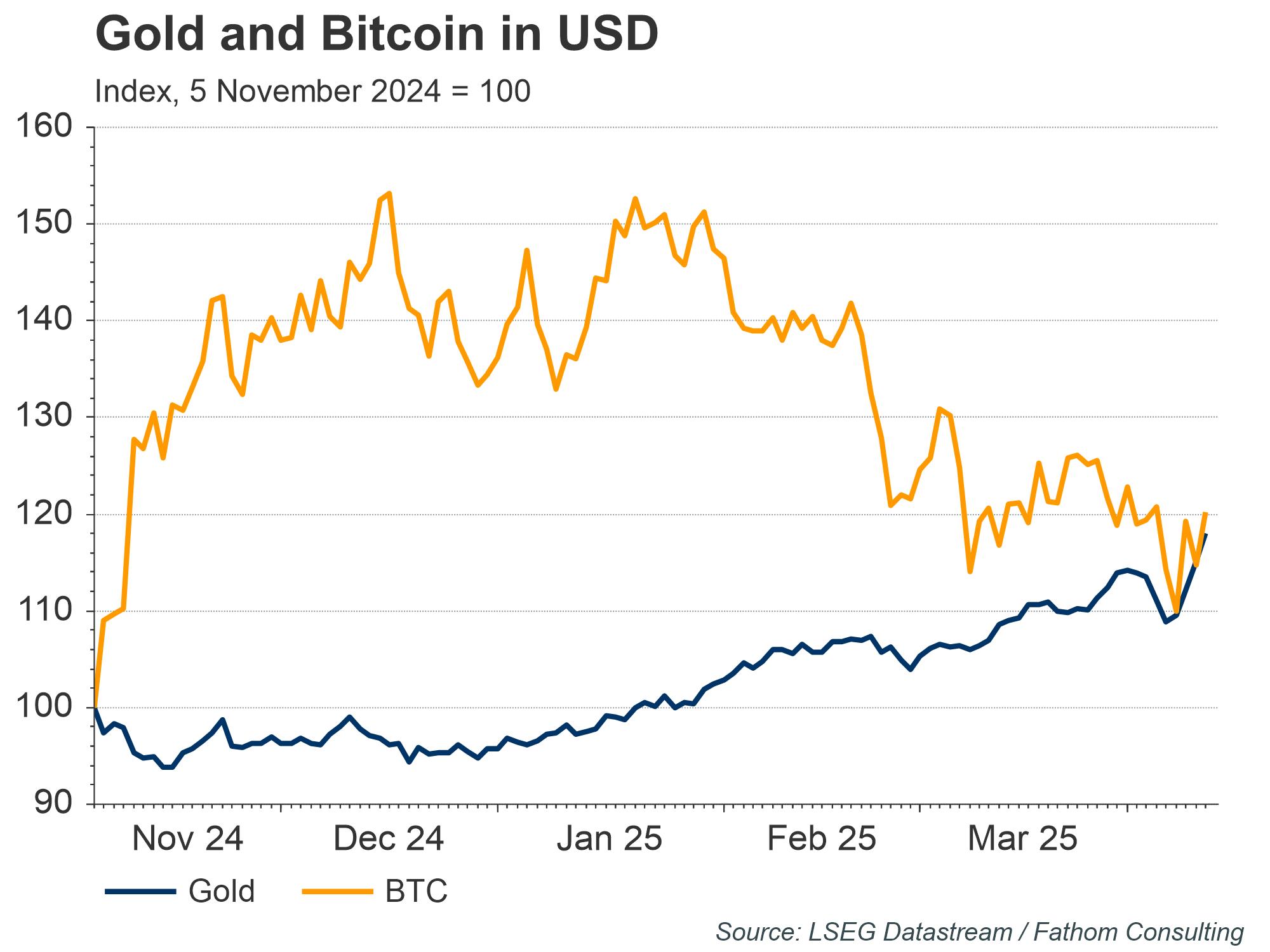

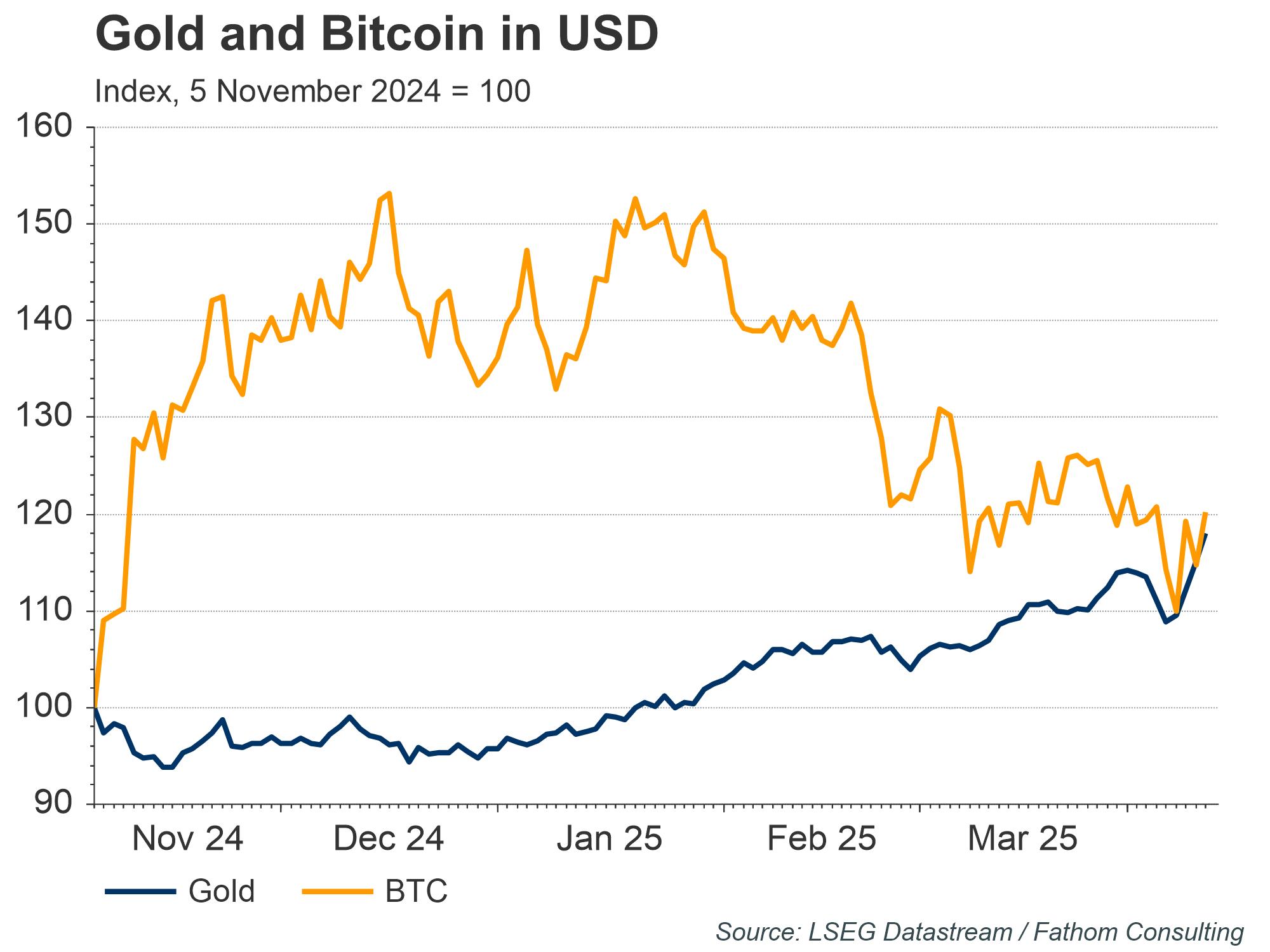

The price of Bitcoin posted spectacular gains following the US election last year, with Donald Trump seen as a ‘pro-crypto’ president. The digital asset rose from $70,000 in early November to over $100,000 in December. However, its appeal as a store of value has declined somewhat amid a general sell-off in risky assets. One Bitcoin now trades at around $85,000. Meanwhile, gold has posted steady gains, rising to a record high of $3,230 last week. Since the election, returns for both the yellow metal and the most famous cryptocurrency are now closely matched, but gold’s much longer track record of acting as a safe haven in uncertain times appears to be bearing fruit. Bitcoin advocates like to point out that it has been one of the best performing assets since inception, with an average annualized rate of return of over 100% since 2011 as it gained more widespread adoption. However, it has been around for less time, raising questions about its resilience to possible future shocks. At this time of uncertainty, with the dollar’s status as a world reserve currency being questioned, gold’s longer track record appears to offer some additional security that the asset’s most prominent digital competitor may not be able to match.

Refresh this chart in your browser | Edit the chart in Datastream

The views expressed in this article are the views of the author, not necessarily those of LSEG.

______________________________________________________________________________________

LSEG Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop viewpoints on the market.

LSEG offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.