November 2020 was another positive month for the European fund industry since the mutual fund promoters enjoyed inflows (+€74.7 bn). Meanwhile, the market environment has become quite uncertain as the second wave of the COVID-19 pandemic hit major markets in Europe and investors feared a second coronavirus lockdown-induced economic downturn. Despite these fears, investors bought into risk assets as long-term funds enjoyed estimated net inflows of €67.4 bn while money market products had estimated inflows of €7.3 bn.

Equity funds (+€63.4 bn) were the best-selling asset type overall for November 2020. The category was followed by mixed-assets funds (+€77.6 bn) and bond funds (+€7.6 bn). On the other side of the table, real estate funds (-€0.1 bn), commodities funds (-€0.5 bn), “other” funds (-€1.9 bn), and alternative UCITS funds (-€8.6 bn) were facing outflows over the course of November.

These fund flows added up to overall estimated net inflows of €67.4 bn into long-term investment funds for November. ETFs contributed inflows of €17.6 bn to these flows.

Money Market Products

As the current market environment is still somewhat fragile, European investors put money into money market products. As a result, money market funds were the asset type with the fourth highest inflows for the month (+€7.3bn). Conversely, ETFs investing in money market instruments contributed estimated net outflows of €0.7 bn to the total compared to their actively managed peers.

This flow pattern led to estimated overall net inflows of €74.7 bn for November and overall estimated inflows of €449.7 bn year to date.

Money Market Products by Sector

Money Market EUR (+€7.0 bn) was the best seller within the money market segment, followed by Money Market GBP (+€6.0 bn) and Money Market SGD (+€0.1 bn). At the other end of the spectrum, Money Market USD (-€4.5 bn) suffered the highest net outflows in the money market segment, bettered by Money Market Global (-€0.7 bn) and Money Market CHF (-€0.4 bn).

Comparing this flow pattern with the flow pattern for September revealed that European investors sold further amounts of the U.S. dollar while buying back into the pound sterling and building up their position in the euro further. In conjunction with the asset allocation decisions of portfolio managers, these shifts might have also been caused by corporate actions such as cash dividends or cash payments since money market funds are also used by corporations as replacements for cash accounts.

Graph 1: Estimated Net Sales by Asset Type, November 2020 (Euro Billions)

