European investors in general were further in a risk-on mode over the course of the year 2021 as equity funds were the best-selling asset type for the year. In fact, the European fund industry enjoyed record inflows (€724.1 bn) over the course of 2021 despite the unclear economic situation caused by the ongoing COVID-19 pandemic, disruptions in the delivery chains of some industry sectors, and steadily rising inflation.

That said, it is remarkable that 2021 was the second year in a row during a global crisis in which the European fund industry enjoyed record inflows. These strong inflows are somewhat surprising, since companies and investors had to weather the uncertainty and impacts caused by the COVID-19 pandemic, which should have led under normal circumstances to a more cautious behavior from investors. Therefore, it can be assumed that the massive financial and fiscal actions taken by governments and central banks around the globe have boosted the confidence of investors to stay in a risk-on mode.

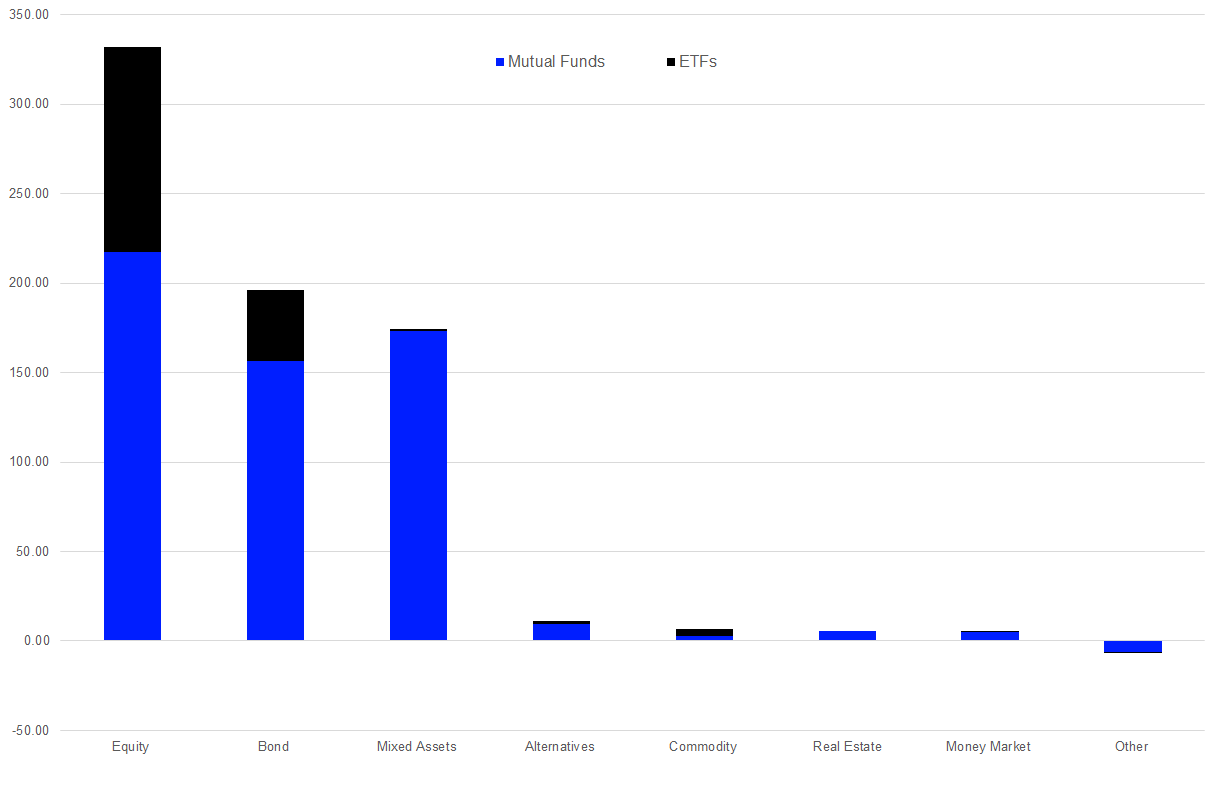

In more detail, the majority of the fund flows for 2021 (+€563.2 bn) were invested into mutual funds, while ETFs enjoyed inflows of €160.9 bn over the course of the year 2021. Despite the fact that the majority of the flows for 2021 were invested in mutual funds, ETFs also reached record inflows over the course of 2021 as the inflows at the end of the year topped the all-time high for annual flows into ETFs in Europe from 2019, which stood at €106.7 bn, by €54.2 bn.

As said before, European investors were in risk-on mode over the course of 2021 since long-term investment products (€718.9 bn) enjoyed way higher estimated inflows than money market funds (+€5.2 bn).

