When it took office, the Trump administration correctly perceived that there was an imbalance in the trading relationship between the US and China. The bilateral trade deficit was not the issue — such deficits exist between many pairs of countries, and usually reflect their relative appetites for saving and the underlying patterns of comparative advantage that each partner enjoys. A bilateral deficit, no matter how large, is not in itself evidence of imbalance in the relationship. Rather, the evidence arises from two sources: first, the tariff regime implemented by China on imports from the US; and second, the net trade position between the two countries specifically in sectors where each party is a global specialist producer.

At the start of President Trump’s administration, China’s tariffs on imports from the US were significantly higher as an average rate than tariffs in the opposite direction. The literature on optimal tariff regimes suggests that, as by far the bigger bilateral importer, the US had more scope to exploit its market power by raising tariffs on China than vice versa. The theory goes: if you are the principal buyer of another country’s goods, then you can reduce your consumption of those goods via tariffs and expect the other country to reduce the price of those goods supplied to you. In short, if you have market power as a buyer then you can force the other country to ‘pay’ at least part of the tariffs you impose and increase the welfare of your own citizens as a result.

Refresh this chart in your browser | Edit the chart in Datastream

The problem with so-called optimal tariffs is that any tariff regime will tend to reduce trade flows, and therefore reduce the gains from trade, which arise from exploiting the underlying patterns of comparative advantage. Tariffs are only welfare-increasing for the sender if the gains from exploiting its market power exceed the gains from trade foregone. Usually, that will not be the case, or will be too close to call.

