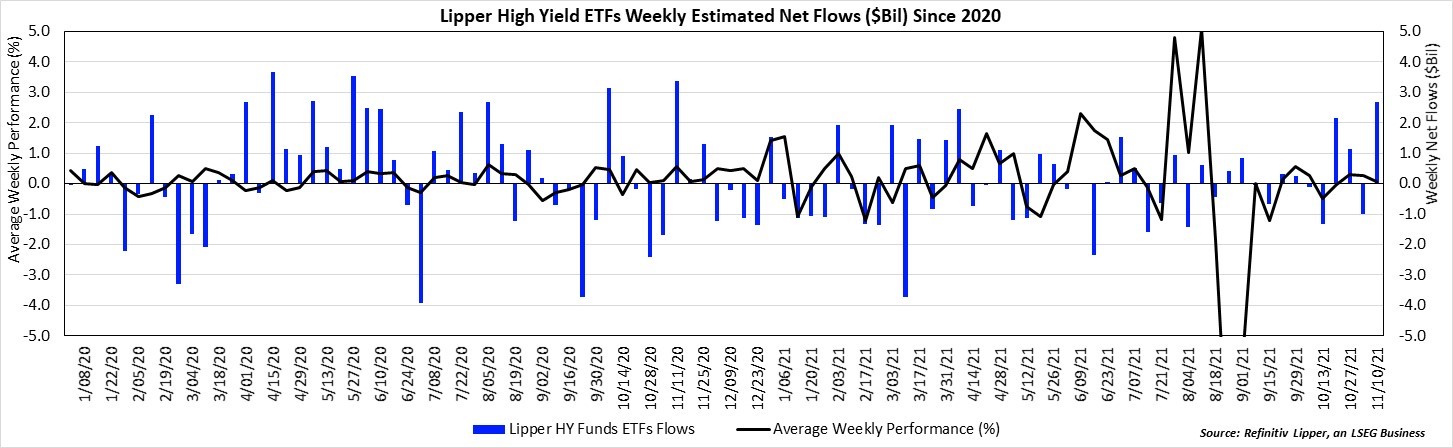

The Lipper High Yield ETF classification consists of funds that aim at high current yield from domestic fixed income securities. These funds typically have no maturity restrictions and invest in lower-grade debt issuers. Lipper High Yield ETFs attracted $2.7 billion in new money last week after posting their largest weekly performance since the first week of September (+0.43%). The classification’s intake was the largest inflow in 53 weeks.

Lipper High Yield classification has outperformed all other general domestic taxable fixed income Lipper classifications on a month-to-date (+0.48%), year-to-date (+4.88%), and trailing one-year basis (+8.22%). Lipper High Yield ETFs are coming off their two largest 12-month inflows in 2020 (+$16.5 billion) and 2019 (+$14.1 billion). The only real blemish over the past three years has been the $5.8 billion in outflows during September 2020 right before the election.

So, while the appetite for lower-grade debt would appear high, inflows into these ETFs have been riding the tailwinds of investors searching for yield in a record-low default rate environment. Fitch reported this week that the year-to-date high yield bond default volume currently is $5.6 billion, the lowest level since 2007. The year-to-date default rate (0.4%) and 102-day stretch without a default are both records since 2007 as well.

The movement toward high-yield ETFs has also benefited from an increase in the credit fundamentals of the overall BB and below-rated issuers. The amount of outstanding BB-rated bonds increased more than 50% since 2007, while B and CCC-rated bonds decreased by roughly 30%, according to Credit Suisse—much of which was aided by the record amount of fallen angels brought on by the COVID-19 pandemic.

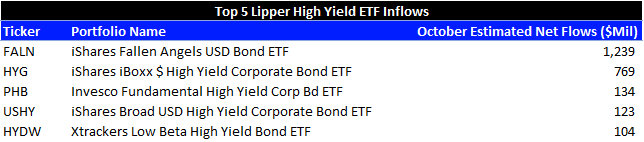

So, while 2020 and 2019 were good years for Lipper High Yield ETFs, 2021 started much slower—through the first three quarters, seven months saw outflows. But now the tides are turning for the classification, and October ended up realizing $1.9 billion in inflows. So far through the fund-flows week ended November 10, Lipper data shows us that weekly reporting fund companies are pulling in $1.7 billion into Lipper High Yield ETFs. The preliminary month-to-date and quarter-to-date (+$3.5 billion) inflows for the classification rank second in taxable fixed income inflows behind Lipper Inflation-Protected Bond ETFs (MTD +$2.1 billion, QTD +$6.9 billion).

High yield ETFs on average offer lower duration and higher yield than many other fixed income funds. The lower duration means these below-investment-grade investments are less exposed to interest rate risk, so when interest rates increase, the price of the underlying bond will decrease less than securities with higher durations.

Refinitiv Lipper publishes a weekly article on flow trends and market topics. Click here for last week’s insight.

Refinitiv Lipper delivers data on more than 330,000 collective investments in 113 countries. Find out more.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.