Asset class view

- UK mutual funds and ETFs saw outflows of £6.76bn over February (-£5.12bn ex-MMFs).

- Equities saw the largest redemptions (-£3.48bn).

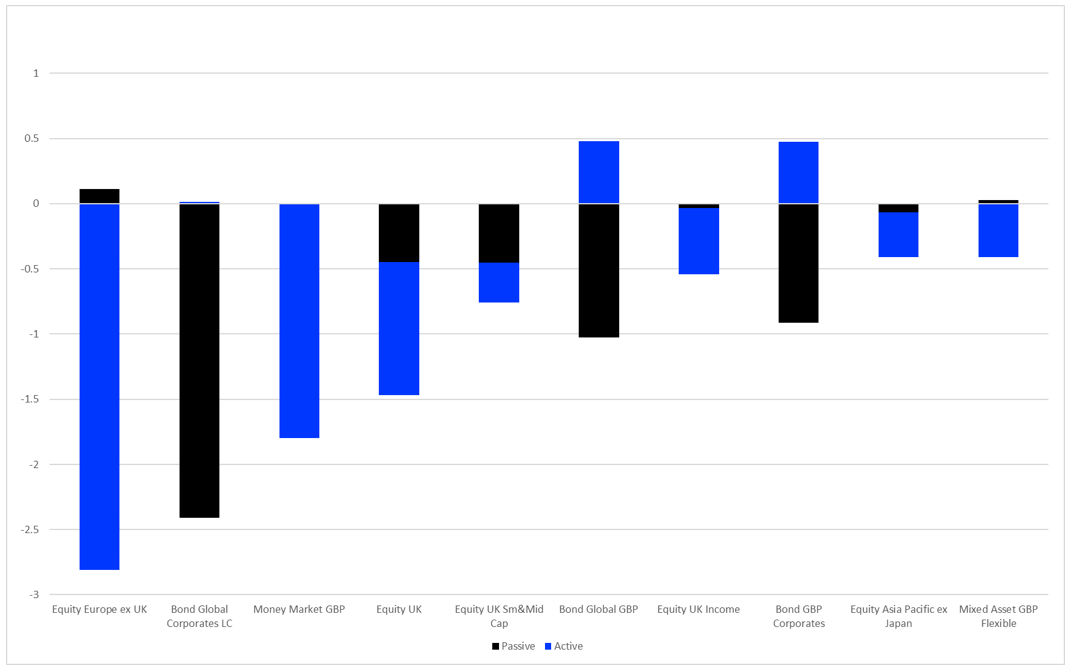

Active v passive

- The active-to-passive bond rotation, which has been a feature of the market since 2021, reversed.

- Some £3.73bn was redeemed from passive bond funds, while their active peers took £1.49bn.

Classifications

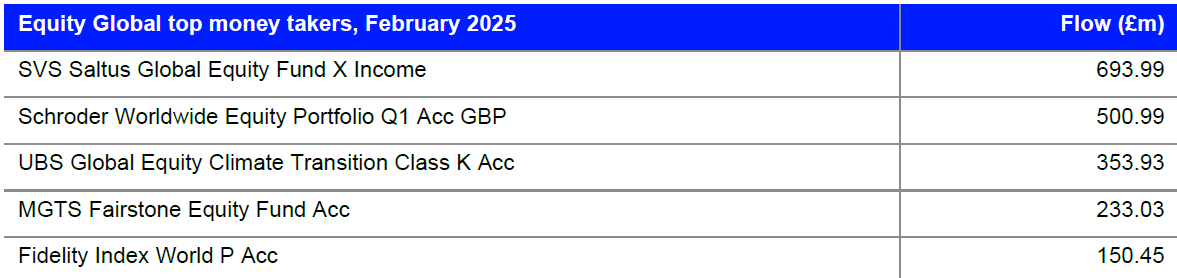

- Equity Global was the top-selling classification for the month, netting £1.87bn (£1.18bn active/£689m passive).

- UK equity funds suffered redemptions of £2.77bn over the month.

Sustainable fund flows

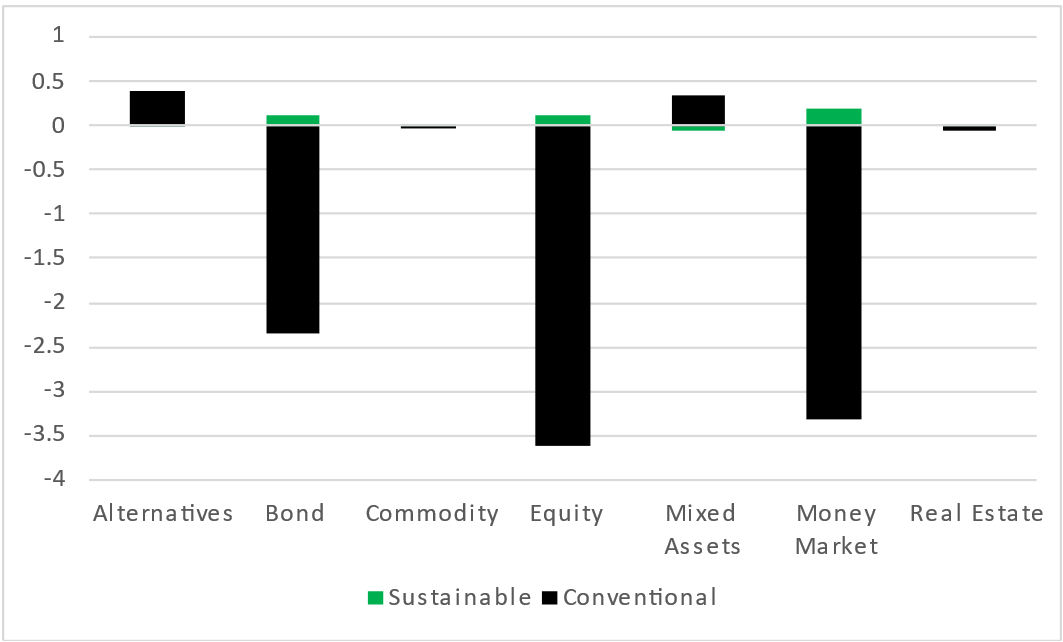

- Sustainable funds netted a total of £367m for the month, conventional funds lost £8.26bn.

- MMFs were the most successful, with a take of £180m.

