Amazon’s Q3 2022 revenue increased 14.7% year over year to $127.1 billion, nearly in line with estimates of about $127.46 billion. Meanwhile, operating income missed expectations and dropped 48% from a year ago. These misses come despite a strong Prime Day globally in July.

Exhibit 1: Amazon Q3 2022 Earnings and Revenue Estimates vs. Results

Source: Refinitiv I/B/E/S

Amazon’s global exposure is also being hit by macroeconomic issues as rising inflation continues to diminish the consumer’s purchasing power. “Primarily in the consumer stores business, it was in international. North America, obviously, it was strong, but it started to slow a bit. But it was mostly in international where we saw the biggest impact, and we think that is tied to a tougher recessionary environment there. Compared to the U.S., it’s worse in Europe right now. The Ukraine war and the energy crisis issues have really compounded in that geography.” (Source: Amazon Q3 2022 Earnings Call)

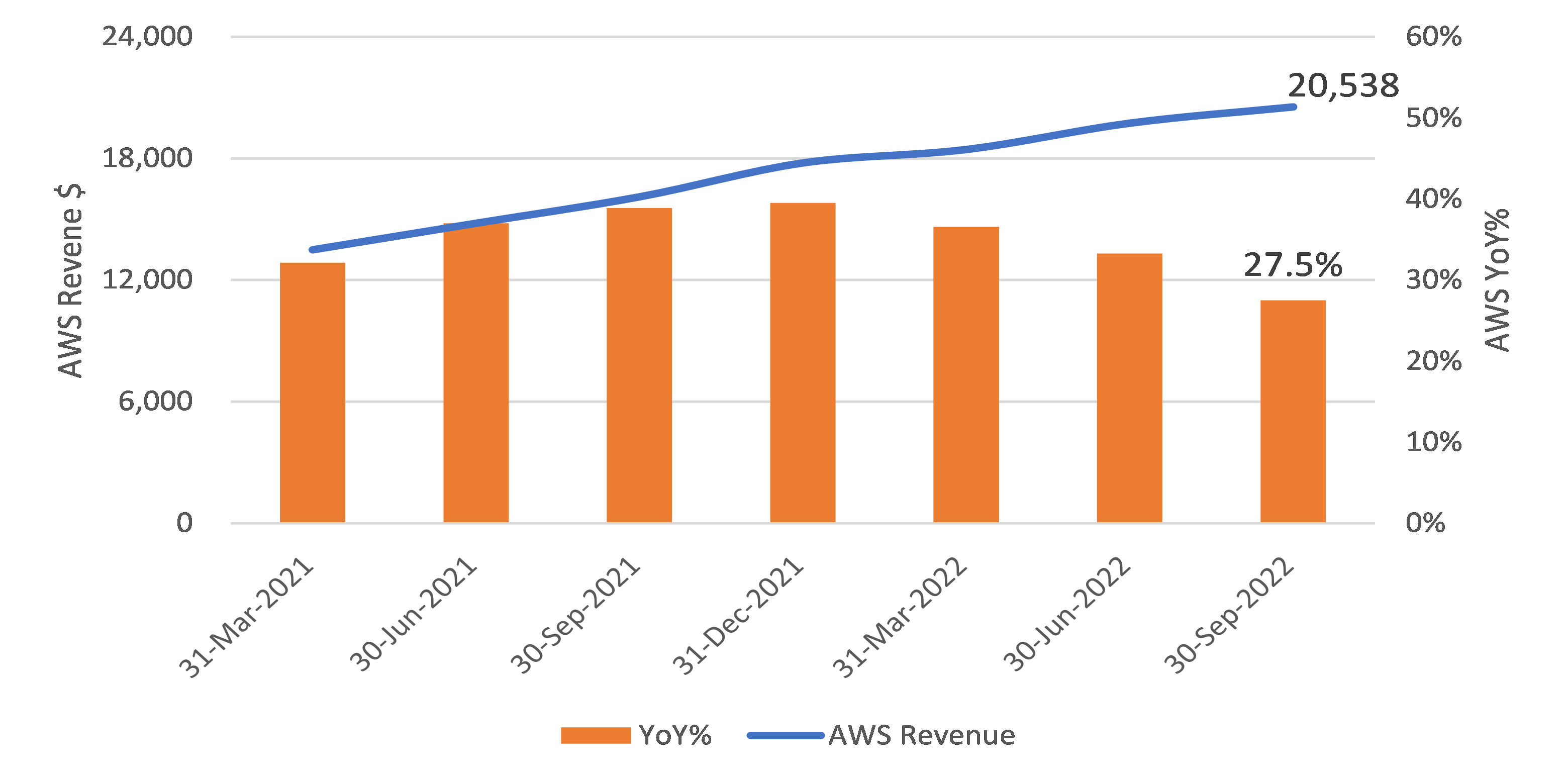

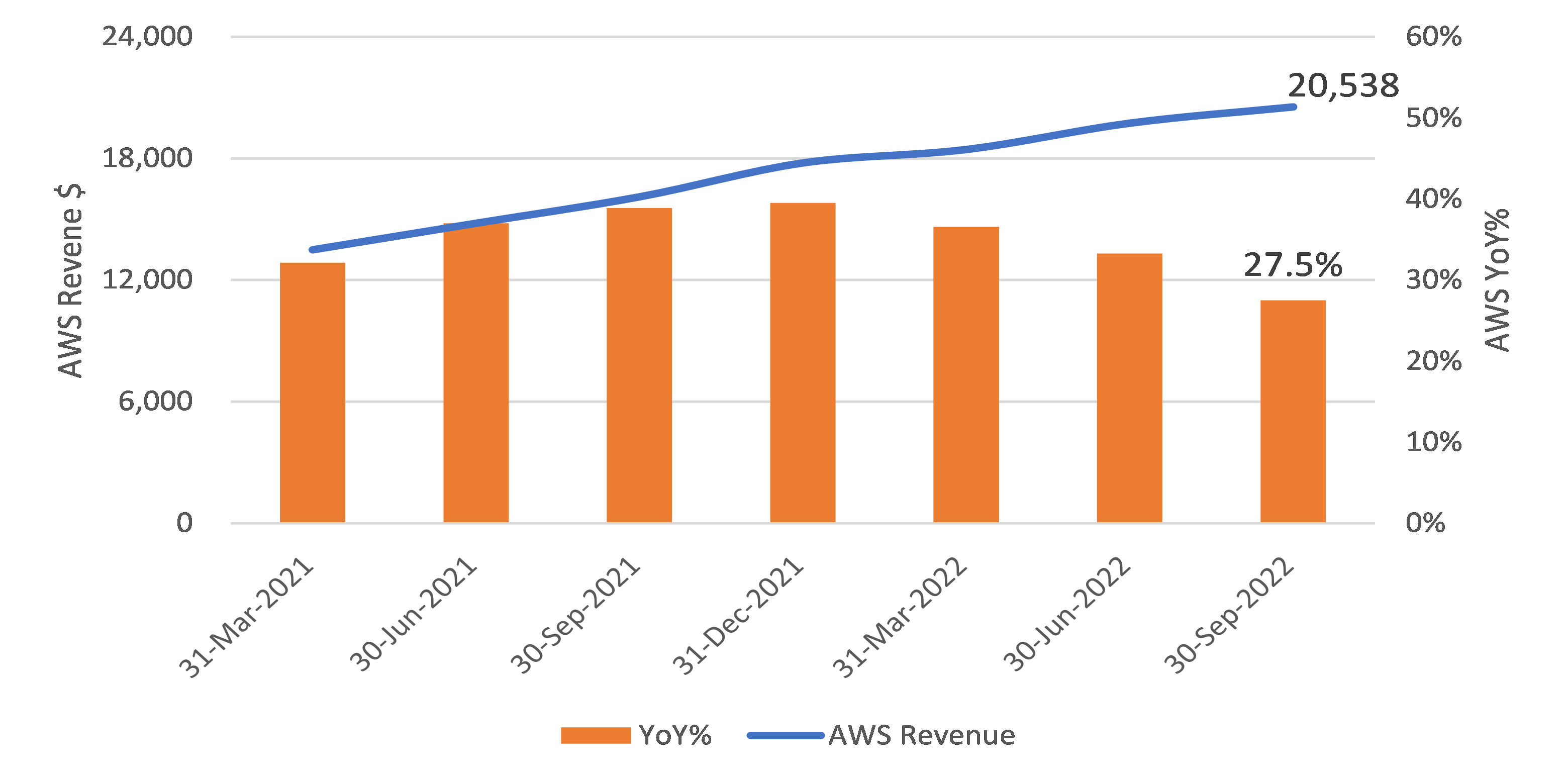

Its Amazon Web Services (AWS) segment revenue grew to a record $20.5 billion in Q3 2022. This, however, represents a 27.5% growth from last year. The 27.5% is the below the 33% – 37% growth range it’s seen over the past year (Exhibit 2). Despite the growth in absolute business dollars, Amazon’s customers are trying to cut budgets to reduce costs.

