The list lengthens as President Trump reiterated his intent for India to join the likes of Canada and Mexico, with plans to raise US tariffs by 2 April. India has traditionally been more of a closed economy and maintained tariff rates above global norms, imposing a mean average 14.36% rate in 2022 — much higher than the average tariff imposed by the US of 2.7%. Mr Trump aims to address this imbalance.

Refresh this chart in your browser | Edit the chart in Datastream

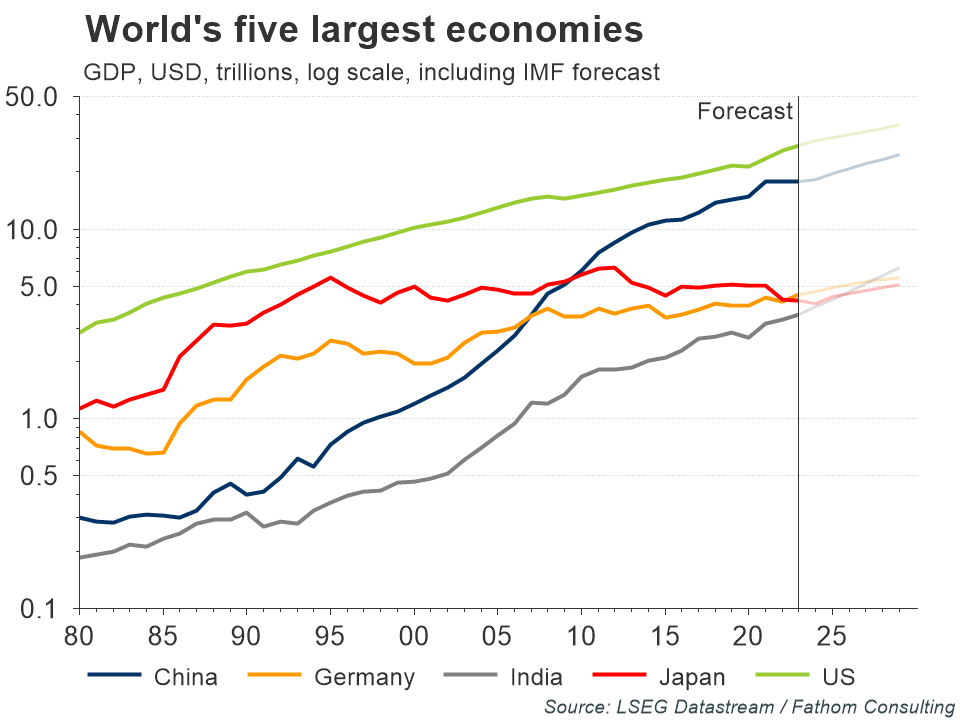

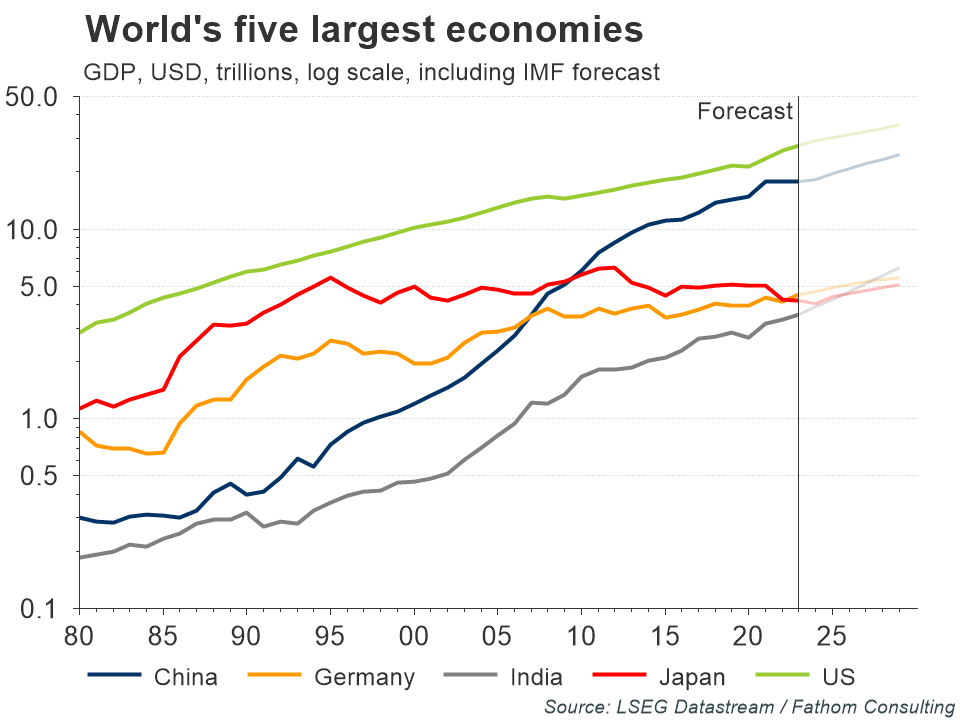

India is forecast, by the IMF, to become the world’s third largest economy by 2028 (when measured at market exchange rates) and while GDP per capita remains low for now it continues to rise rapidly. And, with rising incomes comes increased demand for goods and services, including those from abroad. Were Mr Trump’s threat of tariffs to instead pressure India, and Prime Minister Modi who he has reportedly dubbed the ‘king of tariffs’, into lowering the wall of protectionist measures against the US, Mr Trump may elicit more favourable conditions for US exporters in the world’s most populous country and its fast-growing market. The ‘Make in India’ plan had hoped for manufacturing’s share of overall output to increase from 15% in 2014 to 25% by 2025, however, instead its contribution has since declined to only 13.5% in 2023. A trade deal could actually provide the influx India needs by providing more favourable conditions for foreign firms to establish operations there. Yet, being pushed to negotiate a trade deal and strip protectionist tariffs comes with a trade-off, and could inhibit the development of India’s domestic manufacturers, and broader economic plans.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in LSEG Workspace.

