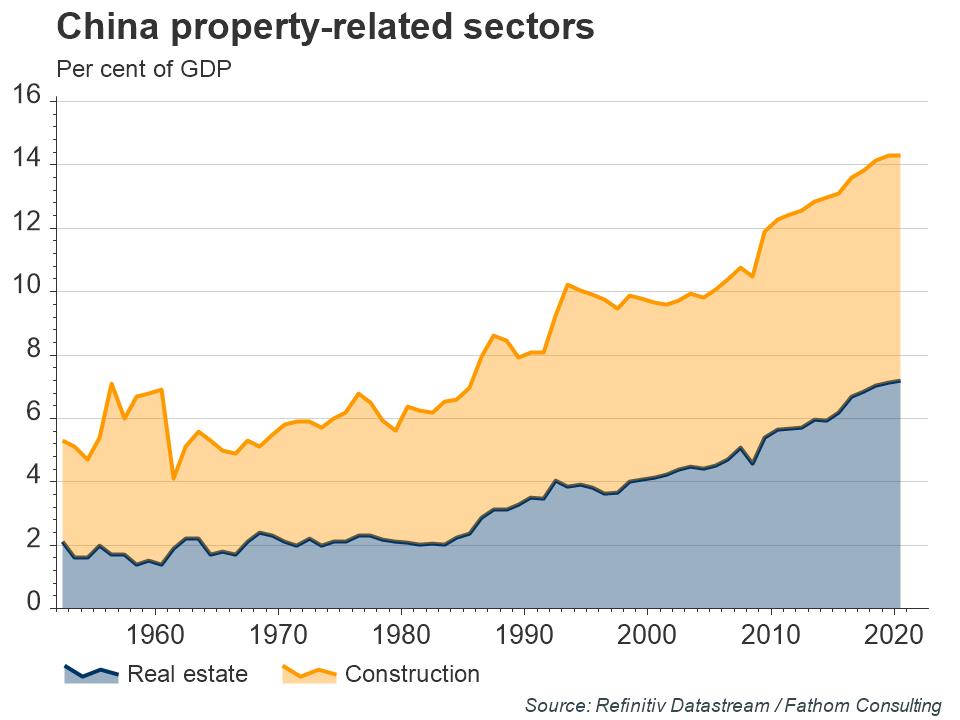

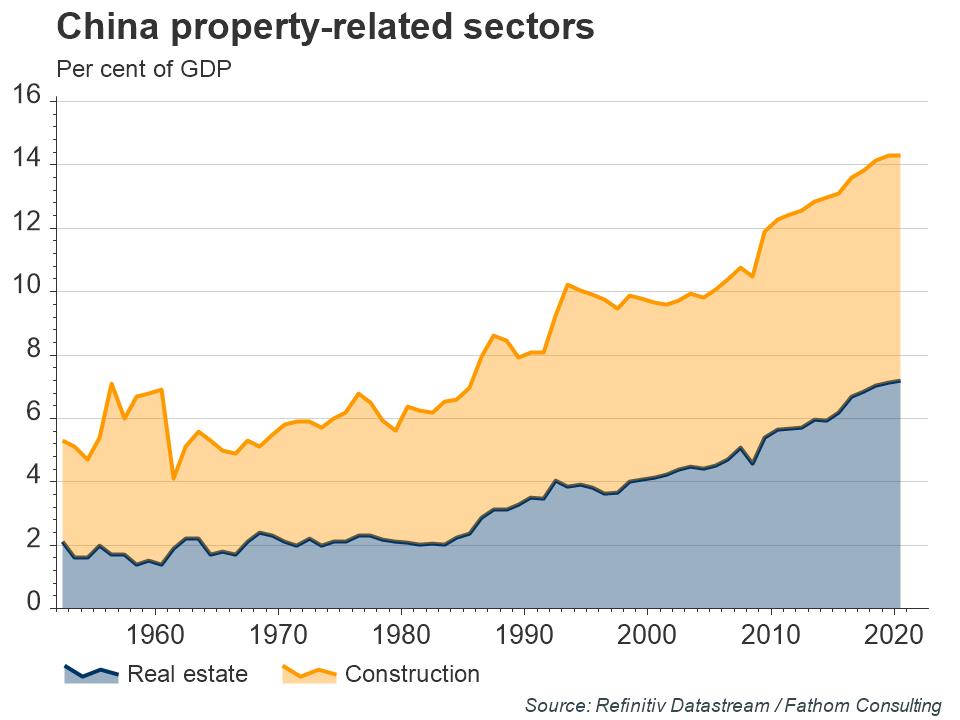

China has been pouring money into residential construction for years, with the sector now accounting for 15% of the nation’s economic activity.[1] It is little wonder that recent events surrounding real estate developer Evergrande have caused so much concern — not least for China’s policymakers. As a consequence, they appear to be recalibrating their policy stance away from the tightening seen in recent years.[2]

Refresh this chart in your browser | Edit the chart in Datastream

China’s policymakers are right to be concerned. Although Evergrande is different to Lehman’s in the sense that there is less hidden connectivity through the global system, Fathom believes that it could still prove problematic if the handling of Evergrande and other highly indebted real estate developers is viewed as a withdrawal of the implicit guarantee that has been in place for many years.

Indeed, it is widely assumed that the Chinese government will step in, underwriting loans if they turn sour, and thereby preventing institutions from failing. But in allowing Evergrande and other real estate developers to default, the Chinese government is signalling otherwise. That could prove problematic if it is viewed as an indiscriminate, industry-wide policy U-turn.

