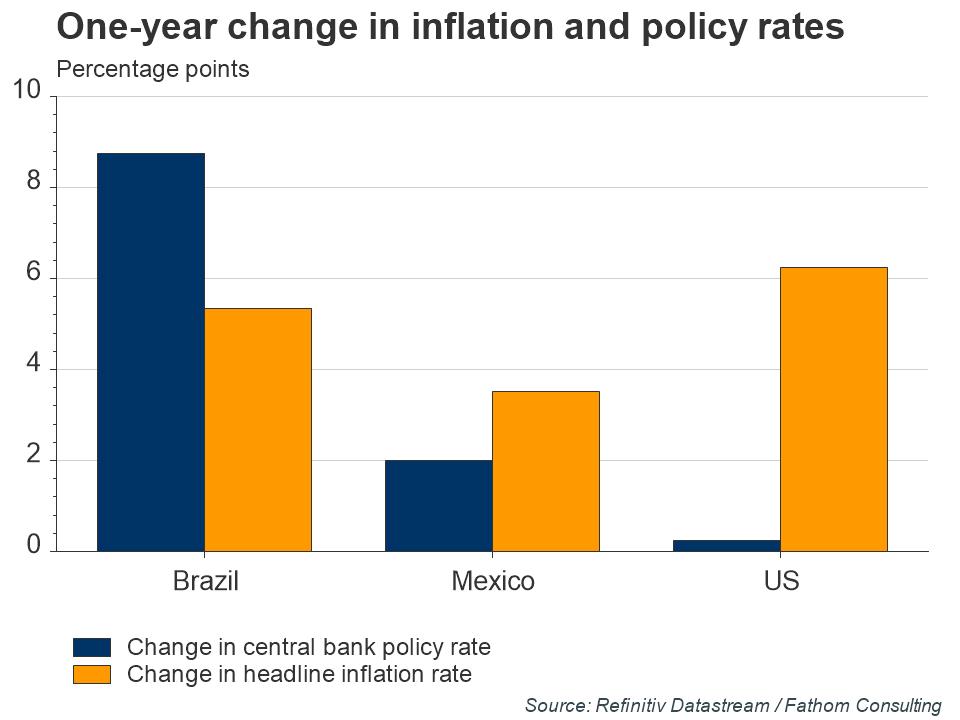

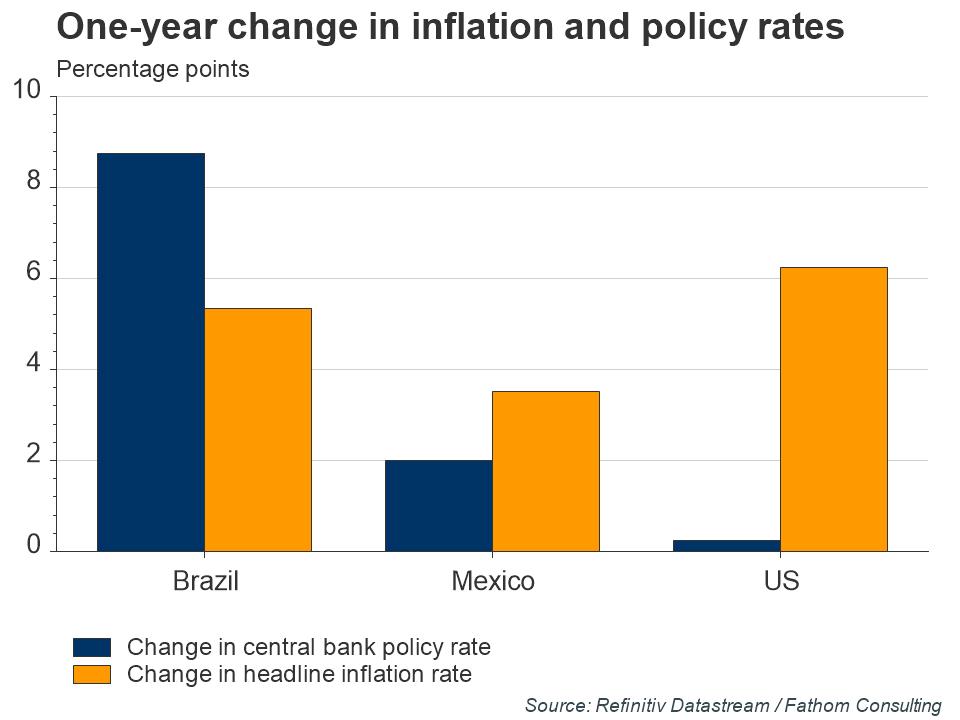

In an earlier article, ‘Behind-the-curve Fed signals more rate hikes’, Fathom Consulting reflected on the careful balancing act that the US Federal Reserve must perform as it embarks on a series of rate hikes. Tighten too quickly and it risks tipping the economy into recession; tighten too slowly and upward price pressures could become entrenched, requiring an even quicker pace of tightening down the line that could prove more costly. For emerging markets, where central banks typically have less credibility, the balancing act is much more precarious, forcing them to start the tightening cycle much sooner, and harder, in order to avoid entrenched inflation. This is shown in the chart below, which reveals that although consumer price inflation has increased by more in the US than in Brazil and Mexico, interest rates in the US have barely budged compared to rates in Brazil and Mexico, where central banks acted earlier to prevent the de-anchoring of domestic inflation expectations. As a result, interest rates have diverged markedly.

Refresh this chart in your browser | Edit the chart in Datastream

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.