In its 2019 annual Financial System Review the Bank of Canada explicitly addressed climate change for the first time, listing it as one of the 6 major vulnerabilities in the Canadian financial system. In the report it cites that insured damage to property and infrastructure in Canada averaged about $1.7 billion per year from 2008 to 2017, up from $200 million per year from 1983 to 1992.

Of course, climate change doesn’t recognize international borders, and the United States has experienced record-level destruction from hurricanes, cyclones, and wildfires in recent years.

According to Boston-based risk modeling firm AIR Worldwide, a hurricane as destructive as Harvey, the costliest ever for the US, would have been seen as a 1 in 2,000 year event in the 20th century. By 2017, the year of Hurricane Harvey, that estimated frequency had risen to 1 in 300 years.

The direct impact on the insurance industry is obvious, but the compounding effects of climate-related disasters can create a “perfect storm” for insurers. First, natural disasters cause drastic spikes in claims, so insurers have to liquidate assets to make good on these claims.

Second, the combined impact of a number of insurers – the world’s second largest institutional investor group, behind only pensions, with $25 trillion in assets – selling all at the same time can have a significant depressing effect on asset prices, just when insurers need them the most to remain solvent.

Finally, the prices of these assets — the stocks and bonds of companies and governments — are directly affected by the same natural disasters. Company operations are interrupted, and government’s budgets are strained with relief spending.

