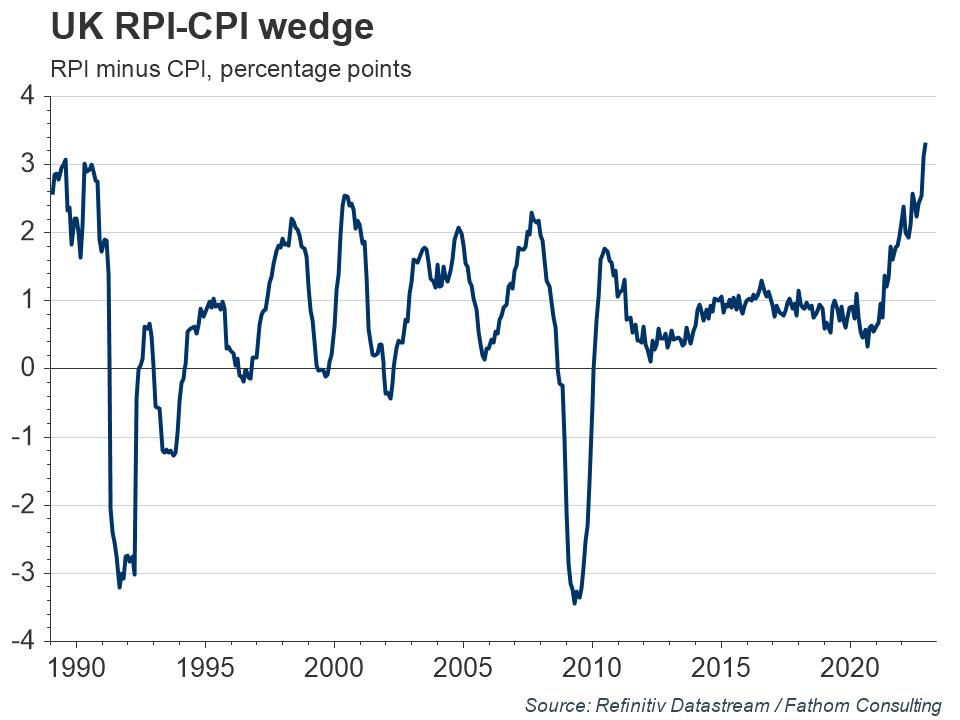

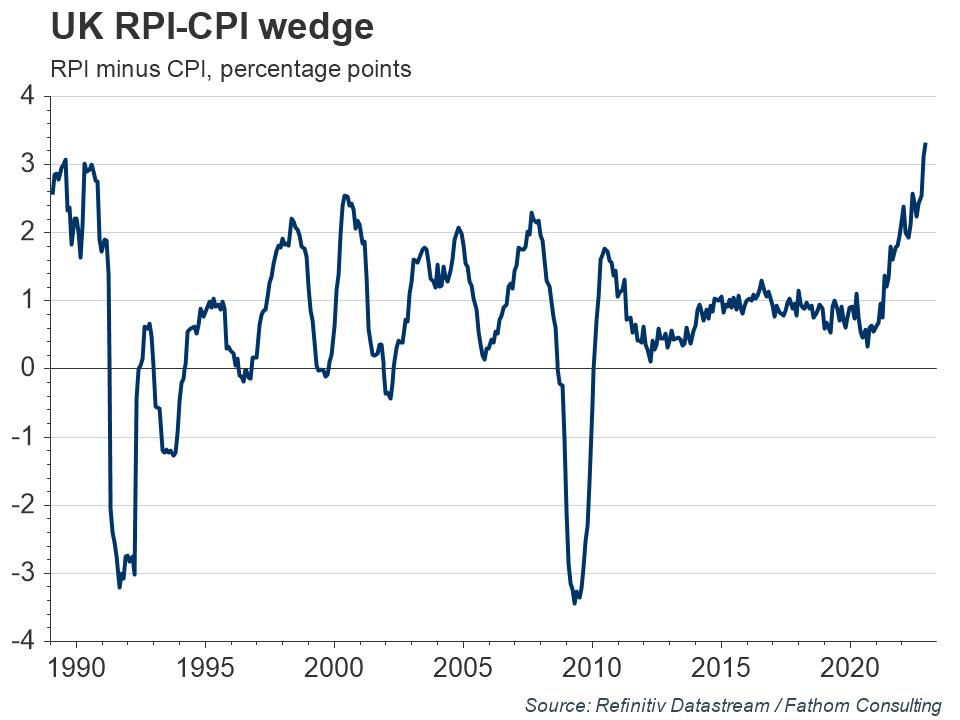

The wedge between the UK retail price index (RPI) and the consumer price index (CPI) widened to 3.3 percentage points in November, the highest it has been since records began in 1989. Typically, the RPI overstates inflation, for several reasons: because it uses different methods of aggregation, its choice of which items are included and the weights it attaches to those items. The widening gap is most probably a result of the rise in mortgage interest payments, an item that the RPI measure includes while the CPI does not. Mortgage interest payments were up 32.3% on the previous year in November. The widening RPI-CPI wedge is likely to become increasingly important, as the interest payments on index-linked gilts are linked to RPI rather than CPI. In addition, RPI is used to calculate student loan repayments, annual increases in rail fares and some pensions. The UK government plans to drop the RPI measure and replace it with measures based on the CPI in 2030 — a controversial decision that will save the government billions, without providing any form of compensation to bondholders.

Refresh this chart in your browser | Edit the chart in Datastream

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

_________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.