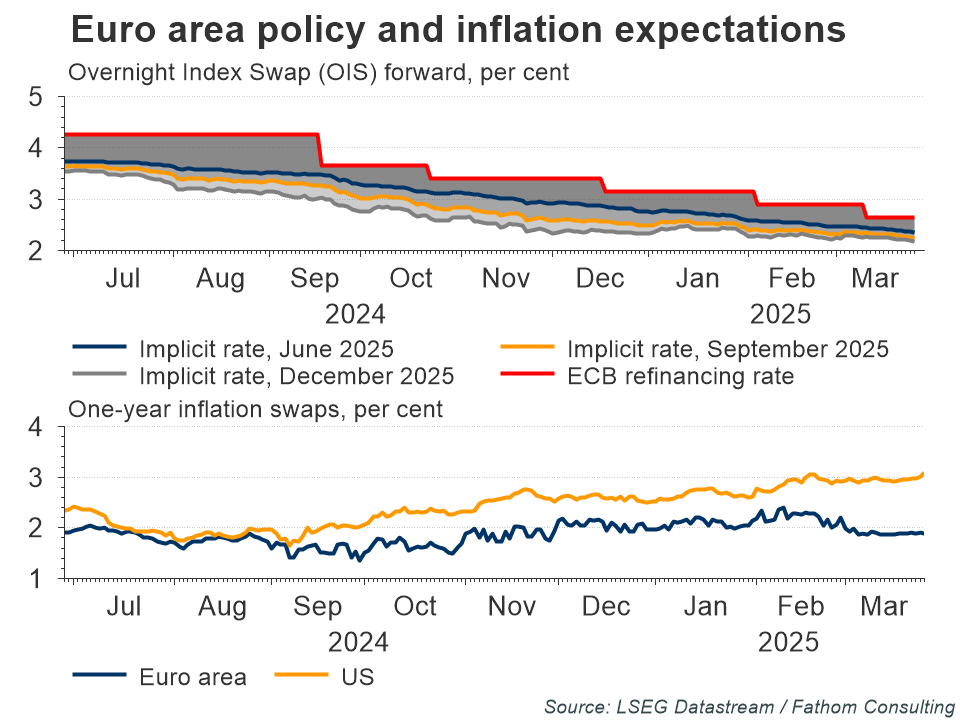

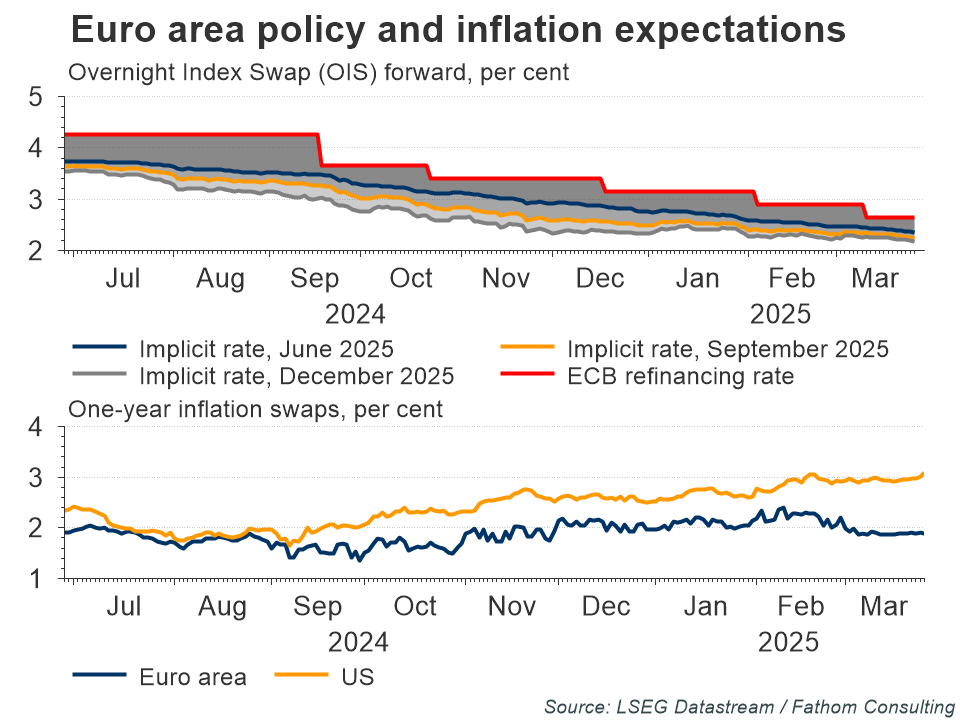

The inflation outlook in Europe continues to improve — especially in contrast to the more persistent inflation dynamics seen in the US. This relative strength is creating room for potential monetary easing. While the ECB remains firmly data-dependent, pricing in the overnight index swap market now anticipates a rate cut as early as June, with total easing of around 50 basis points expected by year-end.

