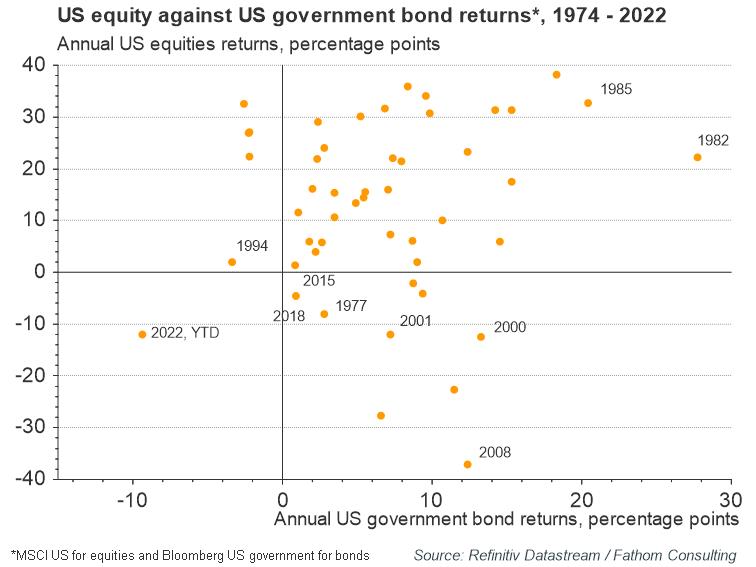

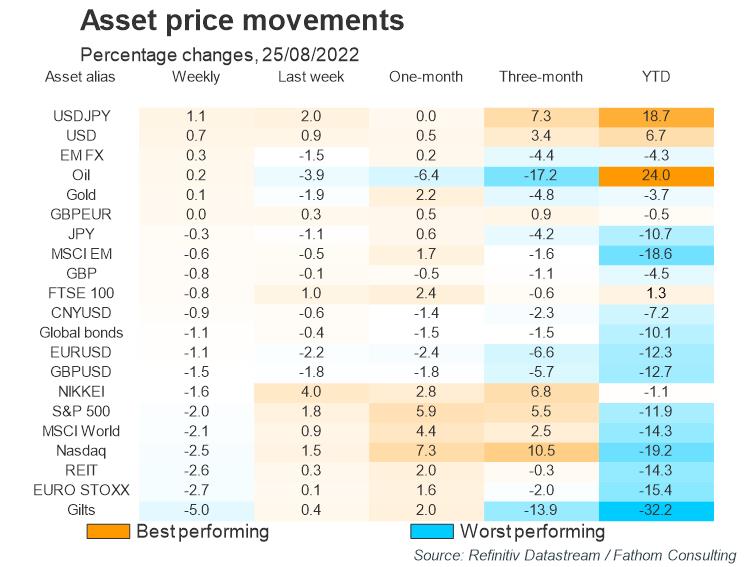

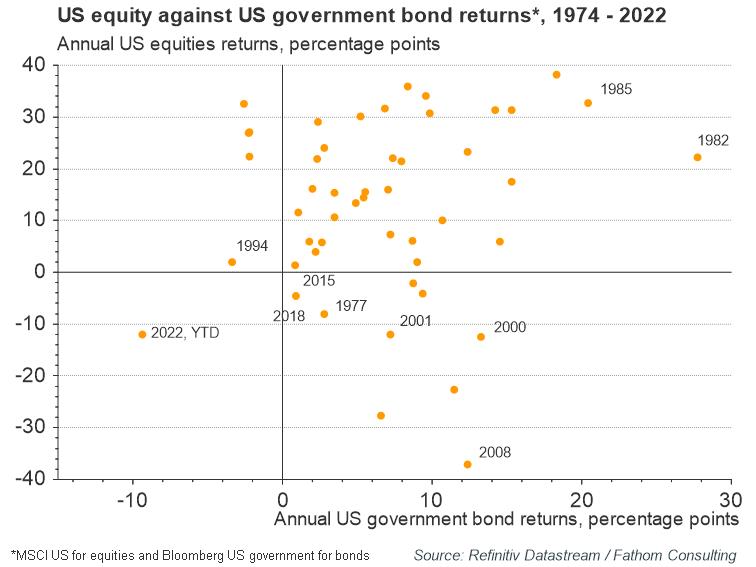

Turbulent geopolitics, soaring inflation and tightening central bank policies have created a narrow and treacherous path for equity investors in 2022, leaving them with few options to diversify and balance their portfolios. The performance of the two most prominent asset classes in the world’s “safest” market shows just how challenging the environment has been. Since 1974, US equities and bonds have provided good levels of diversification. When equities have done poorly, bonds have risen to the challenge to compensate — and the other way around. Thus far, this year has been the only exception, with both equities and bonds suffering significant drawdowns. While there are still four months left of 2022 to turn this around, it seems clear that continued turbulence, from the withdrawal of accommodating monetary policies and energy shocks to the rising forces of deglobalisation, is likely to add more uncertainty and volatility to the markets.

