Over the past decade the trend of hyper-globalisation, which has been one of the defining characteristics of economic growth, has started to wane. More recent changes to the global political climate have further threatened free trade, with the Trump administration is looking set to drive into place a slew of protectionist measures. In light of this backdrop, two other global economic powers, India and the European Union (EU), are increasingly keen to finalise a free-trade agreement (FTA) by the end of the year.

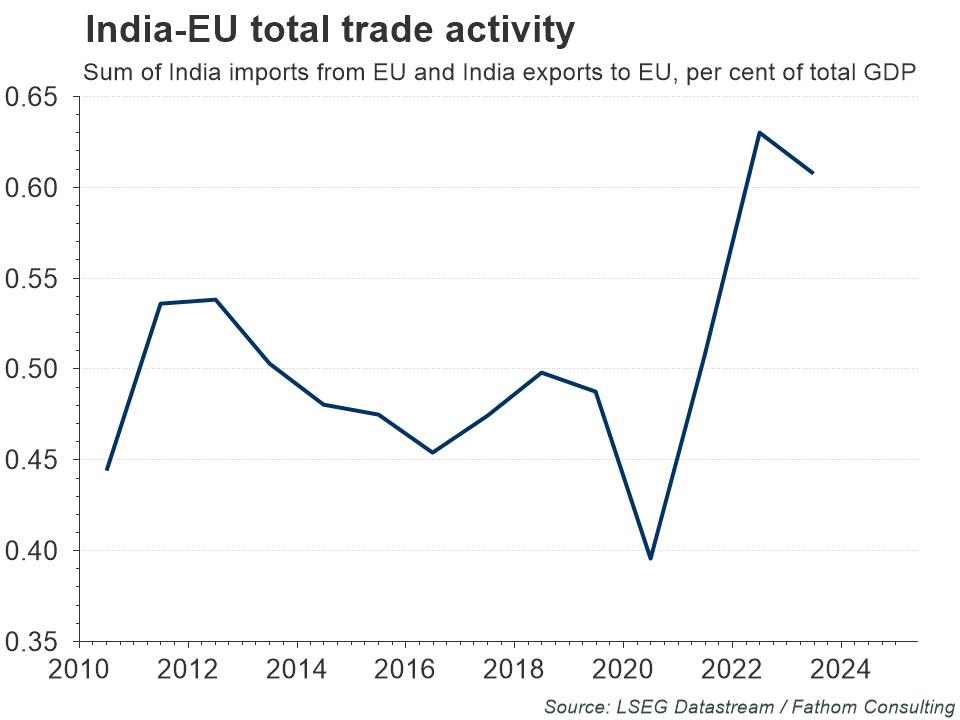

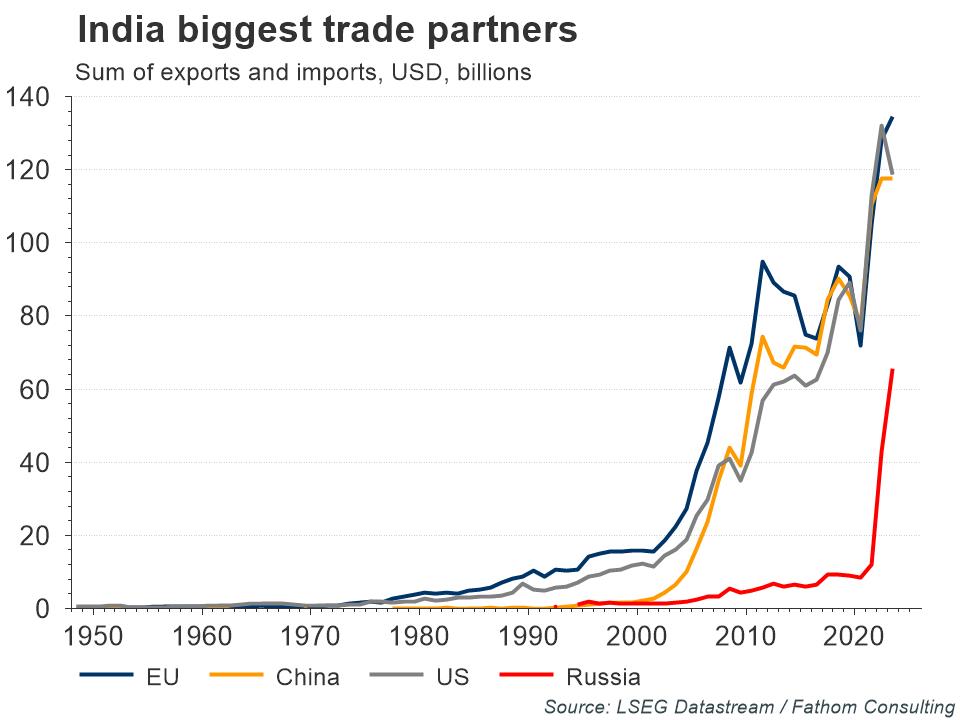

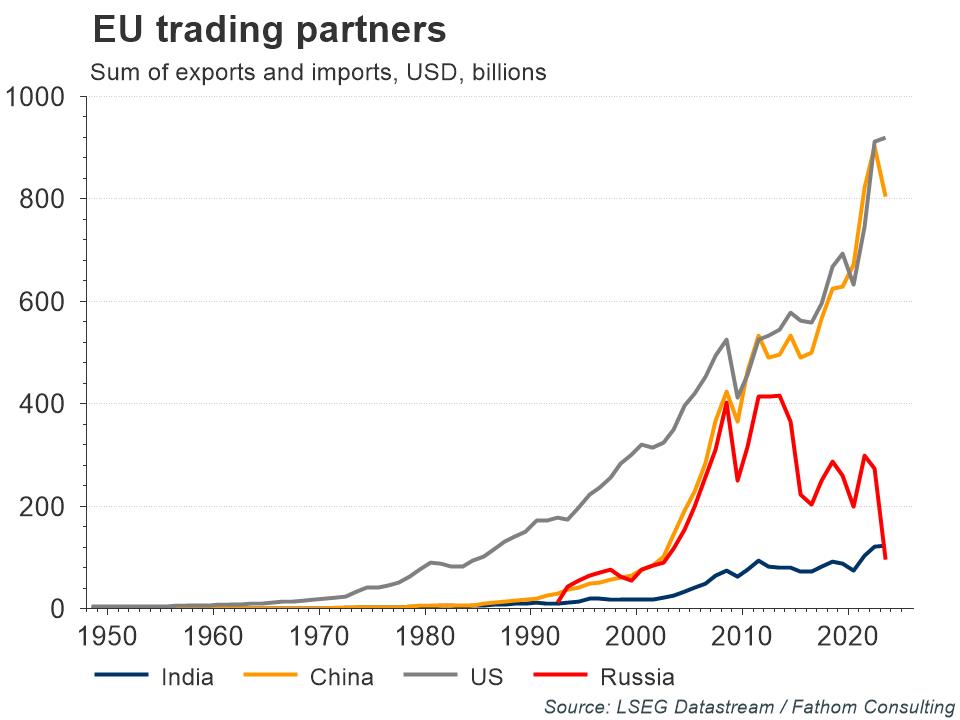

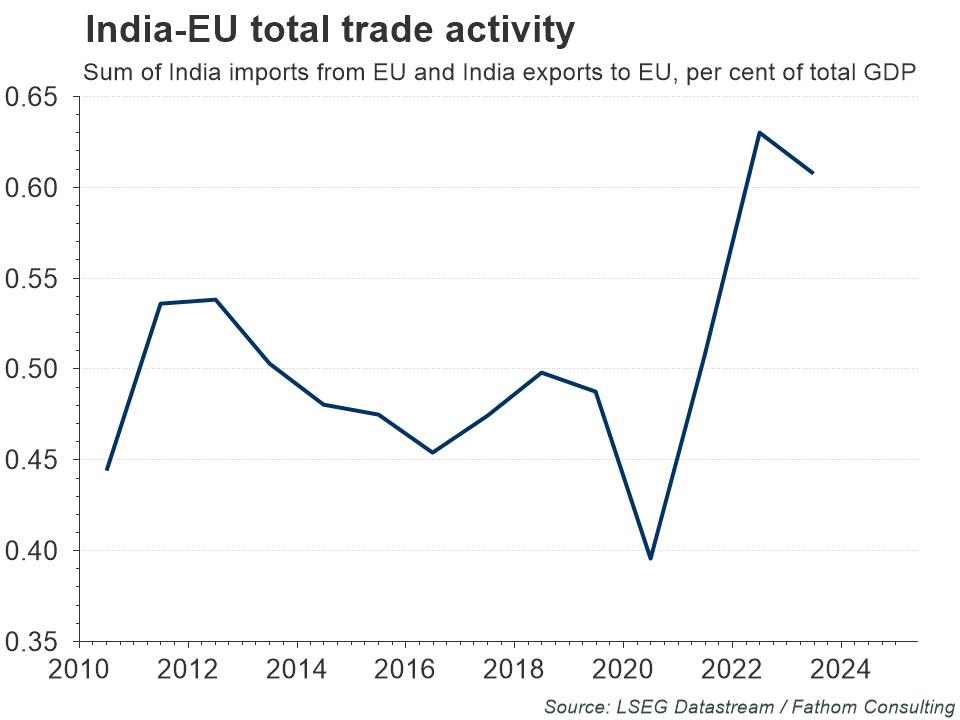

