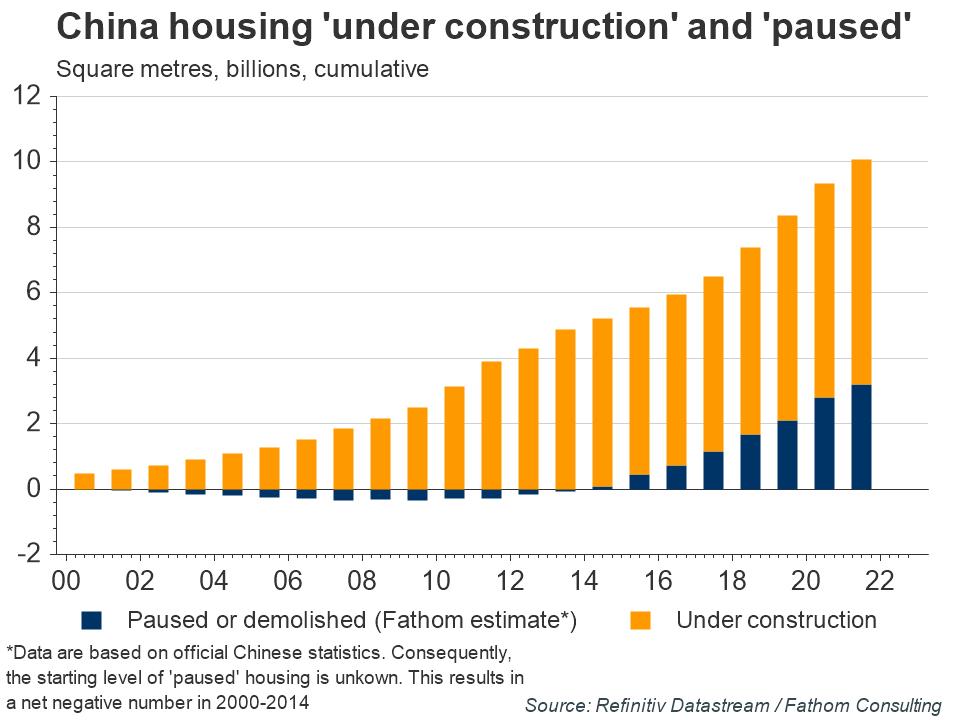

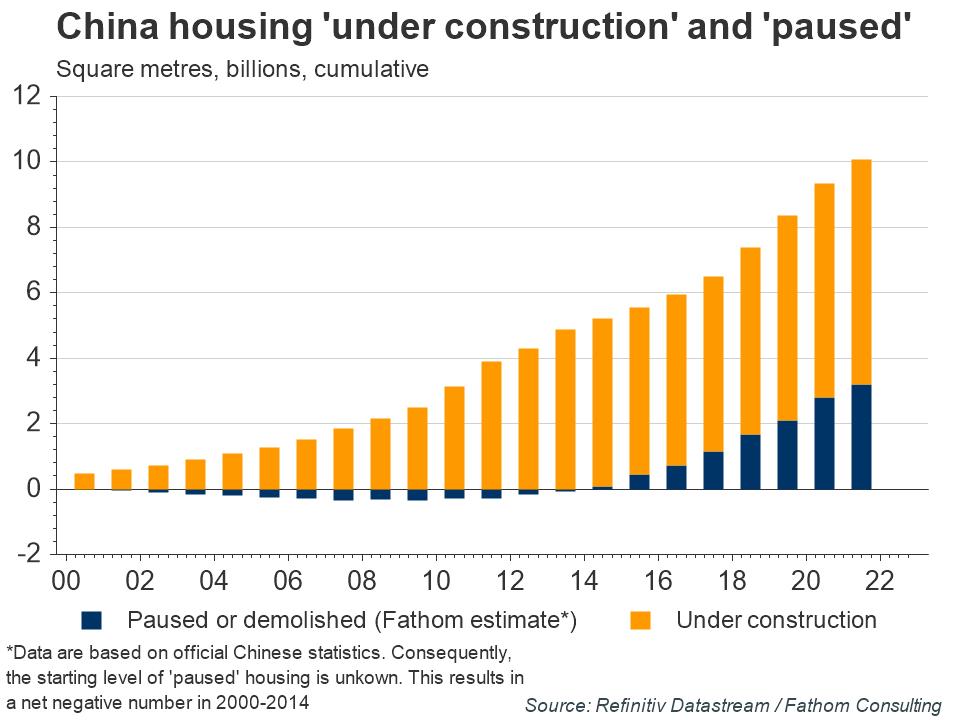

China has a housing problem. In some urban areas, house price to household income ratios are now as high as 18:1. In contrast, the house price-to-income ratio across the US is around 3:1. The answer to China’s housing problem should be simple (build more houses) — and yet it is not. Bizarrely, while there are plenty of construction projects in China, not enough of them are being completed. Indeed, Fathom estimates that the stock of housing currently under construction or paused (including those demolished) would ensure sufficient accommodation to house more than 200 million people. This is roughly equivalent to the population of Brazil. Why not finish them and declare them vacant and ready for sale? The answer is simple — if they released these additional homes on to the market, the boost to supply would crash house prices and place significant stress upon developers, mortgage holders and banks.