Refresh this chart in your browser | Edit the chart in Datastream

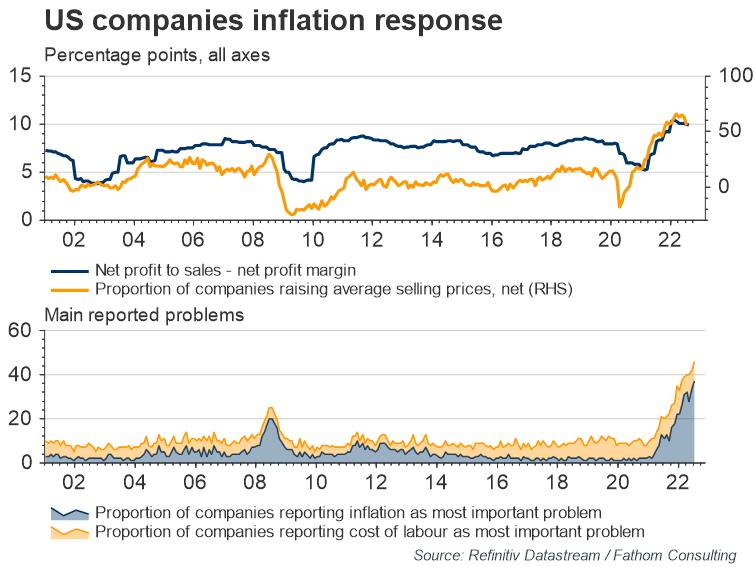

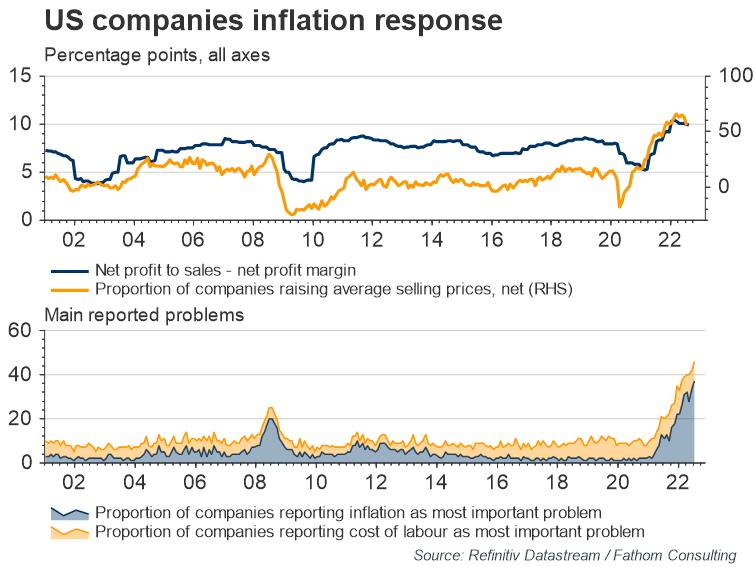

Added to this, corporate fundamentals are now showing signs of fatigue. After a spectacular recovery from the pandemic-related lockdowns, US corporate margins appear to have reached a plateau. On its own, this is not news; profit margins have always been mean-reverting due to competitive forces and business cycle gyrations. However, higher inflation and labour costs are starting to erode margins as corporates, fearing a collapse in demand, appear less willing to pass these costs onto consumers. For investors, the fear is that these forces could push margins far below their long-term average.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

