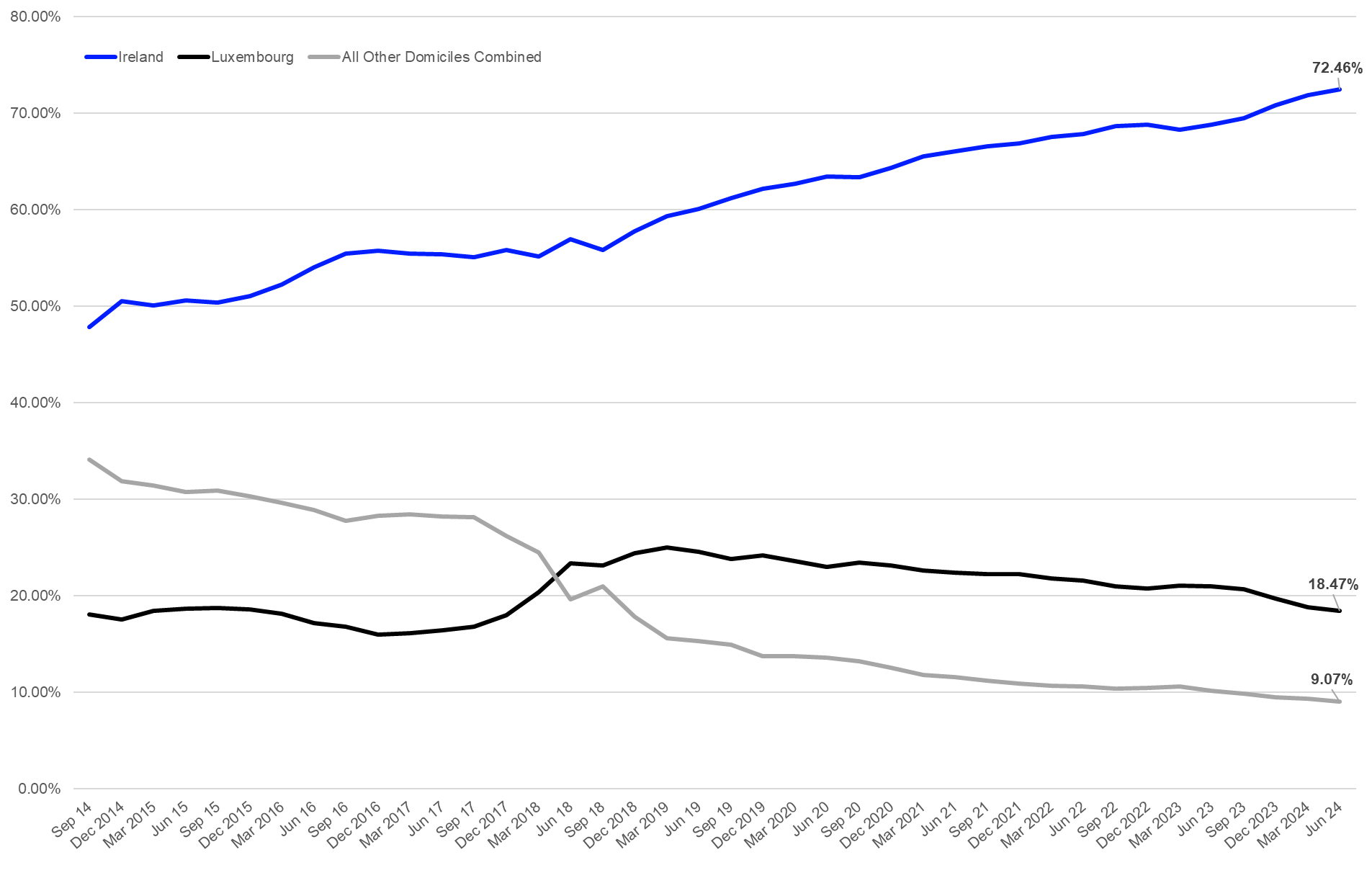

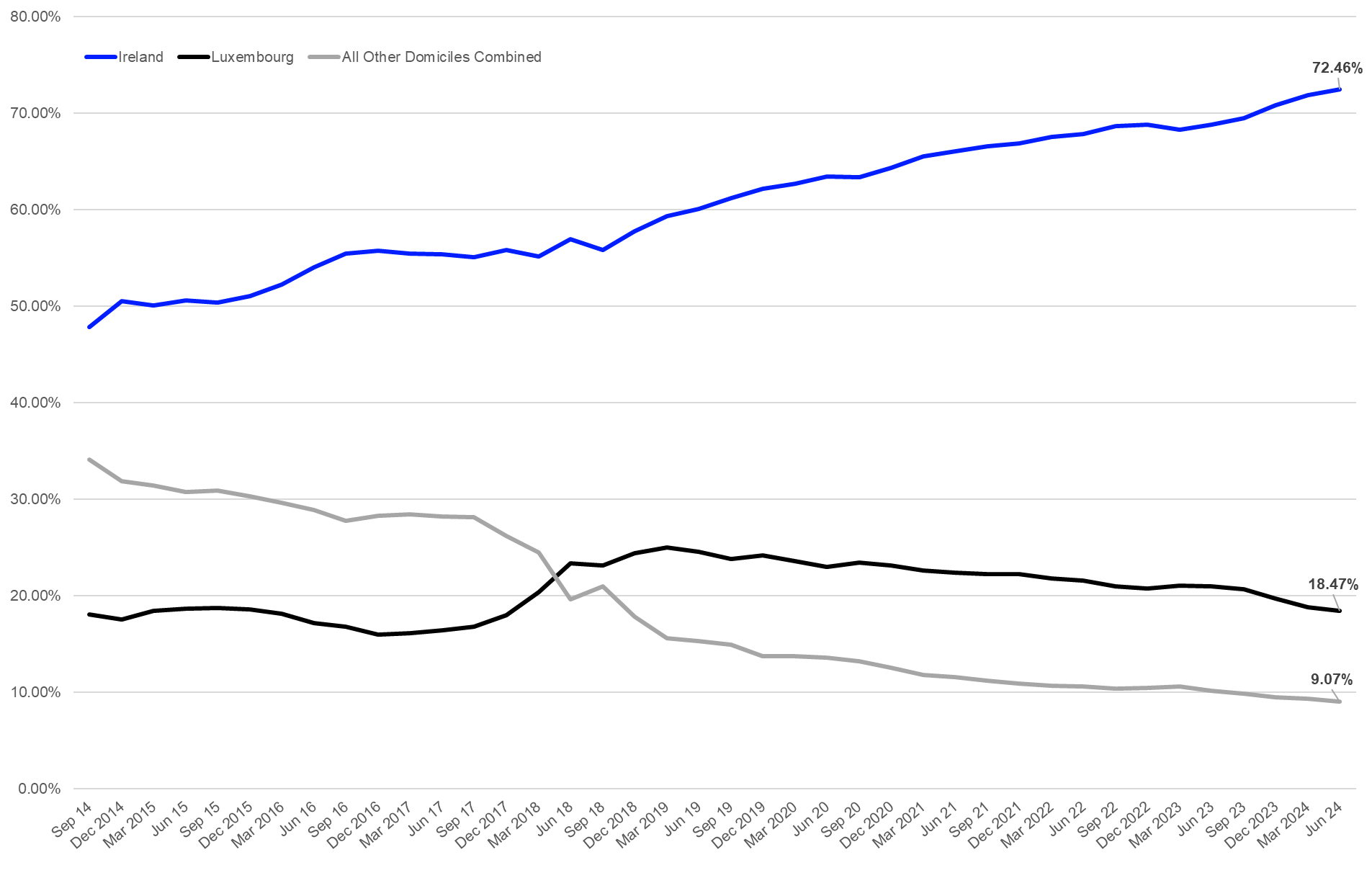

It is common sense that Luxembourg is the leading fund domicile for mutual funds in Europe, while Ireland is the leading domicile for ETFs. Nevertheless, it might be somewhat surprising to see the level of dominance of Ireland’s position when it comes to ETFs. At the end of June 2024, ETFs domiciled in Ireland accounted for €1,314.7 bn, or 72.46%, of the overall assets under management in the European ETF industry, while Luxembourg accounted for €335.1 bn, or 18.47%, of the overall AUM. In turn, this means that all other ETF domiciles in Europe combined account for only 9.07% of the overall assets under management in the industry.

As graph 1 shows, assets under management in ETFs domiciled in Ireland are somewhat growing in nearly every year, while Luxembourg stopped growing during 2019. Before that, the assets under management of ETFs domiciled in Luxembourg stood nearly at the same level as the AUM of ETFs domiciled in France or Germany. This changed over the course of 2017 and 2018, when French ETF promoters started to re-domicile their ETFs in the Grand Dutchy, with the market share of AUM of Luxembourg-domiciled ETFs growing nearly as much as the market share in AUM of ETFs domiciled in France fell. In more detail, the market share of assets under management for ETFs domiciled in France fell from 15.21% at the end of September 2014 to 2.41% at the end of June 2024. The biggest drop in market share took place between September 2017 and March 2019 when the market share of the AUM of France fell from 14.16% to 4.98%.

Graph 1: Market Share of AUM of Ireland, Luxembourg versus All Other ETF Domiciles in Europe

Source: LSEG Lipper

