Earnings season for the third quarter of 2019 is around the corner. The S&P 500 is expected to see the first year-on-year (YoY) decline since 2016 and investors’ attention will soon turn to the banks industry. The group is the first to report earnings, marking the unofficial start to earnings season. Heading into the reporting period, a trend has emerged among the banks; analysts have become more bearish and have consistently made downward revisions to estimates.

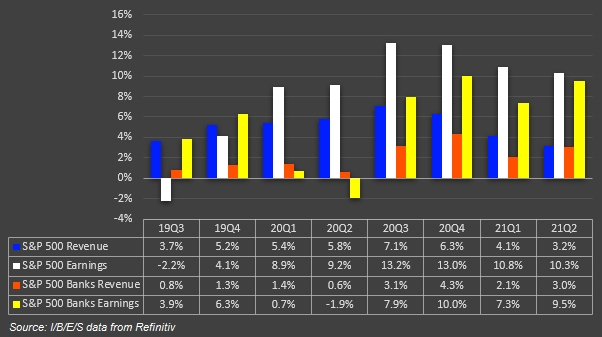

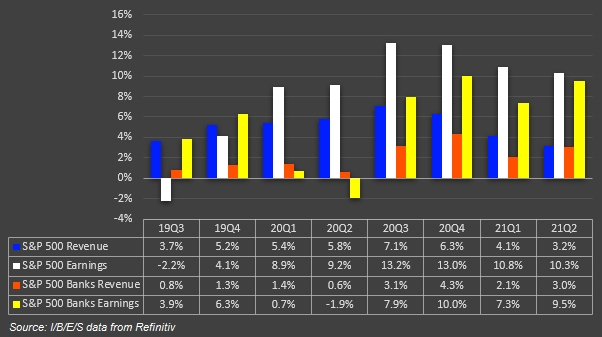

Exhibit 1: S&P 500 19Q3 YoY Earnings and Revenue

Analysts are cutting Q3 2019 earnings estimates ahead of earnings season. YoY revenue growth expectations have fallen to 3.7% from 4.0% as of July 1, 2019 and the outlook for earnings has shifted from positive to negative, with growth anticipated to decrease 2.2% vs. the 0.8% gain as of July 1. If this holds, it will be the first earnings decline since the 2.1% seen in Q2 2016 and would mark the lowest growth rate since the 5.0% drop in Q1 2016.

Exhibit 2: S&P 500 Banks Net Interest Margins and YoY Net Interest Income

The unofficial kickoff to earnings season starts when the major banks begin to report third quarter earnings during the third week of October. Projections for a slowing economy along with a low interest rate environment, tight yield spreads, and a yield curve that has been flat to inverted have contributed to consistently bearish analyst revisions across measures, periods, and constituents. As a result, YoY Q3 2019 revenue for the S&P 500’s bank sector has fallen to 0.8% from 1.8% as of July 1; earnings have come down to 3.9% from 7.1%, and third quarter net interest margin (NIM) expectations have contracted by 8 bps to 2.68%.

Speaking at the Barclays Global Financial Services Conference, JPMorgan Chase & Co.’s (JPM.N) Chairman and CEO James Dimon talked about the economic outlook and said, “It looks like it’s a slowdown, and you’ve seen the slowdown in Germany, Japan, et cetera, but not on the path down. So, it’s possible that you’re just going to have a slower economy. Our economists have emerging markets growing 4%; and after about next year, China at 5.5% to 6%; America, 2%. So, it’s possible you’re just going to be okay; have a deep breath. Bond rates are going to go up. Stock markets are going to be fine.”