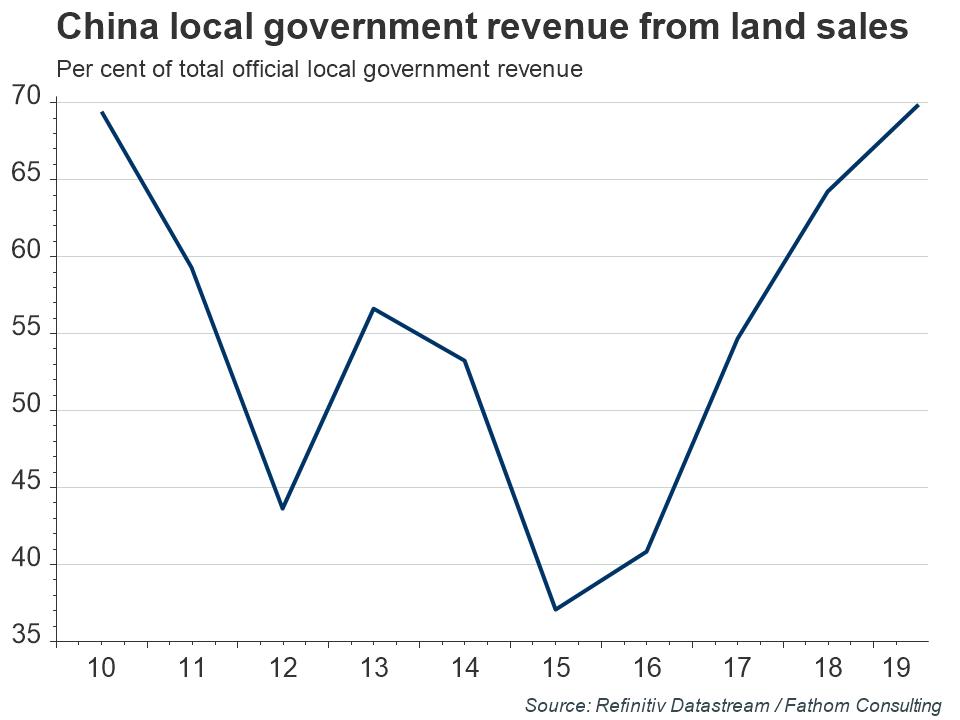

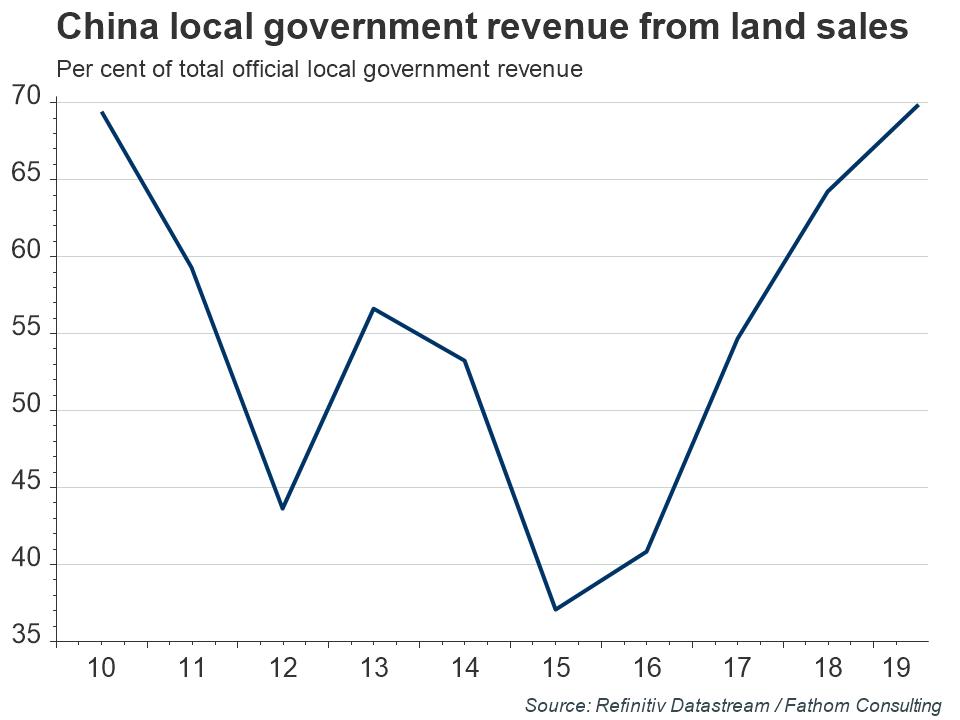

Moreover, due to the government carefully controlling the supply of complete and vacant properties, China’s housing market is viewed as a one-way bet by many. Property prices are allowed to fluctuate to a degree, but as local authorities own the land and rely heavily on income from land sales to augment official revenue streams, the desire to sustain prices often outweighs policymakers’ desire to allow market forces to work.

Consequently, the removal of that guarantee could cause the whole house of cards to come crashing down, harming local authorities’ coffers, consumers, real estate developers, the banking sector and more.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

