Fathom Consulting’s proprietary indicators provide unique, detailed and independent insight into the Chinese economy. Our findings relating to the housing sector are captured in the charts below and are available on Refinitiv’s Datastream Chartbook, under ’05. Fathom’s Proprietary Indices’ and ’04.03 HT China housing market’.

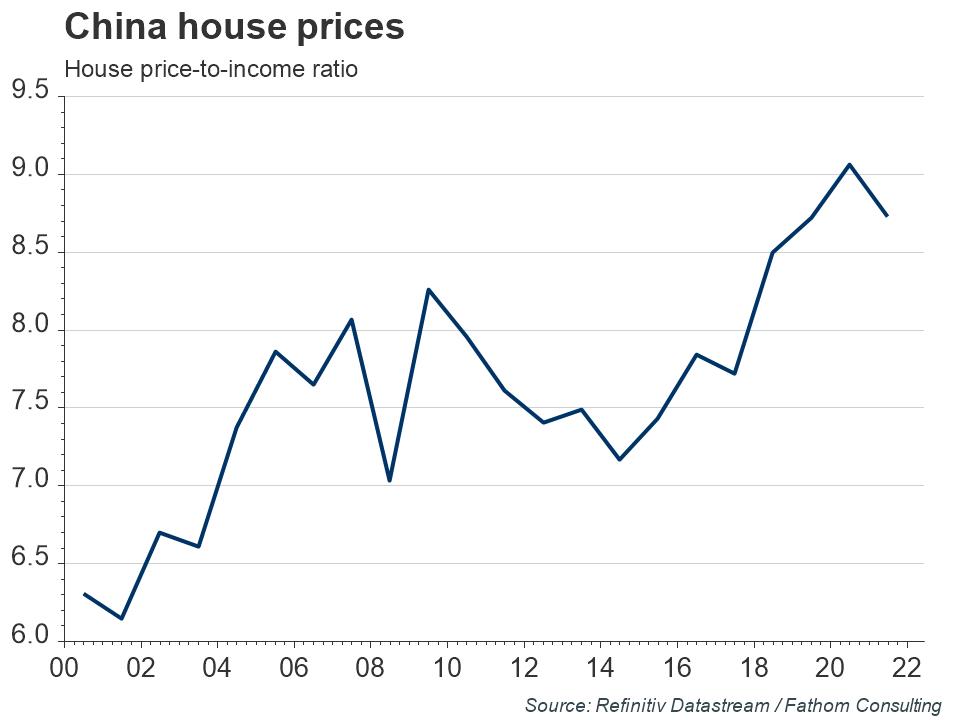

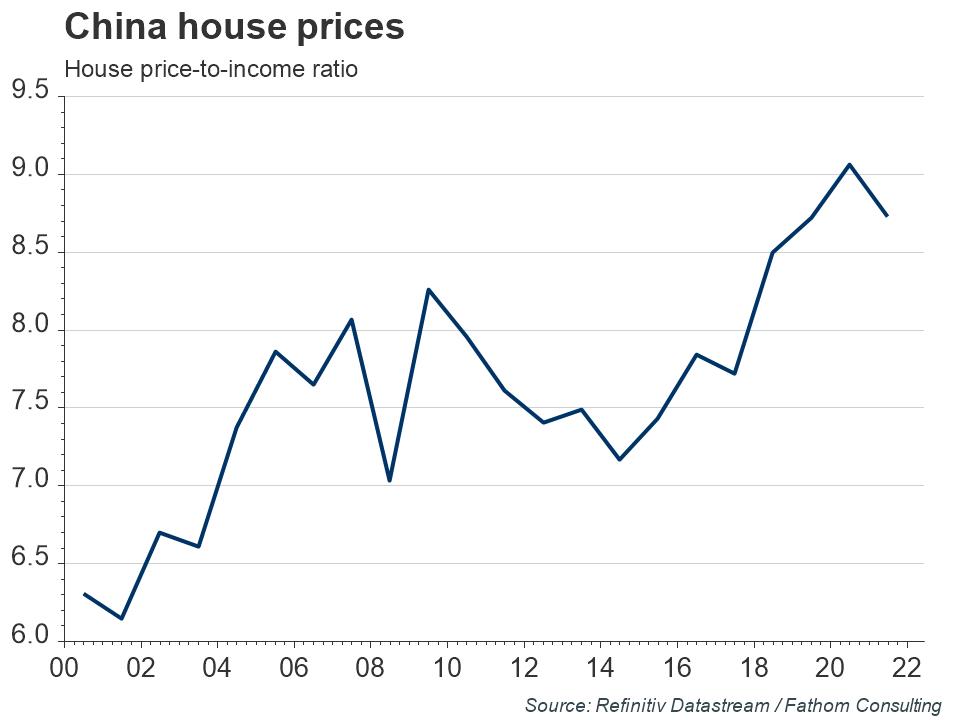

Struggling to find alternative sources of growth, policymakers in China actively encouraged the housing investment boom for many years. Carefully managed by the state, the excess capacity that this growth model created was hidden beneath the surface. Fathom’s proprietary housing indicators provided a detailed breakdown of the extent of China’s housing problem, pointing to the inefficiencies within the sector and the lofty house price-to-income ratio. In recent months, amid the fallout from the collapse of Evergrande, these deep-rooted problems have found their way to the surface.

Refresh this chart in your browser | Edit the chart in Datastream

Over time, the authorities became increasingly concerned about the risks posed by housing, with China Insurance and Regulatory Banking Commission chairman Guo Shuqing suggesting, “It’s safe to say that the property market is currently the greatest grey rhino in terms of financial risks.”[1] The Chinese government is also worried about the impact of soaring prices on inequality and demographics. Continued rises in wealth inequality are clearly at odds with President Xi’s flagship ‘Common Prosperity’ campaign, while expensive housing is likely to be an important reason why Chinese households seem unwilling to have more children. In 2021, new births of 10.6 million were the lowest since the founding of the People’s Republic in 1949.[2]

