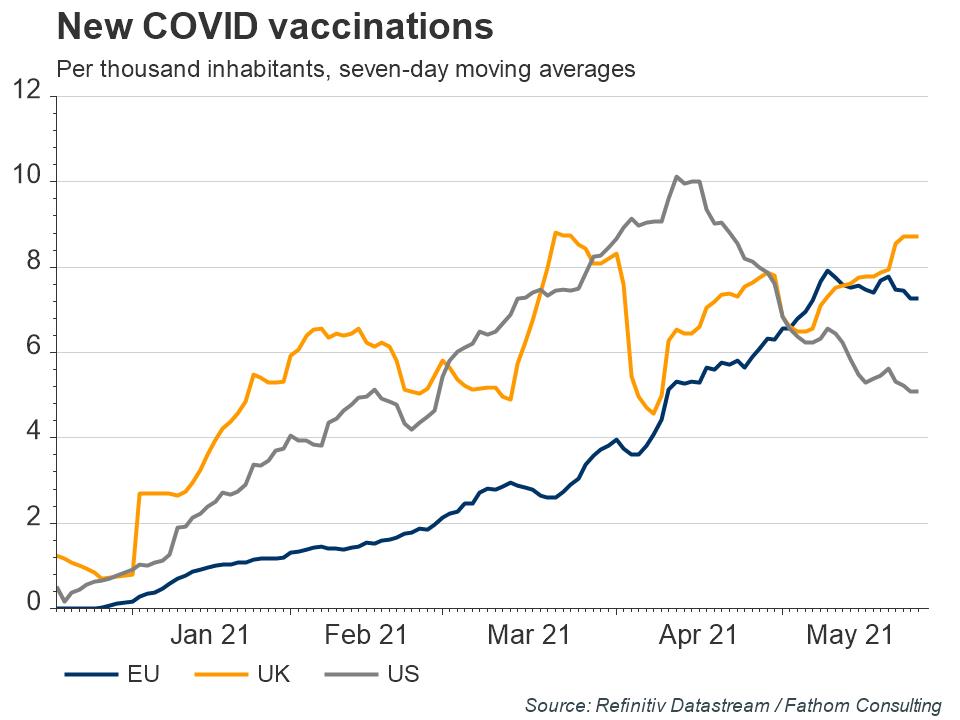

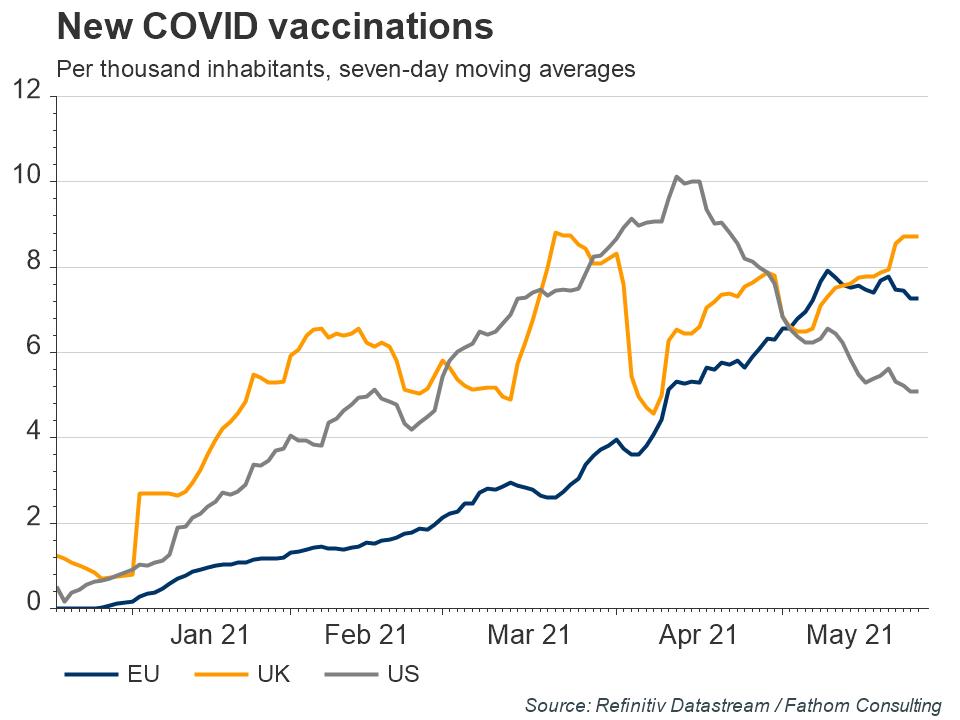

Recovery has been slower to arrive in the European Union than in other advanced Western economies. The EU was three months later than the UK and US to place its first order for vaccines, and nearly a month late to approve a vaccine for use, leading to a late and slow roll out of its vaccination programme. Economic outcomes have followed suit, with EU GDP in 2021 Q1 well below its pre-COVID level, while the US economy had recovered nearly all its lost ground.

But there are signs of improvement across the continent. Again, this is most obviously seen in the vaccination data. After its widely-reported delays in obtaining supplies of vaccines earlier in the year, the EU has caught up with the UK in its rate of new vaccinations and actually overtook the US in May. In March, Fathom estimated that the EU was one financial quarter behind the UK and US in terms of completing the process of providing first vaccinations to its populations. This gap has shortened to around one month in latest estimates.