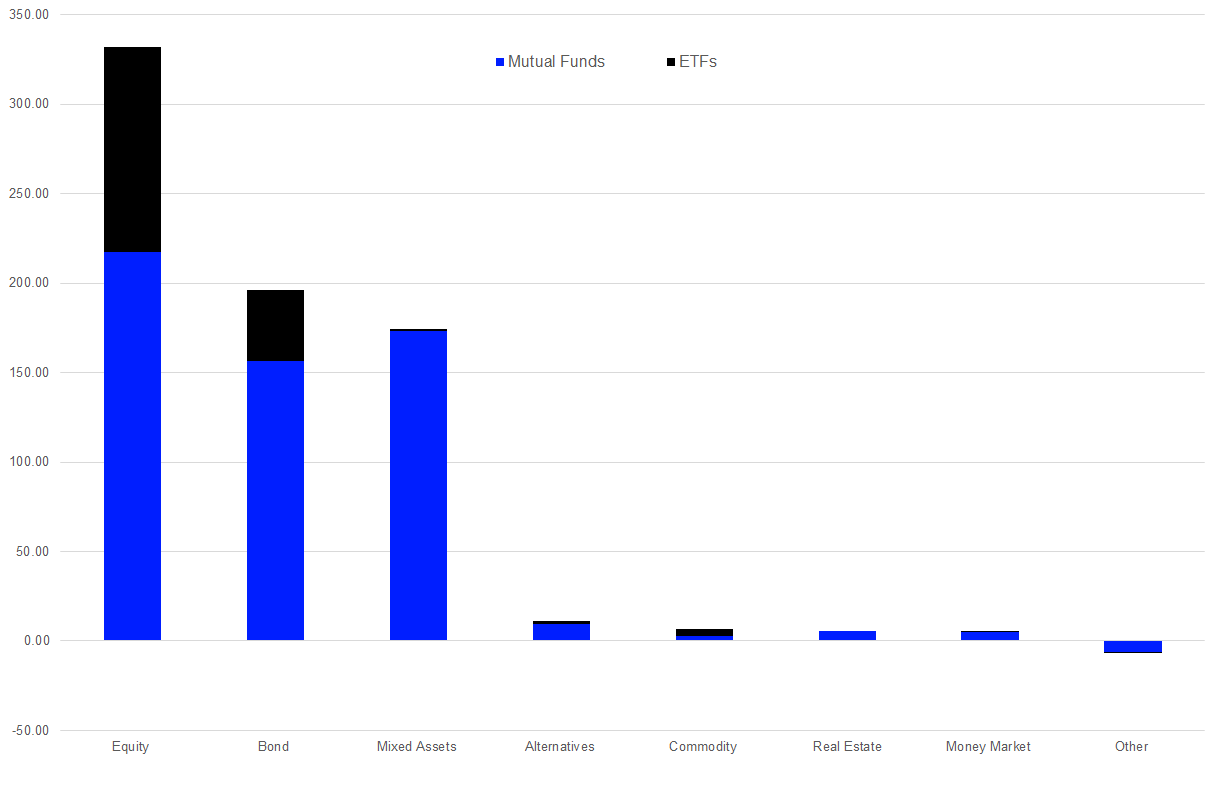

Taking a closer look, equity funds (+€331.7 bn) were the asset type with the highest estimated net inflows overall for 2021. It is followed by bond funds (+€195.9 bn), mixed-assets funds (+€174.2 bn), alternative UCITS funds (+€11.4 bn), commodities funds (+€6.7 bn), real estate funds (+€5.5 bn), and money market funds (-€5.2 bn). Meanwhile, “other” funds (-€6.5 bn) were the only asset type that faced outflows for the year.

Graph 1: Estimated Net Sales by Asset and Product Type, January 1 – December 31, 2021 (Euro Billions)

Source: Refinitiv Lipper

Money Market Products

With a market share of 10.06% of the overall assets under management in the European fund management industry, money market products are the fourth largest asset type. Therefore, it is worthwhile to briefly review the trends in this market segment. As the market environment was rather uncertain with the exacerbating situation around the COVID-19 pandemic, it was somewhat surprising that European investors increased their money market positions only slightly over the course of the year. Money market funds enjoyed inflows for the year (+€5.2 bn). In line with their active peers (+€4.9 bn), ETFs investing in money market instruments contributed estimated net inflows of €0.4 bn to the total.