Refresh this chart in your browser | Edit the chart in Datastream

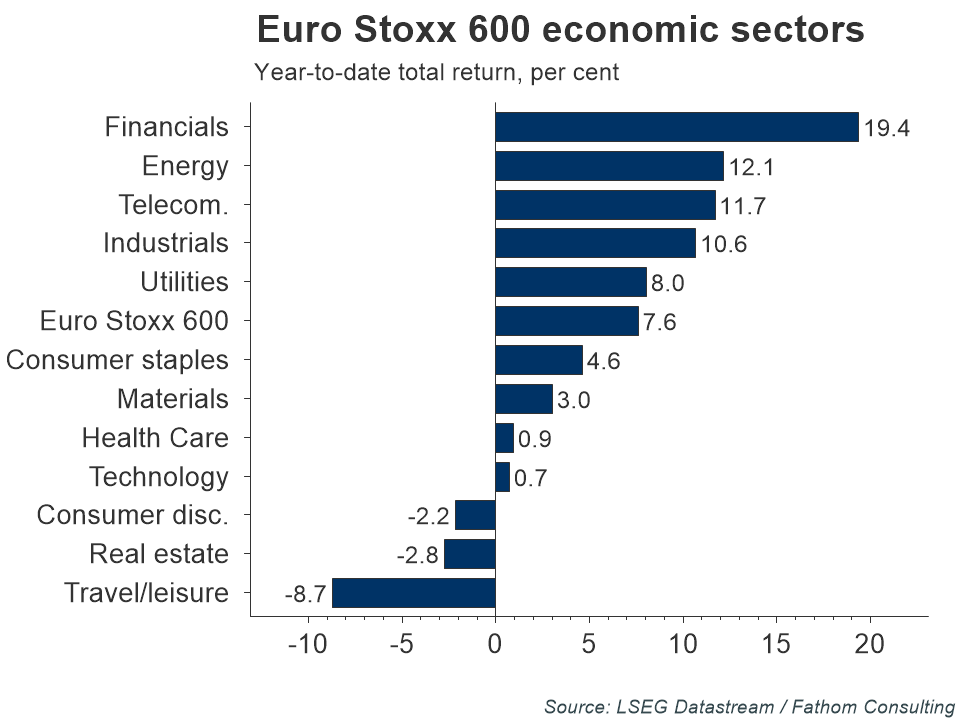

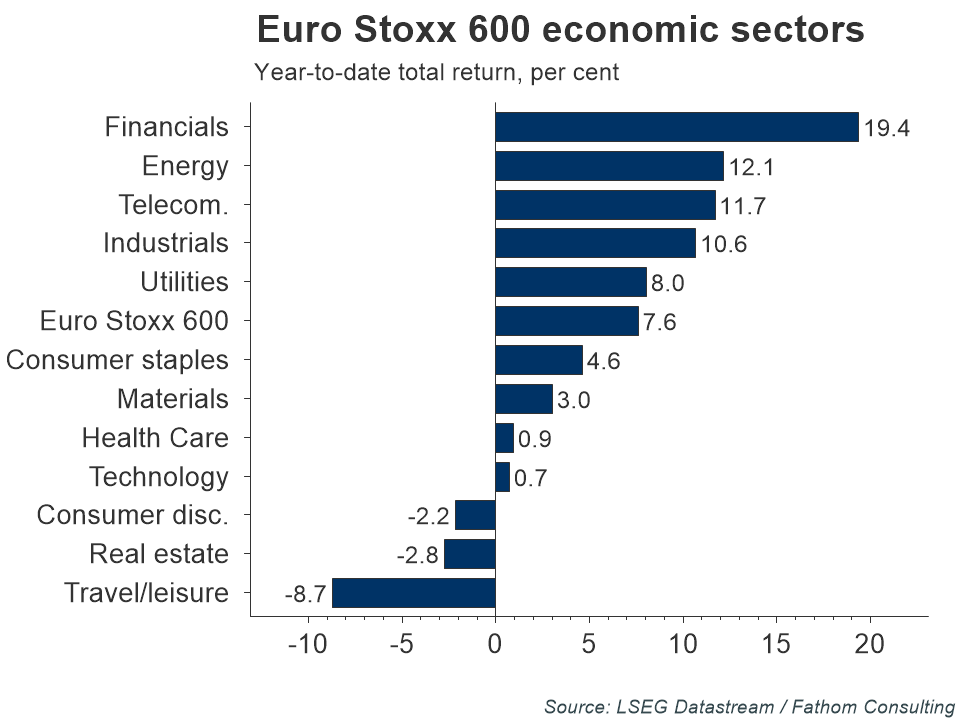

Investors have been quick to adjust to this changing macro landscape. European equities have rallied strongly since the start of 2025, with the Euro Stoxx 600 up roughly 8% — a performance rarely seen in a first quarter. The rally has been driven by some cyclical sectors such as financials, industrials, telecommunications and energy, which have all benefitted from improving risk sentiment and expectations of looser policy. By contrast, travel and leisure stocks have faced pressure, reflecting political uncertainty in tourism-heavy Türkiye. Nevertheless, overall equity market momentum has remained robust, supported by the improved earnings outlook and the repricing of rate expectations.