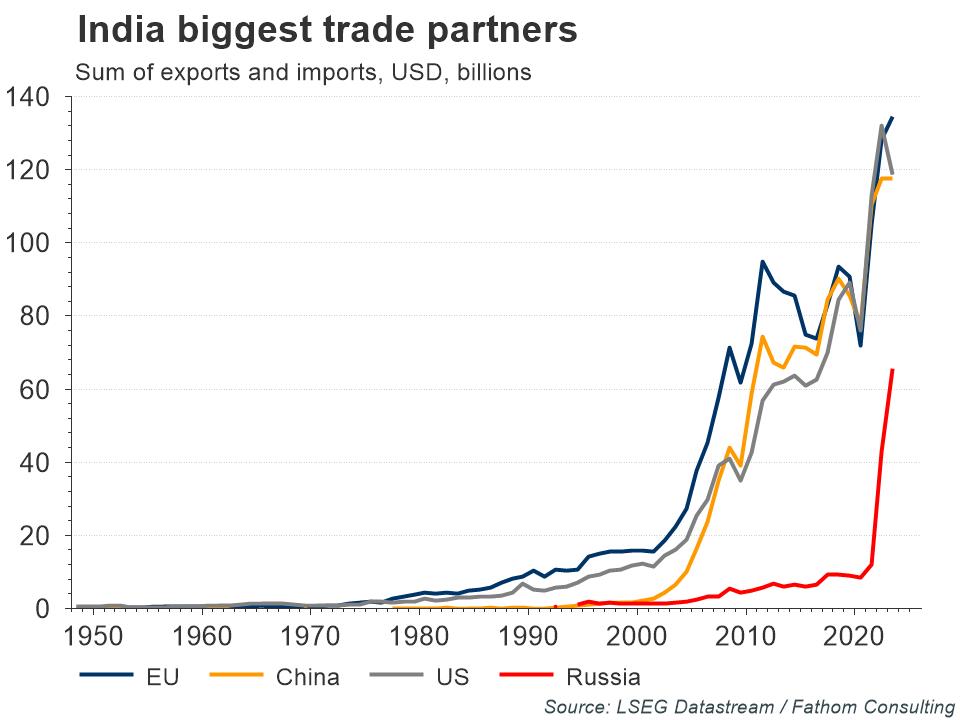

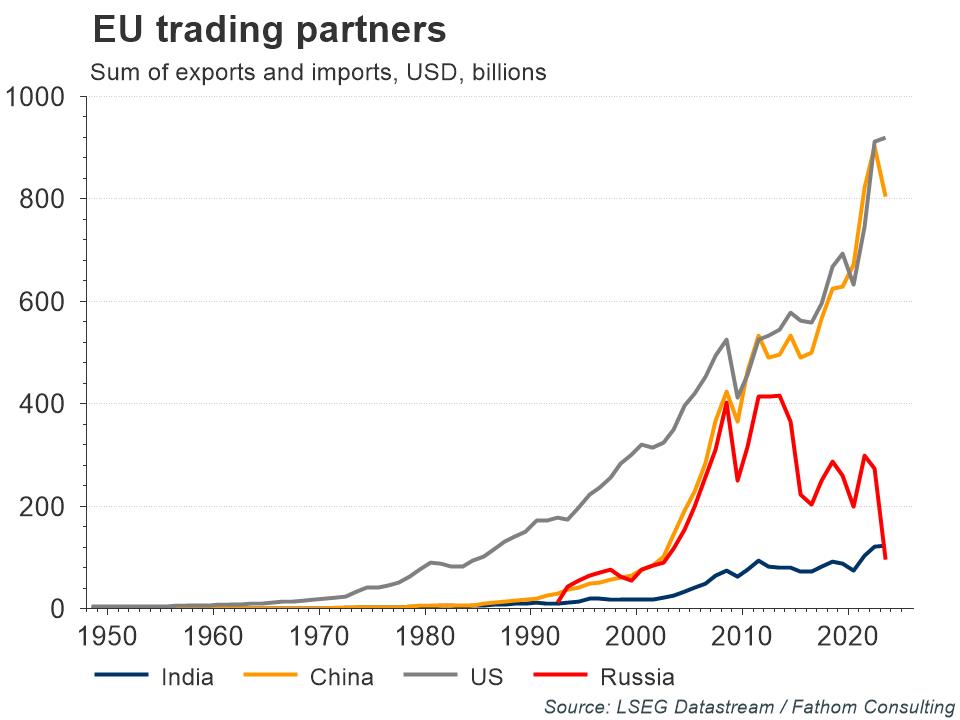

It is clear to see why both parties are keen to engage in a free-trade agreement, with trade activity between the two parties having grown significantly since 2010. In fact, over the past decade, the EU has become India’s largest trading partner, greater than both the US and China in terms of total trade activity. Although rising, India is a much smaller trading partner for the EU compared to countries like the US and China.

Refresh this chart in your browser | Edit the chart in Datastream

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in LSEG Workspace.

