It was not surprising that May 2022 was in general a negative month for the European fund industry given the geopolitical situation in Europe, the still ongoing COVID-19 pandemic, disrupted delivery chains, and the sluggish market environment. That said, the promoters of mutual funds (-€32.3 bn) faced outflows, while the promoters of ETFs (+€2.5 bn) enjoyed inflows. Within this market environment and given the economic uncertainties, one would expect that European investors sold long-term funds and bought money market products. Therefore, it is somewhat surprising that European investors further sold money market products (-€6.5 bn) over the course of May 2022, as these products are normally considered safe-haven investments. As for the above, it was no surprise that long-term funds faced estimated net outflows of €23.2 bn.

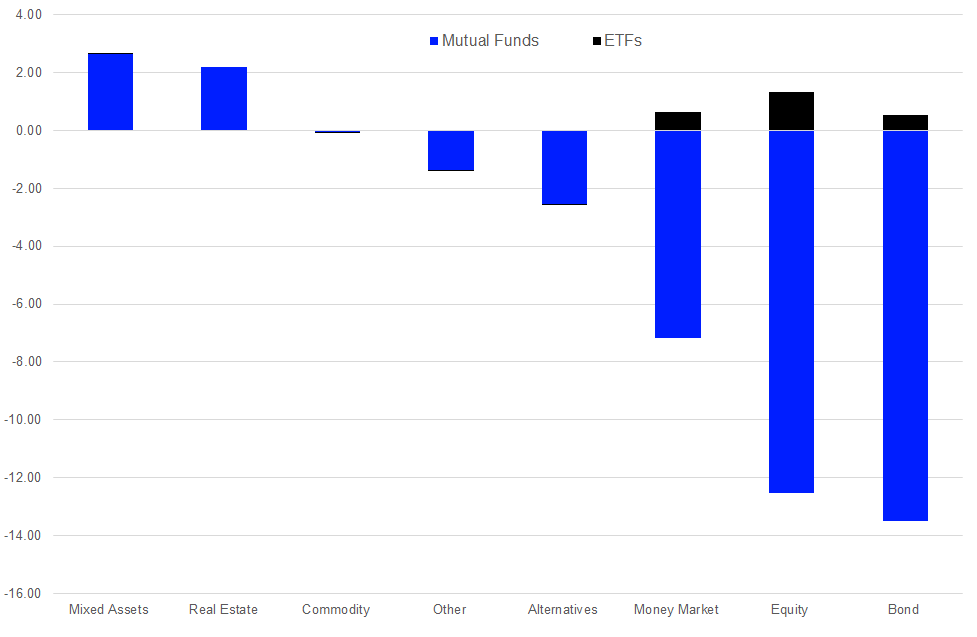

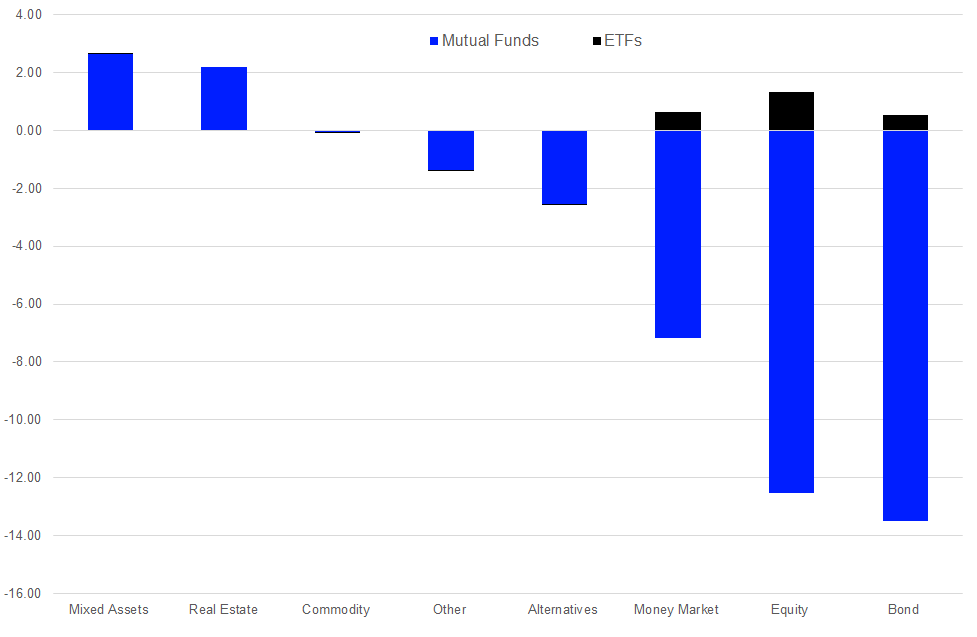

In more detail, mixed-assets funds (+€2.7 bn) were once again the best-selling asset type overall for May 2022. The category was followed by real estate funds (+€2.2 bn). On the other side of the coin, commodities funds (-€0.1 bn), “other” funds (+€1.4 bn), alternative UCITS funds (-€2.5 bn), money market funds (-€6.5 bn), equity funds (-€11.2 bn), and bond funds (-€12.9 bn) faced outflows.

Graph 1: Estimated Net Flows by Asset and Product Type – May 2022 (in bn EUR)

Source: Refinitiv Lipper

Money Market Products

With a market share of 10.19% of the overall assets under management in the European fund management industry, money market products are the fourth largest asset type. Therefore, it is worthwhile to briefly review the trends in this market segment. As the volatility increased in a rough market environment, it was surprising that European investors reduced their money market positions (-€6.5bn) over the course of May. In contrast with their active peers (-€7.2bn), ETFs investing in money market instruments contributed estimated net inflows of €0.6 bn.

