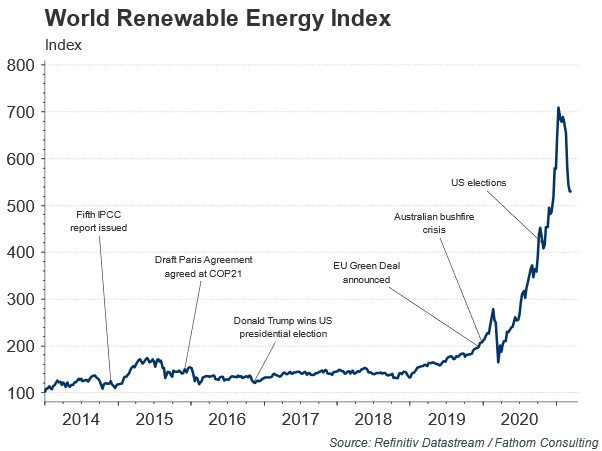

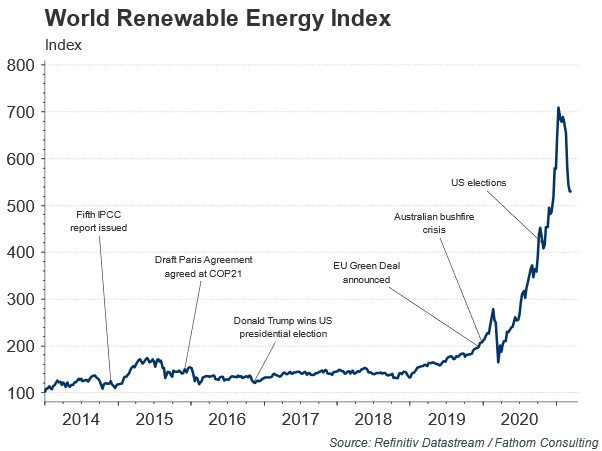

The speed and ambition shown by the European Union in changing its climate policy will have far-reaching economic, financial and geopolitical consequences, starting with a shift in energy demand from fossil fuels to renewables. These are not long-term developments; they are unfolding right now.

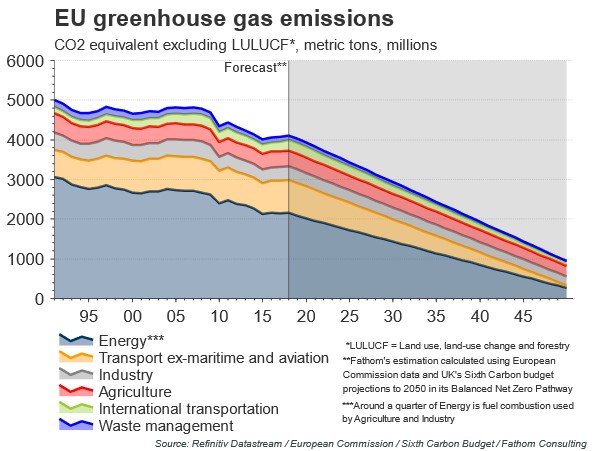

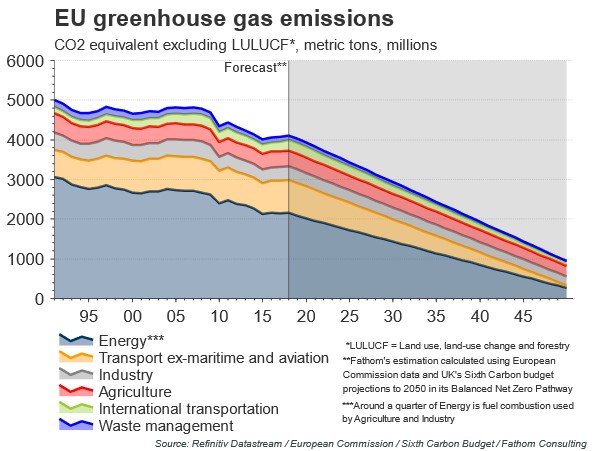

The EU’s announcement of its Green Deal in December 2019 was a watershed moment in the effort to mitigate global warming. The EU pledged to reduce its emissions to 40% of their 1990 levels by 2030, which was later revised to 55% in 2020, and a longer-term goal of net zero emissions by 2050.