Source: Refinitiv Lipper

Fund Flows by Sectors

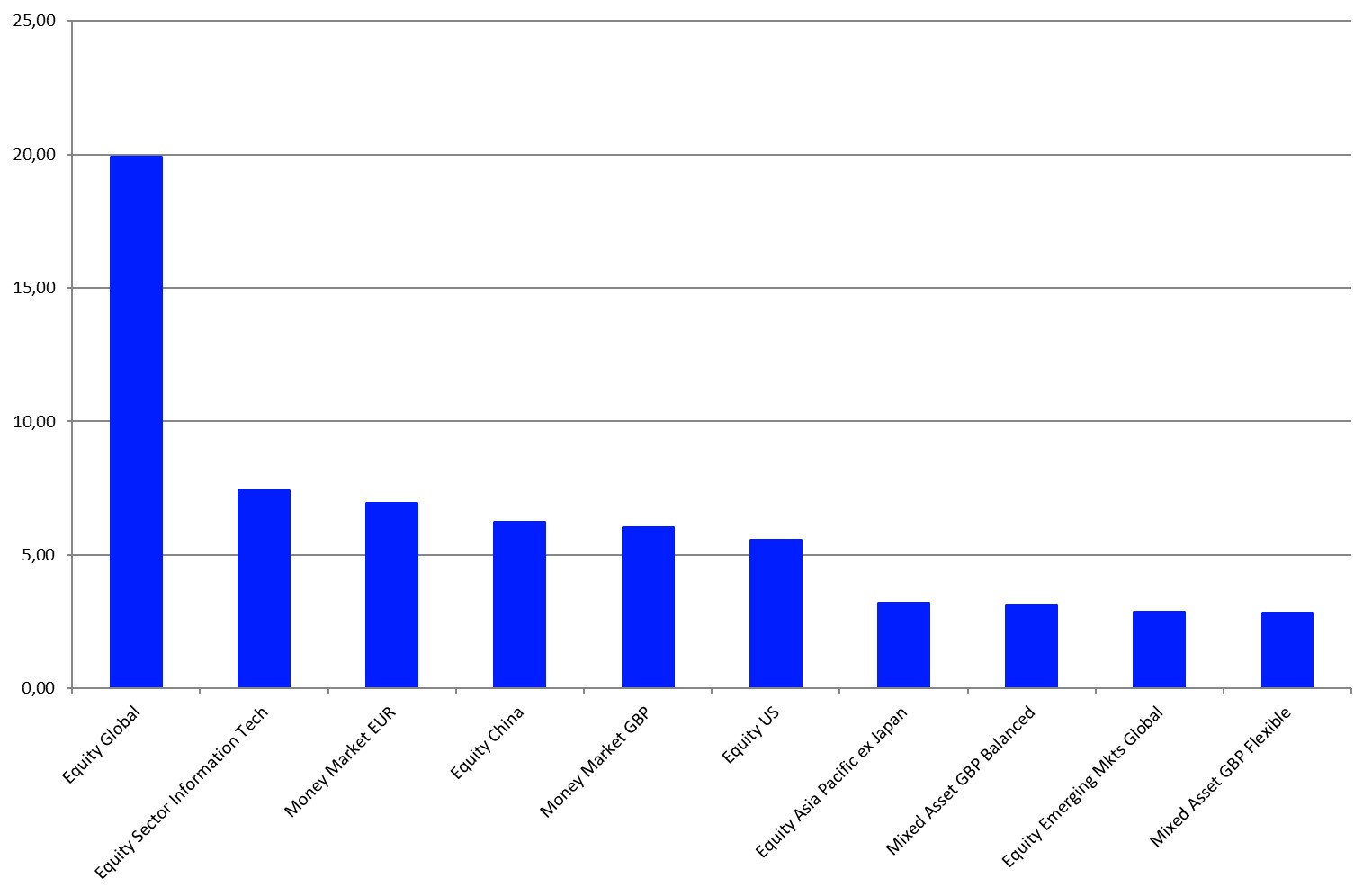

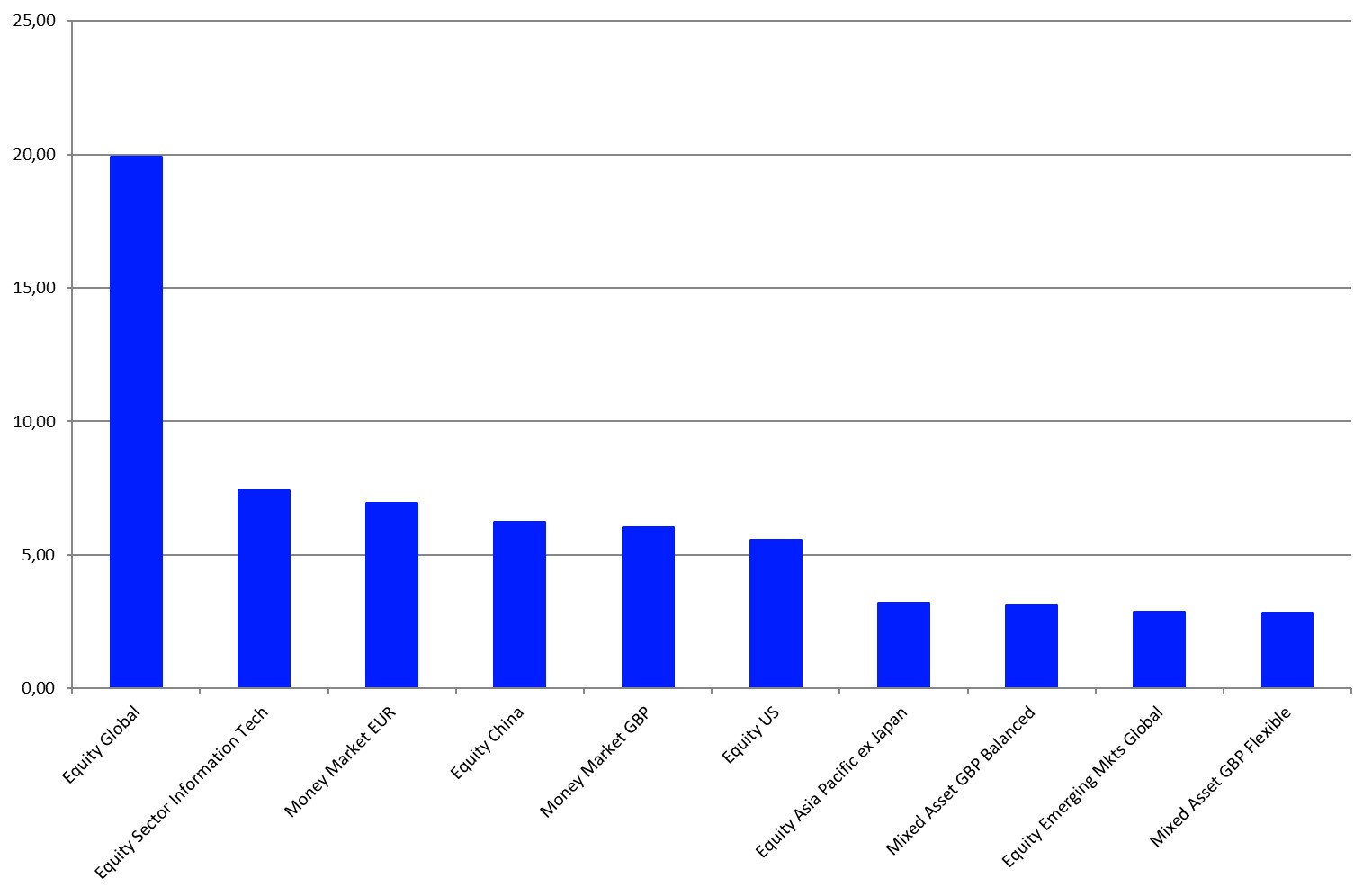

Equity Global (+€19.9 bn) was once again the best-selling sector in the segment of long-term mutual funds, far ahead of Equity Sector Information Technology (+€7.4 bn). Equity China (+€6.3 bn) was the third best-selling long-term sector, followed by Equity US (+€5.6 bn) and Equity Asia Pacific ex-Japan (+€3.2 bn).

Graph 2: Ten Top Sectors, November 2020 (Euro Billions)