“I would say that although we had a 28% growth rate for the quarter for AWS, the back end of the quarter, we were more in the mid-20% growth rate. So we’ve carried that forecast through to the fourth quarter. We’re not sure how it’s going to play out, but that’s generally our assumption.” (Source: Amazon Q3 2022 Earnings Call)

Exhibit 2: Amazon AWS Revenue in Dollars vs. YoY%

Source: Refinitiv I/B/E/S

Subscription revenue

The much-anticipated “Lord of the Rings” series did help subscription revenue rise to a new high in dollar amount. “’The Lord of the Rings: The Rings of Power’ attracted more than 25 million global viewers on its first day. And in the first two months since its launch, ‘Rings of Power’ has driven more Prime sign-ups globally than any other Amazon Original. NFL Thursday Night Football also premiered in September, averaging more than 15 million viewers during its first broadcast, and driving the three biggest hours of U.S. Prime sign-ups in the history of Amazon.” (Source: Amazon Q3 2022 Earnings Call)

Despite the record growth in absolute dollars, it was the slowest single digit growth for its Prime streaming service ever at 9.3%.

Exhibit 3: Amazon Subscription Services in Dollars vs. YoY%

Source: Refinitiv I/B/E/S

Lower guidance

The company blamed the stronger U.S. dollar and the slowing economy for the weaker than expected quarter. As a result, the retailer lowered its Q4 2022 sales and operating income forecast as it feels the pinch. This led the stock price to fall by about 18% in afterhours trading.

The fourth quarter is critical for retailers as it includes the holiday season, which tends to be the strongest quarter. However, this forecast suggests continued growth deceleration.

It is evident that analysts have become more bearish on this stock as the StarMine Analyst Revisions Model scores a 17 out of a possible score of 100, placing it in the bottom quartile. The model is highly predictive of both the direction of future revisions and price movement.

The tech giant is also in the bottom decile, for the Price Momentum model. The StarMine Earnings Price Momentum Score for Amazon is 5 indicating that the company has negative stock price momentum (Exhibit 4). What’s more, Amazon is also in the bottom decile for the Earnings Quality Model, suggesting earnings might not be coming from sustainable sources.