Refresh this chart in your browser | Edit the chart in Datastream

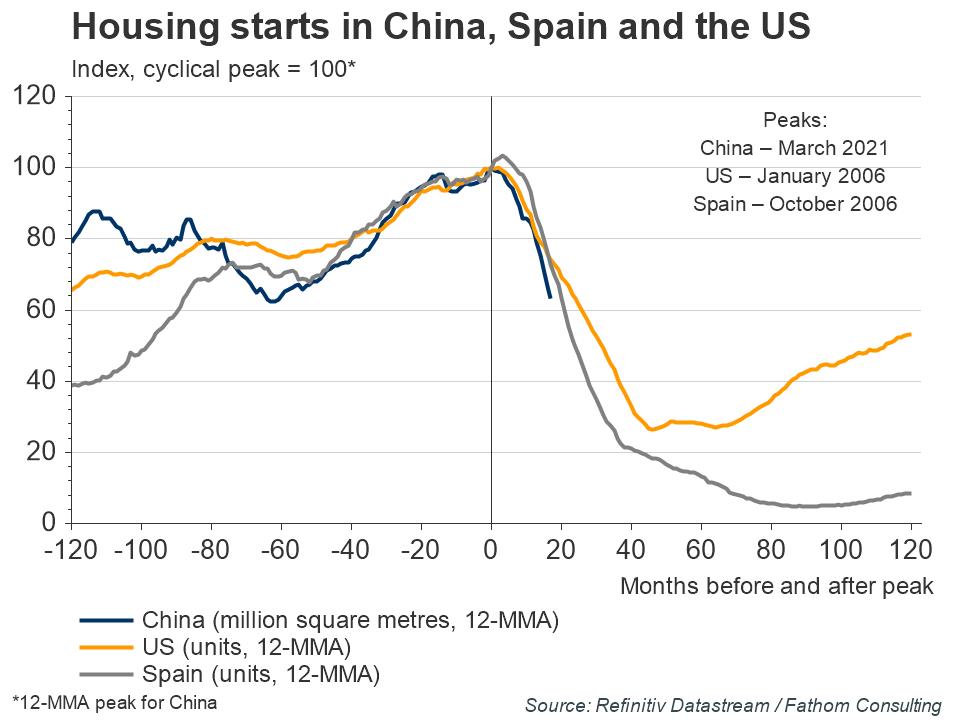

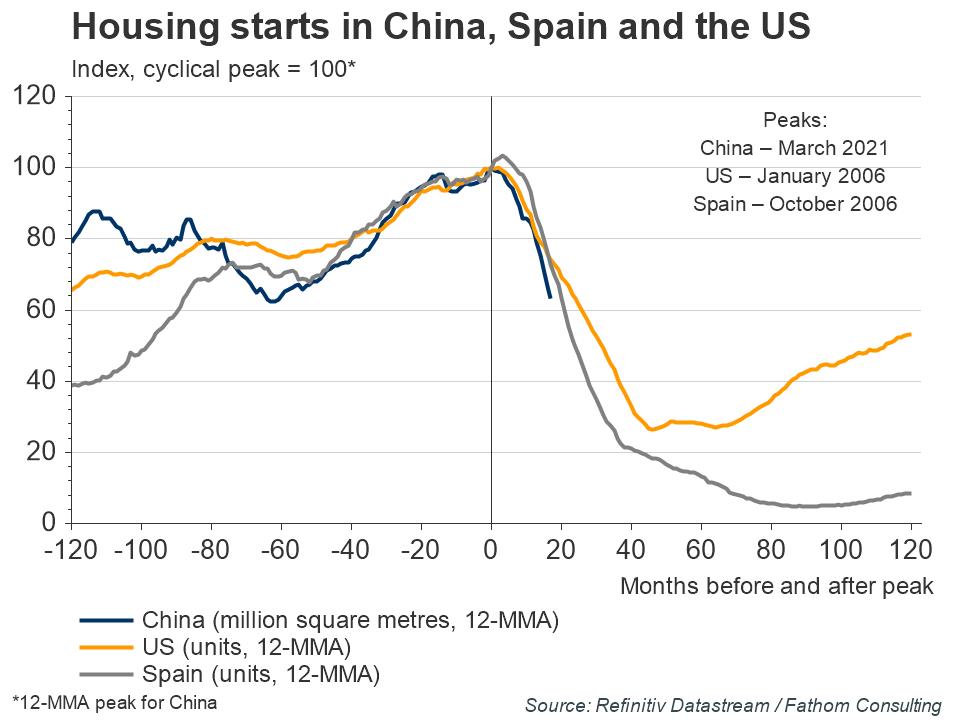

Policymakers are aware of the issues in the housing market but, fearing the impact on the wider economy, have traditionally been reluctant to address them. That low key stance on the housing market appeared to change in the run-up to Xi Jinping’s expected third term as President. Regulations such as the ‘three red lines’, and Beijing’s decision to let the troubled property developer Evergrande fail, reflect this new, tougher stance. Even so, the plan is not to burst the housing bubble (which would undermine the government’s implicit guarantee, both for that sector and the wider economy), but simply to slow the rate at which it continues to expand. Managing this successfully was always going to be a difficult juggling act. Given the recent steep decline in new construction projects, with housing starts down 37% year-to-date, it is easy to draw comparisons between the current situation and the onset of previous housing market crashes in the US and Spain.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