Money Market Products by Lipper Global Classification

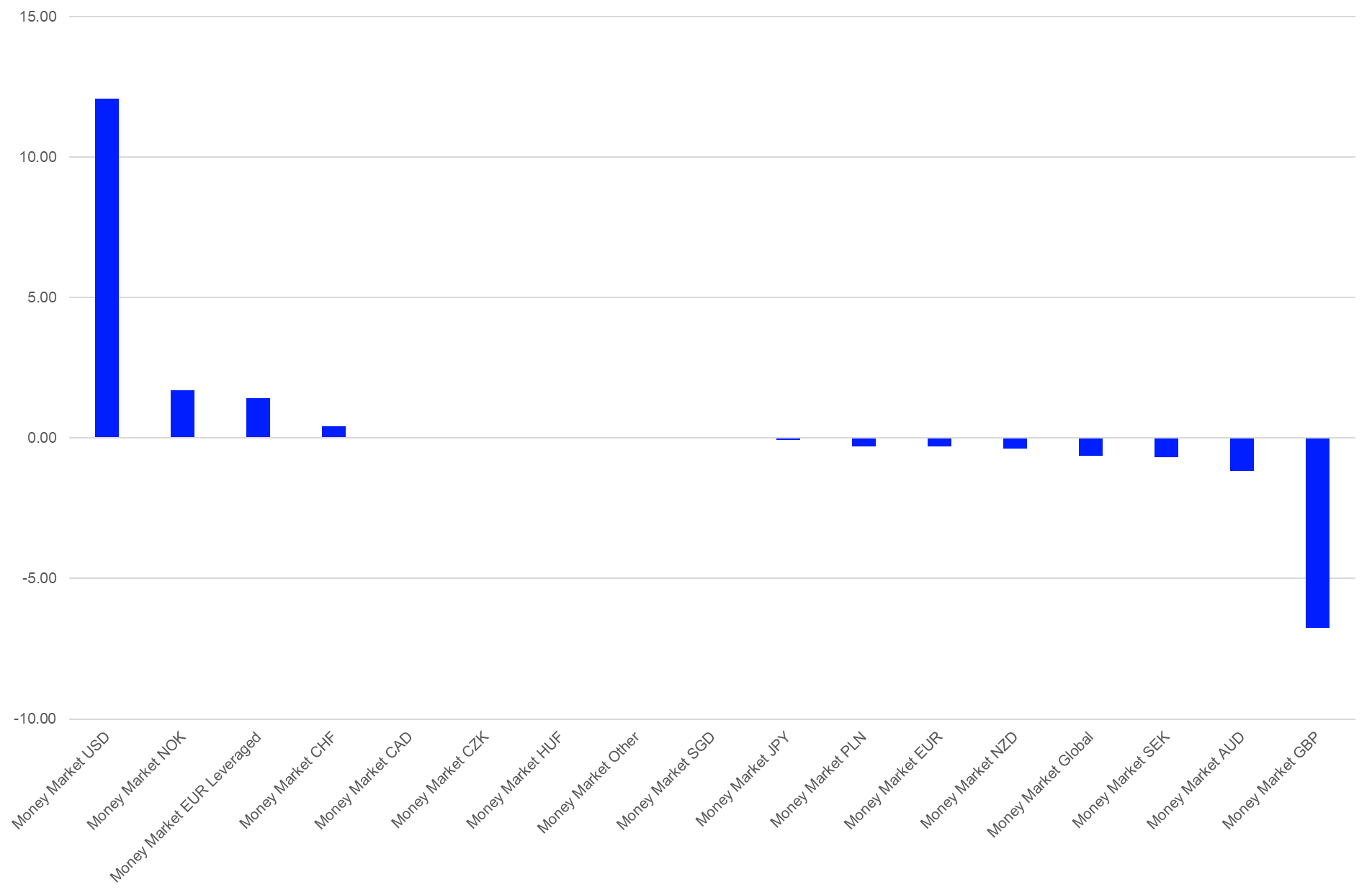

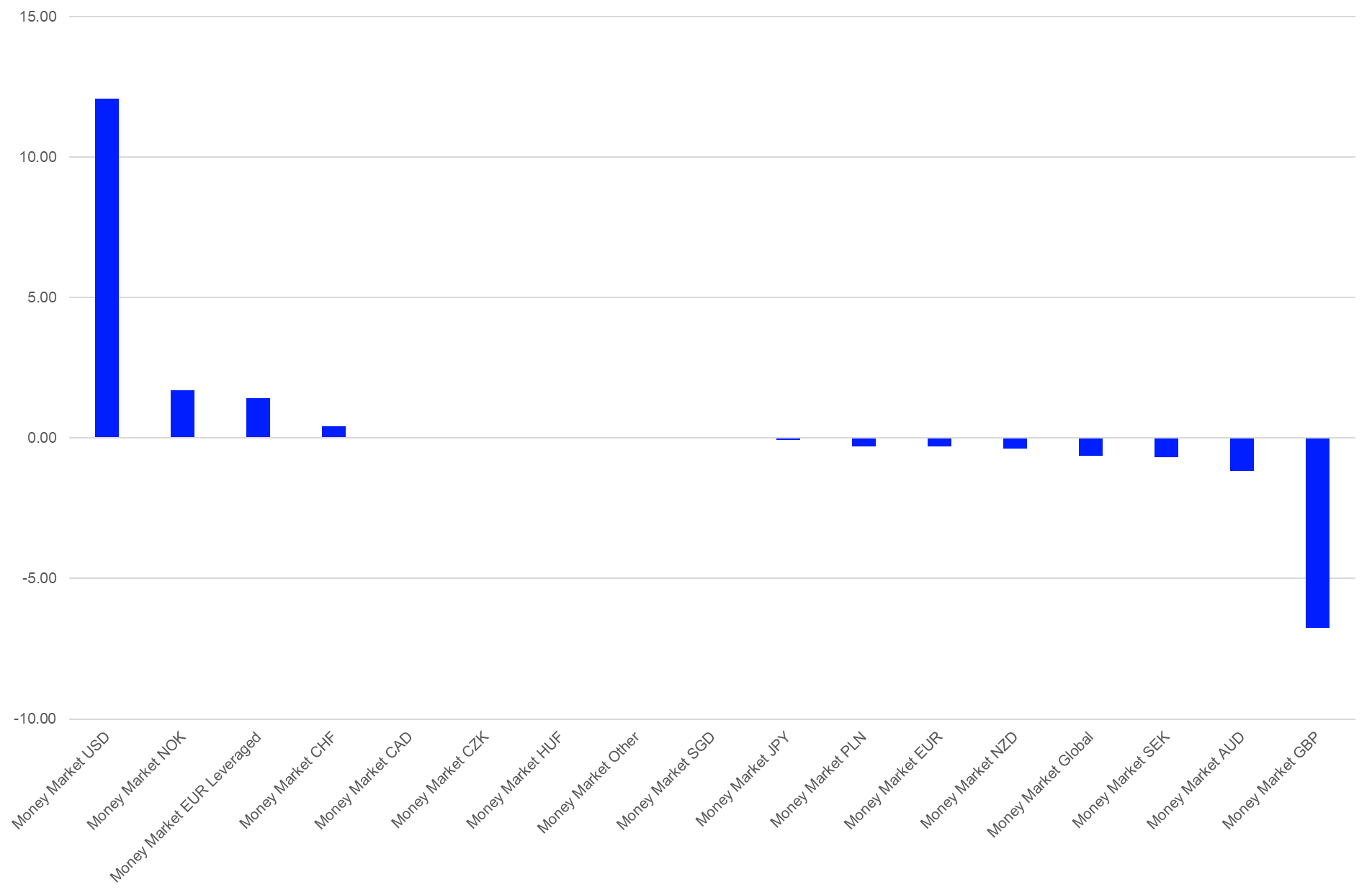

In more detail, Money Market USD (+€12.1 bn) was the best seller within the money market segment, followed by Money Market NOK (+€1.7 bn) and Money Market EUR Leveraged (+€1.4 bn). At the other end of the spectrum, Money Market GBP (-€6.8 bn) suffered the highest net outflows overall, bettered by Money Market AUD (-€1.2 bn) and Money Market SEK (-€0.7 bn).

This flow pattern revealed that European investors bought money market products denominated USD which might have been caused by the strong performance of the USD against the EUR.

In conjunction with the asset allocation decisions of portfolio managers, these shifts in the money market segment might have also been caused by corporate actions such as cash dividends or cash payments since money market funds are also used by corporations as replacements for cash accounts.

Graph 2: Estimated Net Flows in Money Market Products by LGC – October 2021 (Euro Billions)

Source: Refinitiv Lipper

Active vs. Passive Products

The trend toward passive investment vehicles has been widely discussed by market observers and asset managers, and a new all-time high for inflows into ETFs will fuel these discussions further. Therefore, it is worthwhile to highlight this topic—especially as not all passive products are ETFs. In contrast to the year 2020, flows into ETFs (+€160.9 bn) are outpacing the flows into passive mutual funds (€59.4 bn) by a large margin for 2021.

More generally, there is no evidence that passive funds will continue their pattern from 2020 and overtake actively managed funds, as the majority (€503.8 bn, or 69.57%) of the overall fund flows for 2021 were invested in actively managed products. Meanwhile, €220.3 bn—or 30.43%—were invested in passive products. This pattern does not change much when one takes money market products into consideration, as the overall inflows into money market products contributed only €4.9 bn to the inflows into actively managed funds. Cutting these flows out brings the estimated flows into actively managed long-term funds to €498.9 bn and, respectively, the market share of actively managed long-term products down to 69.40% of the overall flows. Meanwhile, passive long-term products had inflows of €220.0 bn—or 30.60%—of the overall inflows in this category.

Graph 3: Market Share of the Estimated Net Flows by Management Approach (January 1 – December 31, 2021)

