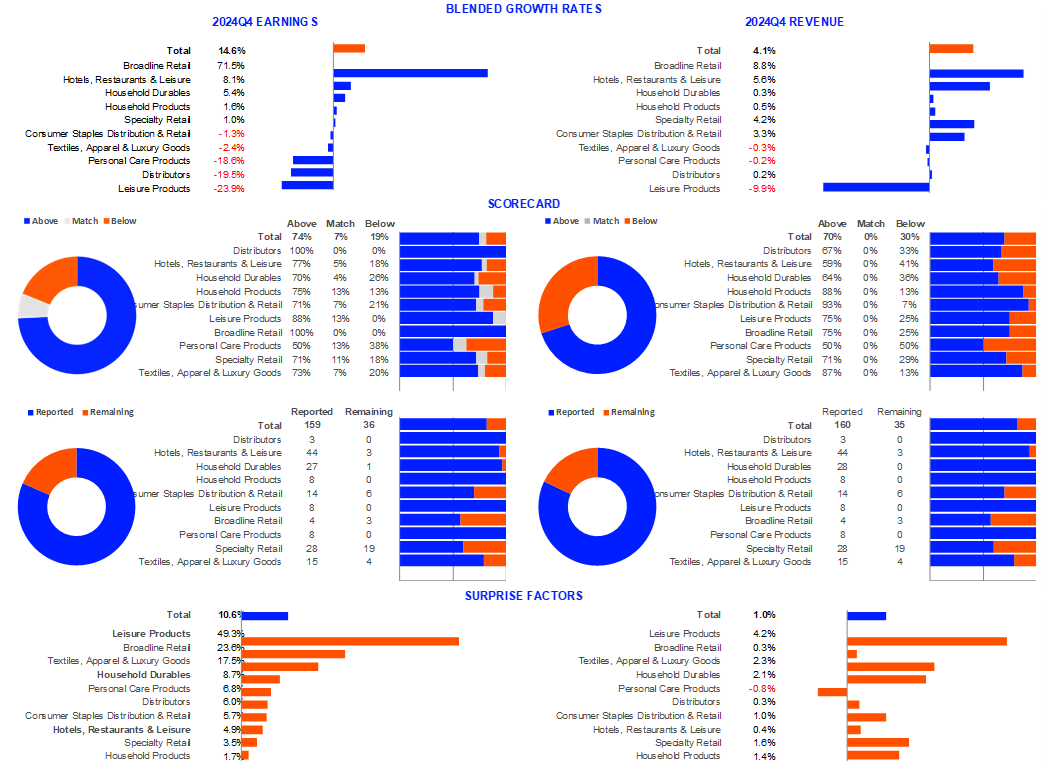

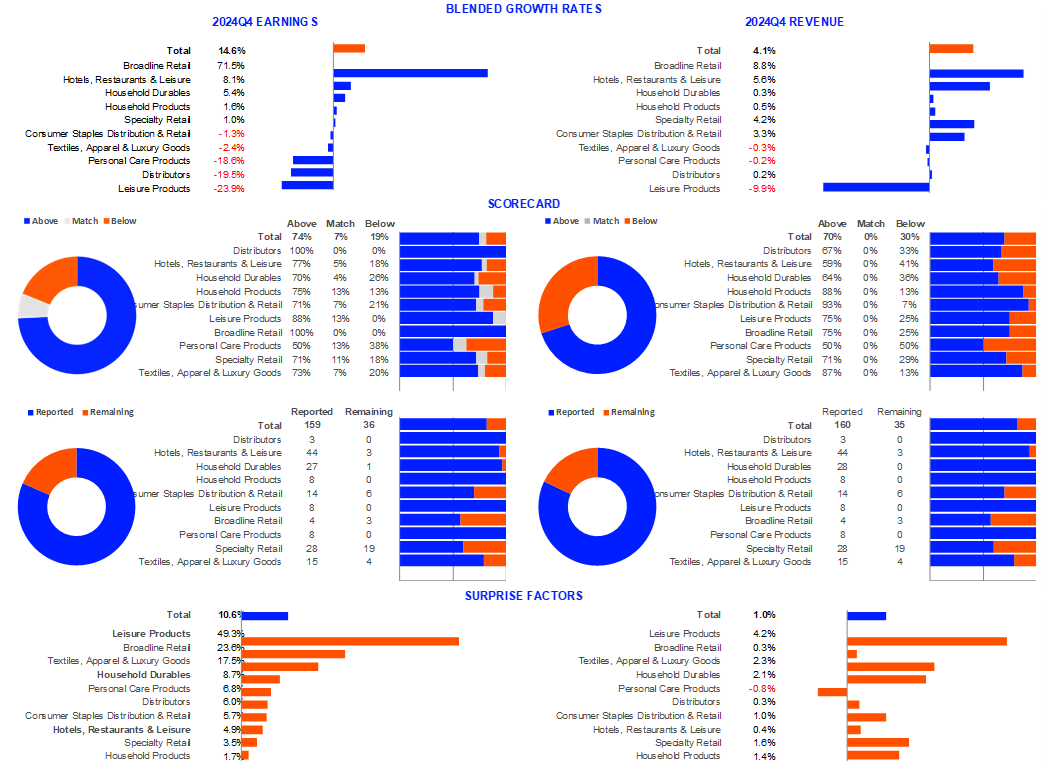

To date, 159 of the 195 companies in our Retail/Restaurant Index have reported their EPS results for Q4 2024, representing 82% of the index. Of those companies that have reported their quarterly results, 74% announced profits that beat analysts’ expectations, while 7% delivered on-target results and 19% reported earnings that fell below estimates. The Q4 2024 blended earnings growth estimate now stands at 14.6%.