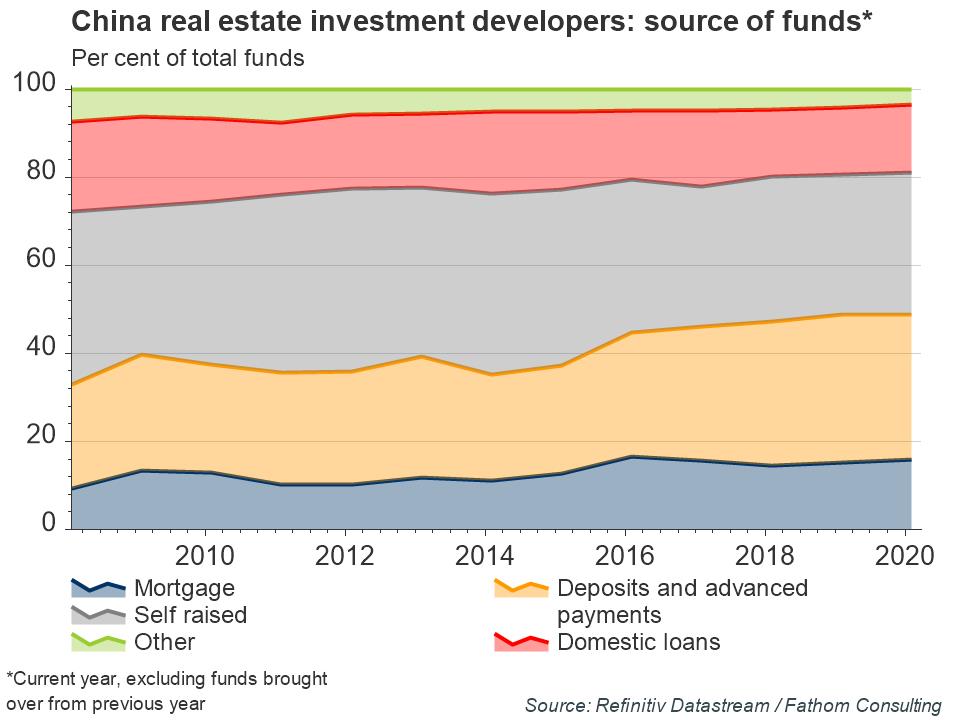

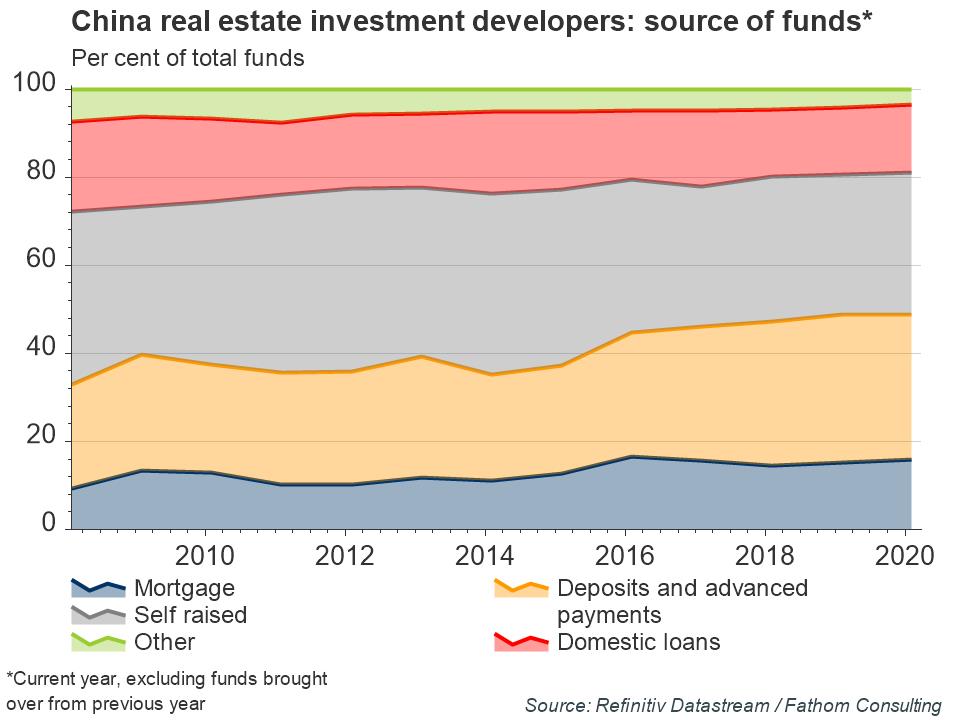

Perhaps recognising those risks and unnerved by the financial market reaction to Evergrande (even if the real economy impact has been relatively muted to date), China’s policymakers appear to be recalibrating. This has seen an easing of restrictions on developer’s use of funds from pre-sales of properties, as well as the resumption of pre-sales at the initial stages of construction for select developers. Regulators have also told banks to speed up mortgage approvals, and there is talk of subsidies for young homebuyers too.

Refresh this chart in your browser | Edit the chart in Datastream

The change in policy related to pre-sales is particularly interesting in light of data on real estate developers’ source of funds which show that pre-sales of properties — in the form of deposits and advanced payments — account for around one-third of their capital. That means that consumers are vulnerable to real estate developers going bankrupt, and real estate developers are also vulnerable to this source of funds drying up.

Refresh this chart in your browser | Edit the chart in Datastream

Until now, consumers had little reason to doubt that this was a sound investment — a one-way bet. What happens next is down to the Chinese government, as it juggles reducing the risks associated with the housing market while preventing it from crashing down. This has resulted in a series of on-off policies, or what we refer to as China’s hokey cokey approach to reform, as policymakers continue to prioritise short-term growth.

While the intention may be to reduce the risks associated with the housing market prior to allowing a correction, and in doing so lessen the collateral damage, the danger with this hokey cokey approach, where policymakers fail to fully commit, is that it merely reinforces the implicit price guarantee which has helped foster much of this risky behaviour in the first place. Or worse still, a misstep could accidently cause the whole house of cards to come crashing down.

[1] Some estimates put that figure even higher, at around 30%, when including other related spending such as that on soft furnishings and the hire of removal vans.

[2] This saw limits on the amount prospective buyers can borrow, ceilings on the amount that banks can lend for the purposes of real estate, and caps on property developers’ allowed debt.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.