Source: Refinitiv Lipper

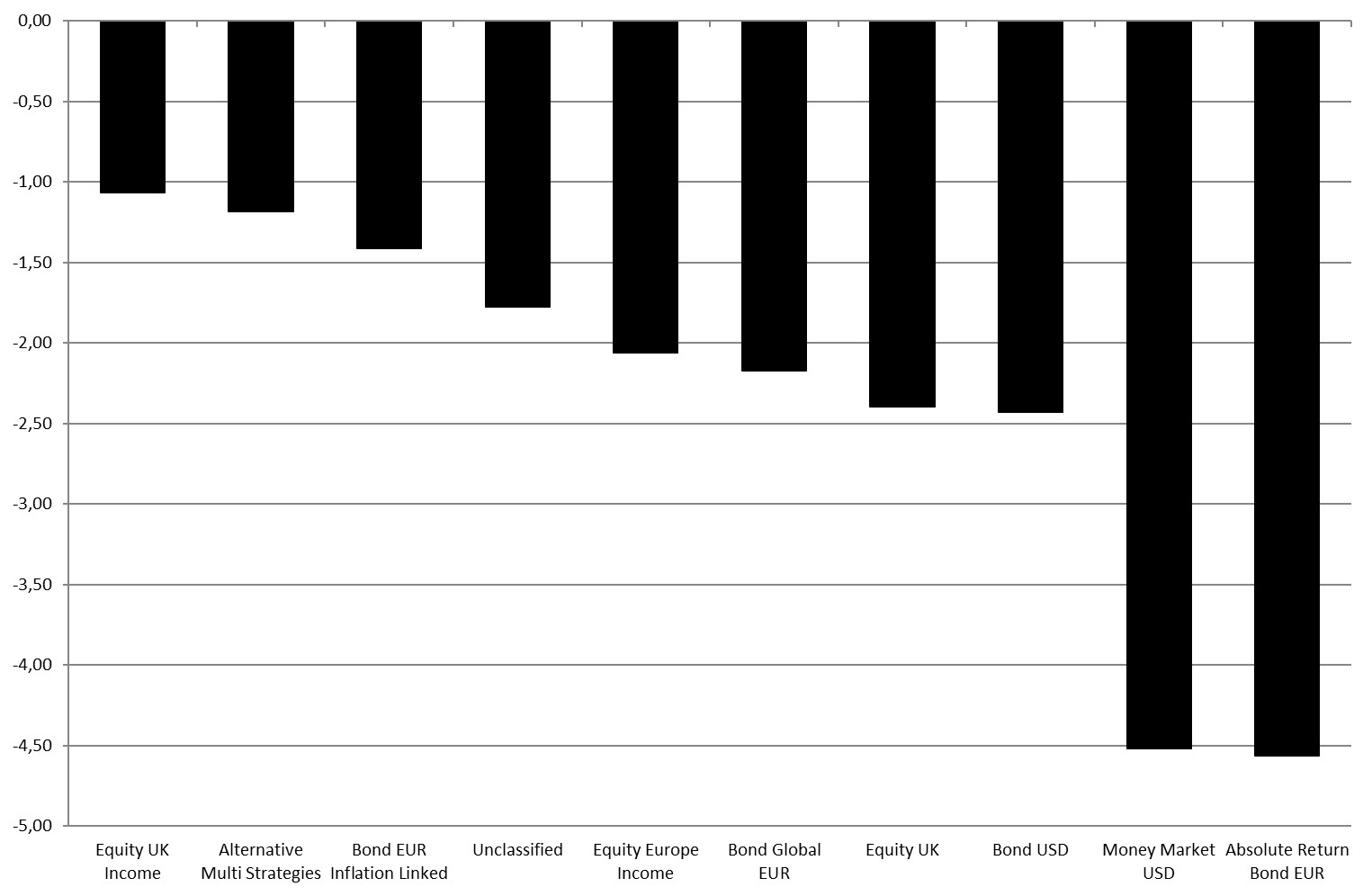

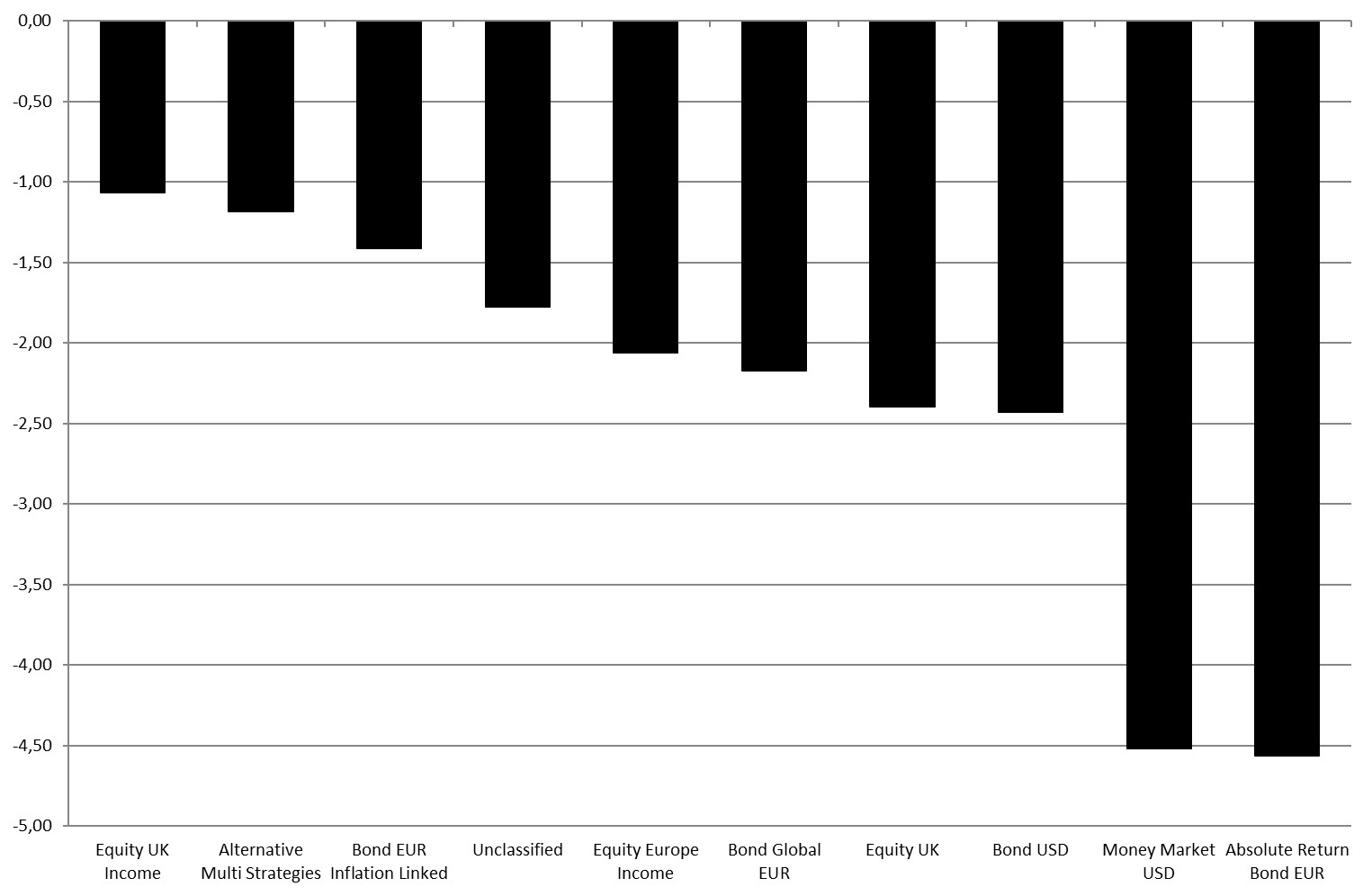

At the other end of the spectrum, Absolute Return Bond EUR (-€4.6 bn) suffered the highest net outflows in the segment of long-term funds, bettered by Bond USD (-€2.4 bn), Equity UK (-€2.4 bn), Gond Global EUR (-€2.2 bn), and Equity Europe Income (-€2.1 bn).

Graph 3: Ten Bottom Sectors, November 2020 (Euro Billions)

