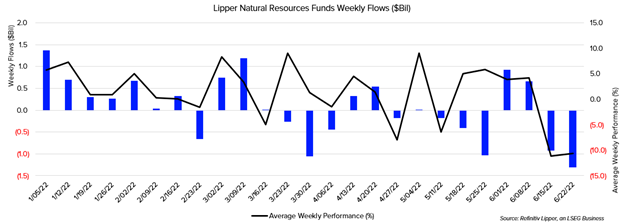

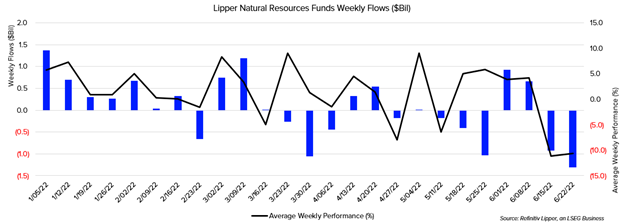

Lipper Natural Resources Funds suffered $1.3 billion in outflows over the past week, marking their third-largest weekly outflow on record. This past week, funds within the classification averaged a loss of 10.64%. Lipper Natural Resources Funds have realized two of their 10-top lowest all-time weekly performances in the back-to-back weeks.

The only other two weeks that posted larger outflows were fund-flows weeks ended October 1, 2014 (-$2.5 billion), and January 16, 2019 (-$1.4 billion). Both these weeks were followed by significant drops in gas and oil prices.

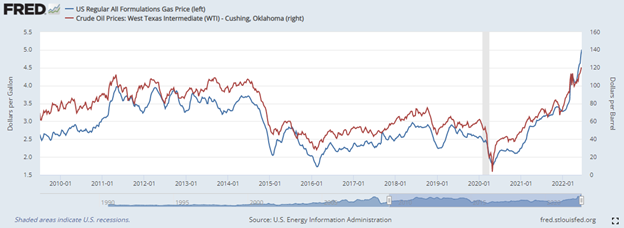

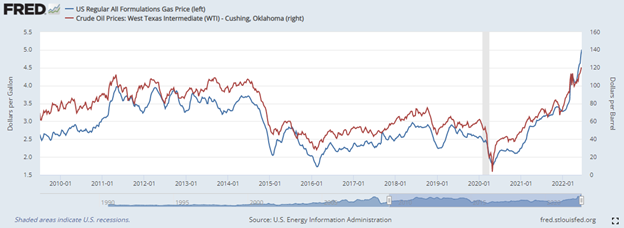

Today, we are seeing massive spikes in all energy prices, which helps the cash flow for energy companies. So, why the outflows?

The key factors are future earnings and the forecasted headwinds brought on by the massive interest rate hikes. This week Federal Reserve Chair Jerome Powell’s increasingly hawkish tone has market participants factoring in another 50-75 basis point (bps) drop in the Fed’s July meeting. His comments had investors fleeing towards the safety of Treasuries, as the 10-year Treasury note yield fell to 3.04%. Powell has made it clear fighting inflation will take precedence over avoiding a recession, saying,

“We are not trying to provoke and do not think we will need to provoke a recession, but we do think it’s absolutely essential (to decrease inflationary pressures).” It is seemingly becoming increasingly likely that the U.S. will not achieve the “soft landing” Powell hoped for back in March.

As interest rates continue to increase at historic paces, future projects for energy companies become more expensive; and as a recession becomes more likely, forecasts of energy demand will decrease, eventually bringing prices back down. The consumer pain at the pump is so significant, President Biden is considering a short-term solution of an unprecedented federal gas tax holiday—suspending 18.4 cents per gallon.

What also makes the outlook for energy companies even bleaker is that this energy crisis is not just limited to the U.S. Germany announced it would signal the “alert stage” of its emergency gas plan, as it also is forecasting a growing risk of a depleted long-term gas supply. Over the last week, Russia cut the capacity of the Nord Stream pipeline to Germany by 60%.

Another factor adding to the increased prices is the strong U.S. dollar. With most commodities being priced in the dollar, a stronger dollar means that purchasing oil from the U.S. with other currencies becomes more expensive.

So, while near-term high prices might be good for energy companies’ bottom lines, the longer-term forecasts that include a recession and decreased consumer demand spell doom.

Refinitiv Lipper delivers data on more than 330,000 collective investments in 113 countries. Find out more.

Join a growing community of asset managers and stay up to date with the latest research from Refinitiv and partners to help you inform your investment decisions. Follow our Asset Management LinkedIn showcase page.