However, if India does not reduce its own tariffs and the US raises its own trade barriers then the story could be very different. India has continued to establish and grow a trade surplus with the US, equivalent to around $45.7 billion for 2024. As with Canada, imposition of tariffs on imports from India could be somewhat detrimental for US consumers, and somewhat inflationary in the short run. This is especially true given the Institute for Human Data Science’s findings that Indian companies supplied four out of ten of all prescriptions filed in the US in 2022, and due to their price competitiveness, provided savings worth $219 billion to the US healthcare system. Similar issues arise when looking at firms that have used India as an alternative element to their supply chain to China. India’s exports to the US constitute around 20 per cent of all its exports, by value. The imposition of tariffs will either reduce profit margins of India’s exporters if they absorb the tariff, reduce the price competitiveness of India’s goods sold in the US, or a combination of both.

Meanwhile, India does not have much room to retaliate. India’s import levels from the US are relatively low, and tariff rates already high, such that further tariff hikes would likely only have marginal impact.

The hit to both economies, and desire for greater US access to Indian markets, likely explains the leaders’ attempts to negotiate a bilateral trade deal.

Refresh this chart in your browser | Edit the chart in Datastream

With exports to the US accounting for about two per cent of GDP, Mr Trump’s tariffs could act as a small drag on future growth in India but have wider implications for its future expansion. Prime Minister Modi’s ‘Make in India’ plan could suffer either way. US tariffs may limit emerging Indian manufacturers access to US markets, and any incentives for foreign manufacturers to continue outsourcing production there as they diversify away from China. For instance, iPhone manufacturers have already made, and enacted, plans to diversify production further from China and increase its global production share in India up from an incumbent 14%, but tariffs may reduce the returns to manufacturing in India.

