So far, 140 of the companies in our Retail/Restaurant Index have reported their EPS results for Q1 2022, or 69% of the total members of the index. Of the group that has reported its earnings, 71% announced that profits beat analysts’ expectations, while 4% delivered on-target results and 25% reported earnings that fell below estimates. The Q1 2022 blended earnings growth estimate is -17.8%.

The Q1 2022 blended revenue growth estimate for this index is 10.7%. Of those companies that have reported their quarterly results so far, 73% announced revenue that exceeded analyst expectations and the remaining 27% reported that their revenue fell below analysts’ forecasts.

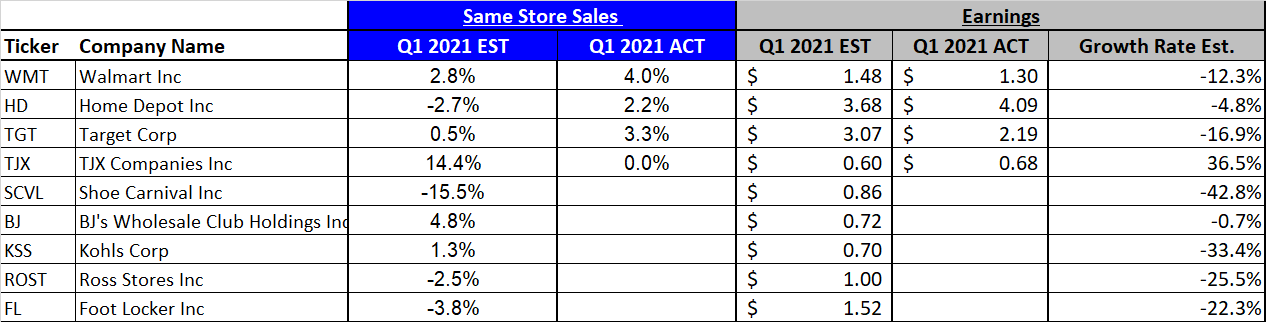

Exhibit 1: Refinitiv Earnings Dashboard

Source: I/B/E/S data from Refinitiv

This week: Q1 2022 earnings

Walmart, hit by higher-than-expected costs, soaring fuel prices and the impact of overstaffing, delivered earnings that fell short of analysts’ estimates for its Q1 EPS. Nevertheless, the retailing giant outperformed when it came to both its revenue and Same Store Sales (SSS) for Q1. Reflecting both results, Walmart raised its outlook for sales for the remainder of the fiscal year, but lowered its forecast for profits.

In spite of the headwind caused by higher expenses, Walmart’s Sam’s Club division saw SSS spike by 17% during the quarter, including fuel. In January, analysts polled by Refinitiv had predicted that SSS at Sam’s Club, Costco and BJ’s would grow at a faster rate than at their peers, as more consumers flocked to these retailers as part of their quest to save money at the pump. During its earnings call, Walmart said that the membership count at Sam’s Club grew at a record clip during Q1. That has translated into strong store traffic, and Sam’s Club SSS (excluding fuel) climbed 10.2% in the period.

Target confronted similar headwinds to those that buffeted Walmart. The higher fuel costs, combined with supply chain issues, led to Target delivering earnings that fell short of analysts’ estimates.

Other retailers are delivering similar warnings as they report their earnings for Q1 2022. So far, 140 retailers have their earnings for Q1; of this group, 121 mentioned the impact of inflation on their operations while 132 flagged supply chain issues.

Meanwhile, consumers are continuing to renovate and repair their own homes, and in the process, helping to boost sales at Home Depot. The retailer beat estimates for its Q1 earnings, revenue and SSS and raised its outlook for sales for the full fiscal year sales. This is impressive, considering retailers are facing very difficult comparisons over year-ago levels. Particularly noteworthy is the fact that Home Depot was able to sell spring merchandise, in spite of unusually cool temperatures for the time of year.

The government also released April retail sales data this week. April sales grew at a pace of 0.9%, a figure that is in line with Refinitiv IFR expectations. Sales at food service/drinking venues, as well as those reported from online sales, saw the strongest gains. These retail sales and earnings results suggest that consumers seem to still be engaged.

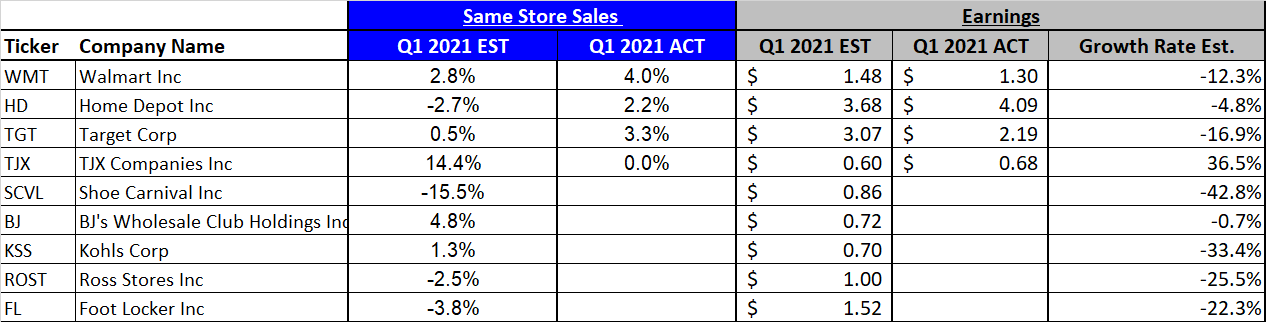

The following chart displays estimates of earnings and same store sales expectations for retailers that are scheduled to release their Q1 2022 results this week.

Exhibit 2: Same Store Sales and Earnings Estimates–Q1 2022

Source: I/B/E/S data from Refinitiv