Asset manager view

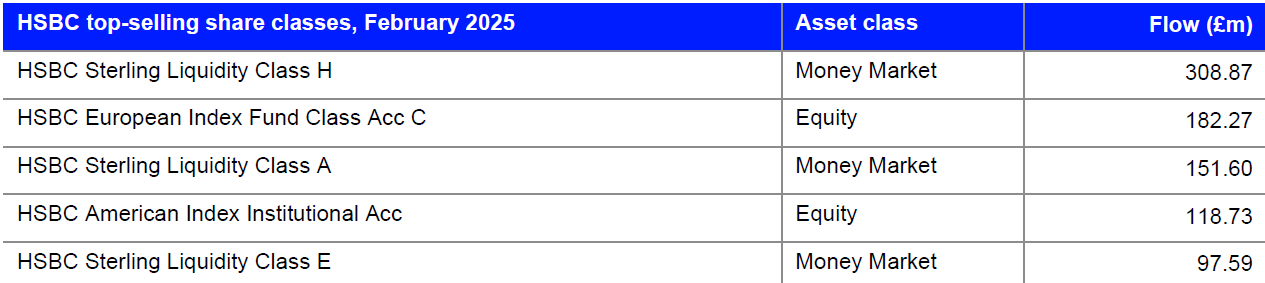

- HSBC was February’s top money taker, attracting £1.46bn, with flows again driven by MMFs.

Flows by Asset Class

Three-year flows

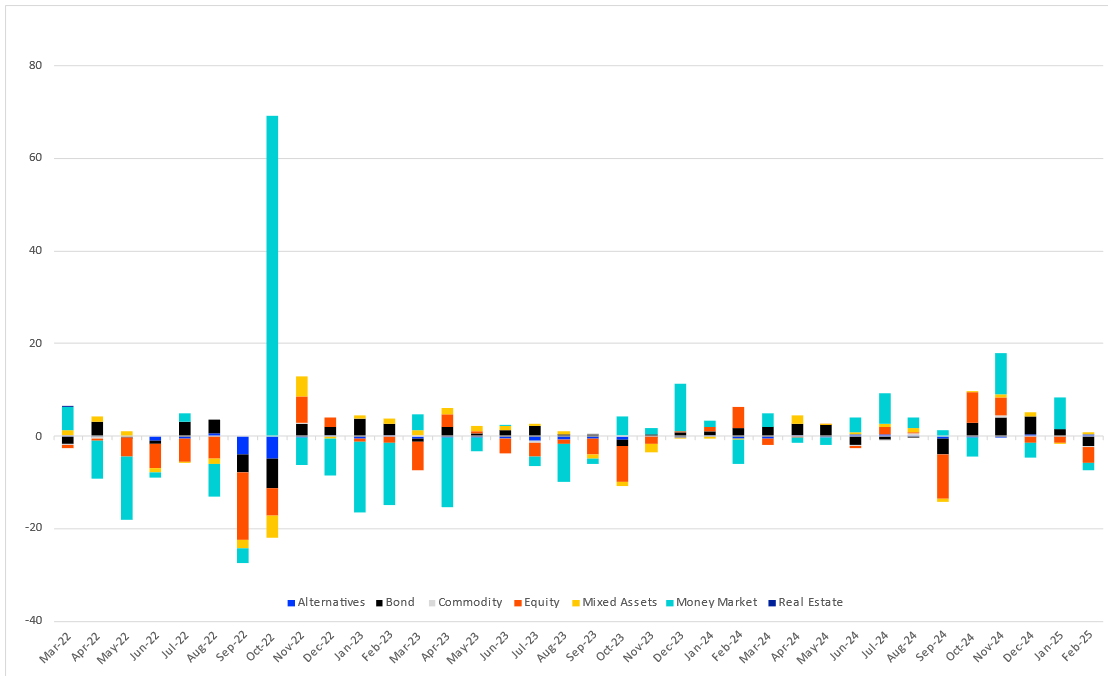

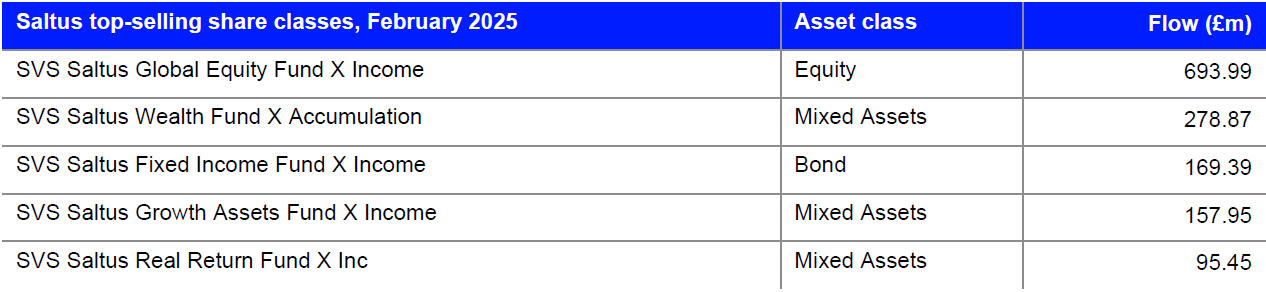

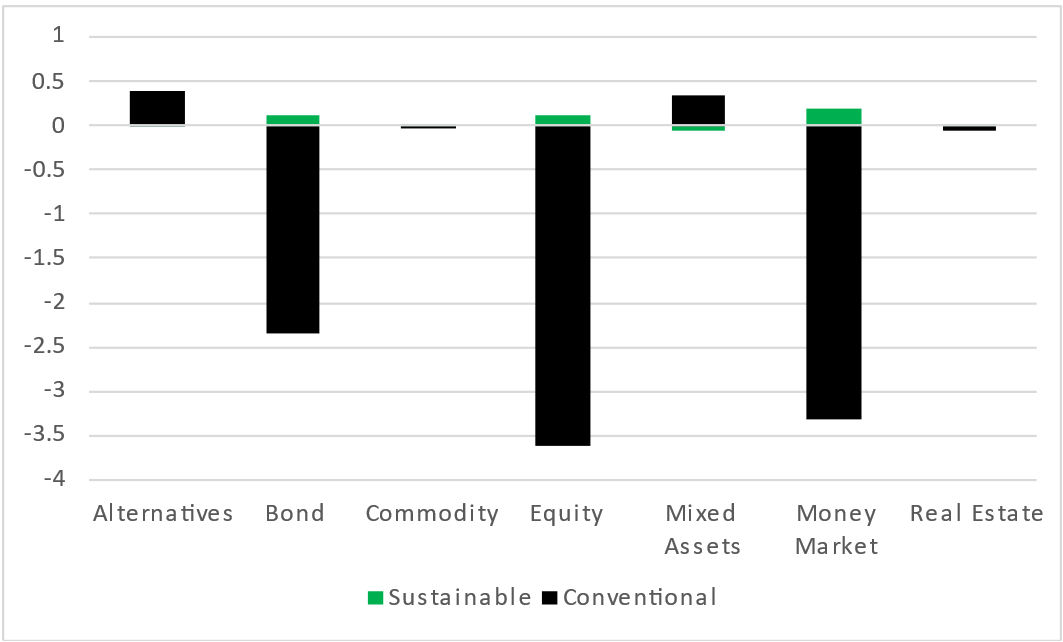

Chart 1: Asset Class Flows, 36 Months, to February 2025 (£bn)

Source: LSEG Lipper

Only alternatives and mixed assets were in positive territory in February. However, MMFs had such a strong January that this still leaves them with the largest net inflows YTD (£5.06bn). This is followed—unusually and at a considerable distance—by alternatives (£313m), then mixed assets (£75m). All other asset classes are in the red, YTD, the worst being equity (-£4.9bn), bonds (-£693m), real estate (-£535m), and commodities funds (-£48m).