Source: Refinitiv Lipper

Fund Flows by Lipper Global Classifications

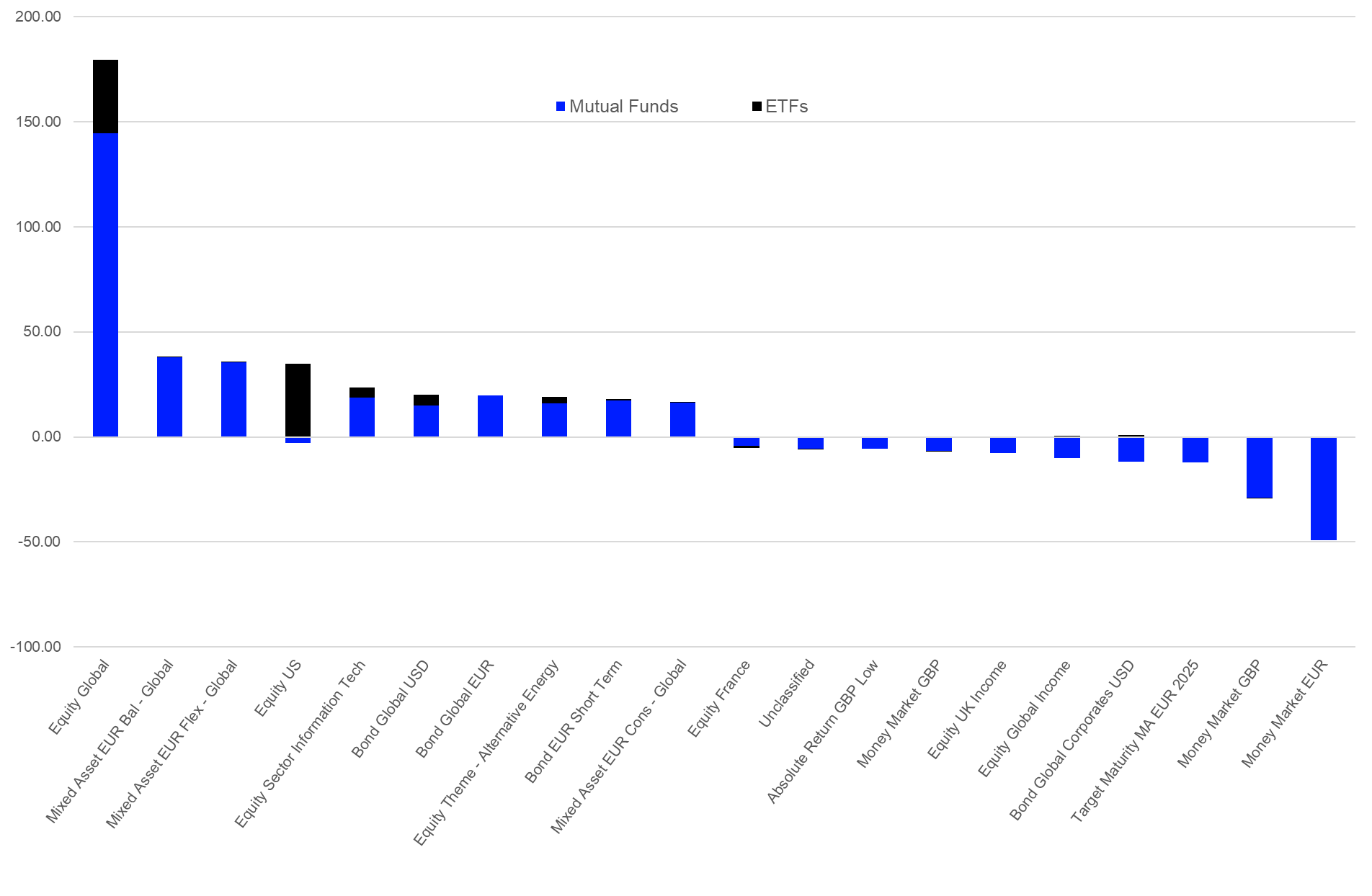

A closer look at the best- and worst-selling Lipper Global Classifications for the year 2021 shows that European investors sold some of their safe-haven investments while investing in funds that may offer diversification for their portfolio or are focused on single themes, sectors, and countries. This flow pattern shows that European investors are back in a risk-on mode.