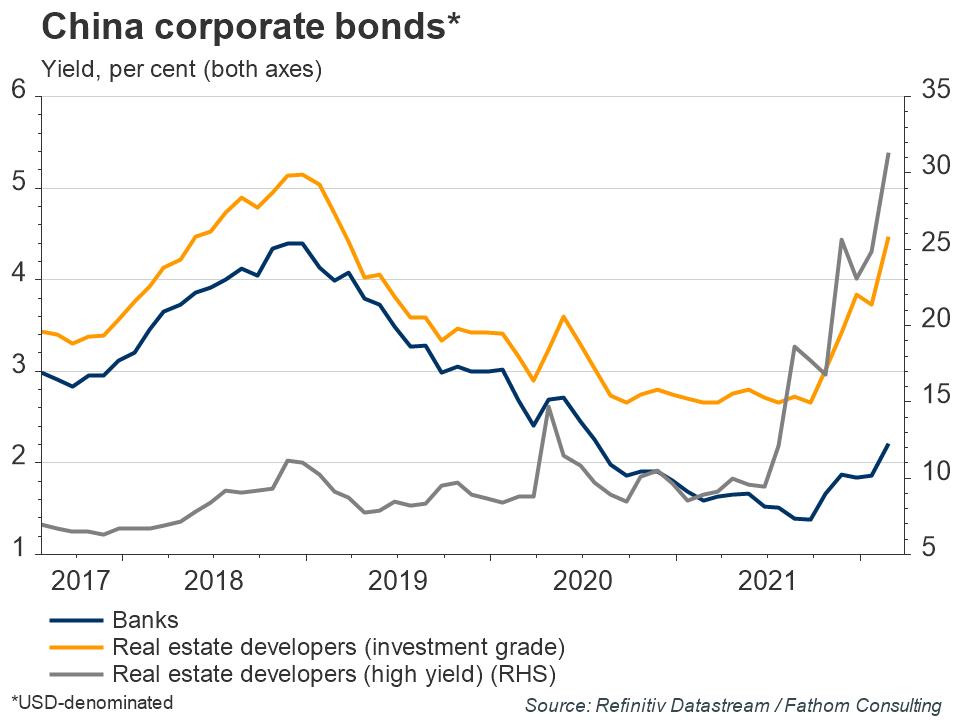

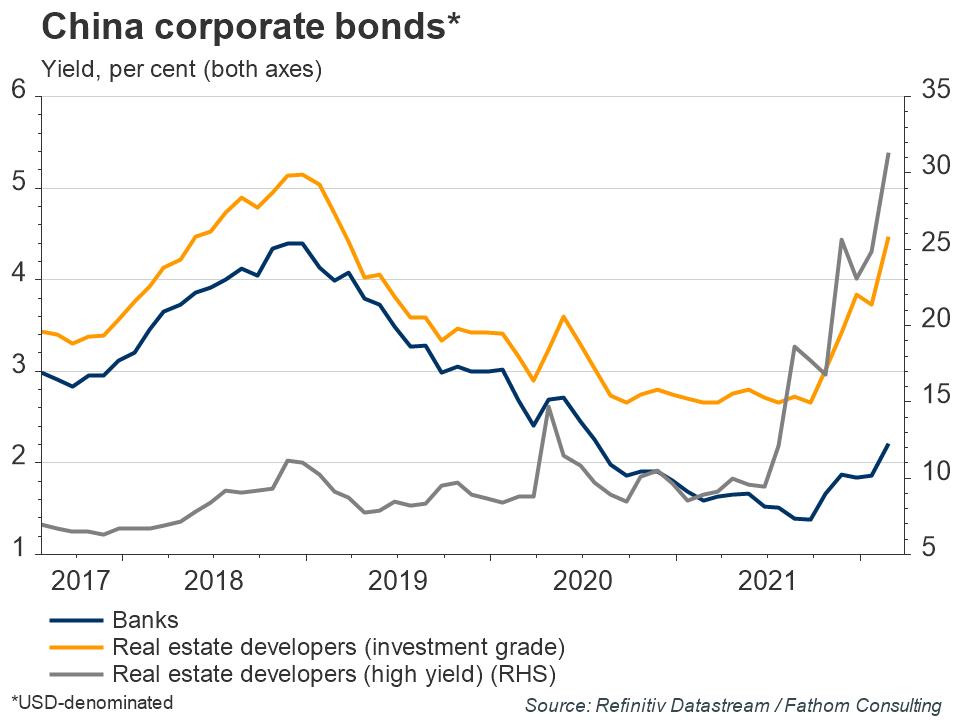

Hence, as the economy began to recover from COVID-19, the authorities moved quickly to rein in the real estate sector. One prominent policy was the ‘Three Red Lines’, which placed varying borrowing restrictions on real estate developers depending on how many of the debt-related limits they breached. These policies resulted in the crisis at the real estate developer Evergrande, with the pain spreading to other developers amid a significant tightening in credit conditions and weaker demand for properties as fears grew of a housing downturn.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