Refresh this chart in your browser | Edit the chart in Datastream

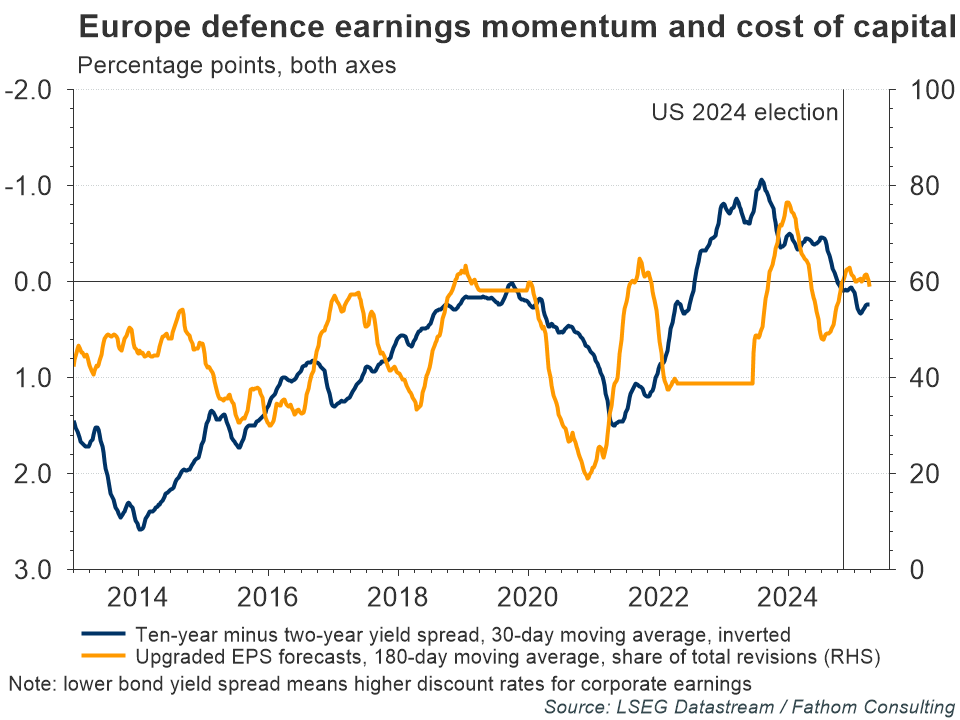

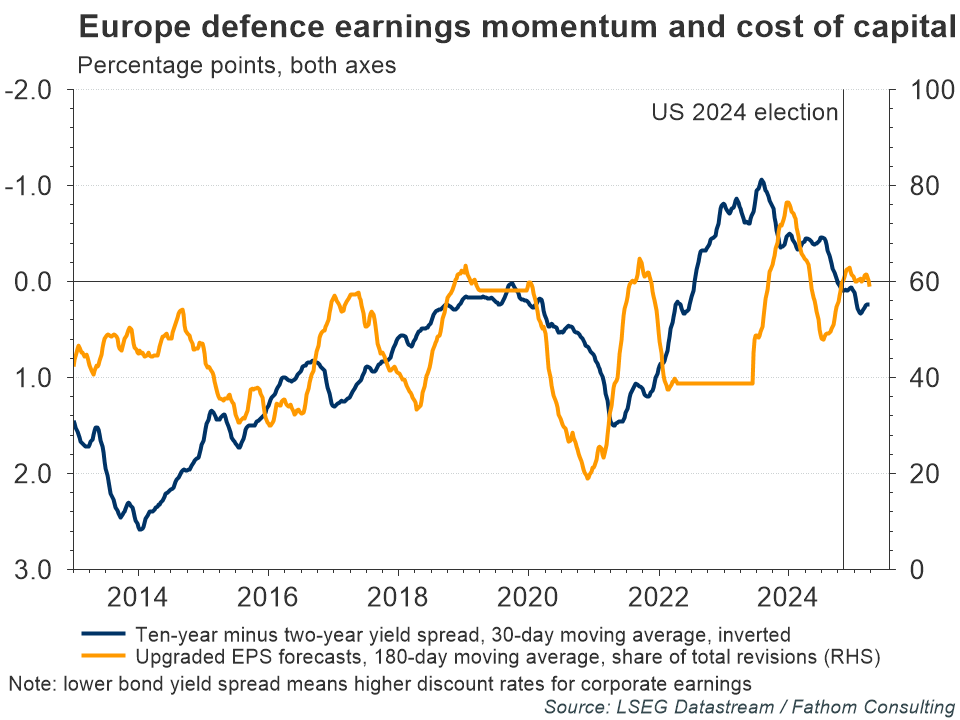

Beyond macro data and policy speculation, geopolitics is playing a significant role in shaping European market dynamics. Regular comments by US President Donald Trump — casting doubt on America’s NATO commitments and criticising European allies — has reignited concern about the continent’s defence autonomy. European defence stocks have rallied as markets progressively price in a sustained increase in military spending across the bloc.

Refresh this chart in your browser | Edit the chart in Datastream

This reflects a structural shift in investor perception: defence is now viewed not just as a cyclical play but as a politically backed growth sector. Advances in aerospace, cyber-defence and autonomous technologies are drawing increased capital into the sector, further enhancing its appeal and long-term growth potential. While profit expectations have been buoyant for some time, investors are now applying lower discount rates to future cash flows — an indication of rising confidence in the sector’s strategic relevance and durability.

Europe’s economic and financial landscape is in a period of transition. Easing inflation, a resurgence in equity markets, and a rotation toward strategic sectors are gradually setting the stage for a recovery and potential policy loosening. Yet, significant risks persist. Valuation pressures, inflation volatility and deep-seated structural imbalances within the euro area continue on unresolved. Perhaps most concerning is the escalation of tariff wars, started over on the other side of the Atlantic, which could severely disrupt trade flows, dampen investor confidence and derail the fragile recovery just as momentum begins to build. The months ahead will be critical in determining whether this nascent recovery gains traction or stalls amid lingering uncertainties. For now, however, a sense of cautious confidence prevails — a sentiment that has been largely absent from European markets in recent years.

The views expressed in this article are the views of the author, not necessarily those of LSEG.

______________________________________________________________________________________

LSEG Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop viewpoints on the market.

LSEG offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.