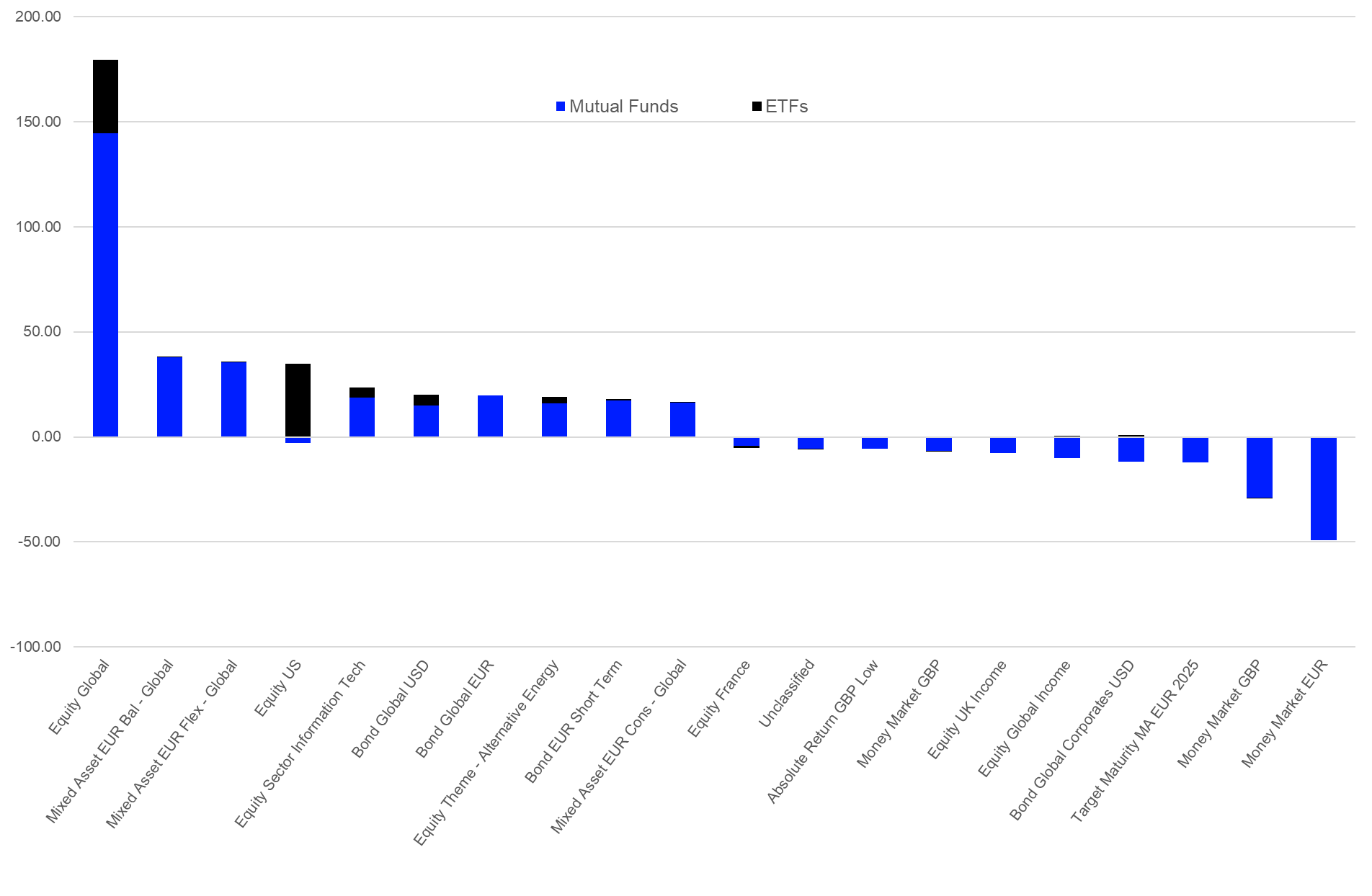

As graph 1 shows, equity products enjoyed the highest inflows over the course of the year 2021. With regard to the overall trend of the year 2021, it is not surprising that the table of the best-selling Lipper Global Classifications for the year was split between equity, bond, and mixed-assets peer groups. Equity Global (+€179.5 bn) was the best-selling peer group for the year. It was followed by Mixed Asset EUR Balanced – Global (+€38.0 bn), Mixed Asset EUR Flexible – Global (+€35.7 bn), Equity US (+€31.9 bn), and Equity Sector Information Technology (+€23.4 bn). It is noteworthy that mixed-assets funds started to gather significant inflows over the course of May and June, which drove the positions of the two mixed-assets classifications within the 10 best-selling classifications up for the year 2021.

Graph 4: Ten Best- and Worst-Selling Lipper Global Classifications by Estimated Net Sales, January 1 – December 31, 2021 (Euro Billions)

Source: Refinitiv Lipper

Conversely, some of the safe-haven favorites of 2020 were at the opposite side of the table. Money Market EUR (-€48.8 bn) faced the highest outflows for the year. It was bettered by Money Market GBP (-€28.9 bn), Target Maturity MA EUR 2025 (-€12.3 bn), Bond Global Corporates USD (-€11.0 bn), and Equity Global Income (-€9.3 bn).

It is noteworthy that the estimated flows in money market sectors are not only a reflection of asset allocation decisions of investors since these products are also used by corporates as a replacement for cash accounts.