Refresh this chart in your browser | Edit the chart in Datastream

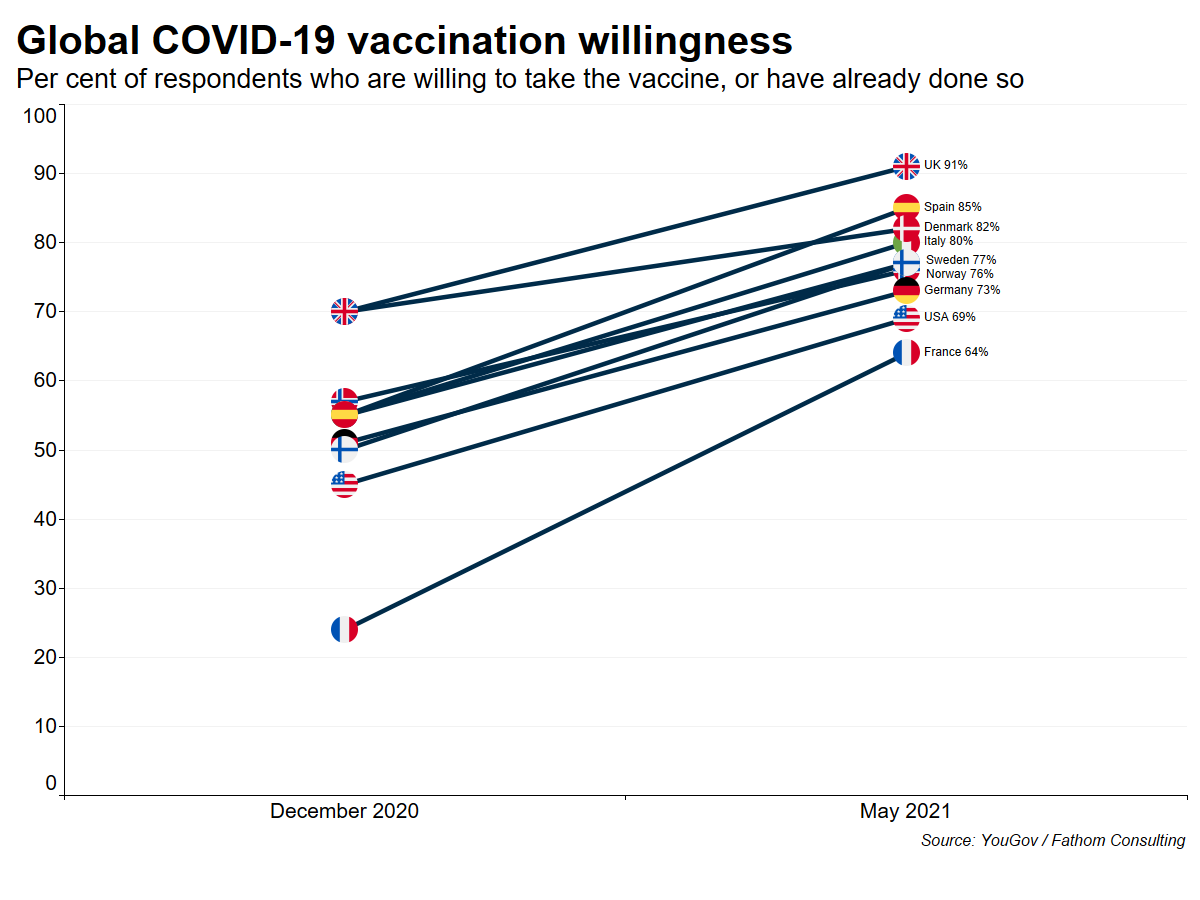

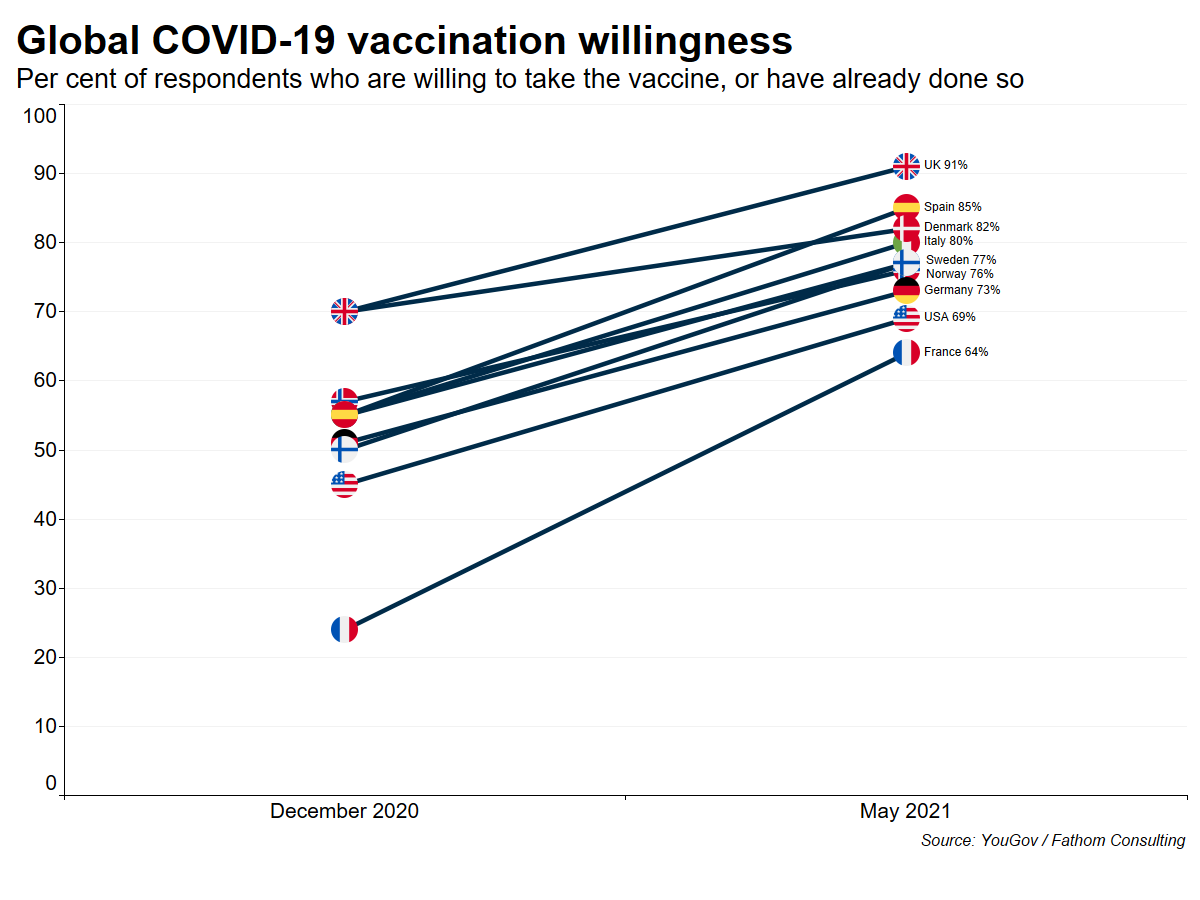

One of the early obstacles to the EU’s vaccine rollout was significant levels of vaccine hesitancy amongst EU nations. In December 2020, only 24% of French citizens polled said they would get vaccinated. Now, however, YouGov polls indicate that vaccine acceptance in the EU is rising markedly. In the latest May poll, 64% of French people said they either have or would submit to a COVID jab, with similar increases in polls across the continent, as the evidence continues to mount that the vaccines are safe and effective.

This is positive news for health outcomes, so are economic outcomes going to improve too? Early indicators seem to suggest so. The IFO survey of German businesses shows that confidence is high, even compared to pre-pandemic levels, and rising. Increases in optimism are most notable in the services sectors, which bore the brunt of the restrictions through the pandemic. And this positive news in economic sentiment is broader based than just Germany. Fathom’s Economic Sentiment Indicators show growing economic confidence across the major EU countries, as businesses and individuals have begun to feel the benefits of the withdrawal of restrictions.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