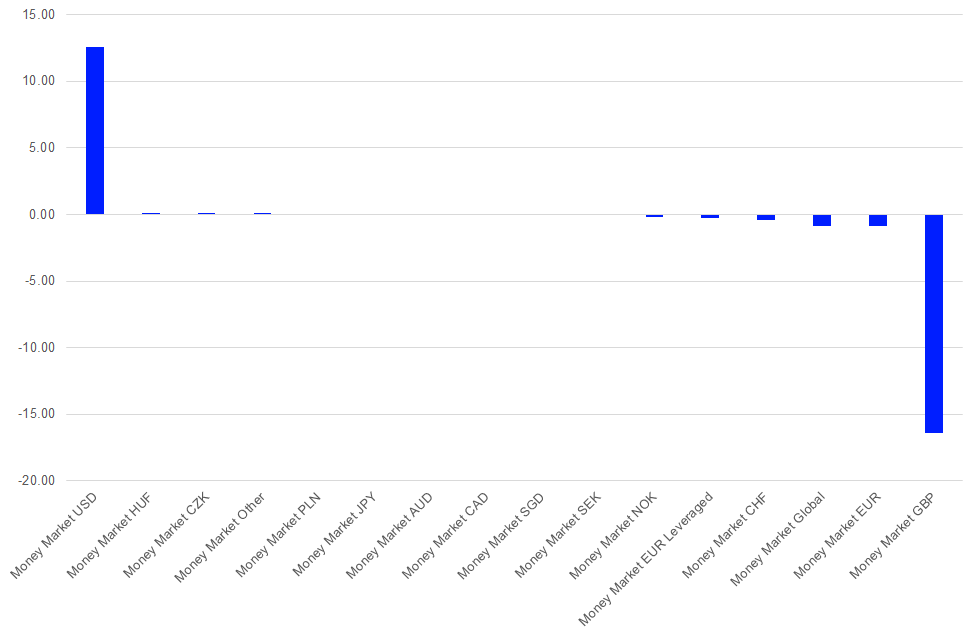

Money Market Products by Lipper Global Classification

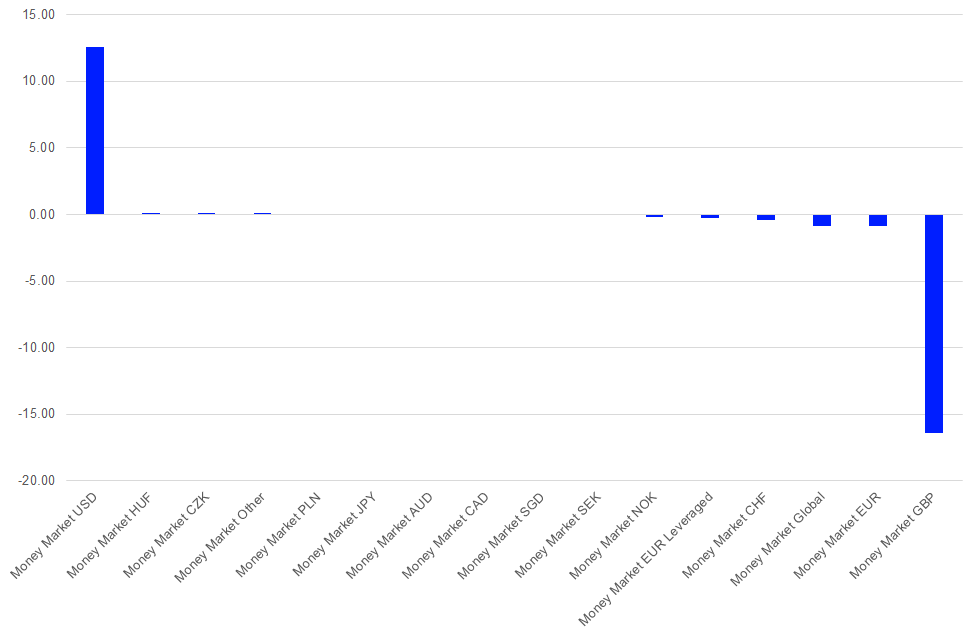

In more detail, Money Market USD (+€12.6 bn) was the best seller within the money market segment, followed by Money Market HUF (+€0.02 bn) and Money Market CZK (+€0.01 bn). At the other end of the spectrum, Money Market GBP (-€16.4 bn) suffered the highest net outflows overall, bettered by Money Market EUR (-€0.9 bn) and Money Market Global (-€0.8 bn).

This flow pattern revealed that European investors sold money market products denominated in GBP and bought back into the USD. These flows might be a sign that European investors may expect that the USD will further outperform other currencies such as the euro or the GBP as result of the central bank activities in the U.S.

Looking at these numbers, one needs to bear in mind that in conjunction with the asset allocation decisions of portfolio managers, these shifts in the money market segment might have also been caused by corporate actions such as cash dividends or cash payments, since money market funds are also used by corporations as replacements for cash accounts.

Graph 2: Estimated Net Flows in Money Market Products by LGC – May 2022 (Euro Billions)

