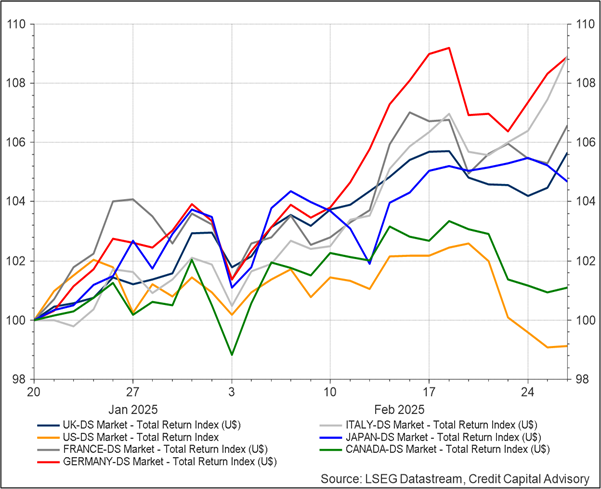

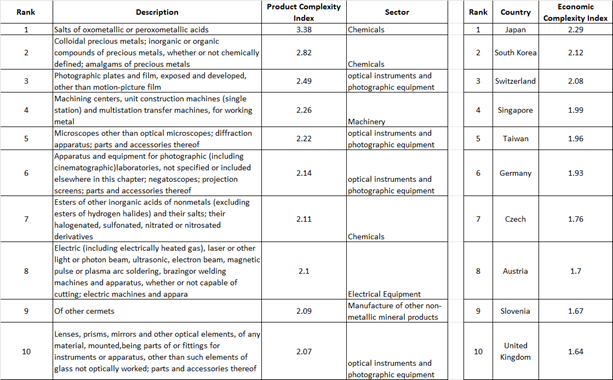

Since President Trump took office on Jan. 20, 2025, the U.S. has been the worst performing stock market of the entire G7. While Trump likes to shoot from the hip when it comes to economic policy, investors in U.S. assets, it seems, do not appreciate this approach.

The uncertainty created by further tariffs is also creating a headache for firms who are trying to figure out how their supply chains are going to be impacted, and to what extent higher costs will reduce their competitiveness, thereby negatively impacting their share prices.

Exhibit 1: Performance of G7 stock markets

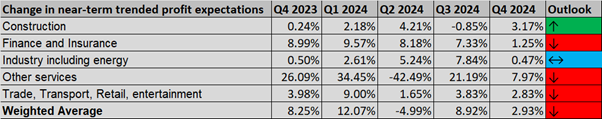

One way for investors to deal with uncertainty is to maintain exposure to equities only when expected profits are rising. This is because firms with declining profits are less able to absorb unexpected negative shocks. Hence, understanding the outlook for profit growth remains central to asset allocation decisions.