Source: Refinitiv Lipper

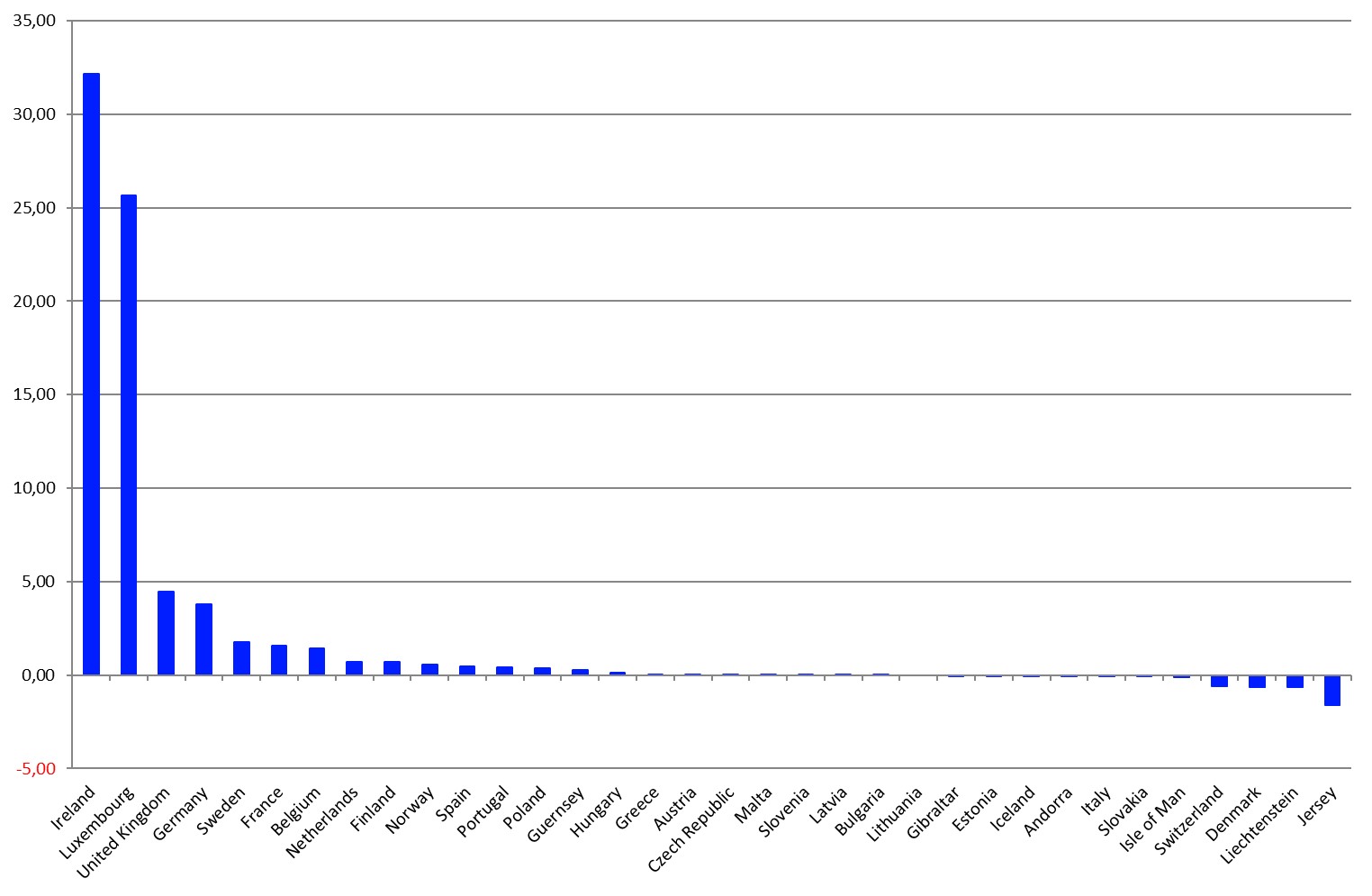

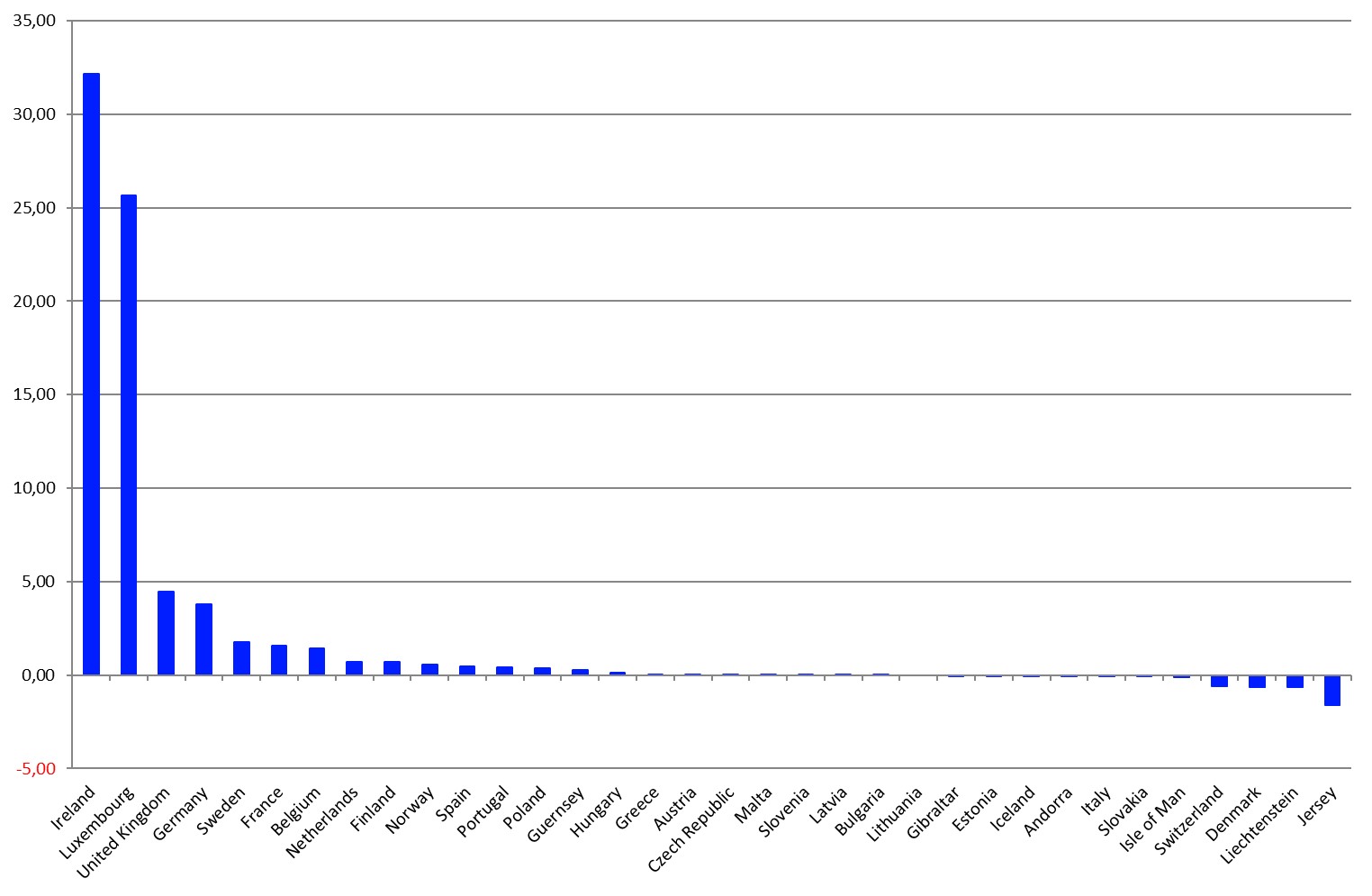

Fund Flows by Markets (Fund Domiciles)

Single-fund domicile flows (including those to money market products) showed, in general, a positive picture during November. Twenty-two of the 34 markets covered in this report showed estimated net inflows, and 12 showed net outflows. Ireland (+€32.2 bn) was the fund domicile with the highest net inflows, followed by Luxembourg (+€25.6 bn), the U.K. (+€4.4 bn), Germany (+€3.8 bn), and Sweden (+€1.8 bn). On the other side of the table, Jersey (-€1.6 bn) was the fund domicile with the highest outflows, bettered by Liechtenstein (-€0.7 bn) and Denmark (-€0.6 bn). It is noteworthy that the fund flows for France (+€10.0 bn), Ireland (+€8.5 bn), and Luxembourg (-€9.7 bn) were impacted by flows in the money market segment.

Graph 4: Estimated Net Sales by Fund Domiciles, November 2020 (Euro Billions)

Source: Refinitiv Lipper

Within the bond sector, funds domiciled in Ireland (+€3.6 bn) led the table, followed by Luxembourg (+€2.7 bn), the U.K. (+€0.8 bn), Spain (+€0.7 bn), and Switzerland (+€0.6 bn). Bond funds domiciled in France (-€1.6 bn), Belgium (-€0.2 bn), and Denmark (-€0.2 bn) were at the other end of the table.

For equity funds, products domiciled in Luxembourg (+€34.5 bn) led the table by far, followed by Ireland (+€18.2 bn), Germany (+€2.5 bn), Sweden (+€2.1 bn), and Belgium (+€1.9 bn). Meanwhile, the U.K. (-€1.1 bn), Liechtenstein (-€0.5 bn), and Jersey (-€0.2 bn) were the domiciles with the highest estimated net outflows from equity funds.