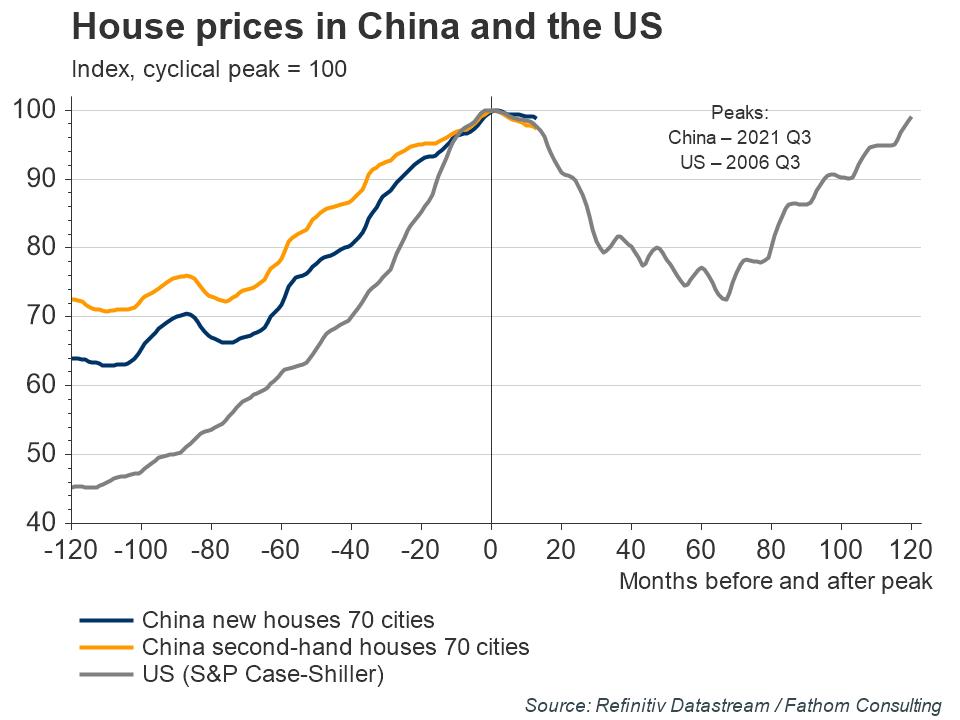

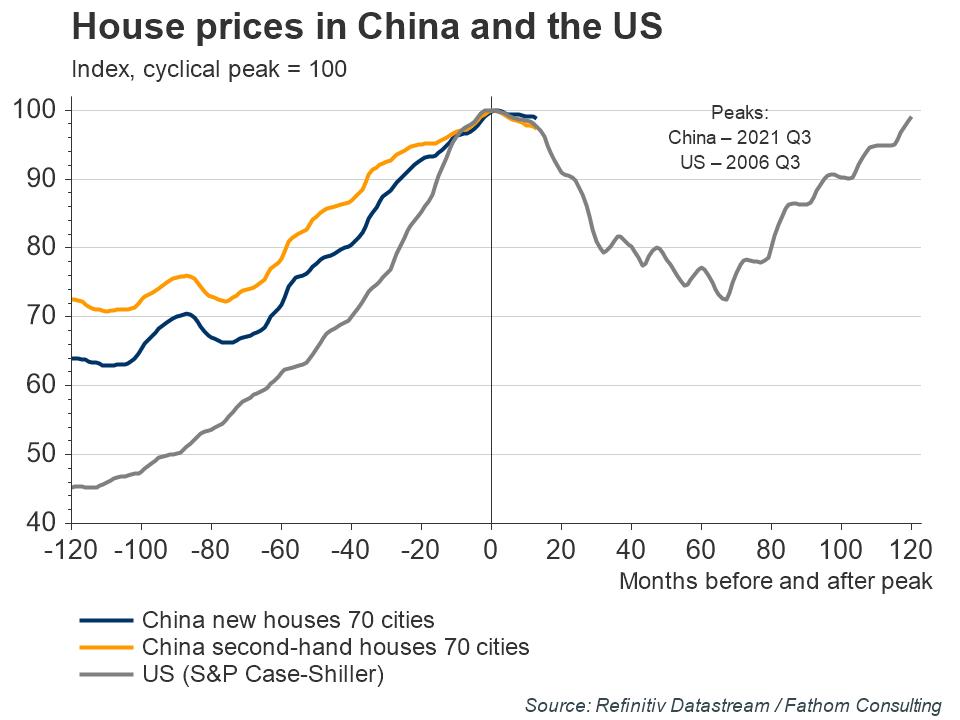

Where China stands apart from those previous crises is in terms of house prices, which remain broadly flat. This has partly been achieved by reducing the number of residential construction projects that reach completion (they are down more than 20% in the year to date). Whether this will be sufficient to prevent prices falling more dramatically remains to be seen.