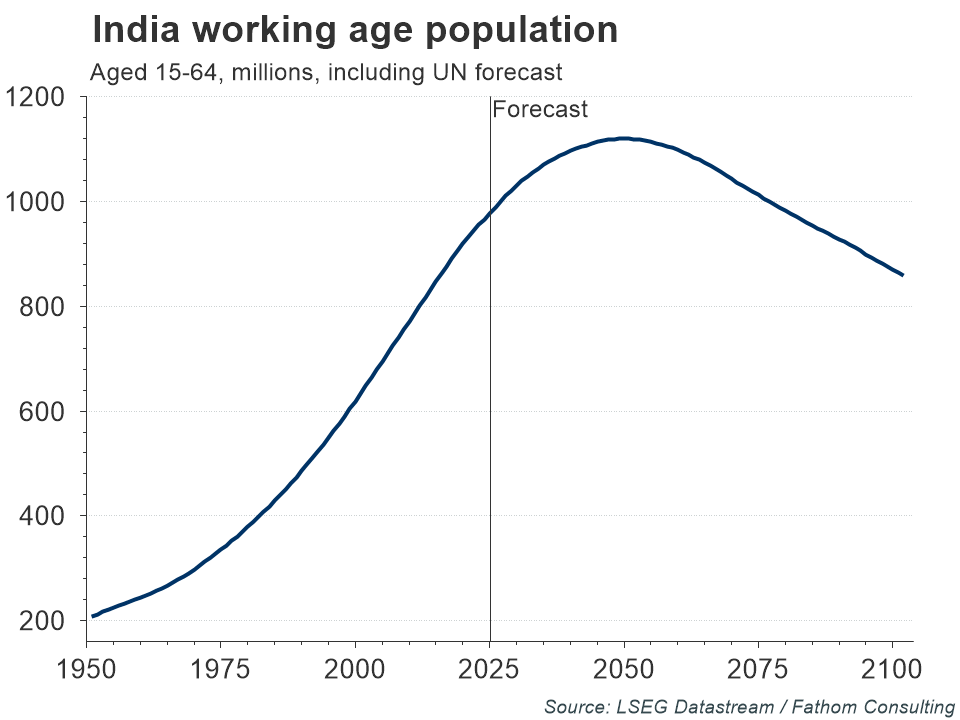

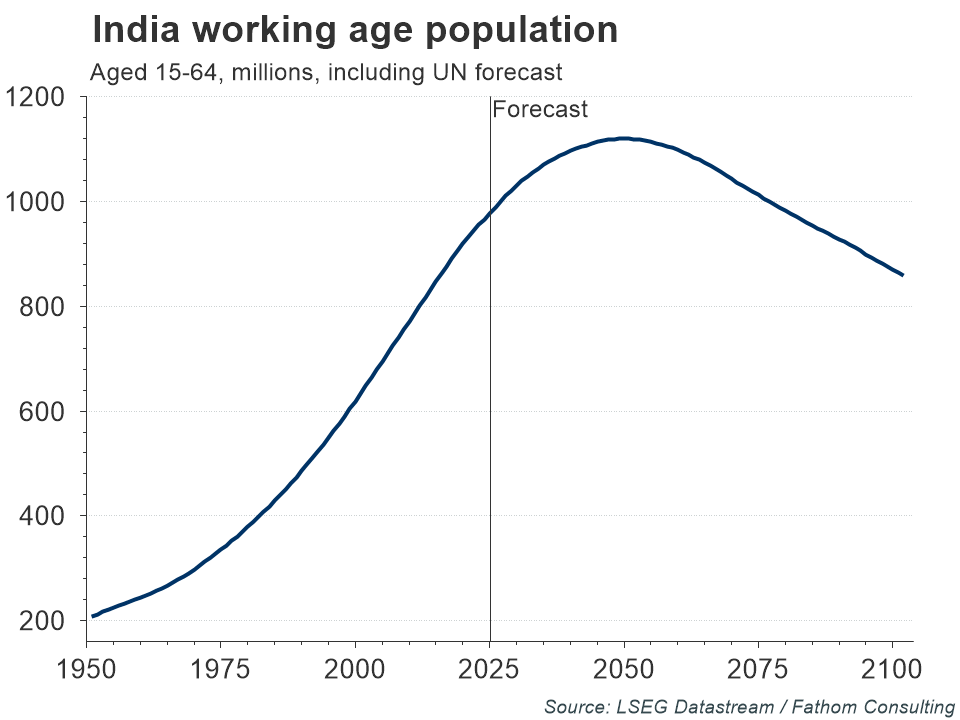

Establishing itself as a manufacturing hub is an age-old means to promote economic growth and raise living standards — the traditional pathway for an emerging economy to grow sees employment move first from agriculture to manufacturing and then later to services. India has somewhat taken a different path with a bias towards services employment. That said, a more prominent manufacturing sector would be an apt way to make use of its demographic dividend much to the same way China did, as mentioned in LSEG’s and Fathom Consulting’s Incredible India Report exploring India’s potential pathway to sustained long-run growth. However, restrictive red tape and low female workforce participation has in the past inhibited India’s ability to further grow its manufacturing sector and leverage off of its large population.

Refresh this chart in your browser | Edit the chart in Datastream

Yet again, geopolitical developments appear to be increasingly important in shaping the global outlook for 2025. India’s near-term future will be prone to volatility arising from its interactions with the US, which may shape the involvement of foreign investors and India’s price competitiveness in both its domestic and export markets.

The views expressed in this article are the views of the author, not necessarily those of LSEG.

______________________________________________________________________________________

LSEG Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop viewpoints on the market.

LSEG offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.