Refresh this chart in your browser | Edit the chart in Datastream

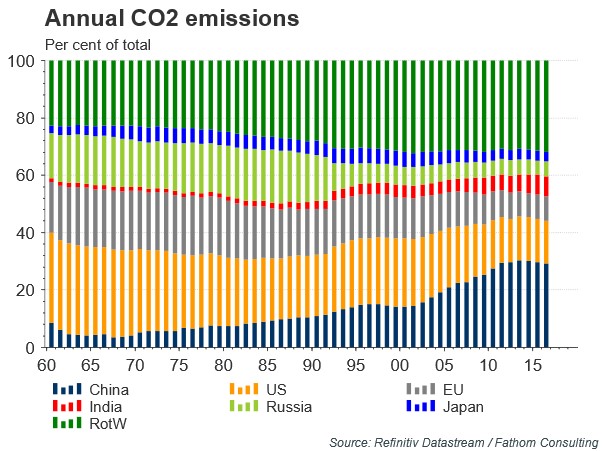

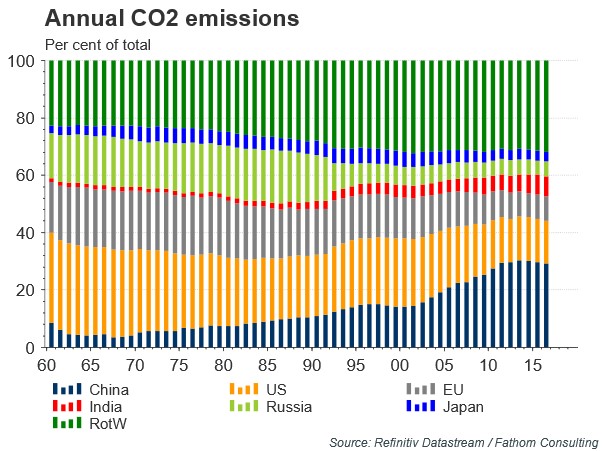

The EU is the world’s third largest CO2 emitter, so cutting its emissions is crucial to the global net-zero effort, both directly and indirectly, as the EU plays a leadership role in this field.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

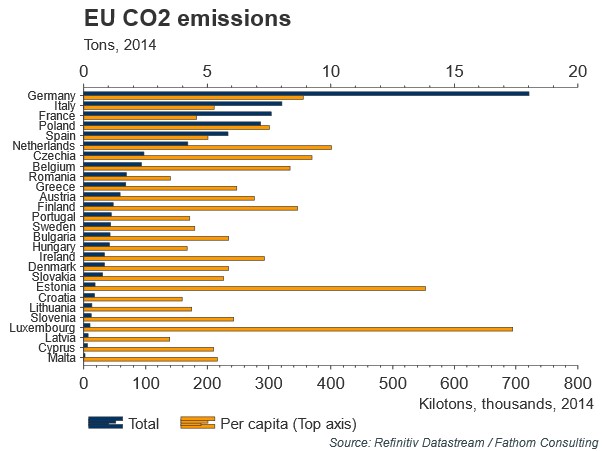

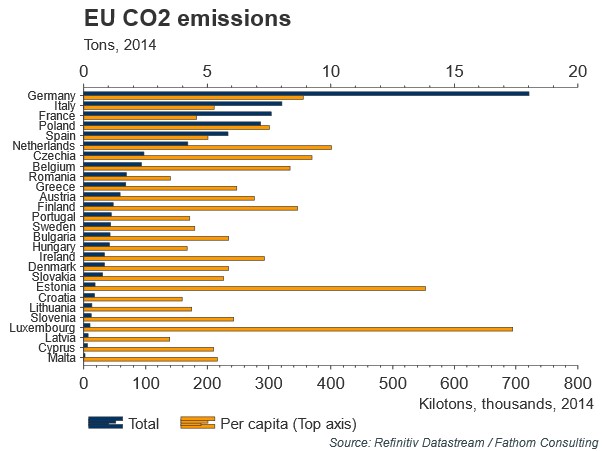

Getting to this point wasn’t plain sailing for the EU and turning the ambition into tangible results will not be straightforward either. Poland, for example, refused to commit to the 2050 net zero goal and the rest of the bloc agreed to let it achieve carbon neutrality at its ‘own pace’. Hungary and Czechia agreed to the pledge but plan to use more nuclear energy to do it (which is against the policies of some other member states). Although the whole bloc agreed to the 55% emission reduction goal by 2030, Poland, Hungary, and Czechia only did so with promises of greater financial support and permission to choose their own energy mix.

Refresh this chart in your browser | Edit the chart in Datastream

Around three quarters of EU emissions come from energy and transport, meaning there is a relatively clear path to reduce most of the bloc’s GHG emissions: switching to renewable energy and electrifying the transportation sector. Emission cuts in other sectors – industry, construction, aviation, maritime and agriculture – will be harder and costlier, and in some cases are not possible without foregoing the activity itself.

Refresh this chart in your browser | Edit the chart in Datastream

This shift will undoubtedly include law changes (including a ban on the sale of non-electric cars), firming up financial disclosure rules, government investment in infrastructure (e.g. to increase electric vehicle charging stations), fiscal support for emerging technologies, funds for research and development into low-carbon solutions, carbon taxes, carbon border taxes, education and awareness campaigns.

Policy and policy credibility will affect the speed of the overall transition to net zero, as will advances in technology and society’s acceptance of change. These uncertainties, both in the EU and beyond, will affect the course of future climate changes, with economic consequences. It appears obvious though that the low-hanging fruit will quickly be picked first, implying a widespread switch from fossil fuels to renewables in energy generation. And it seems that this switch hasn’t been universally accepted or priced into markets yet: the price of renewable energy firms suggests that it has, but the price of fossil fuel producers and fossil fuels themselves suggests otherwise.

Refresh this chart in your browser | Edit the chart in Datastream

Regulations requiring investors, banks and corporates to assess and disclose climate-related financial risks to their businesses and investments are set to become mandatory in many jurisdictions soon. The consequences for companies that fail to do this are likely to become more onerous over time. These requirements are likely to follow the guidelines set by the Task Force on Climate-related Financial Disclosures (TCFD), which are based on four pillars: governance, strategy, risk management, and metrics and targets.

We plan to discuss ESG investing and climate-related risk disclosures in more detail in upcoming research. For more information, please get in touch.

Contact us | Fathom Consulting (fathom-consulting.com)

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.