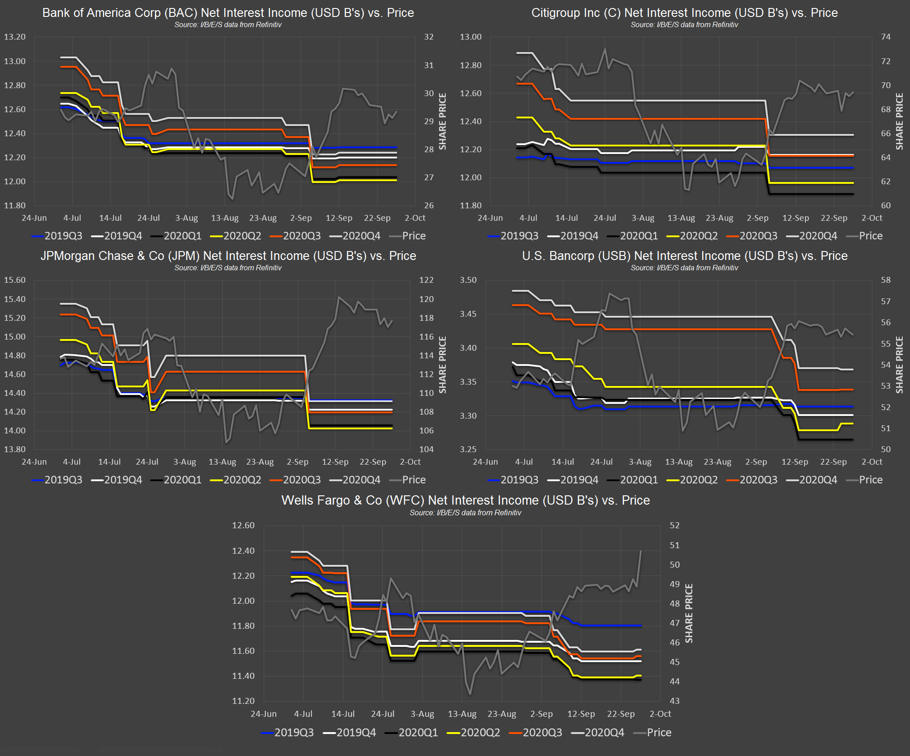

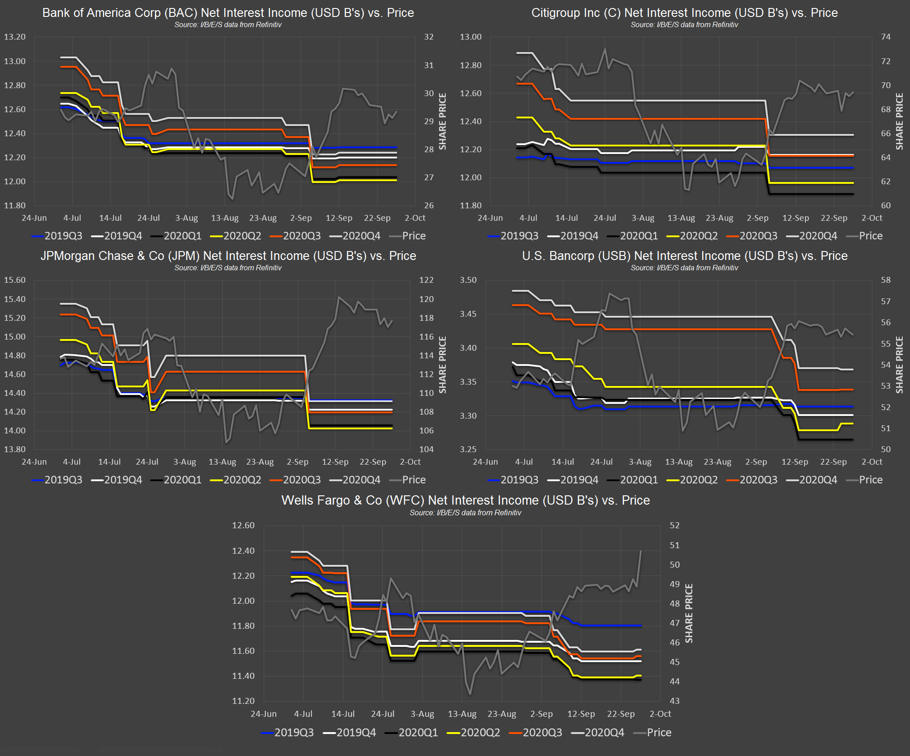

Exhibit 3: S&P 500 Diversified Banks Constituents Net Interest Income

The bearish sentiment about banks is expressed consistently across measures, periods, and constituents. Exhibit 3 highlights this by showing the persistence of downward revisions for net interest income (NII) across all the S&P 500 diversified banks sub-industry’s companies. In aggregate, the bank industry has seen Q3 2019 YoY NII come down 2.4 percentage points (ppts) to 1.4% from 3.7% as of July 1, the regional banks’ sub-industry’s estimate has fallen 2.6 ppts to 3.3%, and the diversified banks sub-industry have seen expectations lowered by 2.3 ppts to 0.8%. With the bar set so low, it is likely that most banks will meet or beat estimates when they start to report results.

The good news is that analysts tend to become more bearish heading into earnings season. The median decline in YoY earnings growth estimates is 2.4 ppts from the start of the quarter to the start of earnings season. Therefore, the S&P 500’s 1.8 ppt decrease in Q3 2019’s YoY earnings growth expectation since August 1, is less bearish than the typical quarter. Additionally, most companies tend to beat analyst estimates. As a result, earnings growth expectations tend to improve by a median of 3.4 ppts from the start of earnings season to the end. This means that the third quarter of 2019 will likely end with positive earnings growth.

Follow the S&P 500 Earnings Scorecard on Proprietary Research from Refinitiv this earnings season to track company performance vs. expectations and the latest analyst expectations.

Eikon from Refinitiv is a complete solution for research and analytics. It places the most comprehensive market information, news, analytics and trading tools available into a desktop as simple to use as the Internet. Eikon from Refinitiv clients can run fundamental and technical screens against a global dataset representing more than 100 countries and over 200,000 securities.

Republication or redistribution of Reuters content, including by framing or similar means, is prohibited without the prior written consent of Reuters. Reuters and the Reuters logo are registered trademarks, and trademarks of the Thomson Reuters group of companies. For additional information on Reuters photographic services, please visit the web site at http://pictures.reuters.com