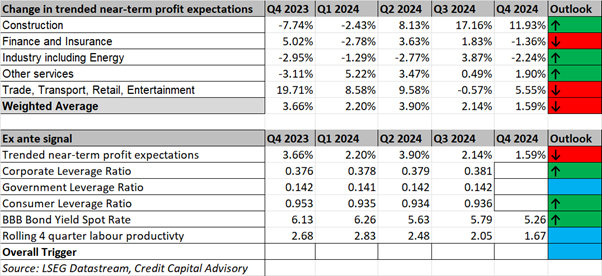

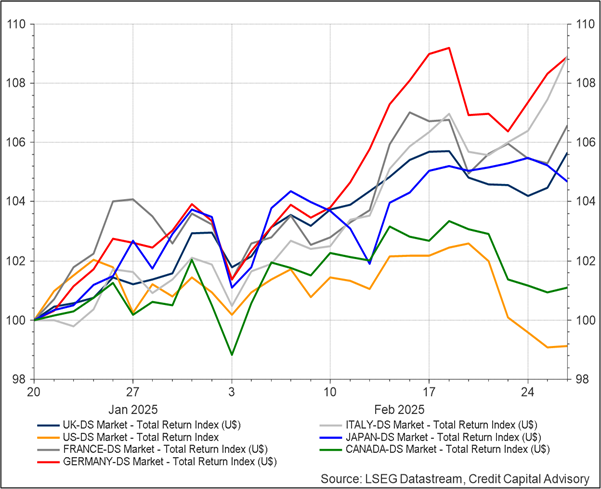

The outlook for the ex ante return on capital for the United States now indicates profits are decelerating across the economy – although still positive. The profit growth of the tech giants FAAMG (Facebook, Amazon, Apple, Microsoft & Google) is also decelerating which may begin to negatively impact their lofty valuations. Despite this deceleration in profits, in aggregate, firms continue to leverage up to invest, and wage growth and job creation remain strong. While this generates an overall neutral signal, the medium-term outlook for consumption is negative due to the rise in the cost of capital.

Exhibit 2: U.S. Summary ex ante signal

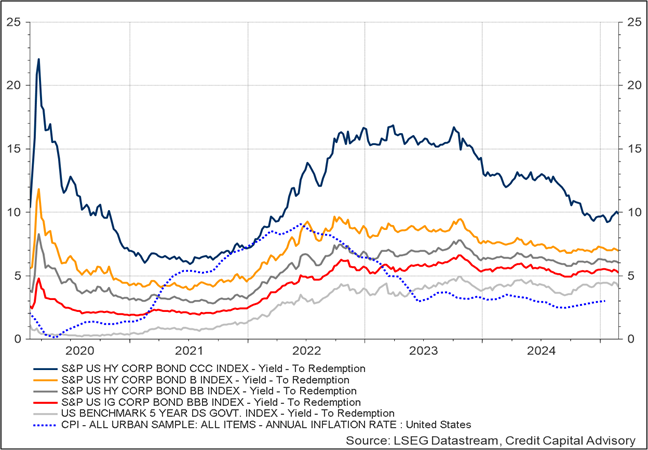

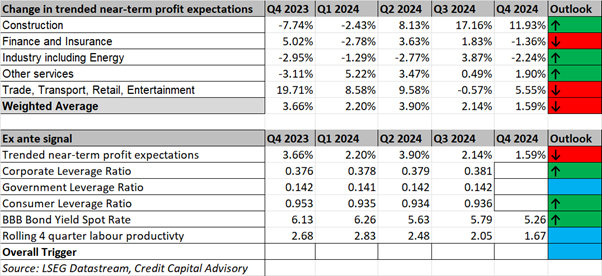

With regards to the cost of capital, BBB bond yields will likely drift upwards along with 5-year government bond yields. The Fed is no rush to reduce rates, given that the economy continues to generate jobs alongside strong wage growth. Furthermore, single b bonds appear to still be in reasonable shape, indicating firms have sufficient cash flows to service their debts.

Exhibit 3. U.S. Bond Market Indicators

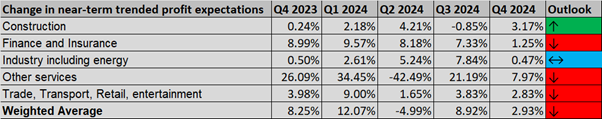

Across Europe, individual economies are either experiencing negative profit growth or at least a deceleration in profit growth. This deceleration in the rate of profit growth can also be observed in Japan, where the economy is also in reasonable shape, despite a rising cost of capital.

Exhibit 4: Japan Summary ex ante signal

Source: LSEG Datastream, Credit Capital Advisory

Given that profits across these markets are, in aggregate, slowing down, the expectation for robust growth in country indices is therefore low. However, certain sectors will be able to outperform and crucially avoid much of the downside from tariffs.

One of the major reasons why Trump likes tariffs is that he appears to think it is the exporter that pays, although the tax is of course actually paid by the U.S. importer. In general, the effects of this tax are split three ways including the U.S. importer passing some of the price increase on to U.S. consumers alongside taking a hit to their own profitability, while there also tends to be some downward pressure on prices from the exporter.