The blended revenue growth estimate for the 159 companies in this index is 4.1% for Q4 2024. Of those companies that have reported their quarterly results so far, 70% announced revenue that exceeded analysts’ expectations and the remaining 30% reported that their revenue fell below analysts’ forecasts.

Exhibit 1: LSEG Earnings Dashboard

Source: LSEG I/B/E/S

This week in retail

Target exceeded expectations in Q4, reporting stronger-than-anticipated earnings, revenue, and same-store sales (SSS) growth. Similar to Walmart, Target noted a slow start to the year. Teen retailer Abercrombie &Fitch also had a strong holiday season, continuing a trend of seven consecutive quarters of double digit comps. However, Abercrombie shares fell due to cautious guidance for 2025. Foot Locker also issued a warning, stating that profits will face pressure this year, as consumers grapple with higher prices and elevated debt levels.

Meanwhile, during its earnings call, Best Buy cautioned about rising costs, with China and Mexico remaining the primary sources for its products. Best Buy stated that while they only directly import “2% to 3% of our overall assortment, we expect our vendors across our entire assortment will pass along some level of tariff costs to retailers, making price increases for American consumers highly likely.” (Source: LSEG Events, Best Buy Q4 2025 Earnings Call)

Department stores Macy’s and Kohl’s are expected to report Q4 2024 financial results soon, although both have been struggling for some time. Based on our StarMine models, both retailers score 19 or lower on the Price Momentum Model (PriceMo), indicating that price stock momentum remains negative and the stock price is likely to continue its downward trend (Exhibit 2).

Furthermore, according to StarMine, the negative outlook may persist. A majority of department stores are in the bottom tertile of the Analyst Revisions Model (ARM), suggesting that analysts are bearish and lowering earnings estimates for the quarter.

Additionally, both Macy’s and Kohl’s rank in the bottom quartile for the StarMine Smart Holdings and Short Interest models (Exhibit 2). With Kohl’s and Macy’s scoring 1 and 23 out of 100 on the Short Interest Model, it is evident that investors are betting against these companies. Buy-side analysts are also becoming increasingly bearish, as reflected in the StarMine Smart Holdings Model, which highlights growing investor concerns.

Exhibit 2: Kohl’s and Macy’s StarMine Model Scores

Source: LSEG Workspace

Here are the Q4 2024 earnings and same store sales estimates for the companies reporting this week:

Exhibit 3: Same Store Sales and Earnings Estimates – Q4 2024

Source: LSEG I/B/E/S

Source: LSEG I/B/E/S

Guidance

So far, 159 retailers have reported Q4 2024 earnings; About 56% of retailers have also discussed the impact of tariffs. Retailers are also warning about slow start to the year, and concerns about higher prices, challenging macroeconomic conditions and a cautious consumer as contributing factors.

Looking ahead to Q1 2025, 24 retailers issued negative preannouncements, while two issued positive EPS guidance so far (Exhibit 4). Of those retailers offering revenue guidance, 29 warned of disappointing results, while only two said revenue might be better than previously expected.

Exhibit 4: Earnings and Revenue Guidance: Q1 2025

Source: LSEG I/B/E/S

Retail outlook: 2025

Although the bulk of retailers are beating Q4 earnings and had a robust holiday sales season, they are cautioning about the outlook for 2025.

Looking ahead, retailers are cautioning that they might face an even more frugal consumer this year. Many have concerns around tariffs, higher prices, challenging macroeconomic condition, and a cautious consumer as contributing factors. Consequently, the LSEG Retail/Restaurant Index is projecting weaker consumer spending in the first half of the year (Exhibit 5). The Q4 2024 blended earnings growth estimate now stands at a robust 14.6%, but is expected to drop to 3.0% in Q1 2025.

Exhibit 5: LSEG Retail/Restaurant Index Earnings Growth Rates: Q4 2024 Est – Q4 2025 Est

Source: LSEG I/B/E/S

Discounting data

Retailers also report that consumers are waiting for promotional events to purchase discretionary items. Strong holiday promotions in November and December helped boost the holiday shopping season. As a result, the bulk of retailers are beating their Q4 2024 financial results. However, they are warning of a slower than usual start of the year. This is also evident in the discounting data.

The discount penetration (how much of the assortment is on sale) dropped to its lowest level in January this year, as consumers took a break from the holiday shopping months and held back on discretionary items (Exhibit 6). This trend was identified through a collaboration between LSEG and Centric Market Intelligence, which analyzes retailers, brands, online trends, and products globally. Although the discount penetration has risen since then, it remains below the 34% average that prevailed in 2024.

Exhibit 6: Average Discount Penetration: U.S. Online Retailers

Source: Centric Market Intelligence

Similarly, the average percent discount in March is also below last year’s average of 36%.

Exhibit 7: Average Discount: U.S. Online Retailers

Source: Centric Market Intelligence

Source: Centric Market Intelligence