Source: Refinitiv Lipper

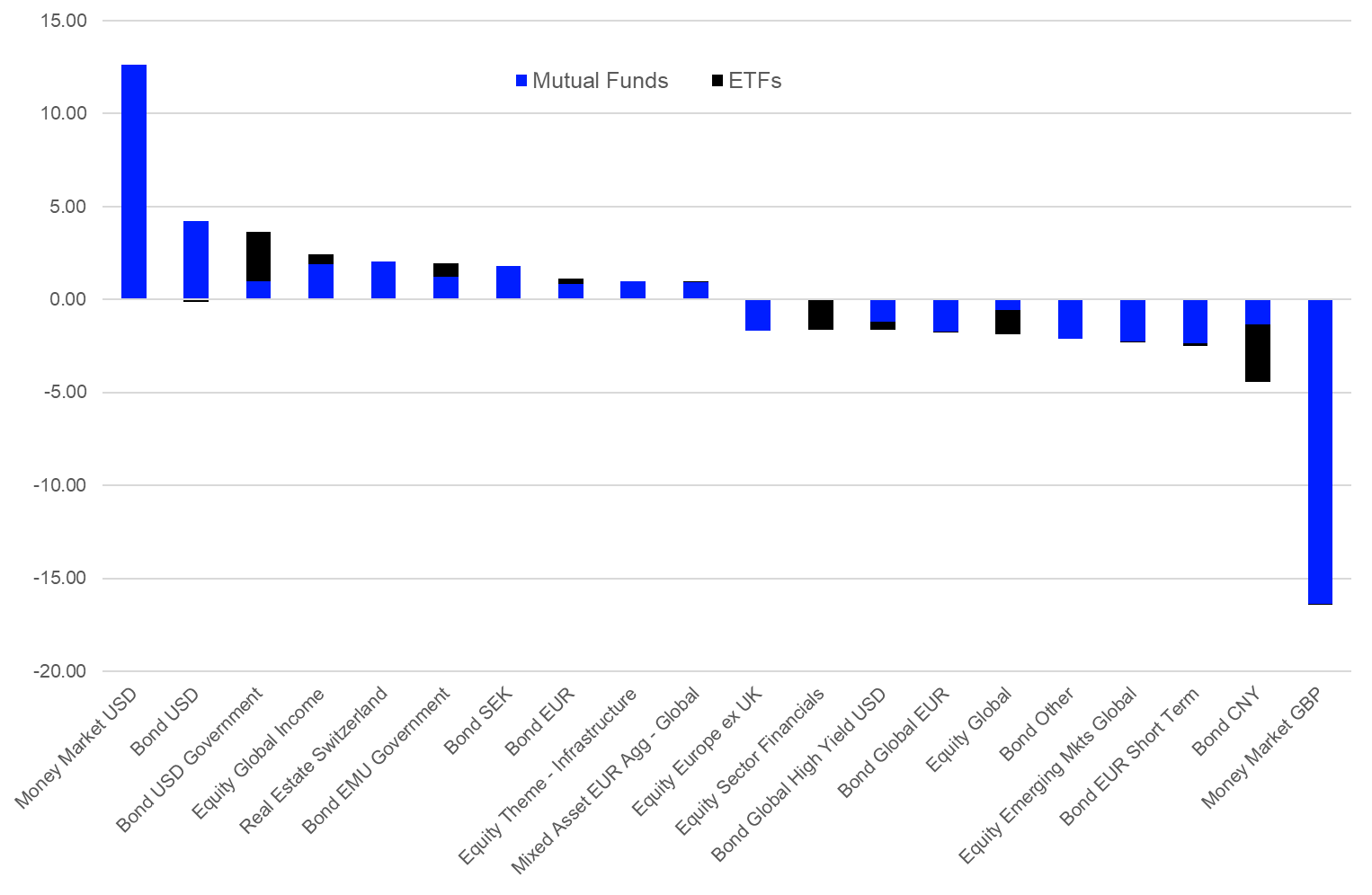

Fund Flows by Lipper Global Classifications

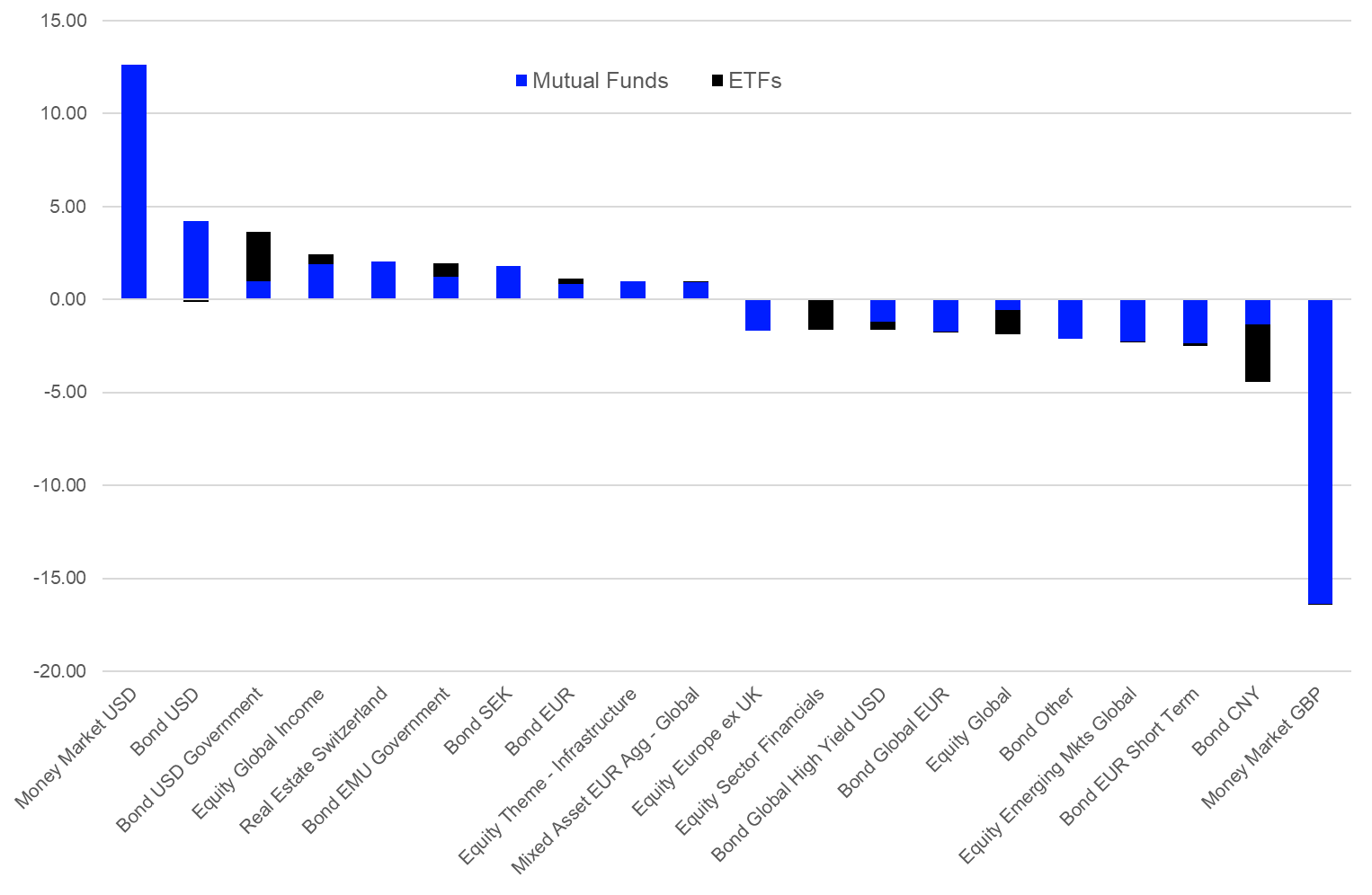

When it comes to the overall sales for May, it was somewhat surprising that the bond and money market classifications dominated the table of the 10 best-selling peer groups by estimated net flows for May given the overall market environment. Money Market USD (+€12.6 bn) was the best-selling Lipper Global Classification for the month. It was followed by Bond USD (+€4.1 bn), Bond USD Government (+€3.7 bn), Equity Global Income (+€2.4 bn), and Real Estate Switzerland (+€2.0 bn).

Graph 3: Ten Best- and Worst-Selling Lipper Global Classifications by Estimated Net Sales, May 2022 (Euro Millions)

Source: Refinitiv Lipper

On the other side of the table, Money Market GBP (-€16.4 bn) faced again the highest estimated net outflows for May. It was bettered by Bond CNY (-€4.5 bn) and Bond EUR Short Term (-€2.5 bn).

A closer look at the best- and worst-selling Lipper Global Classifications for May shows that European investors were somewhat in a risk-off mode as they sold bond funds with various investment objectives and equity funds which might get hit by the current market environment. On the other hand, European investors anticipated the possibility of an increase in the value of the USD compared to the EUR driven by the more restrictive central bank policy from the U.S. Federal Reserve Bank compared to the ECB by buying U.S.-dollar denominated bonds.