Bond and equity funds saw their largest outflows since September of last year, when investors were likely spooked by the uncertainties surrounding the month’s budget.

Active versus Passive

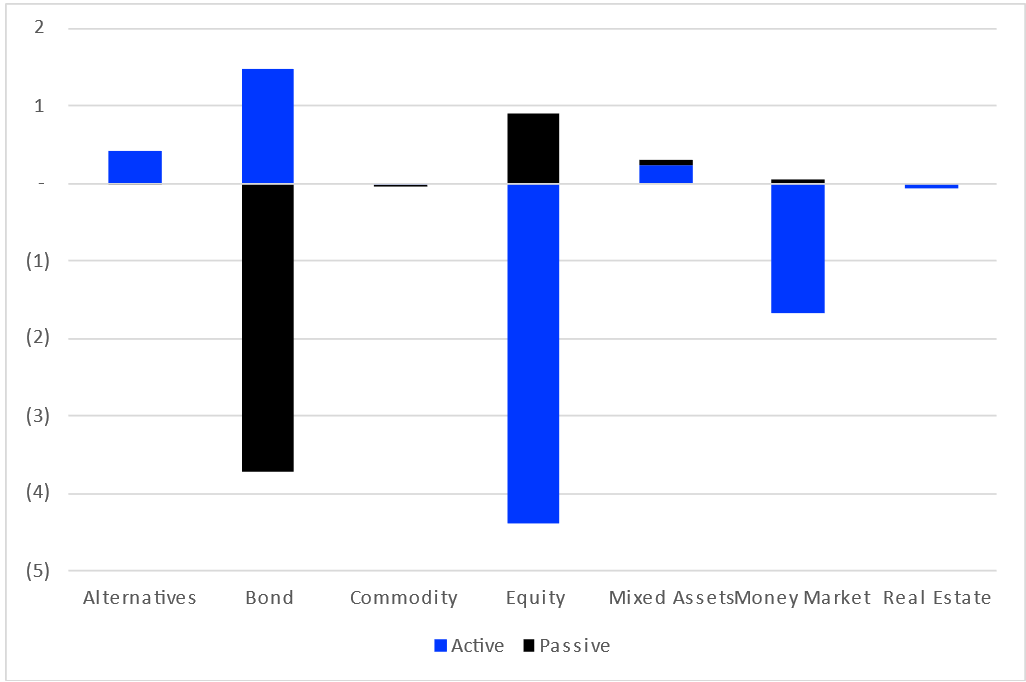

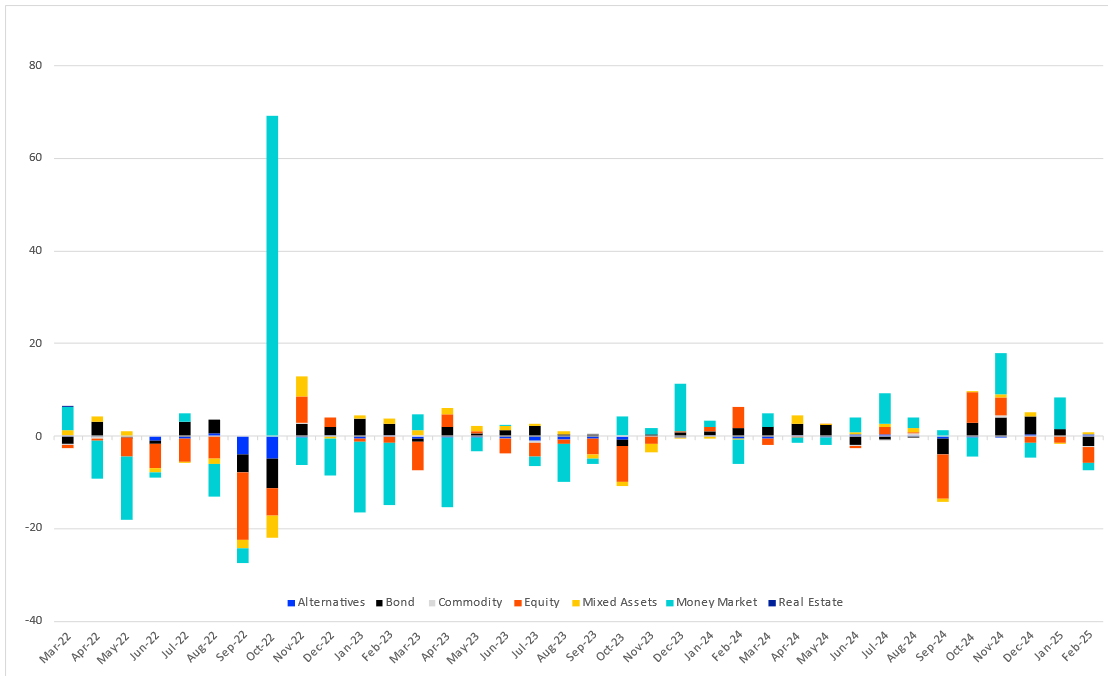

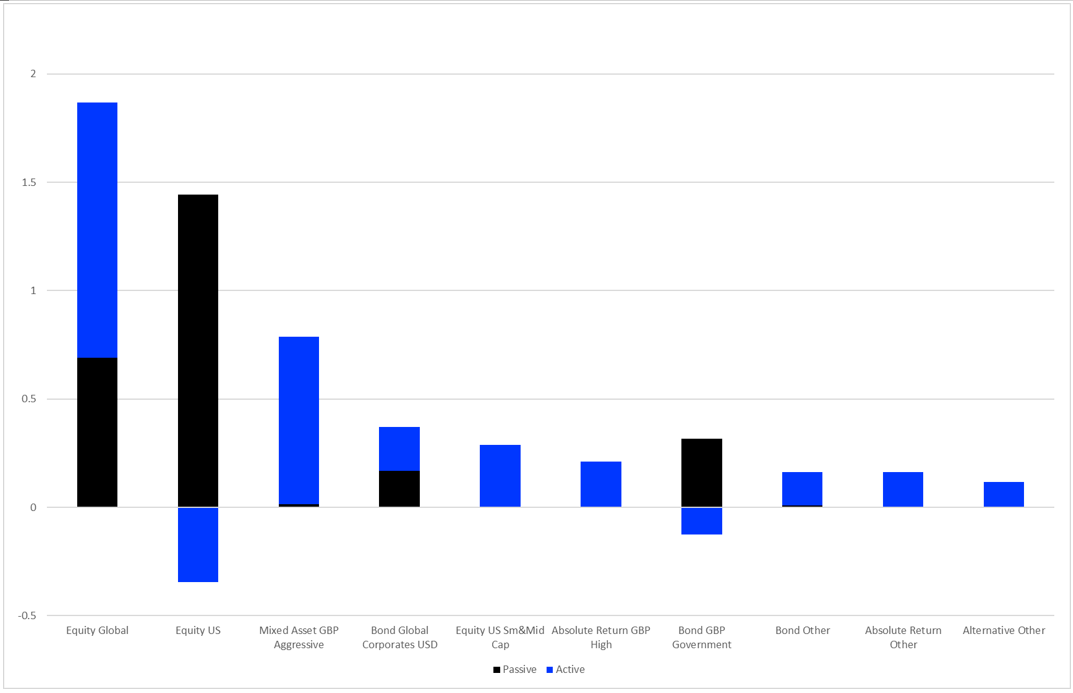

Chart 2: Asset Class Flows, Active and Passive, February 2025 (£bn)

Source: LSEG Lipper

UK mutual funds and ETFs saw outflows of £6.76bn over February (-£5.12bn ex-MMFs). Equities saw the largest redemptions (-£3.48bn), although passive equity funds still netted £907m.

What’s most interesting this month is the reversal of the active-to-passive bond rotation, which has been a feature of the market since 2021, and accelerated in the fixed income annus horribilis of 2022. Some £3.73bn has been redeemed from passive products, while we’ve seen active funds take £1.49bn. Two trackers—sterling and global