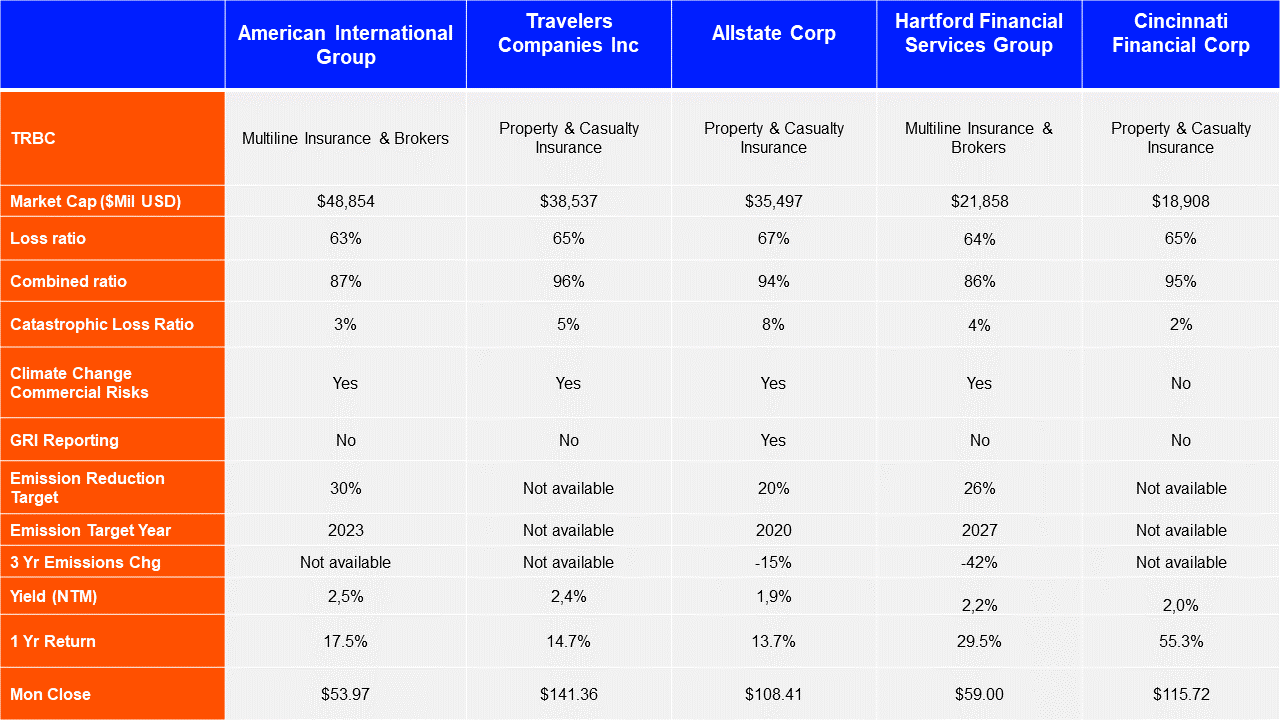

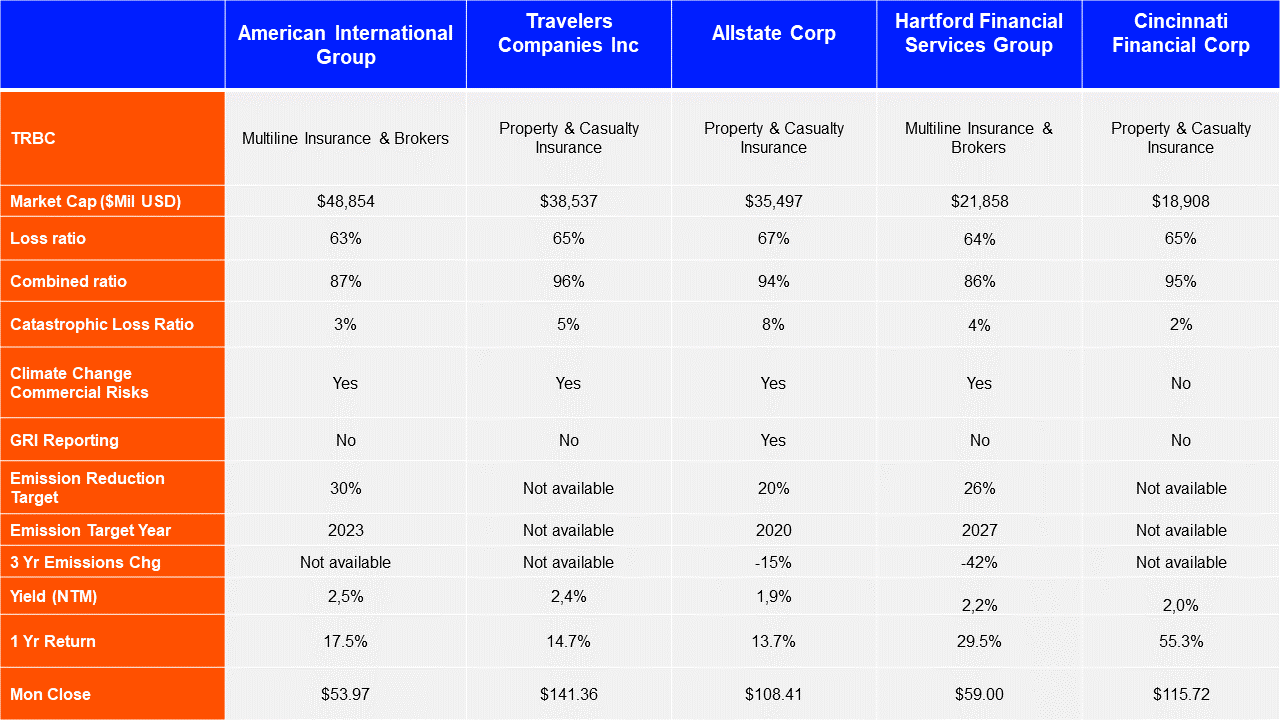

We have looked at the 5 largest North American insurance companies in the property & casualty or multiline (insurance for multiple risks bundled together) businesses to find out how they compare in terms of:

- Their financial strength to withstand disasters;

- Evidence of appreciating and understanding the risks that climate change poses;

The first is easier to quantify. We analyzed the forward (next-twelve-months) estimate of the loss ratio, the ratio of claims paid to premiums collected; combined ratio, the ratio of claims and expenses to premiums collected; and catastrophic loss ratio, losses related to severe events as a percentage of premiums.

The second aspect is less straightforward, but as proxies we looked at:

- If management has explicitly acknowledged the commercial risks associated with climate change;

- If the company reports sustainability data within the guidelines of the Global Reporting Initiative (a standards organization founded by the UN);

- If the company has set emissions reductions targets;

- What the percentage change in their (voluntarily) disclosed emissions have been over the past 3 years;

Here’s what we found

The 5 largest are all American firms (Canada’s 3 biggest companies are all classified as Life & Health Insurance).

Hartford Group has the lowest combined ratio, meaning, all other things being equal, it should have the highest profitably, or, in other words, the most resilient buffer to catastrophes, be they severe weather events resulting from climate change or otherwise.

At first glance, Hartford also shows the most signs of appreciating the risks climate change poses. In its annual Global Reporting Initiative (GRI) report, the company commits to at least a 2.1% reduction in greenhouse gas emissions annually — which would lead to at least a 26% reduction by 2027 and 46% reduction by 2037. Given the reduction achieved over the past 3 years, this target looks more than realistic. This emissions data is verified by an independent 3rd party, Montreal-based WSP, and Hartford has also set the goal of being powered 100% by renewable energy by 2030.

The second lowest combined ratio belongs to AIG. AIG has committed to a 30% reduction in emissions by 2023, but only reports on emissions excluding business travel from its UK and NYC operations “due to the complexity of aggregating the data”, according to the company.

More about Refinitiv ESG Data

Refinitiv, formerly the Financial & Risk business of Thomson Reuters, is one of the world’s largest providers of financial markets data and infrastructure, serving over 40,000 institutions in over 190 countries. Refinitiv ESG Data is designed to help you make sound, sustainable investment decisions and covers nearly 70% of global market cap and over 400 objective metrics. It helps you assess the risks – and opportunities – posed by companies’ performance in critical areas such as climate change, executive remuneration, and diversity and inclusion.

Hugh Smith, CFA, MBA is Director of Refinitiv’s Investment Management business for the Americas, and is a Director on the Board of the Responsible Investment Association of Canada.