Friday Facts: U.S. ETF Industry Review, March 2025

March 2025 was another month with strong inflows for the U.S. ETF industry.

These inflows occurred in a volatile and negative market environment ...

Find Out More

Bond Market Turbulence Triggered Huge Concerns

Bond Market’s Turbulence

On April 2, Trump unexpectedly announced indiscriminate high "reciprocal tariffs," triggering an unprecedented storm in ...

Find Out More

Russell 2000 Earnings Dashboard 25Q1 | April. 17, 2025

Click here to view the full report.

Please note: if you use our earnings data, please source "LSEG I/B/E/S".

Russell 2000 Aggregate ...

Find Out More

Weekly Aggregates Report | April. 17, 2025

To download the full Weekly Aggregates report click here.

Please note: if you use our earnings data, please source "LSEG I/B/E/S".

The Weekly ...

Find Out More

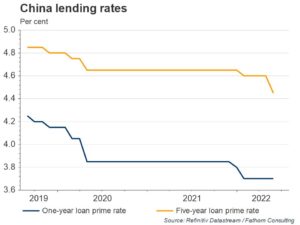

The People’s Bank of China (PboC) cut its five-year loan prime rate (LPR) by 15bps last week to 4.45%, the largest monthly reduction since it became a key benchmark for policymakers in 2019. The move signals a somewhat greater urgency on behalf of the authorities to try to support the extremely weak housing market, as mortgages are linked to the five-year rate; the one-year rate was left unchanged. In the current easing cycle beginning late last year, the five-year rate had previously only been reduced by 5bps. The move follows a recent 20bps cut in the minimum mortgage rate financial

The People’s Bank of China (PboC) cut its five-year loan prime rate (LPR) by 15bps last week to 4.45%, the largest monthly reduction since it became a key benchmark for policymakers in 2019. The move signals a somewhat greater urgency on behalf of the authorities to try to support the extremely weak housing market, as mortgages are linked to the five-year rate; the one-year rate was left unchanged. In the current easing cycle beginning late last year, the five-year rate had previously only been reduced by 5bps. The move follows a recent 20bps cut in the minimum mortgage rate financial