short-duration funds—are responsible for £3.7bn of those outflows, while a sterling absolute return bond fund accounted for £627bn of the active inflows.

It was an unusually strong month for alternatives funds, which netted £397m, and mixed-assets funds stayed in the black (£301m). However, despite the general outflow from risk assets, MMFs were in the red (-£1.64bn).

ETFs and Passive Mutual Funds

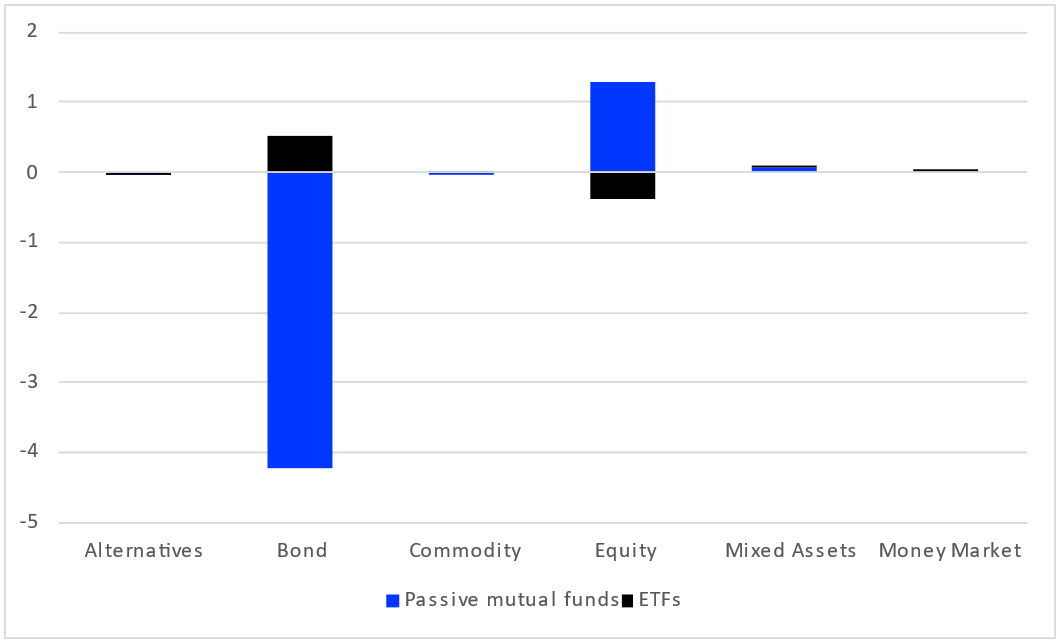

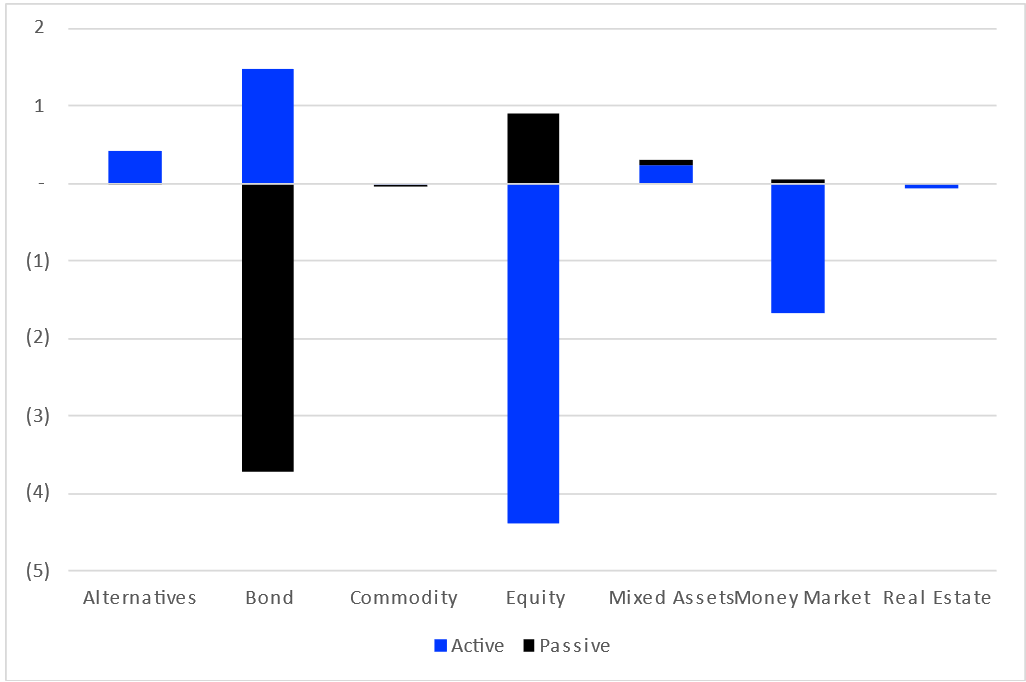

Chart 3: Passive Asset Class Flows, Mutual Funds v ETFs, February 2025 (£bn)

Source: LSEG Lipper

It was an unusually bad month for trackers. Passive funds saw outflows of £2.76bn over February, although with inflows of £158m to ETFs. While passive bond mutual funds shed £4.24bn, their ETF equivalents netted £507m. However, the trend was reversed regarding passive equities, as mutual funds attracted £1.28bn while their passive peers shed £375m.

