Fathom Consulting

Fathom is a consultancy specialising in global economic and financial market research. We make it our business to challenge conventional thinking and to convey rigorous analysis in plain English. Our clients include global asset managers, insurance companies, pension funds, retail banks, investment banks and hedge funds, and major corporates. We also advise governments in a number of countries including the UK, US and Japan. Our strength is undertaking ground-breaking research. We employ, adapt and create the best analytical tools to address questions that often go into previously uncharted territory.

Other recent articles by Fathom Consulting:

- Chart of the Week: Geopolitical risk on the rise

- News in Charts: Could rates have to rise again soon?

- Chart of the Week: The last mile is the hardest for US inflation

- News in Charts: Fathom’s central scenario – recession avoided

- Chart of the Week: Strengthening case for euro area rate cuts

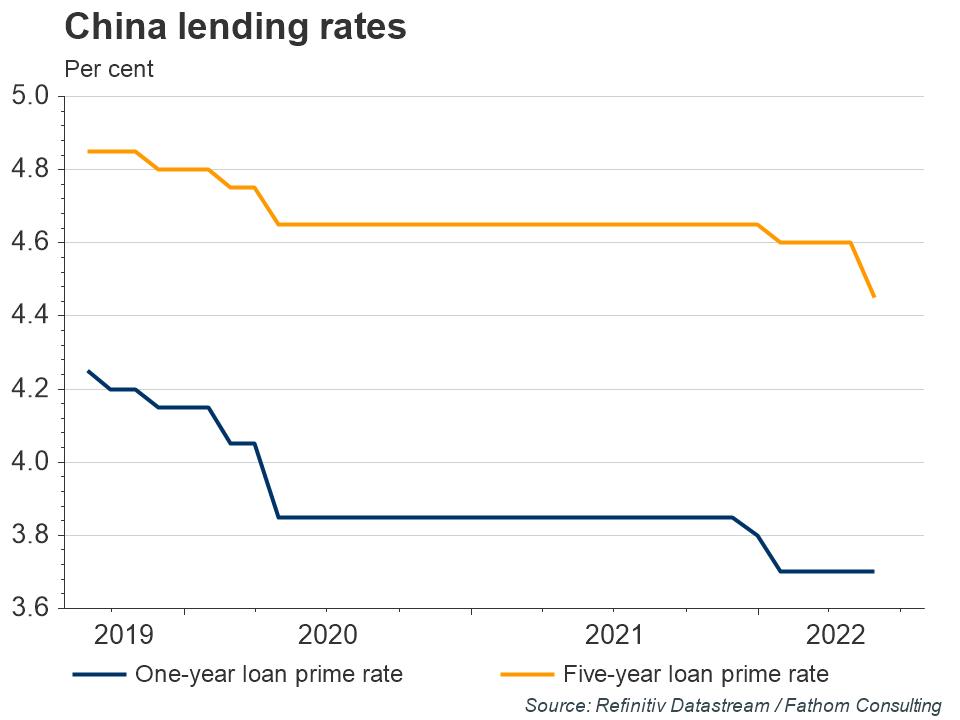

- News in Charts: What’s going on in China?