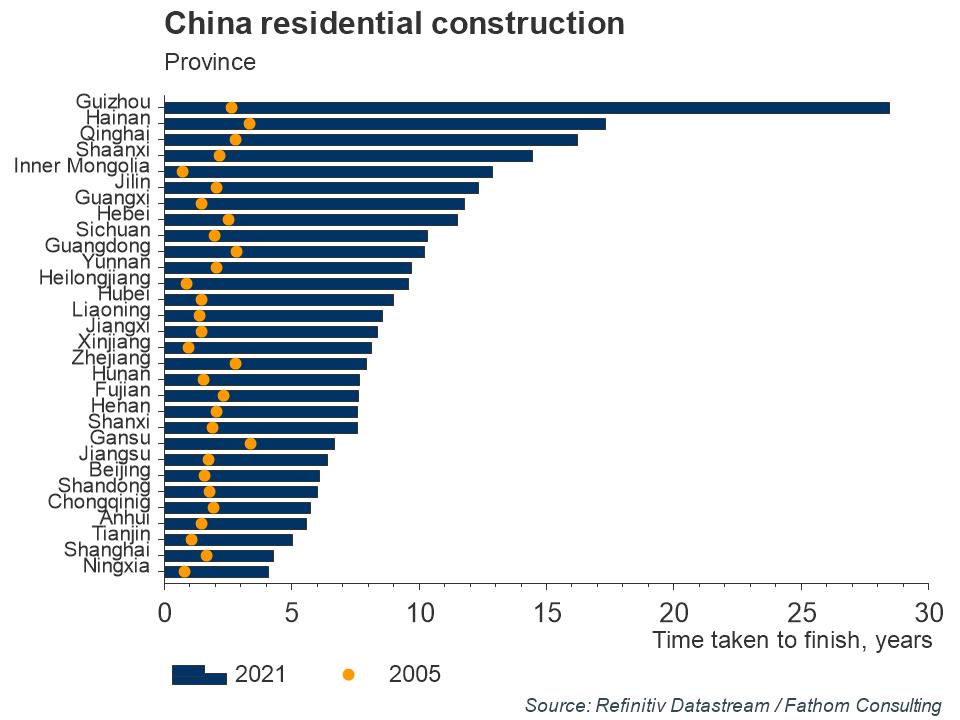

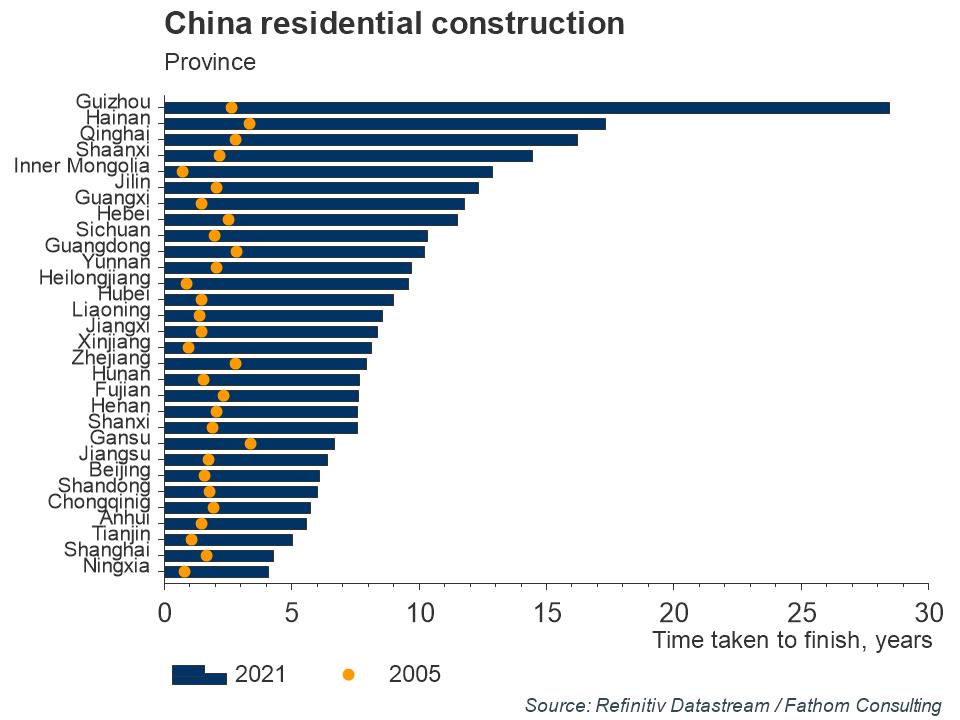

Recent events highlight the difficulty in smoothly bringing the housing sector back down to earth. Many of the issues afflicting the housing market could even be worse than they appear on the surface. For example, we have long argued that the authorities have controlled the supply of residential properties coming onto the market in order to prop up prices.

This includes mothballing properties in the construction phase, as well as failing to declare them as ‘vacant’ even when they are complete. As a result, floor space under construction has soared and the average time to finish residential construction has increased from around 3 years in 2009 to 8 years in 2021 (the decline in 2021 reflects a sharp rise in completions). The increase has occurred across all regions, but has been particularly marked in some. The upshot is that properties listed as being ‘under construction’, as well as ‘vacant’, should be considered when monitoring overcapacity in China’s housing market.

Refresh this chart in your browser | Edit the chart in Datastream

Refresh this chart in your browser | Edit the chart in Datastream

Refresh this chart in your browser | Edit the chart in Datastream

The various authorities in China have taken measures to try to support the housing market in recent quarters, although the easing has been rather measured so far. The central government is trying to walk a fine line between stabilising housing activity and avoiding the risk of reinflating bubbles. In the release of his annual government work report on Saturday, as part of the annual ‘Two Sessions’ parliamentary gatherings, Premier Li Keqiang announced a 2022 growth target of “around 5.5%”, slightly higher than the ‘above 5%’ many had assumed. Unlike 2021, this is not an easy target to hit, particularly given the increasingly challenging external backdrop. As a result, one suspects that further easing on the housing front is in store over coming months, as we previously argued in our 2022 Q1 Global Economic and Markets Outlook.

[1] China banking regulator says property market is biggest ‘grey rhino’ | Reuters

[2] This statistic is even more striking once you consider that China’s population in 1950, 1960 and 1970 was around 39%, 47% and 59% of its current size respectively.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.