Flows by Classification

Largest inflows

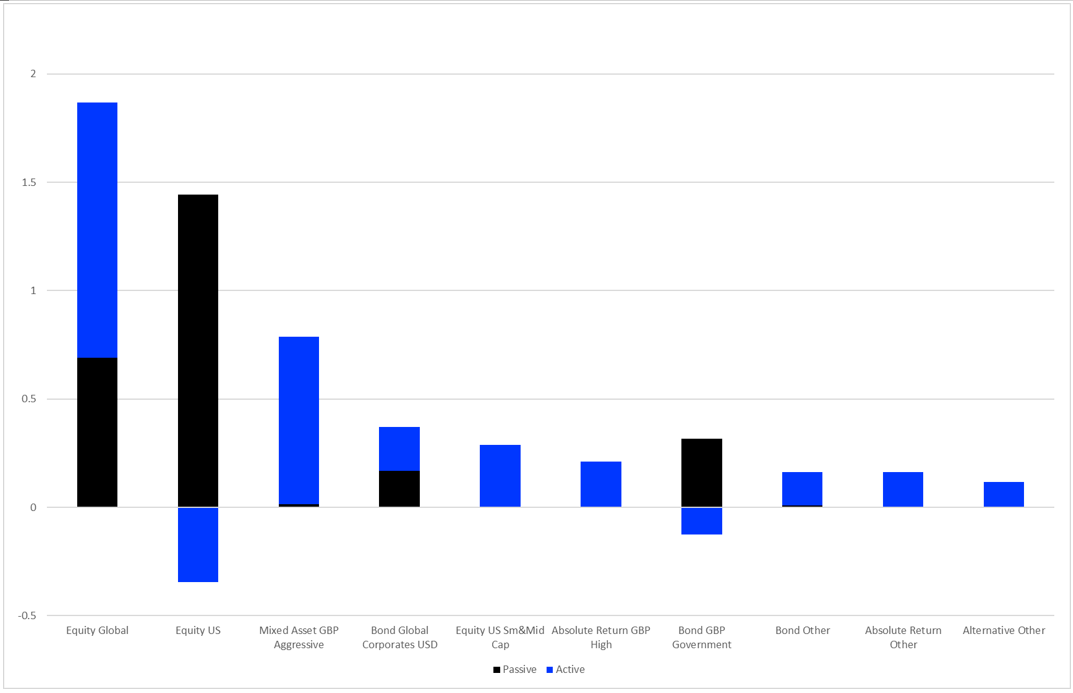

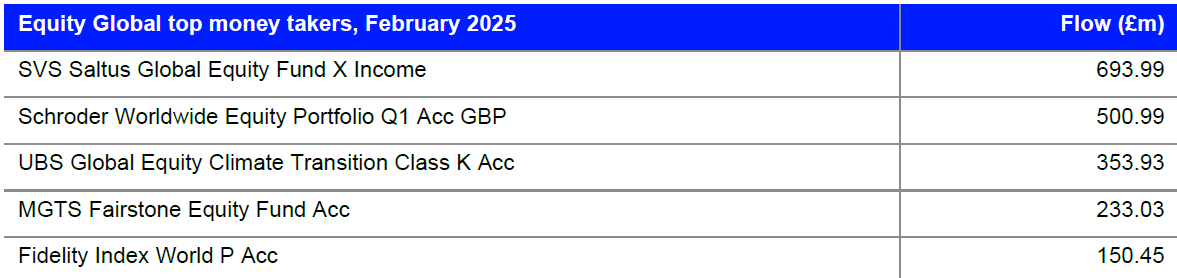

Chart 4: Largest Positive Flows by LSEG Lipper Global Classification, February 2025 (£bn)

Source: LSEG Lipper

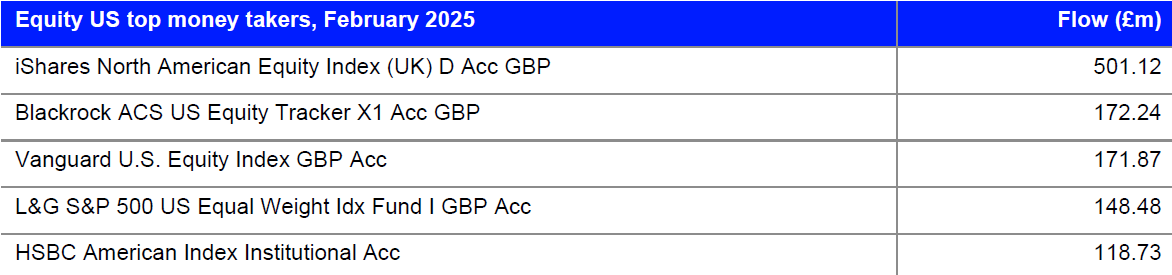

Equity Global was the top-selling classification for the month, netting £1.87bn (£1.18bn active/£689m passive). Given the net outflows for equities, it’s interesting to see that active strategies dominate in this classification, and that the four top-selling share classes are themselves active. MGTS Fairstone Equity is a new launch, part of a managed portfolio service range managed by JPMorgan on behalf of Fairstone.

Source: LSEG Lipper

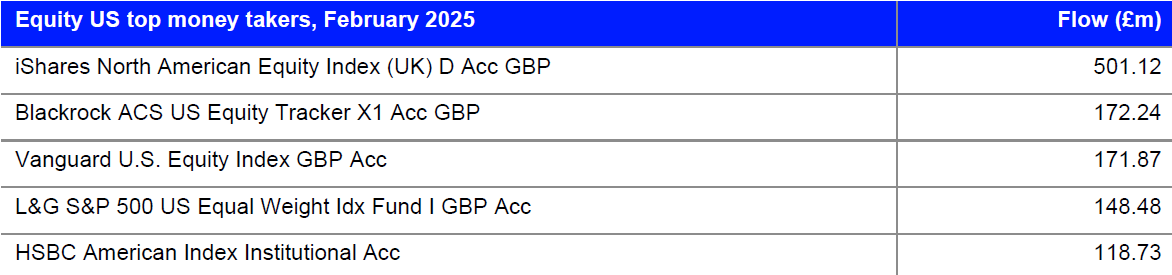

Equity Global bumped Equity US off the top spot for risk assets, though not to the same extent it did on a pan-European basis. However, what’s unusual here is that the change in US market mood music also sees a rotation in strategy. The influx of Equity US cash has hitherto benefitted actively managed funds, but February sees a reversal of this, with passive vehicles netting £1.44bn, as their active peers suffered redemptions of £345m.