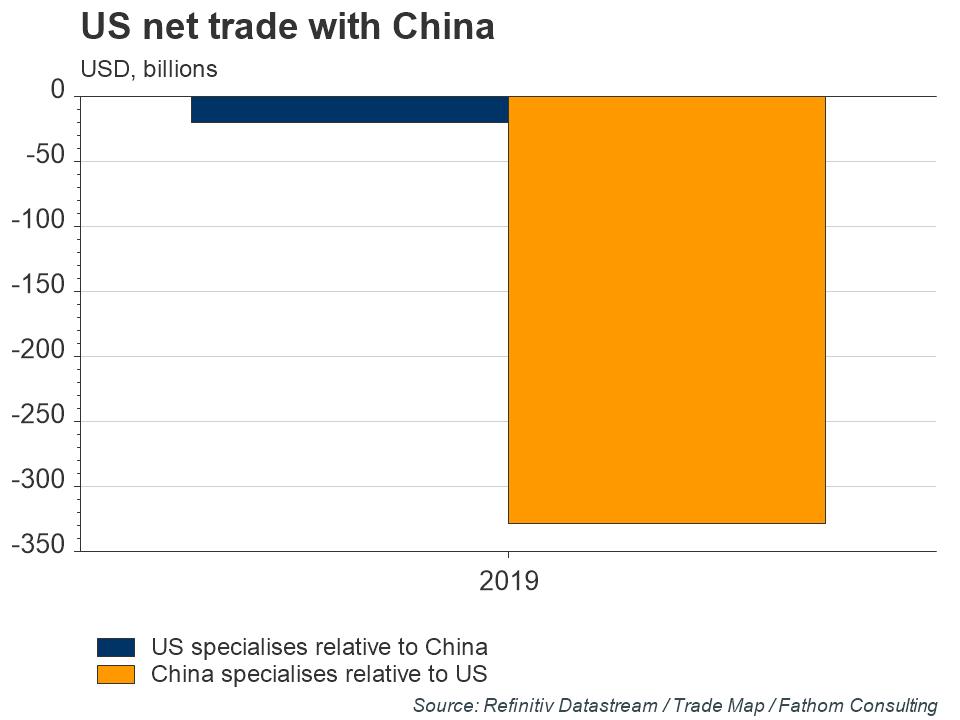

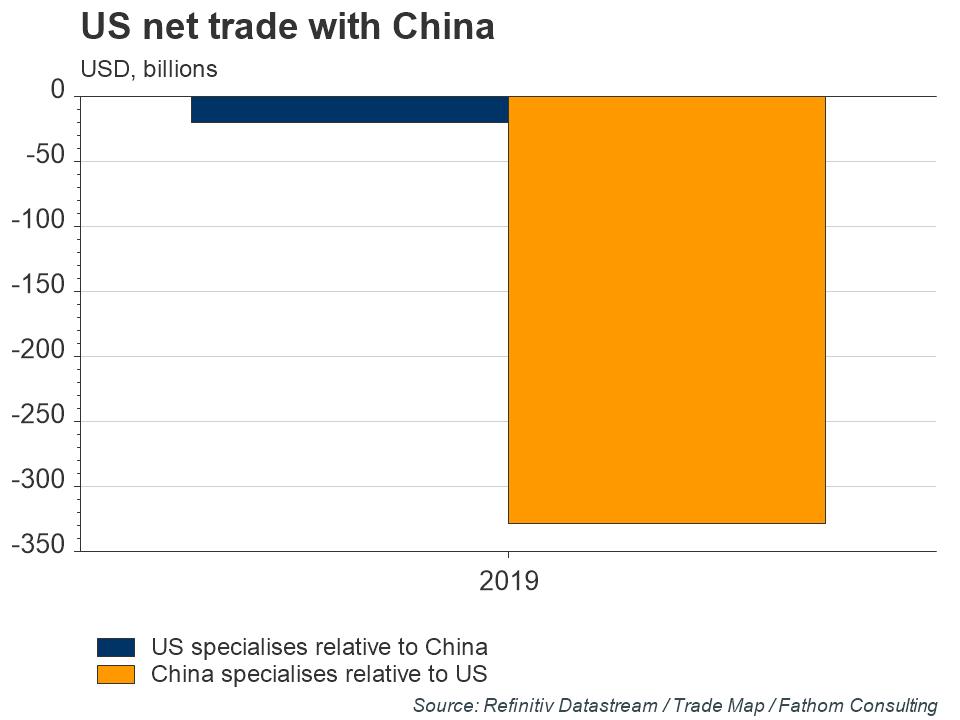

However, the data also suggest that, while China is a big net exporter to the US in the sectors where China enjoys a global ‘Revealed Comparative Advantage’ (RCA) relative to the US, which is what we would expect, it is also a small net exporter to the US in sectors where the US is in the same position with respect to China. By definition, no country can enjoy a comparative advantage over another country in every sector, though it can enjoy an absolute advantage. The gains from trade arise from the exploitation of comparative, not absolute advantage. The fact that China is a net exporter to the US even in the sectors where the US enjoys a global advantage over China suggests that something else is going on.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in Refinitiv Eikon.

These two strands of evidence strongly pointed to a non-reciprocal trading relationship between the two countries: while the US was offering an open embrace, China was deliberately adopting a closed and protective stance towards the US.

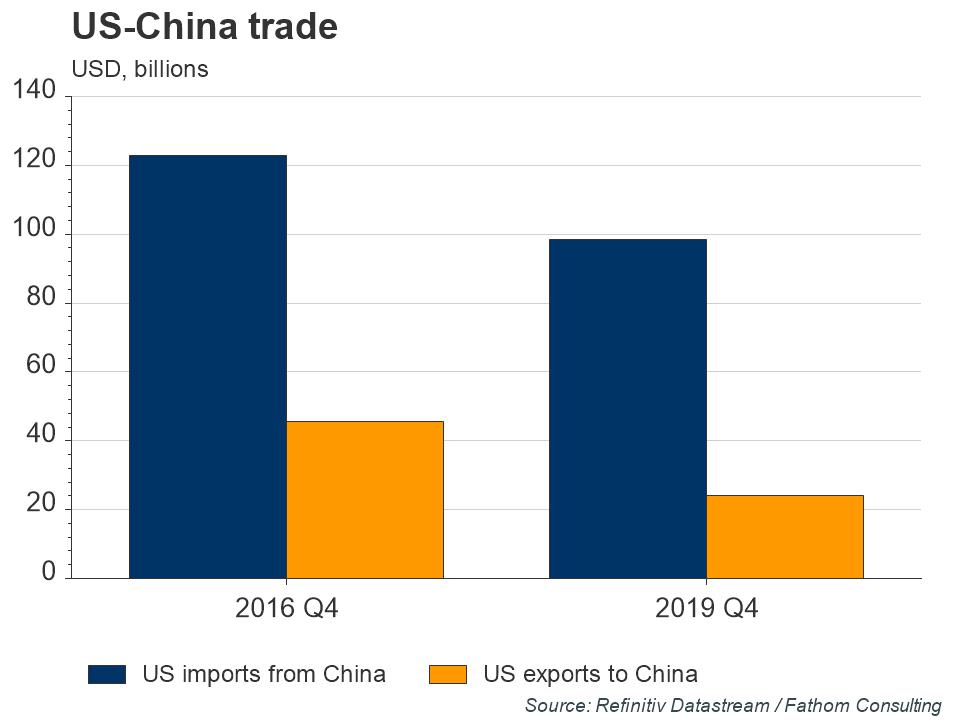

But what impact, if any, have the tariffs had on the bilateral trading relationship?