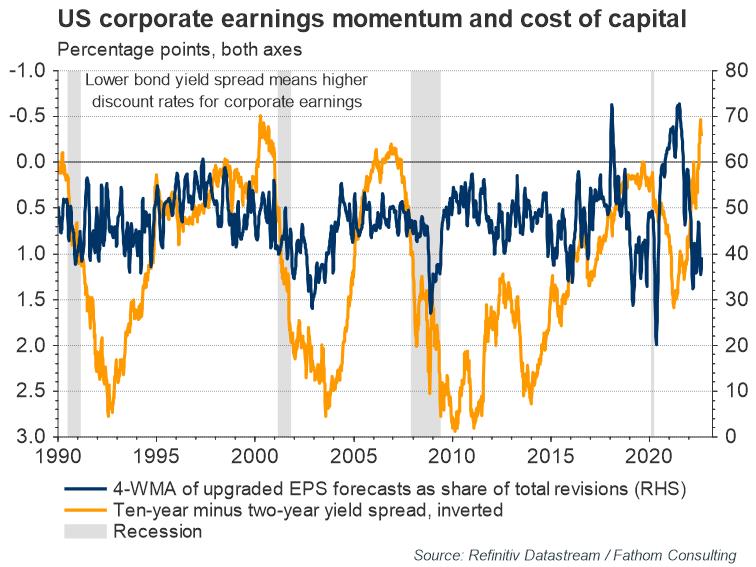

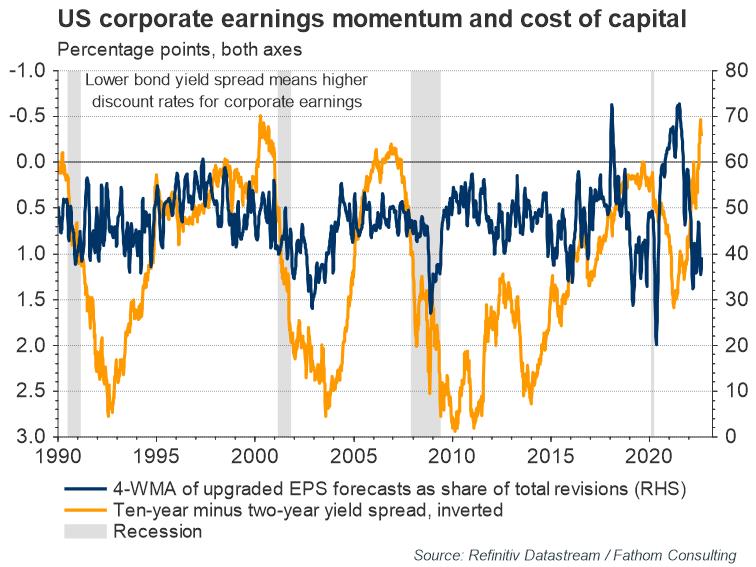

Some evidence that these fears are justified comes from weakening earnings momentum, approximated by the proportion of upgraded earning-per-share (EPS) forecasts in the total Institutional Brokers’ Estimate System EPS forecast revisions. The latest read is at levels last seen during previous recessions such as the Global Financial Crisis (GFC) and the 2001 “dot-com” burst. Higher rates have further compounded this weaker backdrop for corporate fundamentals. As ‘easy money’ is less available, the cost of capital for companies is increasing. In other words, corporate valuations are set for a double hit from lower earnings and higher rates.