Source: LSEG Lipper

Mixed Asset GBP Aggressive also had a strong month, netting £788m, followed by Bond Global Corporates USD (£372m, with £203m to active strategies).

As indicated in chart 2, it has been a good month for alternatives, with Absolute Return GBP High taking £212m, Absolute Return Other (£161m), Alternative Other (£117m), Absolute Return GBP Low (£73m), Alternative Multi Strategies (£64m), Alternative Credit Focus (£63m), and Alternative Equity Market Neutral (£56m) all taking in money. While the previous sentence doesn’t make for particularly interesting reading, it is unusual to see so many alternatives classifications clustered in this way.

Largest Outflows

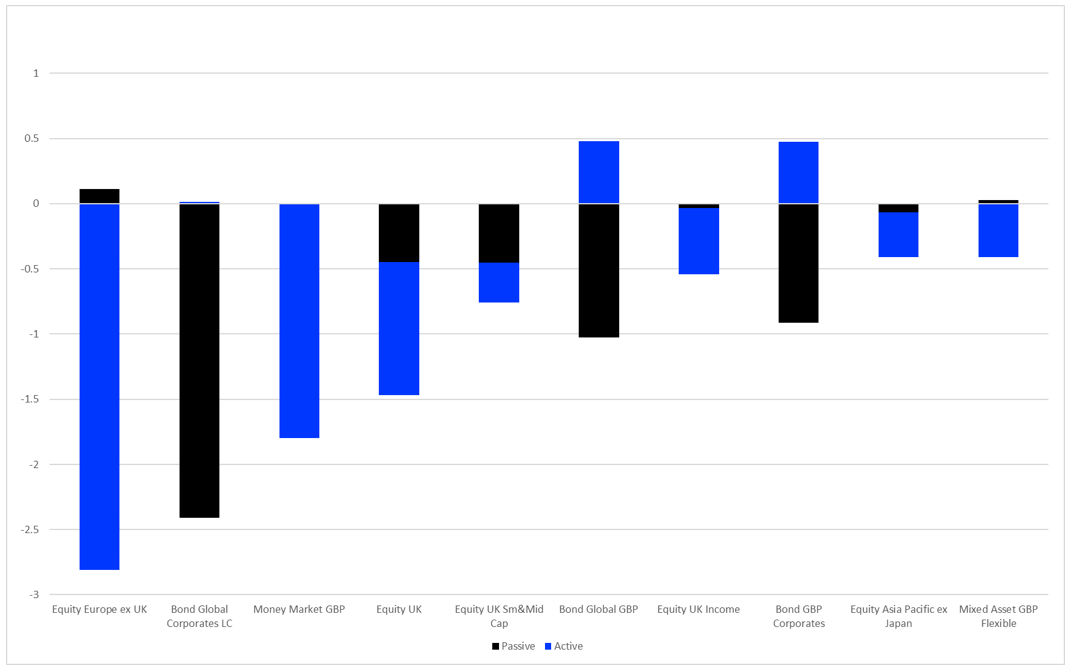

Chart 5: Largest Outflows by LSEG Lipper Global Classification, February 2025 (£bn)

Source: LSEG Lipper

Despite the relatively good performance of European equities, Equity Europe ex UK saw outflows of £2.7bn (with passive inflows of £11m). However, £2.5bn of this was accounted for by a redemption from one fund, and it’s possible that this is an internal move from one asset manager.

Bond Global Corporates LC also sees considerable outflows, with much of this from one short-dated fund (see above). Does this mean at least one large investor has decided that the direction of rates is down, and now is the time to move up the yield curve?

Meanwhile, the pain continues for UK equities, with Equity UK shedding £1.47bn, Equity UK Small & Mid Cap down £757m, and Equity UK Income losing £542m.

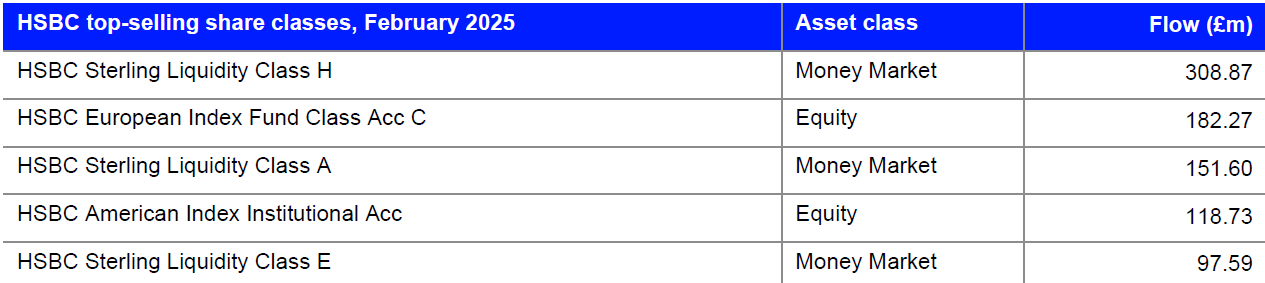

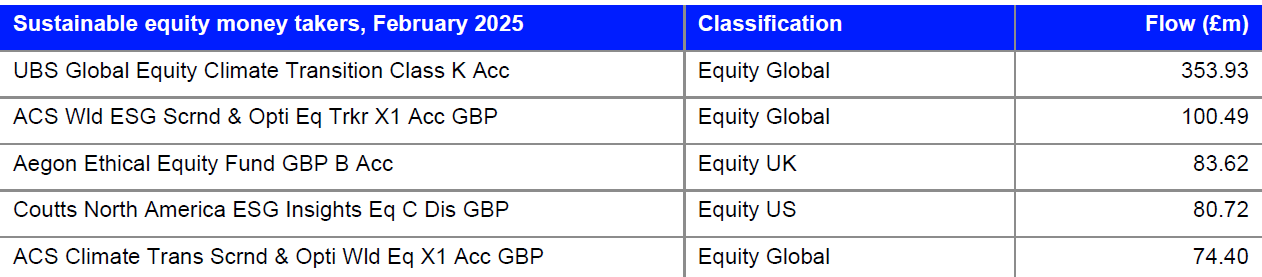

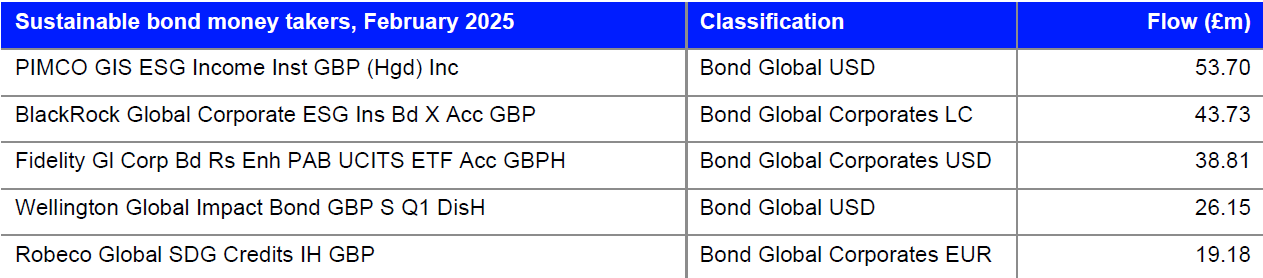

Sustainable Fund Flows

Chart 6: Sustainable Asset Class Flows, February 2025 (£bn)