Nevertheless, Luxembourg has not profited from this move, since the largest ETF promoters in Europe prefer Ireland as ETF domicile since Ireland shares the same language and a legal system with which the dominant English-speaking promoters are familiar.

Another European ETF domicile which lost a lot of its importance measured by the market share of the AUM in the European ETF industry is Germany. Opposite to France, the market share of the assets under management of ETFs domiciled in Germany fell more or less constantly within the observation period. This demonstrates that the importance of ETFs domiciled and distributed in single markets within the EU has gone down over time since investors are increasingly using cross-border products in their portfolios.

Lately, some of the growth of the market share of AUM for Ireland can be attributed to the tax advantage that Irish ETFs (and mutual funds) have over funds from other domiciles with regard to the U.S. withholding tax, as some ETF promoters redomiciled some products which invest in the U.S. to Ireland. As for this, it is noteworthy that Ireland already signed the FATCA IGA with the U.S. on December 21, 2012.

More generally speaking, the development of the market shares shows that there is a hard competition ongoing between the different ETF/fund domiciles in Europe and that the fund promoters are choosing the domicile which suits their need to manage a given product or family in the most efficient manner possible. That said, we are currently witnessing some initiatives regarding the treatment of ETFs in Luxembourg which aim to enhance the capability of the country to compete with Ireland as an ETF domicile.

This article is for information purposes only and does not constitute any investment advice.

The views expressed are the views of the author, not necessarily those of Lipper or LSEG.