Regarding mixed-assets products, the U.K. (+€4.5 bn) was the domicile with the highest estimated net inflows for November, followed by Ireland (+€3.1 bn), Switzerland (+€0.6 bn), Germany (+€0.5 bn), and Belgium (+€0.4 bn). In contrast, Luxembourg (-€1.7 bn), France (-€0.7 bn), and Denmark (-€0.3 bn) were the domiciles with the highest estimated net outflows from mixed-assets funds.

Liechtenstein (+€0.03 bn) was the domicile with the highest estimated net inflows into alternative UCITS funds for November, followed by Jersey (+€0.02 bn), and Finland (+€0.01 bn). Meanwhile, France (-€6.3 bn), the U.K. (-€0.5 bn), and Italy (-€0.4 bn) were at the other end of the table.

Fund Flows by Promoters

BlackRock (+€17.2 bn) was the best-selling fund promoter in Europe for November, ahead of Credit Mutuel (+€4.7 bn), State Street (+€4.2 bn), DWS Group (+€3.3 bn), and UBS (+€2.7 bn). It is noteworthy that the inflows of Credit Mutuel (+€4.7 bn) and State Street (+€2.6 bn) were impacted by flows into money market funds.

Table 1: Ten Best-Selling Promoters, November 2020 (Euro Billions)

Source: Refinitiv Lipper

Considering the single-asset classes, BlackRock (+€3.8 bn) was the best-selling promoter of bond funds, followed by Eurizon Capital (+€1.4 bn), JPMorgan (+€1.1 bn), BNP Paribas Asset Management (+€0.8 bn), and Candriam (+€0.6 bn).