Source: LSEG Lipper

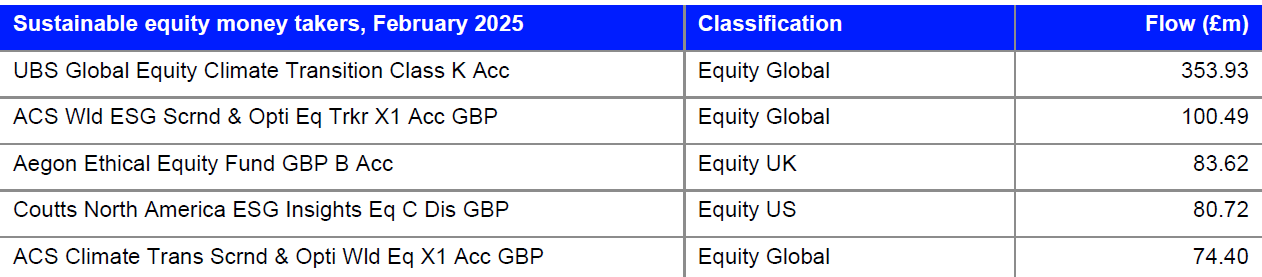

While not a vintage month for sustainable funds, green at least stayed in the black, unlike their conventional peers. Sustainable funds netted a total of £367m for the month, while conventional funds lost £8.26bn. Sustainable MMFs were the most successful, with a take of £180m. Given all the top-selling funds were iterations of the HSBC Sterling ESG Liquidity Fund, similar to last month, I’ll skip this in the first table, and move on to sustainable equity funds, which took £123m. Equity Global wins back most favoured status, which had until last month been held by Equity US, with large allocations to actively managed vehicles.

Source: LSEG Lipper

Sustainable bond funds took £108m, with the money being largely Bond Global and Bond Global Corporates classifications—something that carries on beyond the top five funds listed below.

Source: LSEG Lipper

The Sustainable Fund Flows section has a narrower and stricter focus than those which indicate some form of ESG strategy in their fund documentation—to a smaller group of sustainable funds, defined as all SFDR article 9 funds plus all Lipper Responsible Investment Attribute funds reduced to those containing indicative sustainable keywords in the fund name.

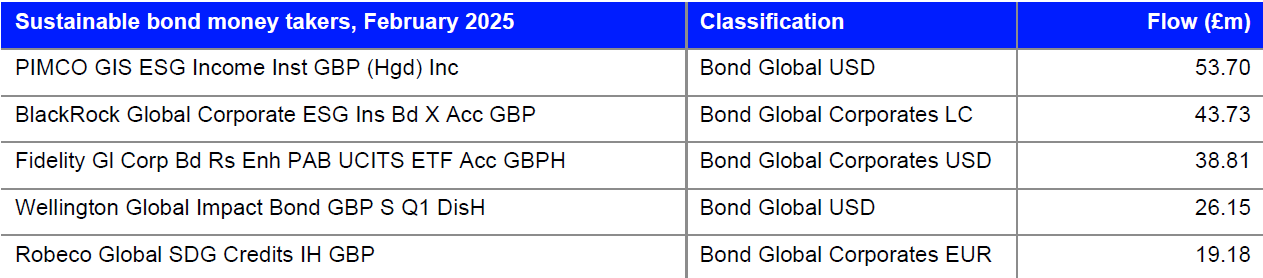

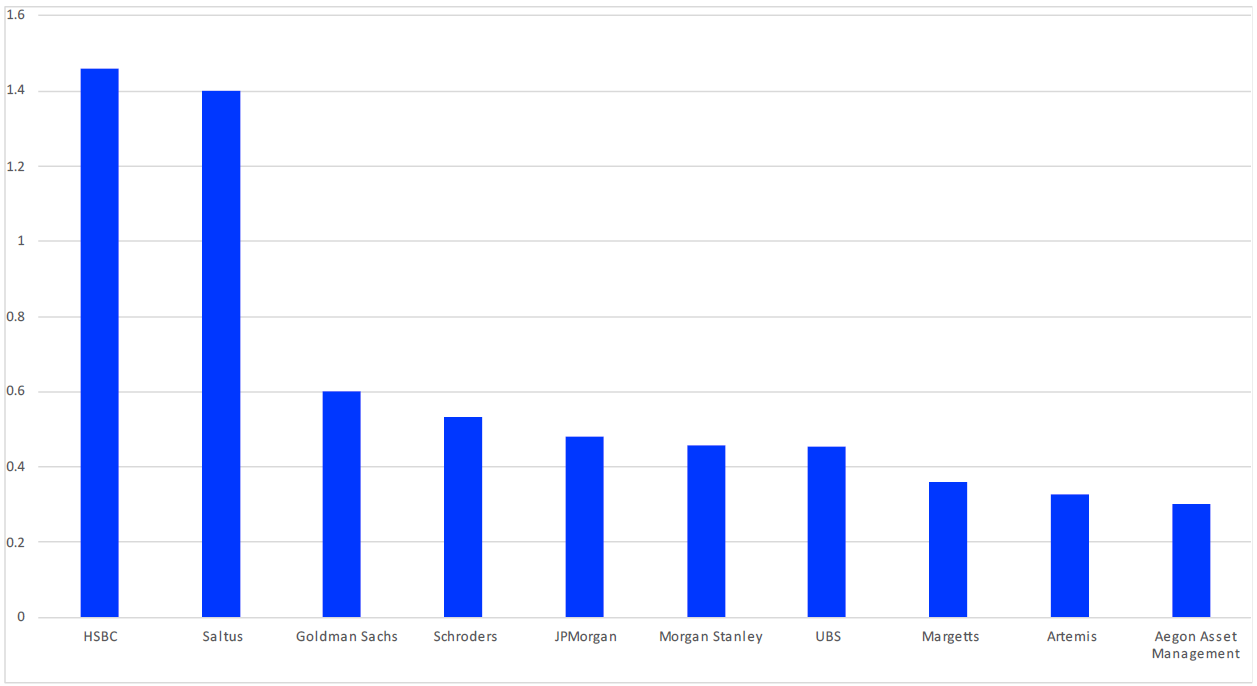

Flows by Promoter

Chart 7: Largest Positive Flows by Promoter, February 2025 (£bn)