Exhibit 4: Amazon StarMine Model Scores

Source: Refinitiv Eikon

Consumer confidence and inflation

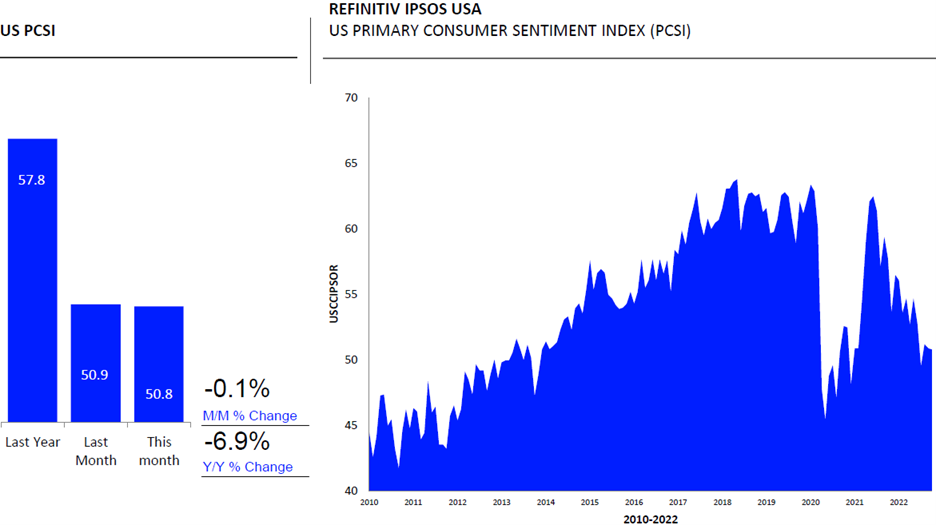

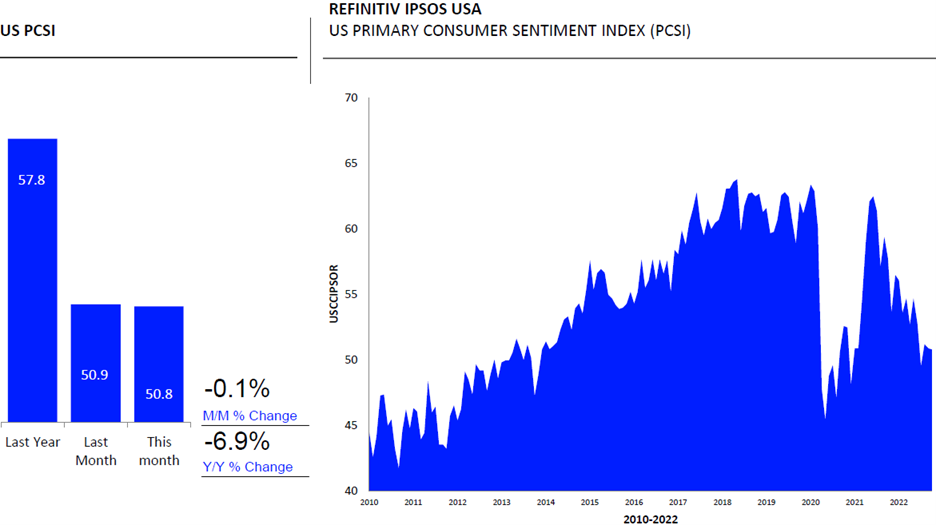

The Refinitiv/Ipsos Primary Consumer Sentiment Index for October 2022 is at 50.8. Fielded from Sept. 23 – Oct. 7, 2022, the index shows month-to-month stability for the second consecutive month. Still, Americans feel uncertain about the economy and their future economic situation. On a more positive note, perceptions of job stability and prospects is higher this month than in September, though this also trails where it was at the beginning of the year.

Thus, the latest reading suggests that consumers’ perceptions of job stability remains positive, which is what fuels consumers’ appetite for spending.