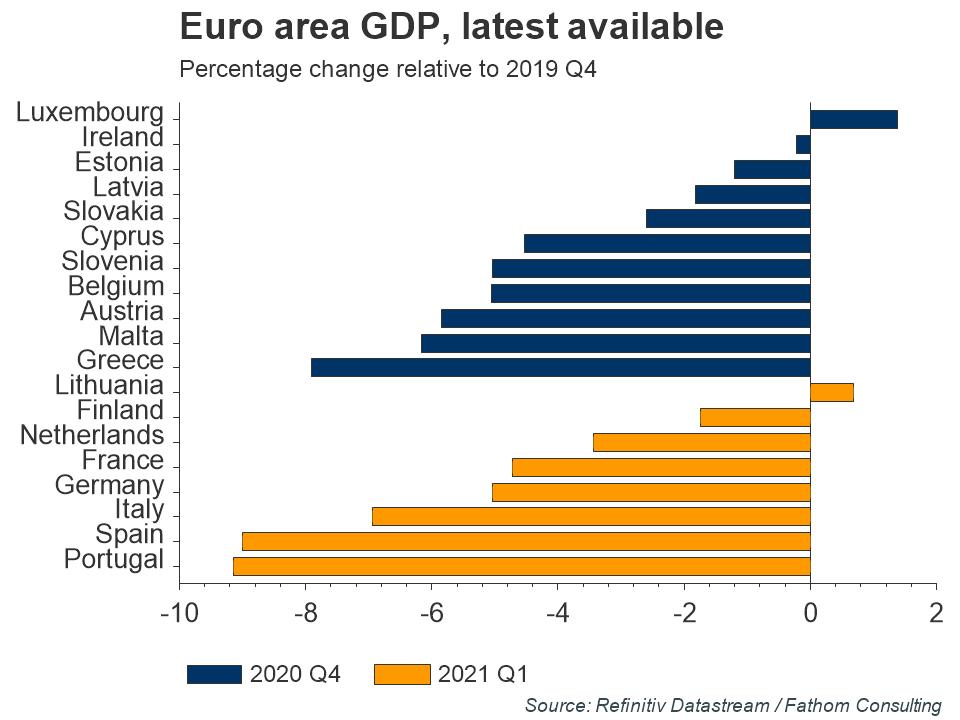

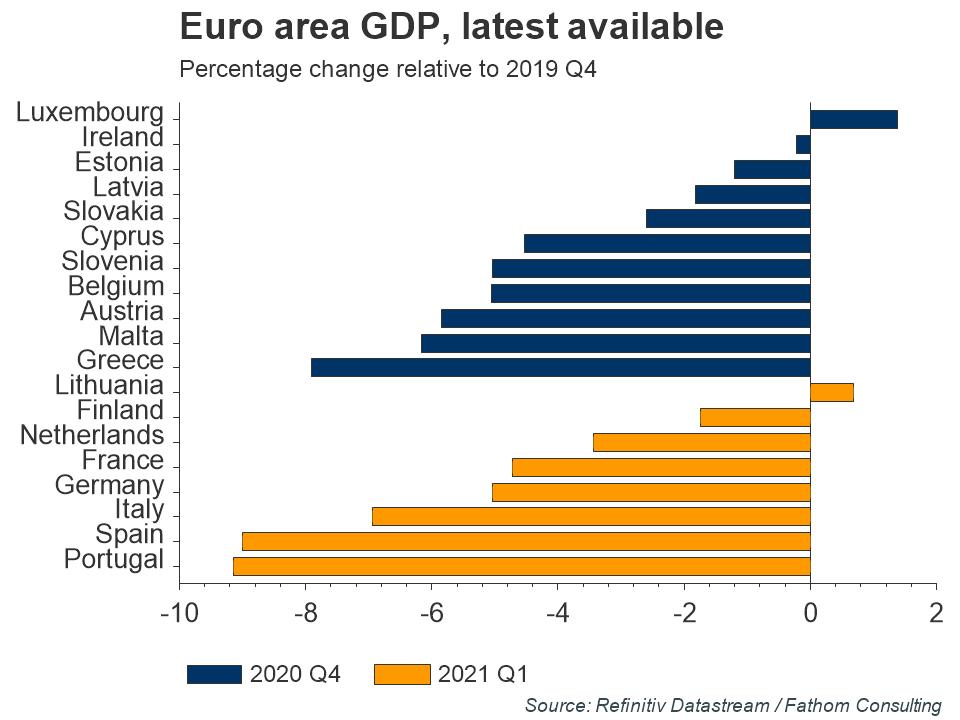

But the EU’s economic output has a lot of ground to make up, and worryingly there is an increasing divergence between countries in the speed of recovery. The core European economies of France, Germany, the Netherlands, Belgium, and Austria saw smaller losses of output at the height of the pandemic, and have recovered more swiftly than their southern European counterparts in Spain, Italy, Portugal, and Greece. Should this divergence continue to widen, a two-speed recovery could create political tensions across the region which could find expression in the ballot box. There are upcoming elections in Germany and France this year and next respectively, whilst all the southern European countries are due to go to the polls in 2023.

Refresh this chart in your browser | Edit the chart in Datastream

However, a return of foreign visitors to the tourism-dependent economies of southern Europe could put a different complexion on things. As restrictions are lifted across Europe, pent-up demand for holidays is likely to be unleashed. Last summer, foreign visitor stays at hotels were as much as 86% below 2019 levels in southern Europe, which took a harder hit than central European counterparts. But with increasing number of people vaccinated, and with large savings pots available to be spent, there’s a case to be made for better news to come for the European tourism industry in 2021.

Refresh this chart in your browser | Edit the chart in Datastream

With the recovery across Western economies very much underway, there’s increasing optimism that the EU recovery will start to pick up the pace. Fathom expects the euro area to reach pre-crisis output levels by the end of the year, albeit probably still behind the pace of recovery in the US. But possible risks remain on the horizon, in the form of variants of concern and tensions arising from a divergence between EU countries.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.