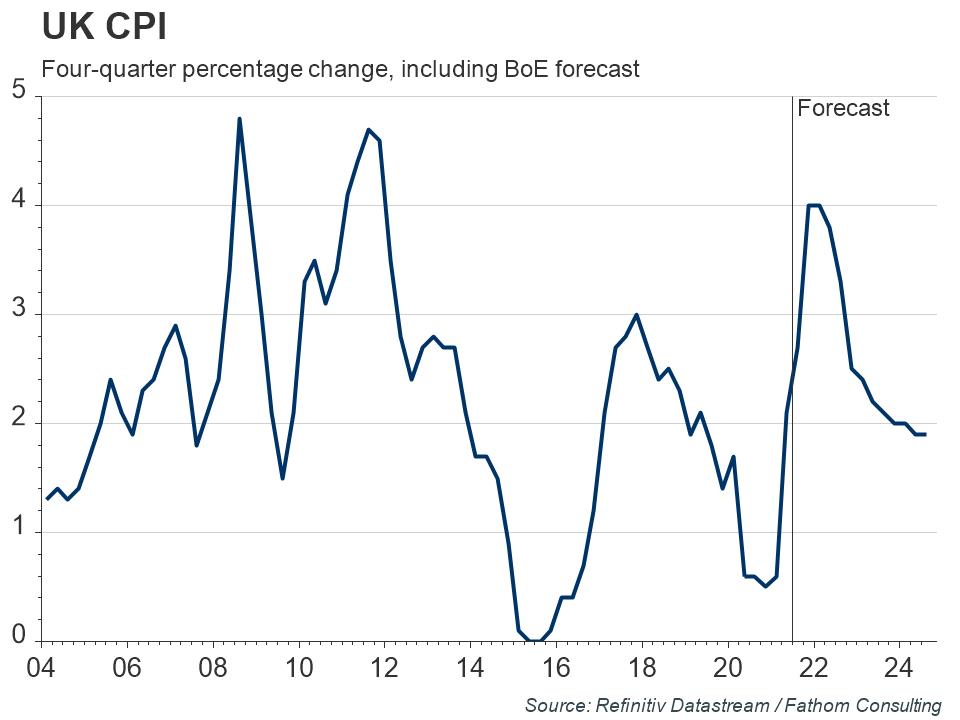

Chart of the Week: Bank predicts higher inflation, but is their forecast high enough?

The Bank of England’s August Monetary Policy Report included an update of their macroeconomic projections out to 2024. The Bank now expects UK inflation to peak at 4% towards the end of this year and start of 2022, before drifting back towards target by the end of the forecast horizon. While many, including Fathom, agree with the Monetary Policy Committee’s assessment of the near-term outlook, there is less consensus beyond the end of this year. Key in the medium term will be how quickly excess pandemic-induced savings are spent and the extent to which higher short-run prices get embedded into the expectations of wage and price setters in the medium run. Fathom sees these outcomes as more likely than the MPC expects and, consequently, expects higher inflation to persist well into next year.

Refresh this chart in your browser | Edit the chart in Datastream

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.

LSEG Solutions

Related Articles

News in Charts: A busy week for economists

It has been a busy week for economists, especially for those engaged in financial ...

Chart of the Week: US assets showed signs of overpricing before sell-off

The markets sell-off since President Trump’s ‘Liberation Day’ tariff announcements ...

News in Charts: The rise of the Chinese automotive industry

A remarkable transformation has taken place in the global automotive export market in the ...

Chart of the Week: Energy and Europe’s productivity problem

Refresh this chart in your browser | Edit the chart in Datastream Europe’s ...