Fund Flows by Promoters

BlackRock (+€10.1 bn) was the best-selling fund promoter in Europe for May, ahead of HSBC (+€7.8 bn), Morgan Stanley (+€3.7 bn), Natixis (+€3.1 bn), and Vanguard (+€2.5 bn). Given the product ranges of the 10-top promoters and the overall fund flow trends, it was not surprising to see that ETFs played a major role for some of the largest fund promoters in Europe, within the list of the 10 best-selling fund promoters.

Graph 4: Ten Best-Selling Fund Promoters in Europe, May 2022 (Euro Millions)

Source: Refinitiv Lipper

Considering the single-asset classes, UBS (+€4.1 bn) was the best-selling promoter of bond funds, followed by Swedbank (+€1.8 bn), La Caixa (+€1.3 bn), HSBC (+€0.5 bn), and Neuflize (+€0.5 bn).

Within the equity space, BlackRock (+€2.1 bn) led the table, followed by Vanguard (+€2.1 bn), HSBC (+€1.5 bn), Legal & General (+€1.3 bn), and Invesco (+€0.8 bn).

abrdn (+€1.4 bn) was the leading promoter of mixed-assets funds in Europe, followed by Groupama (+€0.6 bn), True Potential (+€0.4 bn), AXA (+€0.3 bn), and Banco Cooperativo (+€0.3 bn).

BMO Global Asset Management (+€0.5 bn) was the leading promoter of alternative UCITS funds for the month, followed by DWS Group (+€0.4 bn), Brevan Howard (+€0.4 bn), Amundi (+€0.3 bn), and Schroders (+€0.3 bn).

Fund Flows by Fund Domiciles

Single-fund domicile flows (including those to money market products) showed, in general, a negative picture during May. Twenty of the 35 markets covered in this report showed estimated net outflows, and 15 showed net inflows. Sweden (+€2.9 bn) was the fund domicile with the highest net inflows, followed by Switzerland (+€1.6 bn), Spain (+€1.2 bn), Germany (+€1.1 bn), and the Czech Republic (+€0.2 bn). On the other side of the table, Luxembourg (-€21.9 bn) was the fund domicile with the highest outflows, bettered by France (-€6.0 bn) and the UK (-€3.1 bn). It is noteworthy that the overall fund flows for Ireland (+€4.7 bn), Luxembourg (-€5.0 bn), and France (-€5.1 bn) were impacted by outflows within the money market segment.

Graph 5: Estimated Net Sales by Fund Domiciles, May 2022 (Euro Billions)

Source: Refinitiv Lipper

Within the bond sector, funds domiciled in Sweden (+€1.7 bn) led the table, followed by Spain (+€1.5 bn) and Switzerland (+€0.3 bn). Bond funds domiciled in Luxembourg (-€7.9 bn), Ireland (-€3.6 bn), and France (-€2.0 bn) were at the other end of the table.

For equity funds, products domiciled in Ireland (+€1.4 bn) led the table for the month, followed by Sweden (+€1.2 bn), Germany (+€0.8 bn), France (+€0.6 bn), and Spain (+€0.3 bn). Meanwhile, Luxembourg (-€8.2 bn), the UK (-€4.0 bn), and the Netherlands (-€2.1 bn) were the domiciles with the highest estimated net outflows from equity funds.

Regarding mixed-assets products, the UK (+€1.9 bn) was the domicile with the highest estimated net inflows, followed by France (+€0.8 bn), Switzerland (+€0.8 bn), Germany (+€0.4 bn), and the Netherlands (+€0.2 bn). In contrast, Luxembourg (-€0.8 bn), Belgium (-€0.2 bn), and Spain (-€0.2 bn) were the domiciles with the highest estimated net outflows from mixed-assets funds.

Denmark (+€0.1 bn) was the domicile with the highest estimated net inflows into alternative UCITS funds for the month, followed by Guernsey (+€0.1 bn) and Sweden (+€0.1 bn). Meanwhile, Ireland (-€1.7 bn), Spain (-€0.3 bn), and Luxembourg (-€0.2 bn) were at the other end of the table.

The views expressed are the views of the author, not necessarily those of Refinitiv Lipper or LSEG.

Refinitiv Lipper delivers data on more than 330,000 collective investments in 113 countries. Find out more.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.