Refresh this chart in your browser | Edit the chart in Datastream

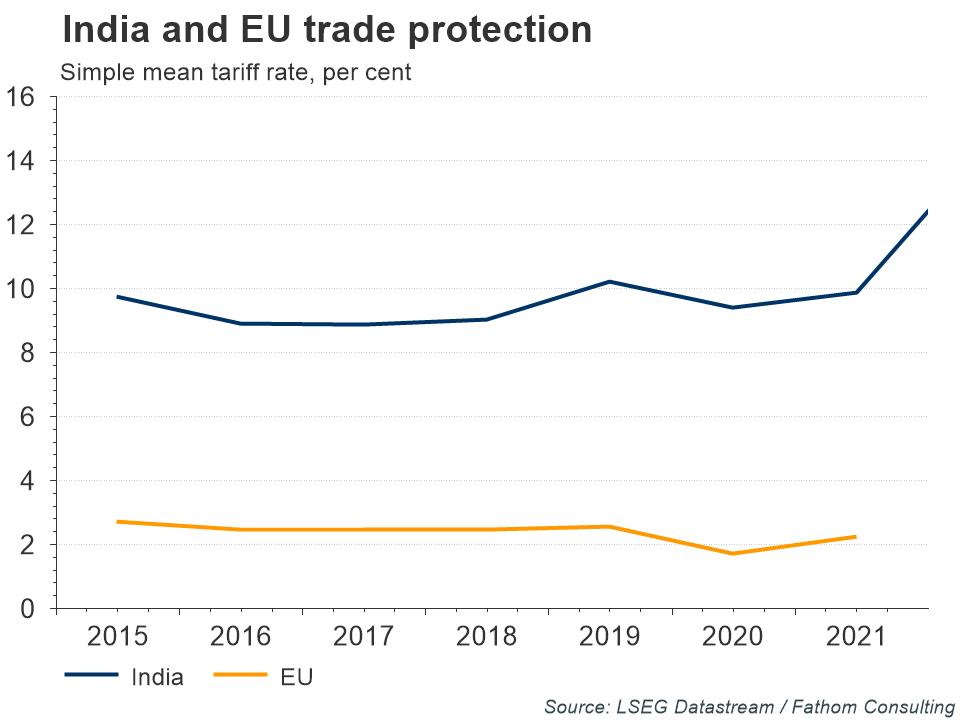

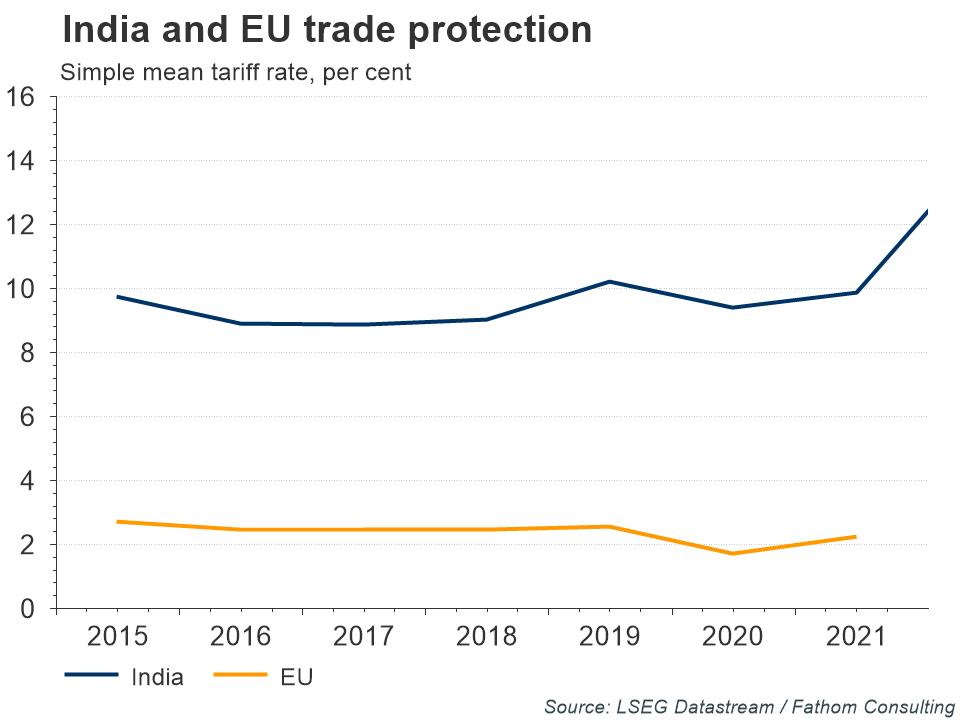

Both parties hold a number of unresolved concerns that will need to be addressed before a deal can be reached. EU concerns are primarily regarding India’s generally more protective stance, where its average tariff rate across all goods is around six times higher than the EU’s. In particular, the EU wants India to reduce its high tariffs on automobiles and wine, key exports for the EU, along with agricultural and dairy products, and domestic industries that India seeks to protect through higher tariffs.