Within the equity space, BlackRock (+€13.3 bn) led the table, followed by UBS (+€5.0 bn), DWS Group (+€3.8 bn), Amundi (+€2.4 bn), and JPMorgan (+€2.4 bn).

BlackRock (+€2.4 bn) was the leading promoter of mixed-assets funds in Europe, followed by Virgin (+€2.2 bn), Vanguard Group (+€0.8 bn), Flossbach von Storch (+€0.6 bn), and PIMCO (+€0.6 bn).

Credit Suisse Group (+€0.5 bn) was the leading promoter of alternative UCITS funds for the month, followed by Schroders (+€0.3 bn), Generali (+€0.3 bn), Nordea (+€0.3 bn), and GAM (+€0.2 bn).

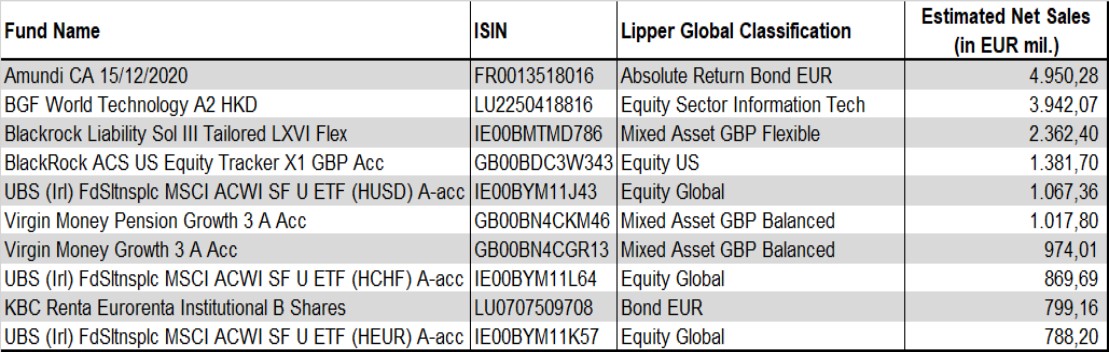

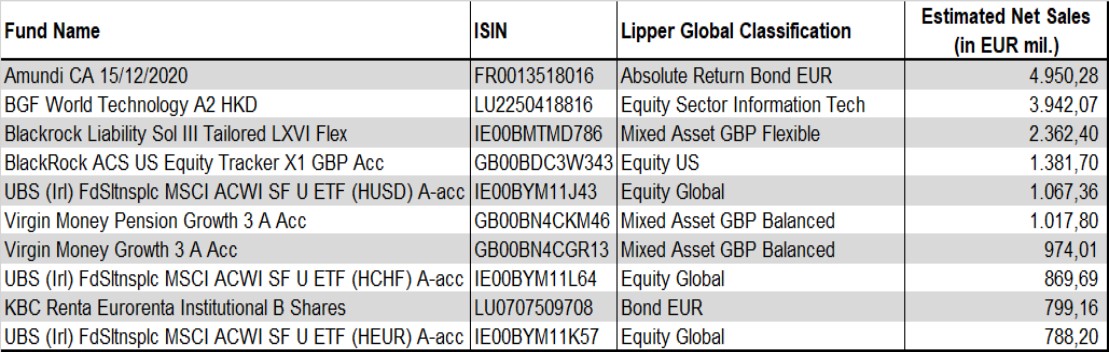

Best-Selling Funds

The 10 best-selling long-term funds, gathered at the share class level, experienced net inflows of €18.2 bn for November. The general fund-flows trend for the 10 best-selling funds was in line with the overall fund-flows trend in Europe as equity funds dominated the ranks of asset types with regard to the 10 best-selling funds (+€8.0 bn), followed by bond funds (+€5.7 bn) and mixed-assets funds (+€4.4 bn). Amundi CA 15/12/2020 (+€5.0 bn) was the best-selling fund share class for November.

Table 2: Ten Best-Selling Long-Term Funds, November 2020 (Euro Millions)

Source: Refinitiv Lipper

Refinitiv Lipper delivers data on more than 330,000 collective investments in 113 countries. Find out more.

The views expressed are the views of the author and not necessarily those of Refinitiv. This material is provided as market commentary and for educational purposes only and does not constitute investment research or advice. Refinitiv cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned. Please consult with a qualified professional for financial advice.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.