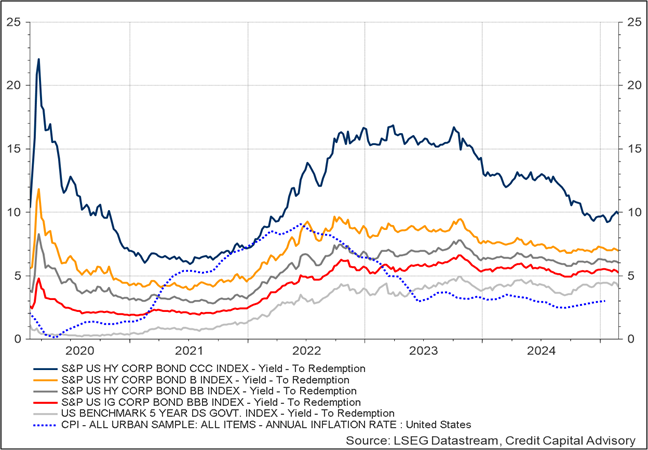

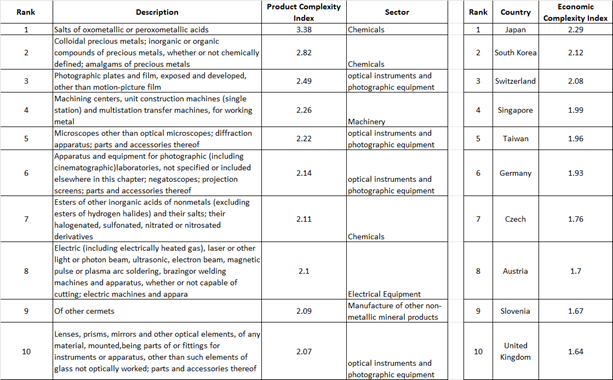

In addition to the tax revenues, Trump also sees tariffs as creating a level playing field with the goal of enticing firms to produce their goods within the U.S. However, the extent to which an exporter is likely to take a hit in profitability or decide to relocate to the U.S. will depend on the competitive advantage that the exporter has created. For many goods, relocating to the U.S. will be much more expensive even if tariffs are put in place. For example it will cost TSMC 30% more to produce chips in the U.S. than in Taiwan. Given TSMC’s capability in the fabrication of the most advanced chips, it is in a strong position to resist any downward pressure on its margin. Hence, what matters when it comes to the competitive advantage of firms is the complexity of the products that are produced.

According to the Atlas of Economic Complexity from the Growth Lab at Harvard University, the following products are the most complex, and the following countries produce and export the greater number of the most complex products.

Exhibit 5: Product and Country Complexity

Source: Atlas of Economic Complexity/Growth Lab at Harvard University

Hence firms in these sectors, which are more likely to be from the above listed countries, are less likely to be impacted by tariffs. While Asian firms exporting complex electrical and optical equipment to the U.S. are likely to remain resilient in the event of tariffs, the same goes for complex products exported by European firms to the U.S. Although European firms exporting agricultural produce, cars and food will find the new economic environment far more challenging, those firms exporting chemicals and complex machinery will be less impacted as they are less substitutable. Indeed, according to one report, the U.S. relies on the EU for 32 strategically important products, whereas the EU only relies on the U.S. for eight products.

Hence in the event these firms are hit with tariffs, given the complexity of their products they are likely to continue to outperform. As a result we can expect to observe a significant bifurcation in profit growth across firms and sectors with complex firms performing much better than less complex ones.

In addition to those firms who make more complex products potentially maintaining profit growth, Friedrich Merz, following his victory in the German general election, made it clear that Europe will now need to rearm, given it can no longer depend on the U.S. security umbrella. This will most likely mean Europe will design and build its own weapons rather than procuring them from the U.S. As a result, the European defense sector is also more likely to be able to maintain profit growth despite the ongoing challenges with the European economy.

For investors looking to maintain equity exposure as the rate of profit growth decelerates – and U.S. bond yields are likely to tick up in the near term – it will mean ditching country indices and instead looking at sectoral exposure to firms generating more complex products and services.

Thomas Aubrey is the founder of Credit Capital Advisory.