Refresh this chart in your browser | Edit the chart in Datastream

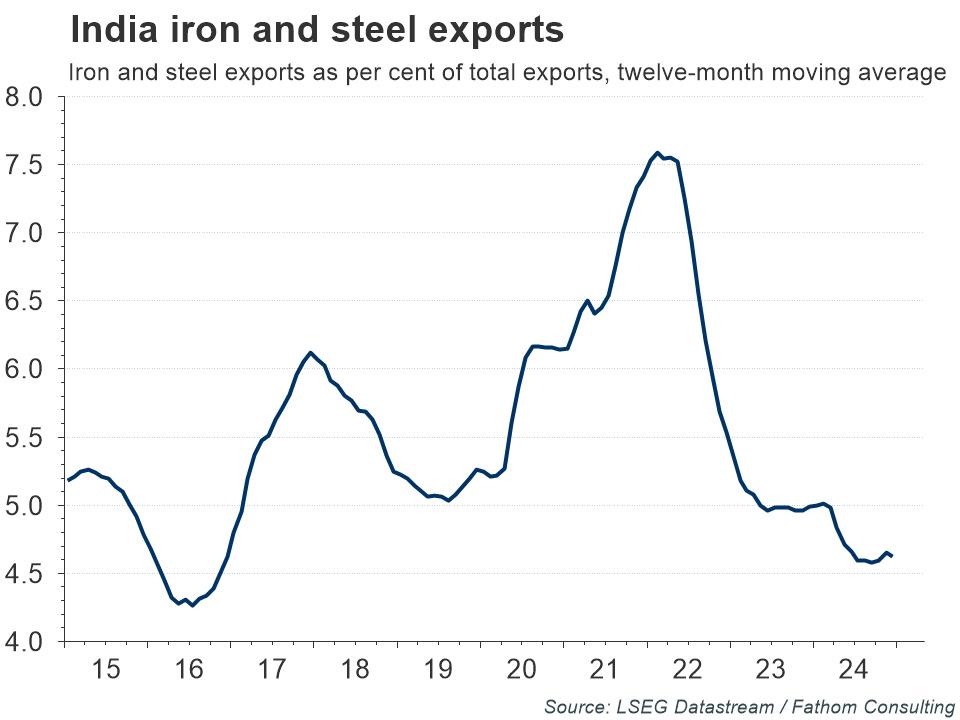

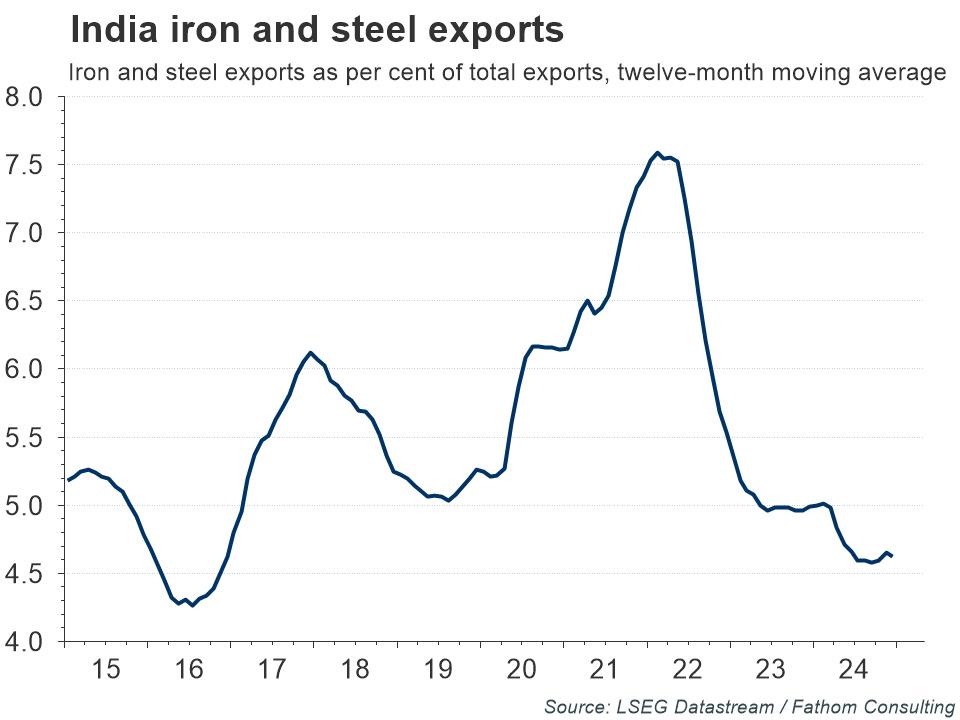

For India, key issues centre around securing a low tariff rate for textile products, along with gaining greater market access for its domestic pharmaceutical industry, which has grown rapidly in recent years and now accounts for an increasing proportion of Indian exports, from 3% in 2010 to more than 5% in 2024. India also holds concern about the EU’s Carbon Border Adjustment Mechanism (CBAM) proposal, which is set to take effect from 2026. CBAM will see high-carbon products like steel, cement and aluminium, from countries with insufficient domestic carbon tax policies, to be charged at a higher tariff rate. With iron, steel and related products accounting for around 5% of India’s total exports, CBAM could hurt India, with the country not having a domestic carbon tax to cover these industries at present. Finally, India is also looking for easier visa processes for skilled Indian workers entering the EU, to also ease services exports.

Refresh this chart in your browser | Edit the chart in Datastream

Refresh this chart in your browser | Edit the chart in Datastream

This is not the first time that India and the EU have looked to agree on an FTA, negotiations for such a deal have been ongoing sporadically over the past 18 years. However, now, given the added threat of increased US tariffs that both parties would be adversely affected by, there is renewed optimism that a deal can be struck before the year is out.

The views expressed in this article are the views of the author, not necessarily those of LSEG.

______________________________________________________________________________________

LSEG Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop viewpoints on the market.

LSEG offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.