Refresh this chart in your browser | Edit the chart in Datastream

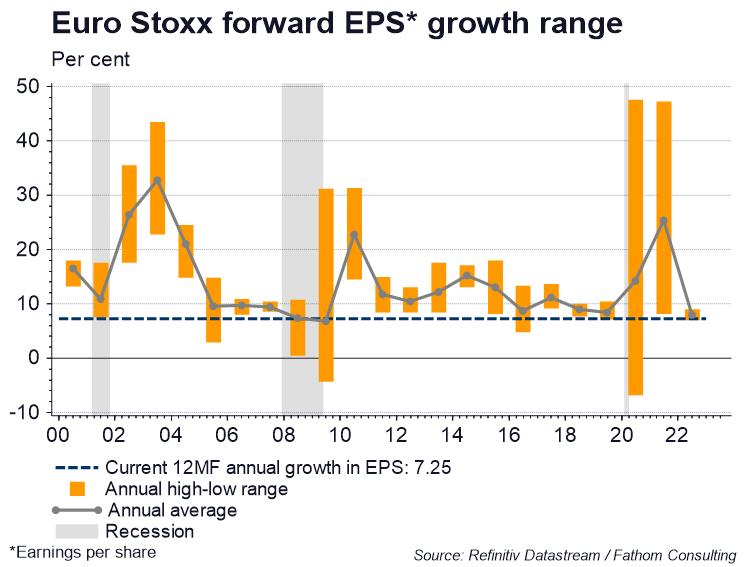

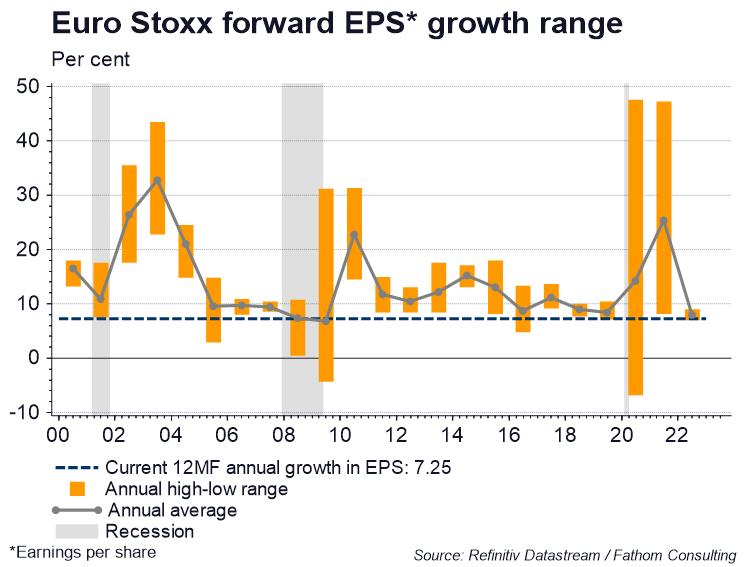

This challenging environment is not restricted to the US market. For example, corporate Europe is also expected to slow to levels it has not experienced since the GFC. The mix of monetary tightening in order to battle inflation, political uncertainty, resurgent worries about debt sustainability in the periphery, lower excess savings and heavy reliance on Russian gas is poised to impact substantially on euro area corporate fundamentals. Valuations may be poised for an even greater hit in the euro area than in the US.

Refresh this chart in your browser | Edit the chart in Datastream

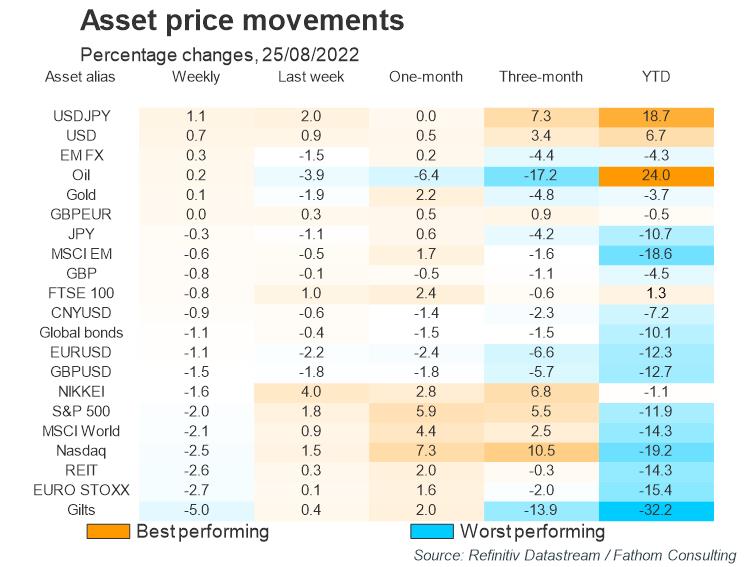

Even if investors cast their net to a wider set of assets and geographies, the conclusion is the same: developments in 2022 have agitated financial markets to such an extent that asset returns and options for diversification are in very short supply for traditional equity investors. Only oil, and the US dollar (particularly against the Japanese yen), have delivered some positive returns and diversifying benefits since the beginning of the year