Source: LSEG Lipper

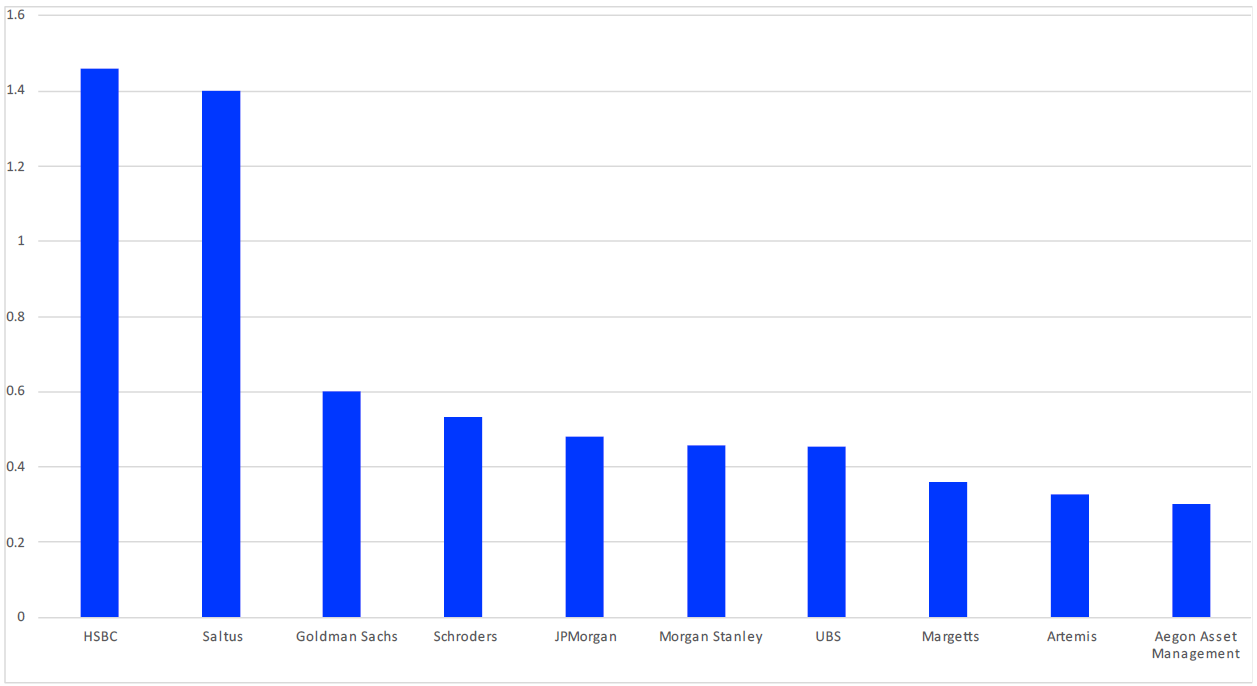

HSBC was February’s top money-taker, netting £1.46, down from January’s £2.12bn, including £605m to equity, £479m MMFs and £205m bonds.

Source: LSEG Lipper

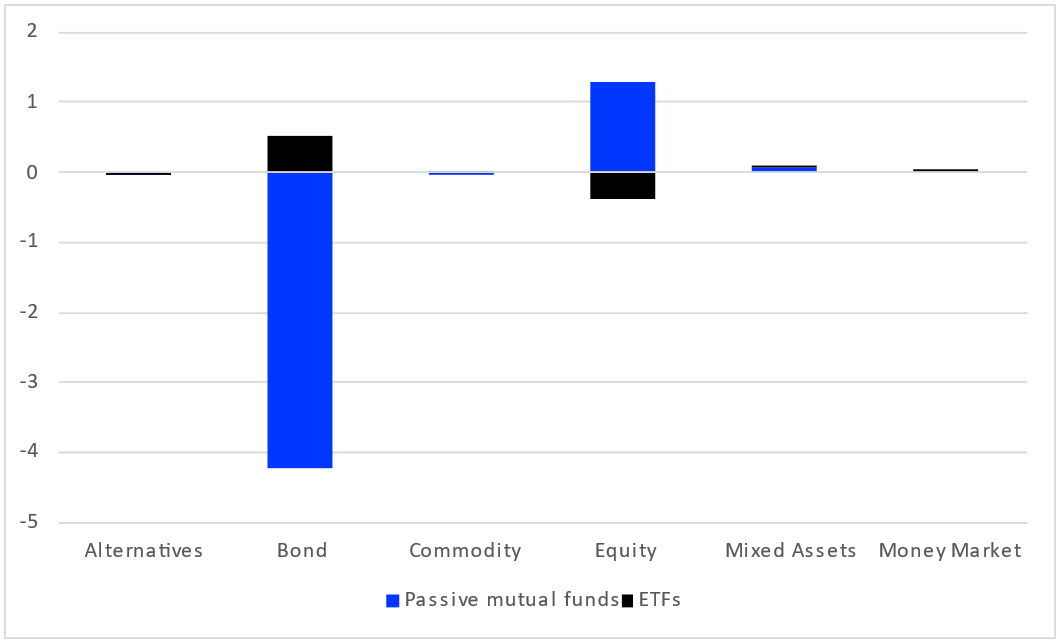

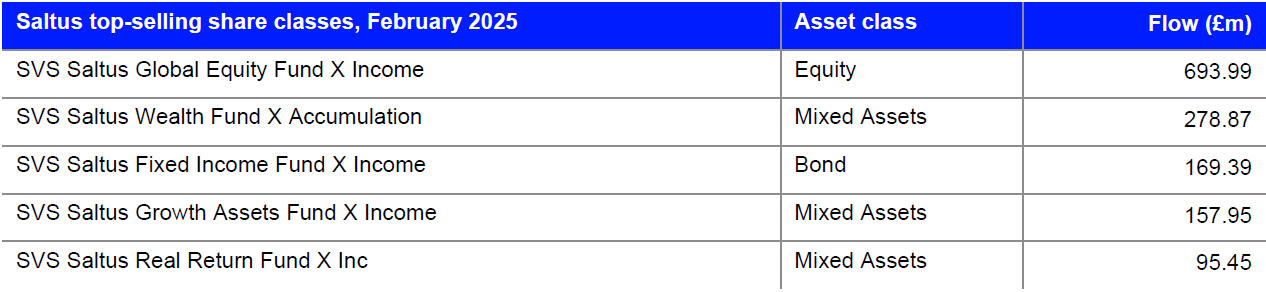

Saltus takes second place for the month, with net flows of £1.4bn, with £1.34bn to equity funds, £414m to MMFs, and £147m to bonds, as mixed-assets funds saw outflows of £138m.

Source: LSEG Lipper