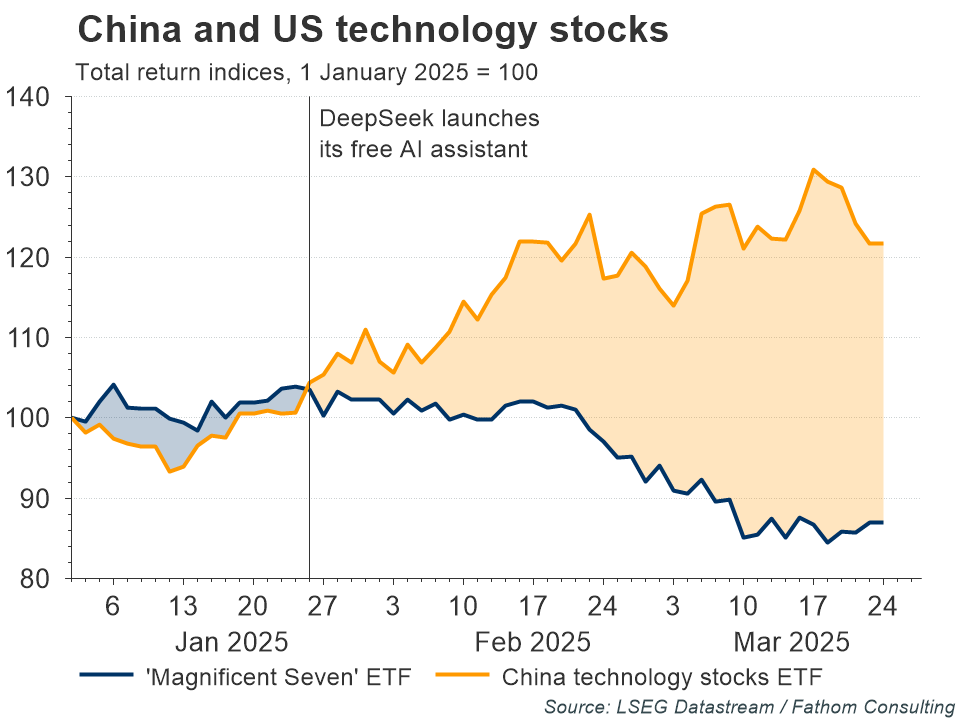

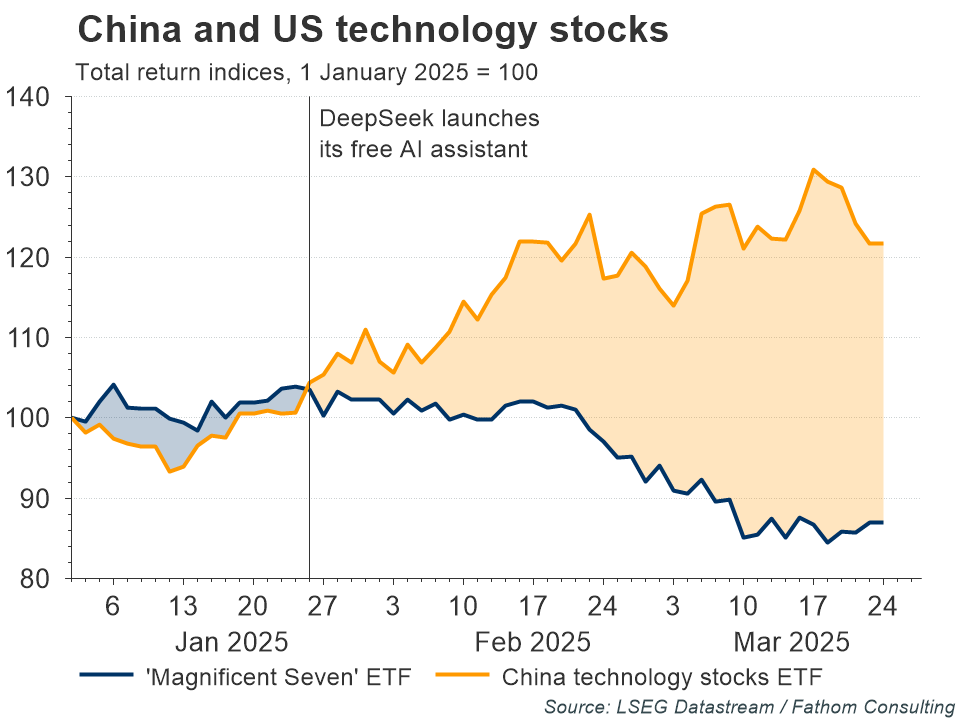

One of the defining features of the past few years has been the continued rise of the US tech giants. In 2025, however, momentum in innovation appears to have started to shift towards the other side of the Pacific. Chinese technology firms, long viewed as playing catch-up, are now emerging as contenders in the global AI race. Leading this surge is DeepSeek, a Chinese startup that, on 24 January 2025, unveiled its R1 large-language model — reportedly developed at a fraction of the cost of similar models from US counterparts. Despite its modest budget, R1 is said to perform competitively, challenging assumptions about where in the world AI leadership resides. The launch sent shockwaves through markets, shaking investor confidence in the so-called ’Magnificent Seven‘ — Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla — who had previously enjoyed an almost unchallenged run. Investors began rotating out of US tech stocks on the day of R1’s debut and have yet to return, as reflected in the 23% year-to-date decline of the ETF offering equal-weight exposure to the group. In stark contrast, the ETF on Chinese tech stocks has surged 21% year-to-date, underscoring not only rapid technological progress but also their strategic agility. These shifts highlight how geopolitical and economic dynamics are redrawing the map for ‘global innovation’. For investors, the implications are twofold: US tech dominance is no longer a given; and China’s role in shaping the next wave of digital transformation is only just beginning to unfold.

Refresh this chart in your browser | Edit the chart in Datastream

The views expressed in this article are the views of the author, not necessarily those of LSEG.

______________________________________________________________________________________

LSEG Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop viewpoints on the market.

LSEG offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.