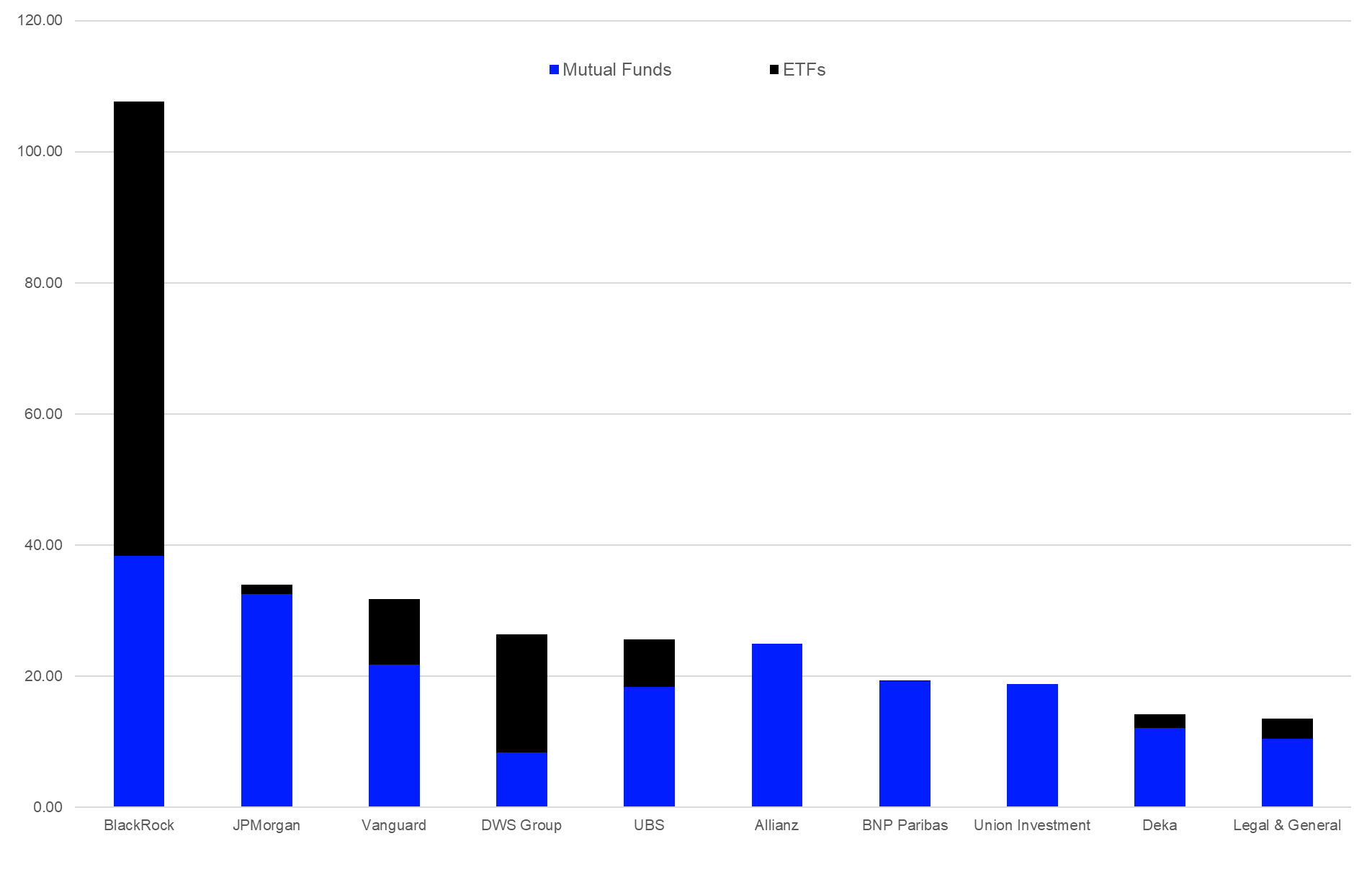

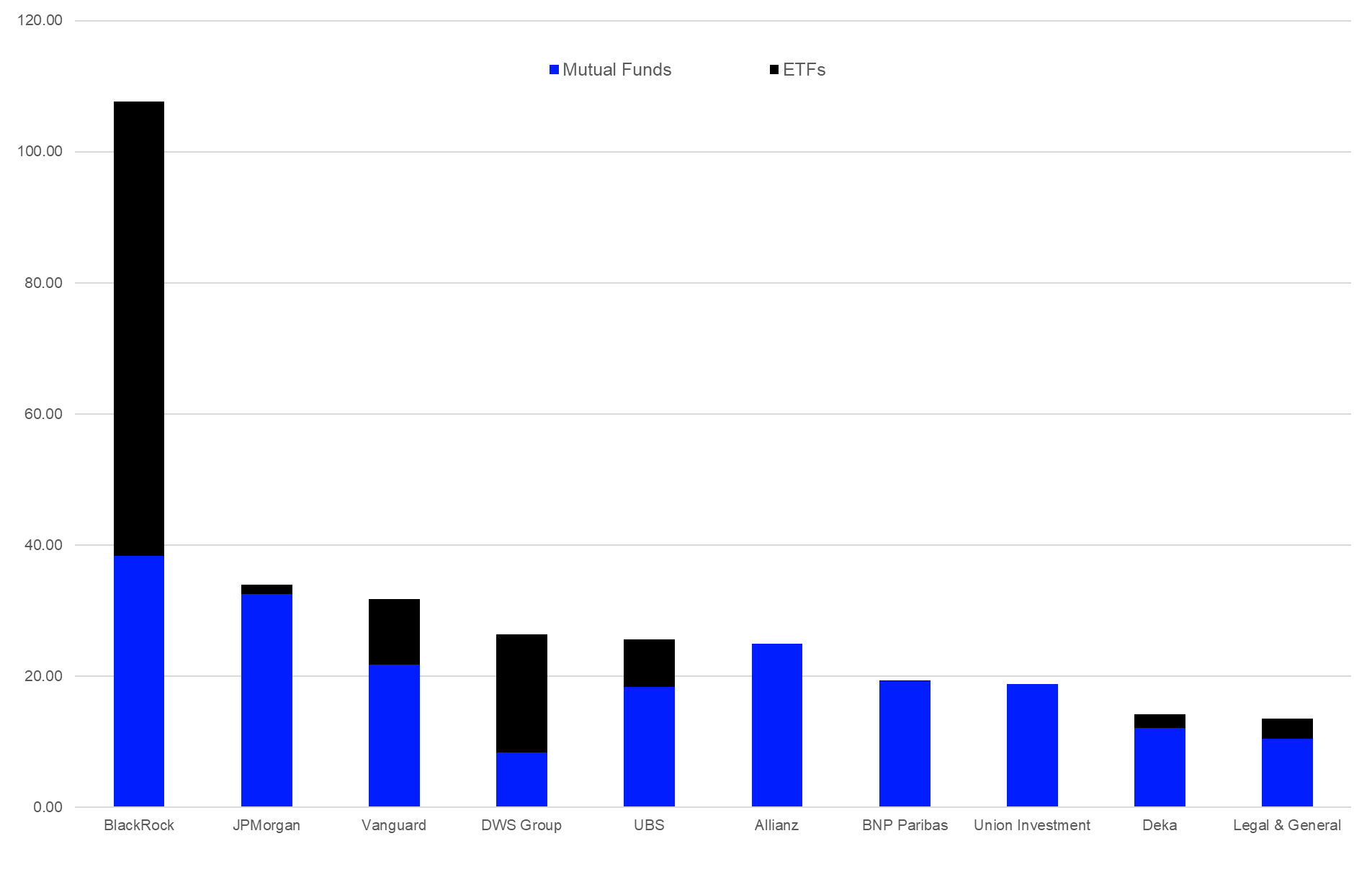

Fund Flows by Promoters

Unsurprisingly, the largest fund promoter in Europe, BlackRock (+€107.7 bn) is also the best-selling fund promoter over the course of the year 2021, ahead of JPMorgan (+€33.9 bn), Vanguard (+€31.8 bn), DWS Group (+€26.4 bn), and UBS (+€25.6 bn). It is noteworthy that the inflows for JPMorgan were impacted by inflows into money market products (+€9.9 bn).

Graph 5: Ten Best-Selling Fund Promoters in Europe, January 1 – December 30, 2021 (Euro Billions)

Source: Refinitiv Lipper

Considering the single-asset classes, BlackRock (+€24.7 bn) was the best-selling promoter of bond funds, followed by UBS (+€21.9 bn), BNP Paribas (+€10.5 bn), Vanguard (+€10.3 bn), and Aegon Asset Management (+€7.1 bn).

Within the equity space, BlackRock (+€79.8bn) led the table, followed by JPMorgan (+€16.4 bn), DWS Group (+€13.6 bn), Vanguard (+€13.4 bn), and Amundi (+€12.9 bn).

Allianz (+€13.6 bn) was the leading promoter of mixed-assets funds in Europe, followed by Union Investment (+€9.7 bn), Vanguard (+€8.1 bn), Amundi (+€7.3 bn), and DWS Group (+€6.7 bn).

Pictet (+€3.8 bn) was the leading promoter of alternative UCITS funds for the year, followed by DWS Group (+€3.4 bn), Nordea (+€2.7 bn), JPMorgan (+€2.4 bn), and Brevan Howard (+€1.6 bn).

Fund Flows by Fund Domiciles

Single-fund domicile flows (including those to money market products) showed, in general, a positive picture over the course of 2021. Twenty-six of the 34 markets covered in this report showed estimated net inflows, and eight showed net outflows. Unsurprisingly Luxembourg (+€329.1 bn) was the fund domicile with the highest net inflows for the year, followed by Ireland (+€204.3 bn), the U.K. (+€40.5 bn), Germany (+€34.2 bn), and Switzerland (+€28.0 bn). On the other side of the table, Finland (-€10.5 bn) was the fund domicile with the highest outflows, bettered by France (-€8.8 bn) and Jersey (-€6.3 bn). It is noteworthy that the fund flows for France (-€2.5 bn) were impacted by outflows from the money market segment.

Graph 6: Estimated Net Sales by Fund Domiciles, January 1 – December 30, 2021 (Euro Billions)

Source: Refinitiv Lipper

Within the bond sector, funds domiciled in Luxembourg (+€70.2 bn) led the table, followed by Ireland (+€64.6 bn), Switzerland (+€22.7 bn), the Netherlands (+€10.5 bn), and the UK (+€7.8 bn). Bond funds domiciled in Italy (-€2.3 bn), Poland (-€1.5 bn), and Liechtenstein (-€1.0 bn) were at the other end of the table.

For equity funds, products domiciled in Luxembourg (+€163.2 bn) led the table for the year, followed by Ireland (+€120.0 bn), the UK (+€23.2 bn), Sweden (+€12.8 bn), and Germany (+€12.4 bn). Meanwhile, Finland (-€13.1 bn), France (-€6.5 bn), and Switzerland (-€4.4 bn) were the domiciles with the highest estimated net outflows from equity funds.

Regarding mixed-assets products, Luxembourg (+€63.3 bn) was the domicile with the highest estimated net inflows, followed by the UK (+€22.6 bn), Spain (+€14.7 bn), Germany (+€11.7 bn), and Italy (+€10.3 bn). In contrast, Jersey (-€1.3 bn), Denmark (-€0.4 bn), and the Isle of Man (-€0.2 bn) were the domiciles with the highest estimated net outflows from mixed-assets funds.

Luxembourg (+€20.7 bn) was the domicile with the highest estimated net inflows into alternative UCITS funds for the year, followed by Ireland (+€8.2 bn) and Germany (+€1.5 bn). Meanwhile, France (-€9.0 bn), the UK (-€7.9 bn), and Italy (-€2.8 bn) were at the other end of the table.

The views expressed are the views of the author, not necessarily those of Lipper or Refinitiv.