Refresh this chart in your browser | Edit the chart in Datastream

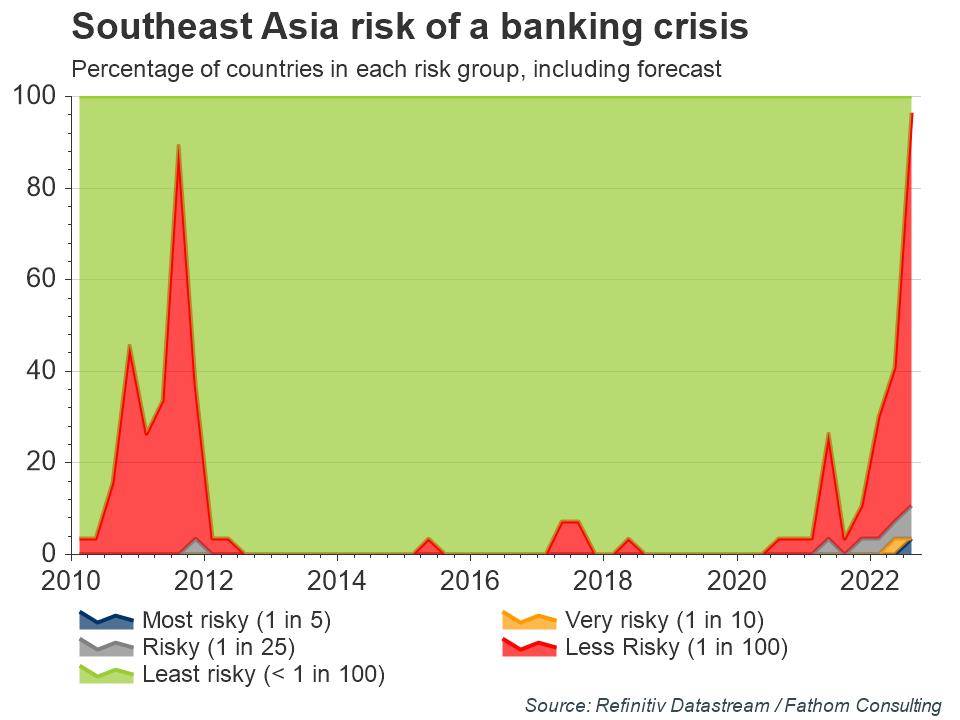

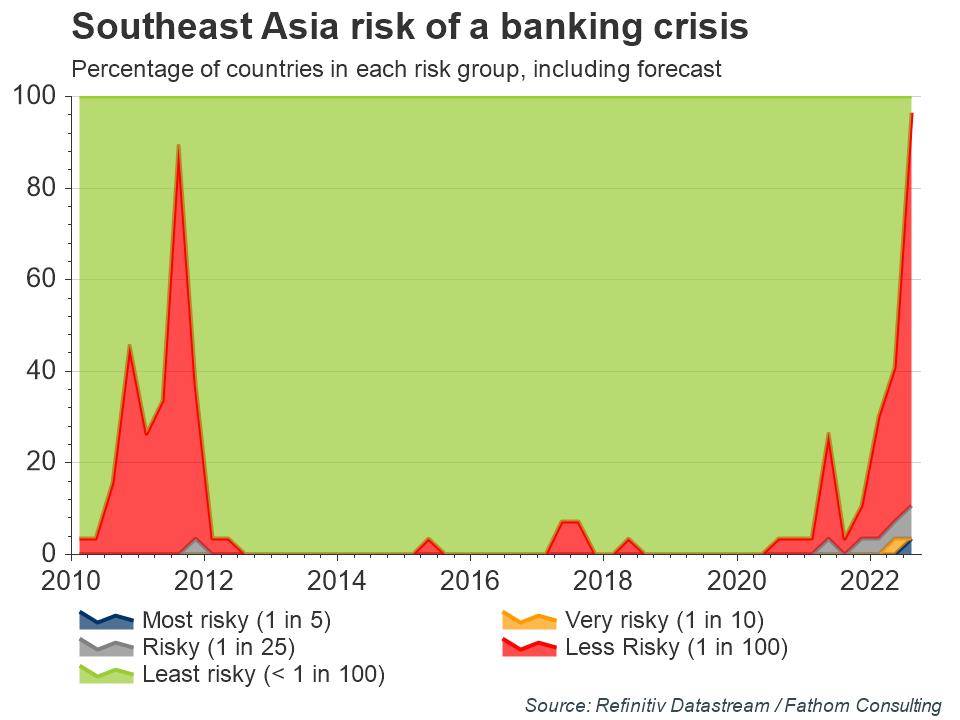

The big question now is whether the issues in China’s housing sector will spill over into other sectors of the economy, especially banking. So far, recent debt defaults among the nation’s largest companies have remained highly concentrated in the construction sector — even more so than normal — with little suggestion that trouble may spread. But that does not mean that contagion can be ruled out. Indeed, consumer confidence and spending plans have collapsed at a remarkable rate, as elevated house prices mean households are highly exposed to adverse outcomes in the real estate sector.

Refresh this chart in your browser | Edit the chart in Datastream

So, what are the odds that these troubles will spill over into the banking sector? Banking FVI scores are elevated globally, and the picture in China is no different — the odds of a crisis are at their highest since before 2010. Indeed, given the malign international backdrop, the attempted clampdown on the housing sector looks somewhat akin to poking a bear in the eye with a pointy stick. As a result, Fathom’s latest quarterly outlook[1] assumes a 15% likelihood of a banking crisis erupting in China.

Refresh this chart in your browser | Edit the chart in Datastream

The economic costs of banking crises tend to be large, with recessions typically L-shaped (that is to say, there is a deep initial negative shock, followed by persistently lower growth rates for many years after the initial shock has passed). Consequently, the impact of a banking crisis in China is likely to be very large — Fathom estimates that the typical loss in output following a banking crisis reaches as much as 10% after three years. This is responsible for the very pronounced downside skew to Fathom’s fan chart for Chinese GDP.[2]

[1]. Charts from Fathom’s Global Outlook, Autumn 2022 are available now for all Refinitiv users via Chartbook’s Global Overview folder.

The views expressed in this article are the views of the author, not necessarily those of Refinitiv Lipper or LSEG.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

_________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.