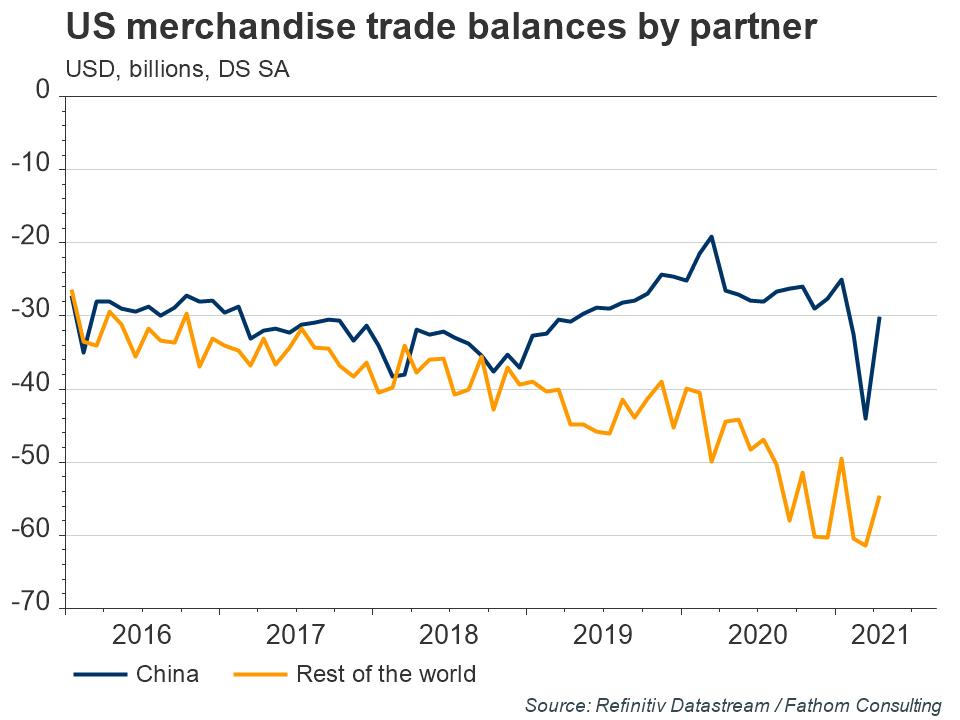

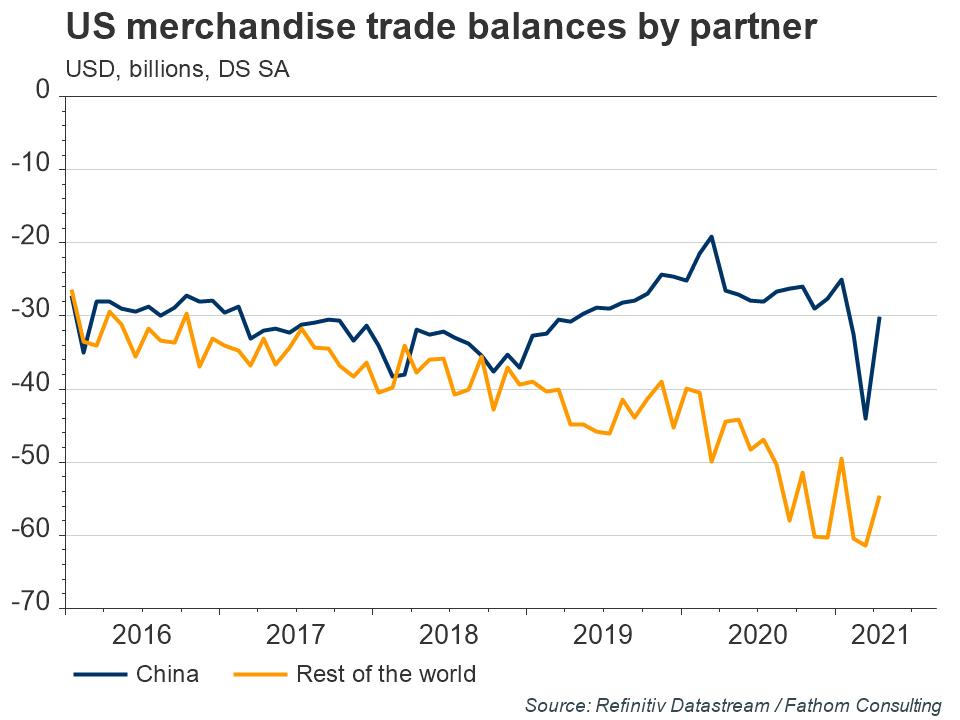

The period after the start of the pandemic should probably be ignored — there was so much else going on at that time that the marginal impact of tariffs is hard to discern. But the period before that shows a clear pattern, and one that is consistent with economic theory. By increasing the price to US consumers and firms of imports from China, tariffs caused those firms and consumers to substitute away from Chinese imports and towards other suppliers who charge more, or towards other goods, imperfect substitutes, which cost more than the price of the Chinese imports net of tariffs. As a result, the overall deficit deteriorated. Indeed, the trade balance would only have improved if the next-best substitute for the Chinese import was produced in the US. The evidence suggests this was rarely the case.

Refresh this chart in your browser | Edit the chart in Datastream

The real impact of the Trump administration’s tariff policy was to shift towards a regime of higher tariffs and lower bilateral trade than prevailed previously. In Fathom’s view, this is not a desirable outcome in and of itself. However, that does not necessarily make higher tariffs a bad idea. As previous Fathom research has shown, there may be gains for the US if the adoption of a ‘tit-for-tat’ strategy can be successfully used to influence Chinese economic policy. Given the world it finds itself in, this may be a policy that the Biden administration chooses to pursue.[1]

Refresh this chart in your browser | Edit the chart in Datastream

[1] For more insights into this topic, including game theoretic insights into trade policy, please see Biden should stick to China tariffs.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.

________________________________________________________________________________________

Refinitiv Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop view points on the market.

Refinitiv offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.