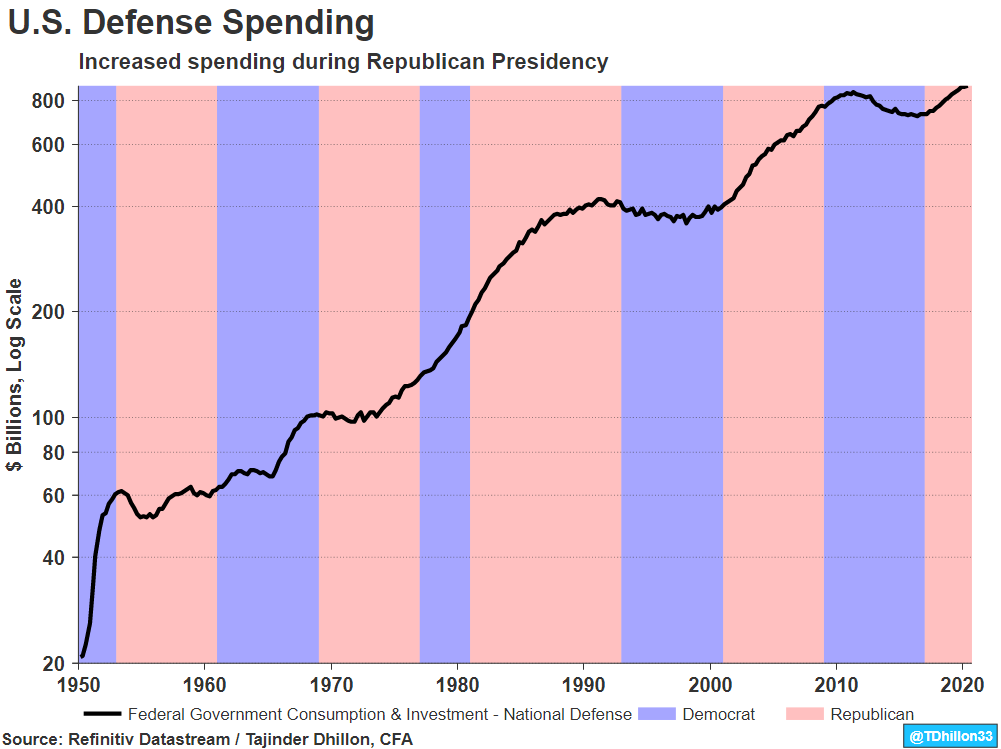

Defense spending is an integral part of the U.S. budget. Since 1950, consumption and investment on national defense has increased from $20 billion to of $877 billion in 20Q2. This represents a 5.5% compounded annualized growth rate over the last 70 years.

While gross spending has increased over the long-term, it appears that the rate of increase is largest during a Republican Presidency. Defense spending has substantially increased over the last two Republican terms (excluding current term), doubling during the 1980s and 2000s. Conversely, defense spending has remained stagnant during the prior two Democrat campaigns.

Exhibit 1 below highlights defense spending as a percentage of gross domestic product (GDP). Current defense spending represents 4.5% of GDP, which is below the 7.4% long-term average.

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

Exhibit 1: U.S. Defense Spending as % of GDP

Within the S&P 500 Defense Industry Group, the top 3 companies by market cap are Lockheed Martin Corp (LMT.N), Raytheon Technologies Corp (RTX.N), and Boeing Co (BA.N). Analyst sentiment on the sector appears slightly bearish when looking at the StarMine Analyst Revision Model (ARM). The Aerospace & Defense Industry Group has an aggregate ARM score of 33 out of 100. To view this in Refinitiv Eikon, visit the Aggregates app by typing “AGGR” in the Eikon toolbar.

Get unique value-add analytics and predictive financial modeling, dedicated to making investment research smarter with Refinitiv StarMine data.

Refinitiv Datastream Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.