Exhibit 5: Refinitiv/Ipsos U.S. Consumer Sentiment Index

Source: Refinitiv Eikon

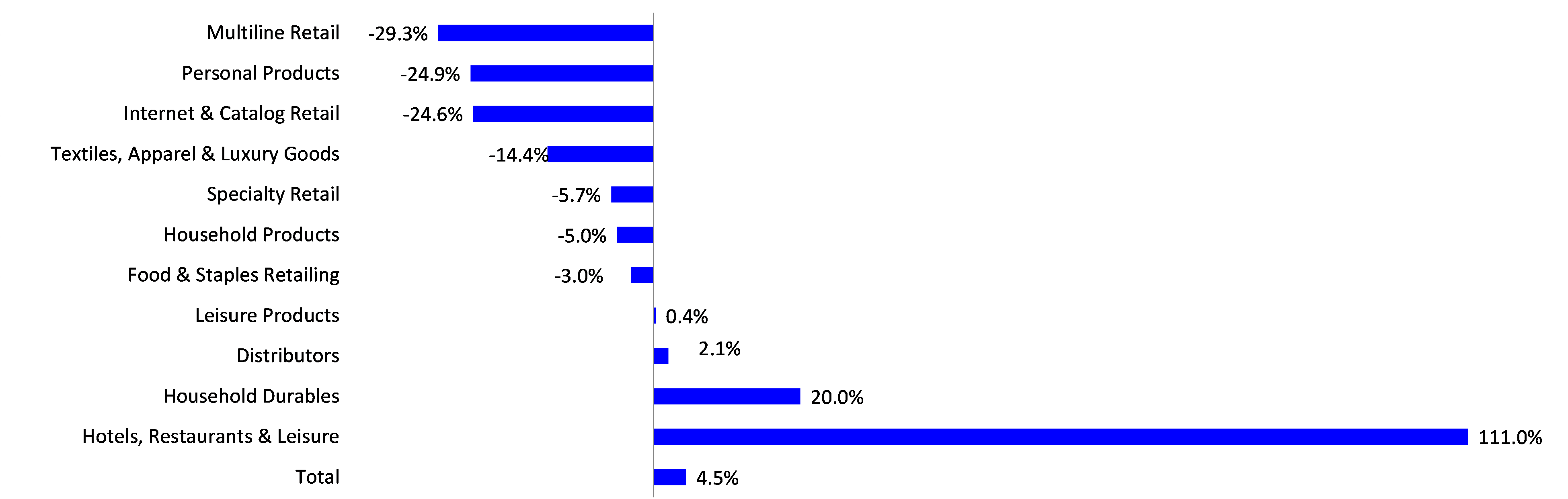

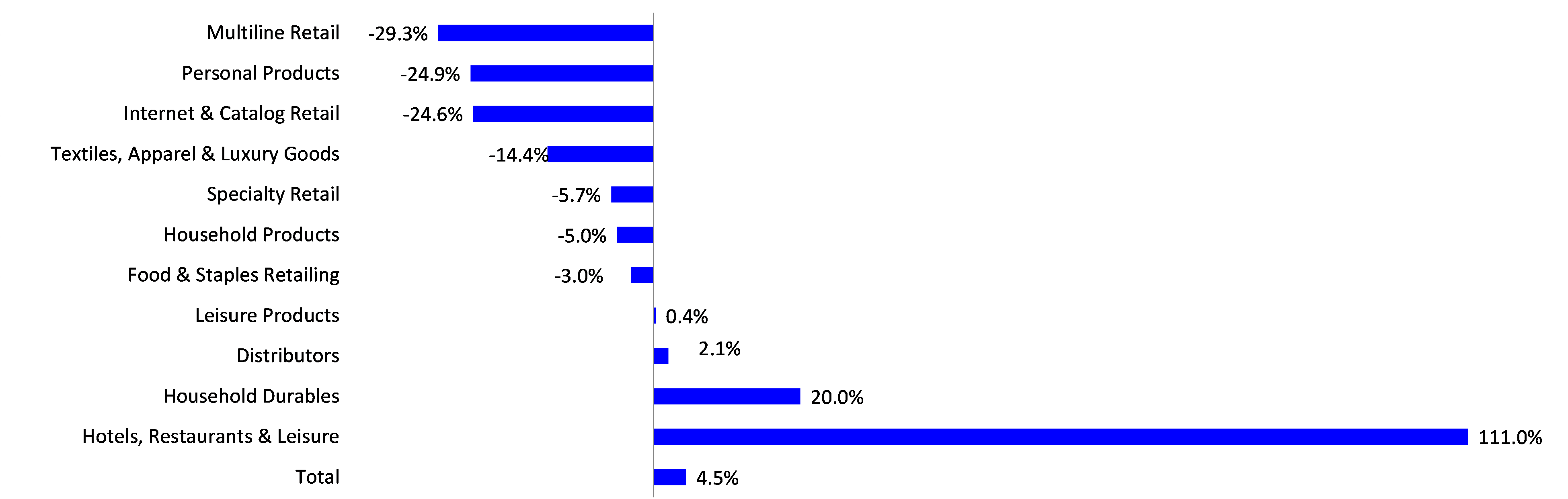

Q3 2022 earnings growth: retail/restaurant industries

For Q3 2022, the Refinitiv Retail/Restaurant Index is looking at a 4.5% blended estimated earnings growth rate, and an 6.3% blended estimated revenue growth rate. Of the 205 retailers tracked by Refinitiv, the Hotels, Restaurant & Leisure sector has the highest estimated earnings growth rate in the third quarter, a 111.0% surge over last year’s level.

The forecasts for 2022, shows that consumers continue to gravitate towards experiences as opposed to mall visits.

Exhibit 6: Q3 2022 Earnings Growth Rates: Refinitiv Retail and Restaurant Index

Source: I/B/E/S data from Refinitiv

Inventory and discount levels

Retailers were dealing with high inventory levels in Q2 2022, and retailers like Levi’s were more promotional to get rid of excess inventory.

Thirty-eight percent of U.S. retailers’ online merchandise was on sale in Q2 2022 (Exhibit 7). Refinitiv discovered this in a collaboration with StyleSage, which analyzes retailers, brands, online trends and products across the globe. This has gone up in Q3. The current discount penetration (how much of the assortment is on sale) is 40%, and is also above the YTD average of 36%, but slightly below the pre-pandemic levels, when the average discount rate was 42%.

Meanwhile, the average percent discount in October is 32.9%; this has come down from the Q2 levels of 36.6% and is significantly below the pre-pandemic levels. This means that although more merchandise is on sale, the average discount is less than usual.

Exhibit 7: U.S. Online Retail: Discount Penetration and Average Discount –2019 – Q3 2022

Source: StyleSage Co.