Refresh this chart in your browser | Edit the chart in Datastream

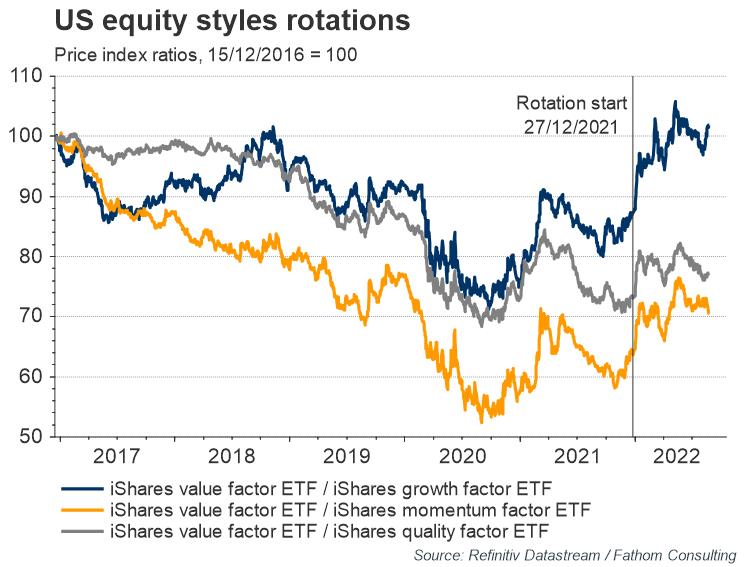

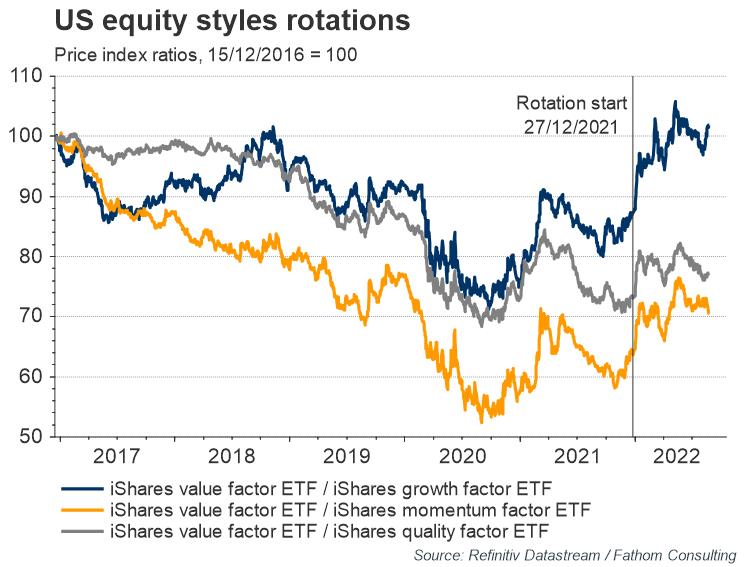

Looking forward, we think value investing could remain an attractive investment option. Uncovering stocks that are cheap relative to their fundamentals (that is, relative to their earnings, book value or cash flows) has started to become profitable again after a poor decade, benefiting from the rare combination of high inflation, high rates and the still positive post-pandemic cycle. Specifically, since the end of last year, value stocks have outperformed growth stocks (expensive, growth-promising companies, such as those in the tech sector), momentum stocks, and even safe-haven quality stocks (with far from stellar, yet reliable growth prospects). Value stocks should continue to do well if rates do not revert quickly to zero, and if the US cycle does not go strongly into reverse. Fathom will consider the prospects for just such an environment in next month’s Global Outlook, Autumn 2022[1].

Refresh this chart in your browser | Edit the chart in Datastream

[1] Fathom’s Global Outlook, Autumn 2022 will be available for all Refinitiv users via Chartbook from October. To see a breakdown of key topics we will be discussing this quarter, please see here: https://www.fathom-consulting.com/wp-content/uploads/2022/08/Global-Outlook-Autumn-2022-web.pdf

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

_________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.

Article Topics

Uncategorized